Steemit Crypto Academy Contest / S6W3 - Tokenomics in the Crypto Ecosystem

Questions

What's your understanding of tokenomics in the crypto ecosystem? And highlight the main importance.

What are the components of tokenomics? Explain each in detail.

Choose a token and discuss its tokenomics. From the information deduced about the tokenomics of the asset, do you consider the asset worthy of investing in? Why?

Give a few points on why you think tokenomics is important to investors or traders.

If you are to be a creator of a token, what aspect of tokenomics would you consider most important to drive investors to the project? Give reasons

Greetings to every Steemian in this community. I hope everyone is doing incredibly well today. I'd like to extend a warm welcome to everyone to the sixth week of the season's engagement competition.

I'll be taking part in the engagement competition named ‘tokenomics’ in the crypto ecosystem. I want everyone to partake in this topic and read other posts as well, as I submit my participation to this contest since this is a good topic to discuss.

I hope you enjoy reading.

Question 1

What's your understanding of tokenomics in the crypto ecosystem? And highlight the main importance.

Answer

Let's look at what a token signifies before delving into tokenomics. A token is a digital representation of a cryptocurrency that is utilized on the network as a specific asset or to represent a certain use.

Tokenomics is basically every essential detail about a certain token or cryptocurrency that has an impact on the value of the token and affects investors’ judgment of investing or trading the token. If the tokenomics of a coin is properly assessed it reveals a lot about that token even if it is hidden.

Technicality, tokenomics is defined as the economic value and development of a specific token. It provides a general representation of the effects of a token on its blockchain, which in turn affects how a token is utilized and the market value of that token. Tokenomics discusses all the aspects of a particular cryptocurrency, including its aim, earnings, utility, and other factors that are likely to entice investors to make an investment.

When thinking about investing in a token, it is essential to evaluate its tokenomics such as its trading volume, ranking on various crypto exchange platforms, burning schedule, token maximum supply, marketcap, circulating supply, etc. all these plus some other important factors which were not mentioned here have a big impact on the token's value. This way, you can determine whether the assets are worthwhile to invest in or not.

Tokenomics also demonstrates the value of the token in its blockchain network, which is crucial because it contains information on its market worth going forward.

The main importance of tokenomics

Tokenomics have some importance as it plays a vital role in investors’ decision-making. Every investor wants to go to bed knowing that their investments are in safe hands, how do they know this? They know through tokenomics. Some other importance of tokens are highlighted below.

Transparency is key in making someone understand better and trust a network or a token. When investors are made aware of the project's transparency through tokenomics, it lends the token some form of trust and credibility, which helps them decide whether to invest or not.

When a token has an excellent tokenomics quality, this sort of guarantees investors that it is a token with a decent project and a valued application with the potency to rise in value any time soon and this lends legitimacy to its sporadic usage.

The primary significance is hence that it is utilized to convey the value and use of a token. Additionally, it informs the investors of the token's creation and management processes.

Also, it provides an accurate evaluation of a token when comparing it to other tokens. In the case where there are two or more tokens to compare and decide which one of them to invest in, tokenomics is the method used to evaluate each token to know which one will return more yields in both the long and short term.

Additionally, it's utilized to calculate a particular cryptocurrency's supply and demand levels. Providing accurate statistics regarding the quantity of a cryptocurrency that has been allocated.

With all these being said, I think they can all be summarized into one important point. Tokenomics’ main importance is, it reveals the essentials of a token to help investors make a decision.

Question 2

What are the components of tokenomics? Explain each in detail.

Answer

The key elements of tokenomics are what best demonstrates the supply mechanism and the preliminary timetable for a token's development.

The supply of the token

This is a crucial component of the supply mechanism since it is used to calculate the coin’s maximum supply and its current circulating supply, which are the supply and demand pressures that a coin is subject to.

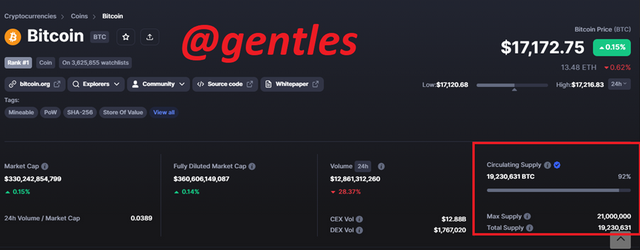

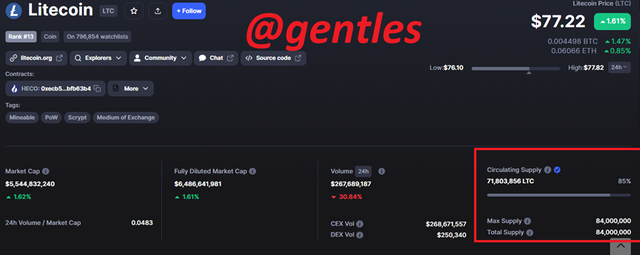

Circulating supply: it describes the quantity of a token's accessible supply that is now in circulation on the blockchain; these are the tokens that may currently be transacted, exchanged, or burned. For Bitcoin, the circulating supply is 19,230,631 BTC and for Litecoin the circulating supply is 71,803,856 LTC.

The circulating supply of a coin is calculated by dividing the market cap by the price.

Circulating Supply = Market Cap / Price

For instance with a market cap of 5,544,832,240 and a current price of 77.22

The circulating supply of Litecoin = 5,544,832,240 / 77.22

= 71,805,649

Maximum supply: The highest number of coins that can ever exist on the blockchain is known as the total supply, and it serves as a cap that cannot be exceeded. Any cryptocurrency's total supply is hard-coded in the code, and more mining cannot be done if that amount is reached. Bitcoin’s maximum supply is 21,000,000 BTC and Litecoin’s maximum supply is 84,000,000 LTC.

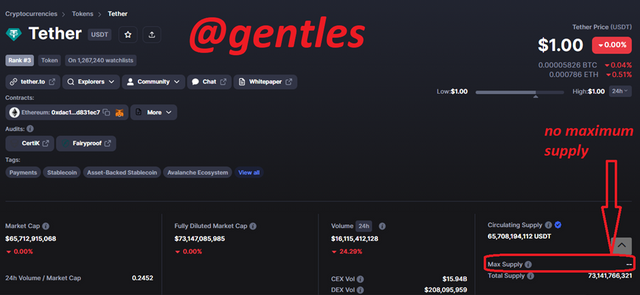

Also, there are coins with no maximum supply, this is because they are pegged to another currency. An example is USDT which is pegged to the US dollar.

How the circulating and maximum supply affect price

This has to do with dilution which is when there is a very huge difference between a coin’s circulating supply and maximum supply. A coin faces a significant dilution risk if there is a big gap between the circulating supply and its maximum supply since, as more coins enter circulation, their value will fall (oversupply with low demand), especially if high demand doesn't emerge to support the price.

The circulating supply is a fraction or percentage of the maximum supply, it is better if the percentage is higher.

Also, as the amount of the token that is currently in circulation approaches close to its maximum supply, the price of the token increases as there will be a higher demand for the token with less supply.

It is best if the token does not have less than 50% of its maximum supply in circulation else there is a very high risk of dilution which is accompanied by a fall in price.

Another component to talk about is the

The utility of the Token

This is yet another important component that influences a token's value; it simply relates to how that token is used; a token that is used frequently has a tendency to be worth more.

For instance, the Solana coin. This con was introduced to increase scalability and transaction speed. This coin is the native currency of the Solana blockchain where several projects have been created and the Solana coin is used as the currency to execute transactions on its blockchain. The coin also serves as a governance token that people can use to make decisions on the network.

The burning method of the token

This is an excellent mechanism in tokenomics since it is used to decide a token's burning structure. Burning a token lowers its circulating supply on the market, this reduces the supply of the token and therefore increases its demand which in turn leads to the increment of inflation of the project and increases its value at the time the burn occurs.

The price of the token is greatly impacted by its burn schedule, which has shown to be very reliable when it happens. It is therefore possible to expect a large investment based on the burning schedule when there is a will to burn more tokens to reduce its supply.

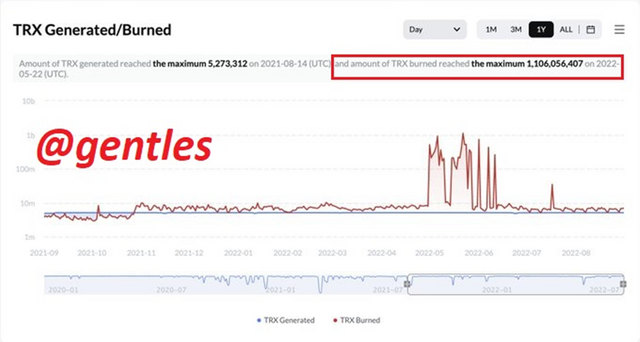

For example, Tron initiated a burn that reached 1,106,056,407 Tron on 22 May 2022.

The three mentioned components are the major components affecting the tokenomics of a coin.

Question 3

Choose a token and discuss its tokenomics. From the information deduced about the tokenomics of the asset, do you consider the asset worthy of investing in? Why.

Answer

The token I am choosing is Tronix (TRX) popularly known as TRON

Tron is a blockchain network that is decentralized with proof of stake as its consensus mechanism. It operates with smart contracts and its native currency is Tronix (TRX). It was founded by Justin Sun in March 2014 and the TRON Foundation, a non-profit organization in Singapore founded in 2017, has been in charge of overseeing it since 2017. It began as an Ethereum-based ERC-20 token before changing to its own blockchain network in 2018.

TRON performs two functions: first, it acts as a worldwide platform for the sharing of online entertainment materials; and second, it enables developers to build autonomous applications that work directly among users without third persons.

One of the numerous cryptocurrency initiatives attempting to use blockchain technology to decentralize the internet is Tron. The platform was created with the express purpose of competing with centralized media platforms like YouTube and also allows peer-to-peer file sharing among users.

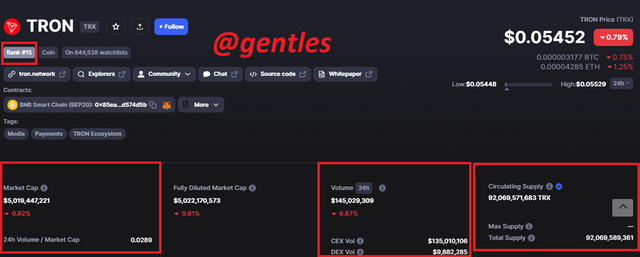

Tron is currently ranked 15th on coinmarketcap with a marketcap of $5,019,447,221, and a circulating supply of 92,069,571,683 TRX. The coin has a total 24hr trading volume of $145,029,309, its total volume on centralized exchanges is $135,010,106 and on decentralized exchanges, it has $9,882,285. The current price of the token is $0.05452.

The coin has no maximum supply of TRX tokens. It is hence inflationary, similar to Ethereum. Investors in general do not support this strategy. TRX would have a scarcity element similar to Bitcoin if there was a maximum quantity, however, reducing the maximum supply might make TRON last longer.

As we can see, the currency has tremendous productivity in the crypto ecosystem and has great utility benefits, making it a wonderful choice of investment. What makes this special is the broad application of this coin. A wide variety of Tron-based platforms make use of this coin. In many situations, including payments, sales, and votes both inside and outside the TRON ecosystem, TRX is frequently used. As an illustration, TRX is supported by TRON ATM machines and credit cards for online transfer and TRX payment, respectively.

Tron has the fastest-growing number of applications in its ecosystem which means there will be more use of the coin in the future.

Why do I consider the asset worthy of investing in?

Yes, I consider Tron worthy of investment due to its numerous utility application on its various platforms. As we all know a token’s frequent usage increases its value. In many situations, including payments, sales, and votes both inside and outside the TRON ecosystem, TRX is frequently used. Tron can also boast of the platform with the highest application growth rate, this means there will be increased usage eventually increasing value.

Tron is also a token that does a lot of burns, this helps to reduce the amount of TRX tokens in circulation to increase its demand and thereby increase the price of the coin.

Question 4

Give a few points on why you think tokenomics is important to investors or traders

Answer

One of the importance that tokenomics give to investors is Transparency. Tokenomics reveals every important detail about a token. Investing in a token without tokenomics will be the same as a lottery or gambling as nothing about the coin to inform you of its future will be known. The tokenomics is essential and provides to a certain level a form of guarantee of the returns to the investor and shows what the future of the token is like, this gives the investor trust in the coin.

It gives the investor a sense of when the value of the token will change. the circulating supply and maximum supply involved in the tokenomics of the coin greatly determine the supply and demand pressure on the token, this also greatly affects the change in the price of the token. Investors who have done proper tokenomics will know when to buy or sell a certain token based on its supply to make profits.

Tokenomics can also determine the future yield of the token before investors consider investing in it. In a sense, when the burn schedule is known and happens at regular intervals like yearly or quarterly, this can give investors a warning or a go-ahead to decide if it is a smart idea to trade the token.

Another importance to investors is that before anyone would contemplate investing in a specific asset, the key consideration is to determine whether the coin has potential for future growth. And tokenomics is one of the best ways to find out the growth of a particular coin.

Question 5

If you are to be a creator of a token, what aspect of tokenomics would you consider most important to drive investors to the project? Give reasons

Answer

The token utility is the aspect I will consider more in the creation of my own token. The circulating supply and maximum supply are also very important aspect to consider since they also have an impact on the token’s value, a reduction in the circulating supply increases demand which in turn increase price, the burn schedule will also be given some consideration.

However, the utility of the token is what I think in my opinion have a greater effect on the price of the token. A token's utility defines its worth in daily use, and a token with higher daily usage offers investors a fantastic choice because it suggests that the project is robust and has significant use.

For instance, a token that is regularly utilized as a payment method will attract investors. Even when there is price fluctuation, the token will be able to retain excellent price stability as people use it every time for payments.

This is the part I will consider most important because it has the potential to increase the value of my token significantly and it will determine the number of investors that invest in my token.

Conclusion

Tokenomics is basically every essential detail about a certain token or cryptocurrency that has an impact on the value of the token and affects investors’ judgment of investing or trading the token. It provides transparency and gives credibility to the token as it helps the investor to be abreast with the economics of the token before investing. Tokenomics is very important as it can be used as a means to efficiently compare two or more tokens.

The supply component of tokenomics comprises both the circulating supply and maximum supply. These are some factors that drive the price of the token. When there is less of the token in circulation it raises the demand for the token and increases the price. Too less of the token in circulation will also cause dilution which will reduce the price. there are other components such as the utility of the token which affects price through the frequency of the token’s usage and the burning mechanism which is done to reduce the number of tokens in circulation to increase the price.

Investors are advised to desist from investing in tokens with less than 50% of their maximum supply in circulation, those tokens have a higher risk in terms of dilution.

I chose Tron to be very worthy of investing in because of its numerous uses both on its platform and outside the platform. it also boasts of the network with the fastest growing rate of applications on its network, this means more utility therefore a good potential for a price rise.

Tokenomics makes the token more transparent, and more credible and allows investors to be able to determine future price changes that is why tokenomics is very important to investors.

I will consider the supply and burn mechanism of a token, but the utility of a token is an aspect I will consider more since I believe it is a greater driver of the token's value.

It is my hope that investors, both beginners and old will learn the importance of tokenomics in their journey of investment.

I invite @phlexygee, @solexybaba, @verdad, @lawson19, and @josepha to partake in this contest.

Good job done as usual.

Thanks for the insight on the concept Tokenomics.

A lot of key things are to be considered before trading or investing in a token and you have made justice to them.

Good luck, dabro.

I'm glad you learnt from my post. I really appreciate you reading it. Thanks

I must commend that you have done well in attempting all the questions and sharing your opinions on the concept of tokenomics.

The way in which tokens are distributed will have a direct impact on the value of the tokens and the security of the overall system. For example, if a large portion of the tokens are given away to early investors, then the remaining tokens will have less value and security as they become harder to acquire.

Tokenomics is an important concept to understand in order to ensure that token-based projects are successful and sustainable. By taking into account all of these elements, developers and investors can create a system that rewards participants and encourages long-term growth.

Thanks for sharing friend, and goodluck in this contest. #steem-on.

I will appreciate if you equally engage on Mine

Thanks very much @preye2. what you said is very true. Thanks for engaging with me

You have explained this post in a very beautiful way. Your presentation is also good you have drawn a clear understanding of the topic.

Thr major components of the Tokenomics are the token supply, token utility, token distribution, and token burning schemes. All of these components can be managed well for the better future of that token.

I also agree with you. Without any doubt, Tron is one of the most popular and successful blockchains of the time. The token of this Blockchain, TRX has a great utility within the platform and others dApps that are associated with it.

We cab predict a very good future of the TRX token as its use cases are many and the burning schemes that are adopted to burn this token are also impressive ones.

Thanks a lot for sharing your precious post with us. I wish you a very good luck for the contest 🤞

Thanks very much @steemdoctor1 for your kind reply

You're welcome brother

After 5 years on the platform I have recently launched a Steem witness - @pennsif.witness.

You may know me for Steem News, which is now nearing its 500th edition.

As a witness I am running a Full API Node and a Seed Node. Together with the @steemwow team I have also launched Press4Steem, a plugin to connect WordPress sites with Steem.

It would be great if you are able to support my work by giving one of your witness votes to @pennsif.witness.

If you have any questions about Steem, or if I can help you with anything please contact me on Discord at @Pennsif#9921.

Thank you

Pennsif