[Cryptocurrency Triangular Arbitrage]-Steemit Crypto Academy | S4W4 | Homework Post for @reddileep

.jpg)

Hello friends. I believe you are all good? This post is my homework submission to Professor @reddileep’s class on cryptocurrency Triangular Arbitrage. The assignment was given as below:

1- Define Arbitrage Trading in your own words.

2- Make your research and define the types of Arbitrage (Define at least 3 Arbitrage types)

3- Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your illustration)

4- Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

5- Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

6- Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

Define Arbitrage Trading in your own words.

Arbitrage trading is a phenomenon that has been in existence on traditional markets for centuries now. When the same assets or products are sold at different prices on distinct markets, savvy traders who notice the price gap take advantage and capitalize on it by purchasing the product for a low price on one market. These traders will then move to the other market and place it for sale at the higher price demand. In the end, the traders will walk away with a significant amount of profit off their bold business transactions.

The illustration above simply sums up the core concept of arbitrage trading. Arbitrage trading is therefore the purchase of a financial entity for a low price on one market and concurrently selling it for a considerably higher price on a different market. Sometimes arbitrage trading can even happen on the same market but with different trading execution on a variety of assets. Arbitrage is a legal course of action, and more often than not causes different markets to converge at a similar price point for the respective assets.

Since cryptocurrencies have economic values and markets in place, the theory of arbitrage trading is very much applicable. Hence, the incidence of a cryptocurrency arbitrage is the case in which traders generate profits from the price gaps of the same assets on a cryptocurrency market by buying a number or fraction of the asset at a cheap price on one exchange and then selling it for a more expensive price point on another exchange. The presence of price gaps on cryptocurrency markets of the same asset can be attributed to various factors such as the discrete trading volume and liquidities of the exchanges.

Though practical, the concept of arbitrage trading does not necessarily result in immense profits. This situation is so because the price differences are usually small, and this requires the investment of bigger capitals to realize significant profits, especially when the transaction fees of the order execution are also taken into consideration. This means that traders with smaller capitals could end up breaking even or losing a minute percentage of their capital if they engage in such trades because a very small price gap with exchange trading transaction fees could cancel out the expected profits.

Regardless, arbitrage trading on cryptocurrency, even for small capitals, often result in profits when the price gap is bigger. It takes no special skills for traders to recognize price differences, and so arbitrage trading is a common strategy for novice and skilled traders on the cryptocurrency markets.

Make your research and define the types of Arbitrage

1. Exchange Arbitrage

As its name implies, exchange arbitrage occurs on cryptocurrency exchanges. It is defined as the event whereby an investor or trader recognizes a price gap of the same asset on distinct cryptocurrency exchanges and capitalizes on the market condition by purchasing the same for a low price on one exchange and then selling it on another cryptocurrency exchange at a higher price to secure profits. The multitude of these kinds of traders eventually results in the uniformity of the price points of the asset on these two different exchanges.

An instance of exchange arbitrage is cited below concerning the Ethereum cryptocurrency and two different exchanges.

.jpg)

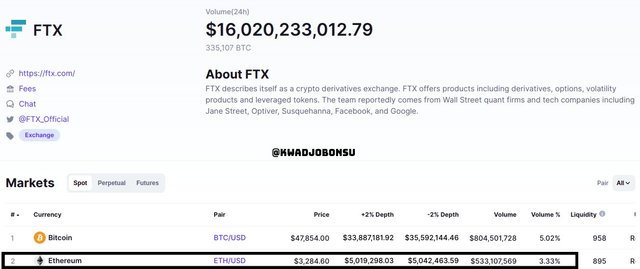

At the time of visit, the CoinMarketCap website indicated that the Ethereum cryptocurrency was selling at the price point of $3280.71 on the Kraken Cryptocurrency Exchange platform.

At the same time, the CoinMarketCap website indicated that the Ethereum cryptocurrency was selling at the price point of $3284.60 on the FTX Cryptocurrency Exchange platform.

Pragmatically, a trader who buys spends $3280.71 to acquire 1 Ethereum on the Kraken exchange will then transfer and sell that 1 Ethereum on the FTX exchange for $3284.60 on the FTX exchange. In the end, the net profit after the transfer and transaction fee has been deducted will still be significant enough.

2. Statistical Arbitrage

This form of arbitrage employs mathematical and programming models as well as software in recognizing the price differences of various assets on a market before executing the respective form of order to obtain profits. Statistical arbitrage is efficient as the bots are programmed to scan through distinct assets and their prices points. If there is a significant probability of making profits, the bot will accordingly place a buy or sell order based on the generate quantitative assessment to obtain profits.

A demerit to this type of arbitrage is that such software or robots may not come at a cheap price. Also, the existence of bugs in the programming space means that there is a chance for malfunction. In the worst-case scenario, the malfunctioning bot can place the wrong orders and wipe out a trader's capital reserve. Hence, regular monitoring of the executions of the bots by humans is necessary to put things in check.

3. Triangular Arbitrage

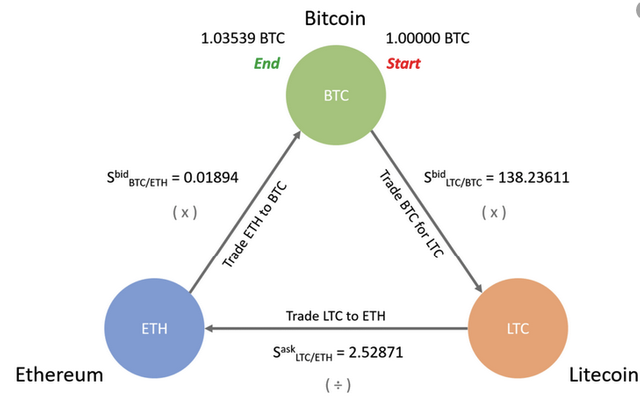

As its names implicitly foreshadow, the Triangular Arbitrage requires three cryptocurrency assets for its operation. It demands that traders or invests spot advantageous cross rates of three cryptocurrencies on the market. The difference in the rates is dependent on the market conditions for the respective pairs of cryptocurrencies. To these ends, traders capitalize on these ratios to obtain profits by first establishing a base cryptocurrency, which is then exchanged for another at a good rate. The newly acquired asset is exchanged for another cryptocurrency asset, which is then traded back for the base cryptocurrency element.

At the end of the move-around, significant profits will be realized by traders when the order fees are considered. This form of arbitrage is commonly performed on a single cryptocurrency exchange platform because the price gaps are usually of short duration. The risk involved is very low, and no special trading skills are required to put this strategy into action.

Explain the Triangular Arbitrage Strategy in your own words

Triangular arbitrage as introduced earlier is one of the forms of arbitrage trading strategies and is accordingly dependent on the gaps of cross-rates of three cryptocurrencies on a market. Multiple cryptocurrencies have trading pairs on the market, and the trading volume, as well as liquidity for each pair, differs. This is because there are higher demands for some cryptocurrency pairs on the market, whereas the demand for other pairs is lower, and an evident repercussion of such market conditions is the price ratios.

Traders are able to recognize such price gaps and capitalize on the market conditions of the distinct assets to acquire profits. In so doing, three cryptocurrencies must be identified. One of the three is regarded as the base asset. This base asset will be exchanged for the second cryptocurrency at the market price. The second asset, likewise, will be traded for the third cryptocurrency element – again at the market price. Finally, the third cryptocurrency will be exchanged back for the base asset on the market at the demand ask price.

Evidently, there will be several instances of transaction fees. However, if the cross rates were fairly good, a significant net profit would still be obtained by the trader. Also, huge capitals are needed to bag more profits off such market conditions since the price gaps are not very wide on regular cases. The window of opportunity in triangular arbitrage is small; hence, traders need to be rapid in executing the orders. The risk is low for triangular arbitrage and is a good strategy for all kinds of traders with different levels of tradings experiences.

A hypothetical illustration of triangular arbitrage is as follows:

A trader recognizes a triangular arbitrage opportunity among cryptocurrency assets A, B, and C. Cryptocurrency asset pair A/B is selling at $0.600, and the B/C cryptocurrency pair is trading at $2.200. Finally, the A/C pair is being traded at $1.200.

In such a scenario, should the trader buy $1000 worth of crypto A after trading his repository of crypto B based on the A/B pair rate 0.600, the trader would get $600 worth of crypto A.

Afterward, the trader would sell the $600 worth of crypto A for crypto C based on the $1.200 rate. The ideal return of this trade would be $720.

Lastly, the $720 worth of crypto C will be traded at the rate of $2.2 for the base cryptocurrency, crypto A. The returns in an ideal circumstance will be $1584

Deducting the final returns from the initial capital translates to a $584 profit. It must, however, be noted that the calculations were performed under an ideal supposition. In reality, transaction fees for the orders would have to be deducted.

Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price.

For this section, the two exchanges I used were the Binance and Poloniex cryptocurrency exchanges. I used the desktop application for the Binance exchange trade, whereas a desktop browser was used to visit the Poloniex website to perform the respective transactions.

The image above highlights my verified account on the Poloniex platform.

The screenshot above highlights my verified account on the Binance platform.

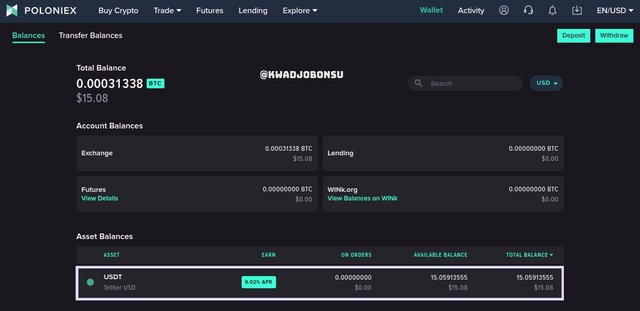

This photo above shows that I had $15.08 of USDT in my wallet on the Poloniex platform.

I then exchanged all the USDT assets in my wallet for TRX cryptocurrency at the market price of $0.09367587. The receivable amount of TRX coins was 160.75

The order was filled, and the amount of TRX in my wallet was 160.50. This is because transaction fees were deducted.

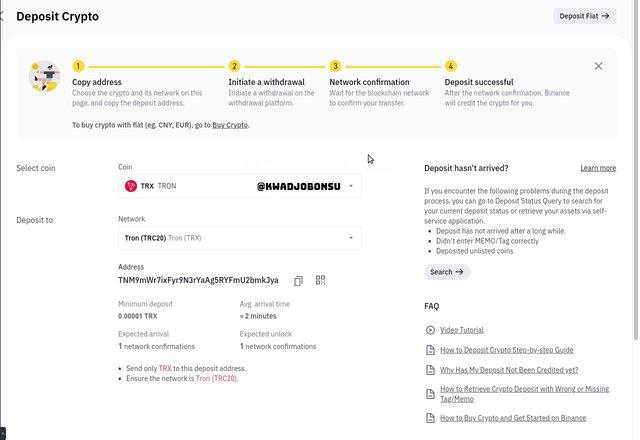

Next, I prepared my Binance account wallet for the deposit of the TRX coin. I copied the deposit address for the Tron (TRC- 20) network.

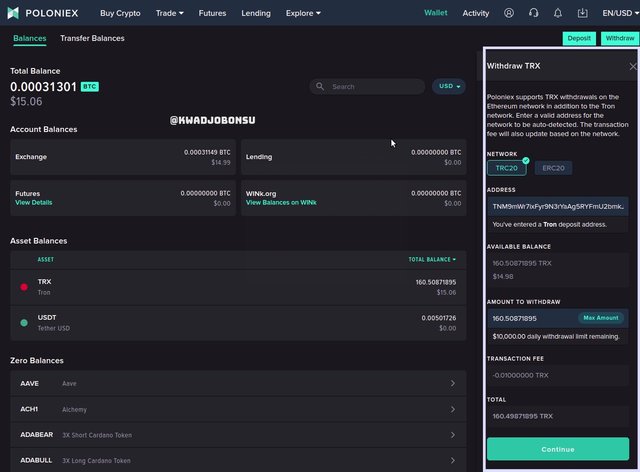

I pasted the deposit address at the Poloniex withdrawal address section, and also select the corresponding network, thus TRC-20. A transaction fee of $0.01 TRX was estimated to be deducted, and the receivable number of TRX coins was 160.49.

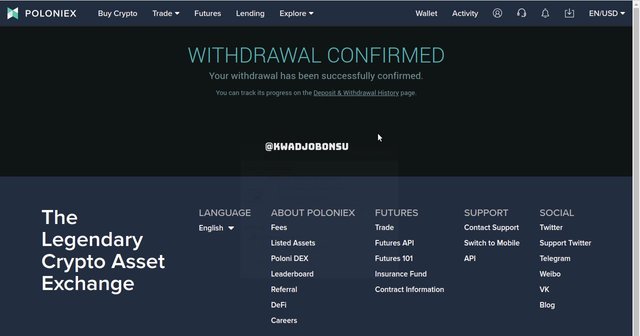

I continued with the transaction and clicked on the confirmation link sent to my email address. The withdrawal was confirmed. The TRX coins were sent to the respective address after the required number of confirmations were achieved.

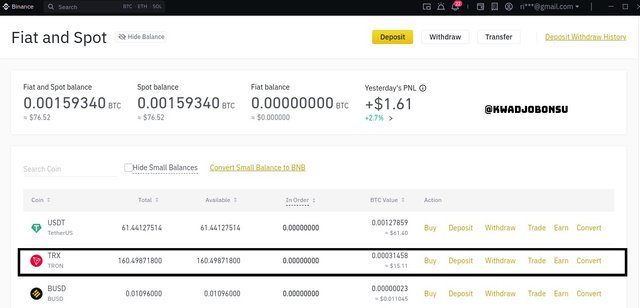

The received TRX coins are highlighted in my Binance account.

Next, I traded the TRX coins back to USDT at the price of 0.09394. The market was intensely active, so at the time I was taking the shot the market price has momentarily dipped to 0.09389. I still maintained the initial ask price and sold the TRX coins.

The order was placed on pending for a short while because there were violent up and downswings that did not yet meet my demands.

A few moments later, the order was filled, and I received a total of $15.0679 USDT at the price of $0.09394 TRX.

Therefore, my net-profit would be calculated as follows:

$15.0679 - $15.08 = - $0.0121

So I basically ended up with a negative profit or a loss of $0.0121, even though I purchased at a lower price of $0.09367587 on the Poloniex platform and sold at a higher price of $0.09394. This situation is a testament to my reiteration that either huge capitals or very wide price gaps are required to benefit from arbitrages because deduction of transaction fees can be a menace to the expected profits.

Invest for at least 15$ worth of a coin in a verified exchange and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH.

For this section, I converted a portion of my USDT coins into TRX coins on the Binance Desktop platform. I received a total of 263.16 TRX. I used 200 TRX out of these to demonstrate the triangular arbitrage among TRX, ETH, and BTC.

First, I traded 200 Tron coins at the market price for Ethereum coins.

The Order was filled at the price of $0.00002852. The transaction fee was 0.00000570 ETH, and I received 0.00570400.

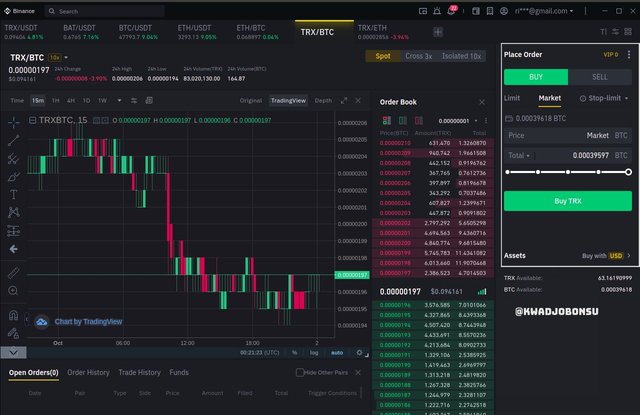

Next, I exchange all the 0.0057 ETH for BTC at the market price as shown in the image above.

The order was executed and filled at the price of $0.068845. The transaction fee was 0.00000039 BTC, and I obtained 0.00039241 worth of Bitcoin.

Finally, I exchanged all the received BTC amounts for the base cryptocurrency, which is the TRX coin. I exchanged it at the market price.

It can be seen from the highlighted transaction history that 201 TRX were received at a price of 0.000000197 for a transaction fee of 0.201 TRX.

Therefore the initial capital, 200 TRX, when deducted from the final revenue, 201 TRX, fetches a profit of 1 TRX. This proves that this arbitrage resulted in positive profit regardless of the instances of multiple transaction fees. A key contributor is also the bigger capital size in this case, compared to that of the exchange arbitrage demonstration.

Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words

Advantages of Triangular Arbitrage

Triangular arbitrages are very important because this form of trades lead prices of assets on various markets to converge. This event improves upon how efficient markets can be as their orders cause the price gaps to close progressively. The multiple orders on the markets also contribute immensely to the liquidity of the market.

Another merit of triangular arbitrage is that it is a simple strategy to understand and implement. Traders are usually on the lookout for ways that can fetch them profits. However, some of the means are abstruse and require some advanced quantitative background to comprehend them. Triangular arbitrages are, on the other hand, very easy for any trader of any level of experience and background to apply.

Triangular arbitrages are of minimal risk levels. Admittedly, the trades can result in losses; however, such losses are insignificant most of the time. This is because there is a low risk involved in performing this form of arbitrage. So it is technically a safe procedure for obtaining profits on the market.

- The framework of the triangular arbitrage makes it feasible to automate the process. As a result, there are multiple software and bots that are used to search for opportunities among various pairs. Respective orders are executed by the software to secure positive gains in returns, without the constant intervention and efforts of the human trader.

Disadvantages of Triangular Arbitrage

The window of opportunity to capitalize on price gaps regarding triangular arbitrages is very small. Therefore, in the absence of bots, traders need to be very fast in executing the orders else the rate of the pairs may end up in an unfavorable form. When did happens, the market spillage can cause traders to make losses instead of profits.

Huge amount of capital is recommended to secure large positive gains from the transactions. During the exchange, transaction fees are deducted. Also, since there will be multiple exchanges among the various cryptocurrency pairs, there will also be many instances of transaction fee deduction. Therefore, if the invested capital is not large, traders will either gain the same initial amount or a slight loss.

The effective software or bots that are used in capitalizing off the market conditions concerning triangular arbitrages are not free. Traders would have to spend a significant amount of money to purchase this software or subscribe to such features on a trading platform. Hence, this price can serve as an impediment to low-budget traders who are hoping to scalp profits from a wide range of cryptocurrency asset markets.

Conclusion

Arbitrage trading is a great strategy with a low-risk consequence that can be used to make profits off market conditions where there are price gaps between asset pairs, either on the same exchange platform or between distinct platforms. It is a simple method that can be put into practice by traders of diverse backgrounds. There are also a variety of forms when it comes to arbitrages such as exchange arbitrage, triangular arbitrages, and many others. Either way, it is good for merging the price of assets on the markets and also increases the liquidities of assets on the market.

I am grateful to Professor @reddileep for this class.