Crypto Academy / Season 3 / Week 6 - Homework Post for [@yohan2on] by @ibad4242

Hello Steemit:

How are you all, hope you all are doing well. So, today after reading and understanding @yohan2on week 6 lecture on Crypto scams and what extend crypto scams effects crypto space. After the research on crypto scams, I learned many aspects and things that are essential to get rid of these crypto scams.

Let's start with the answering of given questions,

Question 1) What are Crypto scams?

Crypto Scams:

Crypto scams are the activities from which hackers and spammers use different types of tools to steal the crypto assets of others. Newbie needs to understand the working of cryptocurrencies before investing their money in this crypto world. Crypto scams are mostly done by individuals and organizations as well. Some crypto scams are given below,

1) Pump and Dump Scheme:

Most people buy cryptocurrencies as a speculative asset which means you buy these cryptocurrencies today for cheap and sell them when the prices are really high and more than what you bought them for initially. So you could say that most cryptocurrencies at least bitcoin, for example, have their utility as a store of value then we have the rise of meme currencies especially with the popularity of dogecoin that Elon Mask widely promoted. This coin was created as a joke and Elon Musk took this joke a little too far. The success of dogecoin result in a rise of meme tokens with the sole purpose of going to the moon. There is no real-world utility of these coins. These coins are entirely driven by the hype surrounding them and once the hype settles, you will lose a lot of money that you invested in these cryptocurrencies.

How do the pump and dump schemes work?

The initial investors of these coins will buy these coins for extremely cheap rate and then they will create a huge hype around these coins which will drive up the prices, once the price will high enough these initial investors who hold a large number of these tokens will sell their holdings to make a lot of money and when these whales decide to sell their tokens, the entire price of the token will go down because of the fact that these investors hold the huge of the percentage of the entire token supply. So, whenever you are investing in cryptocurrency projects be sure to invest the money you are willing to lose.

2) NFT Scams:

NFT solved the problem with buying digital collectibles and peoples are ready to pay millions of dollars worth of cryptocurrencies for NFT are or collectibles in general even if these are powered by blockchain technology and they work somewhat similar to cryptocurrencies. The only difference is that cryptocurrencies are fungible assets which means you can exchange coins of similar value but you cannot do the same with NFT because as the name suggests they are non-fungible tokens. The way scammers scams you are by creating replica stores of famous nft platforms. These online nft platforms are so well designed that it is easy to trick users into either logging in with their credentials or giving away credit card information. The other way users get scammed with nfts is with the help of fake nfts stores. Now the difference between the fake and replica is that the replica nfts platform use names similar to the original one including their logos and even content. People who are really new to the nft can get scammed with these fake online platforms that pretend to sell nfts.

3) Fake ICO:

It is similar to IPO which is a short form of Initial Public Offering and ICO is a short form of Initial Coin Offering. Entrepreneurs are looking to launch a new cryptocurrency usually do it by launching an initial coin offering. Right now there are little to no government regulations for ICOs to operate and anyone can launch an ICO if they have the technological support to do so. To create an ICO it does not require much effort because all need to do create a white paper and a few other documents that describe the system along with a website or app that describes how the cryptocurrency project is going to work. The ease of doing something like this has attracted so many scammers as well.

There are many ICO scams,

- Exit Scam.

- The Ponzi Scheme.

- Exchange Scams.

- Bounty Scams.

4) Viruses and Malware Scams:

Cryptocurrencies being completely digital means that they are prone to malware infections and it is one of the primary hacking methods for cryptocurrency hacks. It is usually done by infecting the device with key loggers to steal passwords and pins that you are entering. You will then be redirected to the website without your permission and this website will then be used to steal your sensitive data, install malware on your device.

5) Hacked Social Media Accounts:

We all know the tweets of Elon Mask influenced the prices of bitcoin and so many other altcoins, so it is clear that social media has the power to pump and dump the crypto market. These high-profile celebrities can be hacked or sometimes fake accounts of these celebrities will be used to scam people. Suppose the account of a high-profile celebrity is hacked, in that case, the hackers usually ask their followers to donate or transfer their cryptocurrency assets to a specific account promising higher returns or giving away double the amount of their investment back to them. Newbies trust them and transfer their assets to their fake accounts.

Make your research on any Cryptocurrency scam. (Attach a few references to the news surrounding that scam crypto project)

OneCoin Scam:

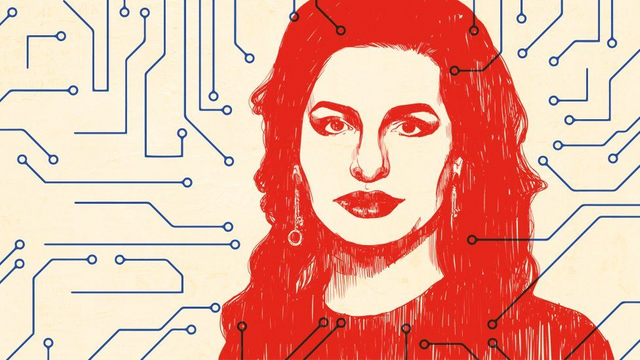

Ruja Ignatova is the biggest scammer in the history of the crypto world. She convinced the whole world that her cryptocurrency OneCoin would be the next big thing. However, it turns down the 3 billion dollars scam.

Who is Ruja Ignatova?

Ruja Ignatova was born on May 30th, 1980 in Sofia Bulgaria and after immigrating to Germany at the age of 10, she would eventually go to earn a Ph.D. in European private law at the University of Constance. As a very intellectual person, she was able to easily win people's trust which is perhaps what made her skilled at parting people with their hard-earned cash. In 2014 she founded OneCoin.

What is OneCoin:

OneCoin was essentially a large cryptocurrency company owned by Ruja which promised that their form of currency would outplace bitcoin and become the next big thing and luckily for Ruja her timing had been just right after the peoples had lost their trust in the large banks that held most of their money thus when Ruja sold OneCoin as a way to get back at these greedy and selfish banking institutions with the new and more modern system. People began to like this concept. Then Onecoin displaces Bitcoin at that time and gaining people's trust because Onecoin has a pyramid scheme. OneCoin has a market that has the ability to convert each OneCoin into euros and transferred it into an investor's bank account.

The Scam:

Onecoin business model is not only flawed but in every sense of the word ended up a complete scam. The most important thing to address is that no blockchain mining is ever to place so therefore each coin had no actual value in fact as put by the US department of justice quote that the value of OneCoin is determined internally and not based on the market supply and demand. Onecoins are not mined using computer resources. The value of the coin was arbitrarily set by the company founders means if they were to pull the plug on the company, the coin would lose all its value and theoretically could all disappear. In order to keep arbitrary marketplace at least temporarily afloat, Ruja had to have some sort of cash flow and this is where the pyramid and Ponzi scheme element of the scam came into play. In order to promote Onecoin, Ruja with her associates had conducted countless seminars worldwide. These all promised that any investment made in the company would come out the other side at least threefold and that by selling onecoin packages to their friends they could use their commissions to become billionaires. This pyramid scheme is very attractive to many hungry peoples. US Department of Justice found that as a result of 3.8 billion dollars in revenue and 2.5 billion dollars in profit were made over onecoin's lifetime.

The Missing Crypto Queen:

On 1st March in 2016, without notice Onecoin's marketplace shut down for a two-week period for maintenance however no visible changes were made to this system. This also happened again in 2017 January. After that many national banks and anti-fraud agencies began to issue warnings about the company and many countries officially banning Onecoin and after that investigation into the Onecoin company began and it was at this point that Ruja realized that her time was up and so in early October of 2017, Ruja has not conducted a seminar in Portugal and after the phone calls of her staff and supporters many thought that she would be kidnapped or killed by the big banks but according to the FBI on 25th October 2017 after the two weeks of no-show in Portugal, Ruja boarded a flight from Sofia Bulgaria to Athens Greece and then completely off the radar after that.

References:

Emerging Europe news.

BBC news

Question 2) To what extent have Crypto scams affected the Crypto space?

Crypto scams damage the beliefs of people in cryptocurrencies. In these areas, crypto scams affected the crypto space,

1) Government Banning Cryptocurrencies:

Many countries banned cryptocurrency to save their people from crypto scams. Countries like Turkey, Ghana, Egypt, Nepal, etc banned cryptocurrencies. The main thing about banning cryptocurrency is that the crypto world is decentralized that means if any fraud is done by anyone just like Ruja, no one can take action because in the decentralized system the government is not responsible for any sort of transactions. Money laundering is also a reason many governments banned cryptocurrency in their country.

2) People Trust:

With the rapid increase in crypto scams rate, many peoples or investors don't want to invest their money in this crypto world. Many newbies were scammed just after they entered the crypto world. This would make a negative impact and people lost their trust in any coin just because they were fooled by meme coins.

3) No Recommendation:

Many peoples or investors were fooled by crypto scams in their initial days in the crypto world. So they don't recommend their friends to invest in any cryptocurrencies because they had a bad experience. My friends recommend me many meme coins and then I invested in them because I have a small amount of money to invest but after some time I have a loss in every meme coin I invested because of the bitcoin crash badly and almost every altcoin relies on bitcoin.

Question 3) Will regulations in Crypto add value to the Crypto space?

Yes, regulation in crypto adds value to the crypto space. With the regulation, crypto scams percentage will be reduced. Just like fiat currency where big bank and government is responsible if the currency is lost and damage. If the crypto world will regulate then it will help to decrease the rate of crypto scams. ICOs can be introduced by those who have a high profile and well-organized institutions and they have a well-reputed name in the market. This will help investors to refund their money if the ICO will not succeed in the market of cryptocurrency.

If crypto will be regulated then there will be no control on the price of a cryptocurrency by whales and celebrities just like Elon Musk, who controlled the price of bitcoin and another meme coin by just one tweet. This will make the crypto world more non-volatile than before regulation. The market will work on the use-cases of projects rather than tweets of celebrities.

Regulation improves the efficiency of virtual assets trading. There is no need for KYC verification again and again when opening an account. Instead of this KYC verification, the universal virtual profile is made and this is the real identity of the user from which the user will be recognized.

Asset ownership will be made by regulating the crypto world. It will provide a sense of ownership to traders. They owned their crypto assets and trade them after learning the important aspects of trading. This will help traders to trade openly without any influence by any whale and other celebrities' tweets.

Conclusion:

In every field, people don't want to be fooled by anyone. In the crypto world, there are many scams were making fooled many users and that is giving a negative impact on users' minds. So, education about any field helps and prevents us to not get fooled and lost money by any scams. I believe that if we learn about the crypto world, then we will not be fooled by any scams because we have knowledge about these types of crypto scams.

Every industry in the world has advantages and disadvantages. The Crypto world also has some good and bad aspects. We all know that there is always a risk in investing crypto world because it is a decentralized platform. Regulation makes this crypto world more secure and nonvolatile than before. But it is difficult to regulate the crypto world.

Hi @ibad4242

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good content. Well done with your research study on the plague of Crypto scams.

Thank you professor