Trading Cryptocurrencies-Crypto Academy/S4W6-Homework Post for @reminiscence01

Designed in canva

Greetings Steemians, welcome to week 6 of the crypto academy Season 4, this is my homework post for @reminiscence01 in the Trading Cryptocurrencies class.

1 Explain the following stating it’s advantages and disadvantages -spot trading, -margin trading , -futures trading

Spot Trading

In the world of cryptocurrencies, spot trading is a direct market strategy where assets are purchased with either a corresponding asset of value or with fiat money at the current market price and are giving as soon as the purchase is made. Traders who trade spot trading can hold onto their cryptocurrencies and sell when the price increase to maximize profit. This trading pose minimal loss because when there is a drop in the price of the particular asset purchased the trader will not be affected as the asset is placed in his/her wallet and can wait till price goes back up to beat the loss and gain profit by selling at the point of high price. The spot price is determined through the process of demand and supply by sellers and buyers.

There are two types of spot trading

● Over the counter (OTC): here trade is bilateral, there is no central exchange institution to regulate the trade, all terms of trade are being made and negotiated on the spot. For example the trade of foreign currency for local currency.

● Market Exchanges: here trading is carried out on an electronic trading platform. Prices are set through buyers offered price and sellers offers.

As every other trading formats the spot trading is not left without it’s advantages and disadvantages, they are as follows;

| Advantages | Disadvantages |

|---|---|

| 1) The major advantage of the spot trading is that you get to purchase and be incharge of your asset thereby gauging when to sell to maximize profit and minimize loss | When using the spot trade, traders do not get the opportunity to take advantage of the price trend |

| 2) There is no minimum required capital to join spot trading | Traders might buy asset at a very high spot price and have to wait long periods to be able to get gain |

| 3) Trading on spot trading is a transparent process as the price is public and known to all parties involved | There is no option for compensation when trade irregularities is noticed and the spot transaction is concluded. |

Margin Trading

In margin trading, the trader deposits collateral with their broker or exchange

to be able to borrow funds and take advantage of the market with little starting capital. Margin trading allows traders buy more stock than they can afford, when successful traders get larger profits.Using margin trade you can open both long and short positions, a long one assuming price will go up and a short one assuming asset price will go down.

The following are it’s advantages and disadvantages;

| Advantages | Disadvantages |

|---|---|

| 1) Margin trading can bring about greater profits because of the high relative value of trade | Margin trading is a high risk trade as it has the possibility of increasing losses. |

| 2)Margin trading allows traders open multiple positions with little capital investment | Margin trading introduces the possibility of loss greater than an investor initial investment capital. |

| . | it is not a suitable trading for beginners |

Futures Trading

In the futures market, a trader predicts the later price of an assets or commodity and is required to either buy or sell the asset at the predicted price regardless of the current price at the end date of the agreement. Just like the margin trading, a trader in the futures market is able to make trade higher then their initial capital. With the high chance of making huge profit comes the high chance of making huge loss. Different asset commodity, precious metals, currency etc can be traded in the futures market. the futures market gives room for short and long positions where trade can either shift in Favour or against the traders predictions. As a beginner like myself it is totally not advisable to enter into the futures trading as any wrong prediction of price spells sure doom.

| Advantages | Disadvantages |

|---|---|

| 1) Traders can trade with little capital using leverage. | The futures market has the risk of making a trader lose more than his/her initial investment. |

| 2 ) A trader has the option of longer positions and can hedge to minimize loss | |

| 3)A trader trading in futures can get greater value (-great profit) of asset or commodity than he/she could have gotten with initial capital. |

2 (a) Explain the different types of orders in trading. (b) How can a trader manage risk using an OCO Oder (technical example needed)

In trading there are different orders through which a trader can enter the market and execute strategy they are as follows;

●Market Order

In a market order, a trader can buy or sell at the current market price which can easily change in a fast moving market this simply means that price is determined by the market.

● Limit Order

A limit order refers to a trade order where purchase or sale can be made at a specific set price by the trader for example; a buy limit is made at the set price of the trader for execution of the trade to occur, also the sell limit is made when the market price reaches the set price by the trader.

● OCO order

The acronym OCO stands for one cancels the other, this means that a trader is required to make two orders in a market (a limit and stop limit order) which if one occurs before the other, the other is cancelled. This type of order offers traders risk protection and can be for either bearish or bullish.

● Exit orders

Exit orders can either be stop loss or take profit where in the case of market deviation against the prediction of a trader the stop loss order already placed by the trader is automatically executed while for the take profit when the market goes in Favour of the traders prediction the take profit order is executed to maximize profit.

How can a Trader Manage risk using an OCO order

From the definition of the one cancels the other order a trader can set both a stop limit order and a buy or sell limit order and this can help a trader minimize and manage risk if price deviates away from predicted price the entire transaction ends (-stop limit) but if price goes high the limit price helps the trader take profit and the transaction ends.

For instance;

I want to purchase tron tokens and it is currently trading between $0.09949 with a resistance price of $0.09950 i would prefer to purchase if the price drops to $0.9943 or rise above 0.9950

Image from my Binance App

3 Open a limit order in any crypto asset with a minimum of 5USDT and explain the steps followed (screenshot needed for any cryptocurrency exchange)

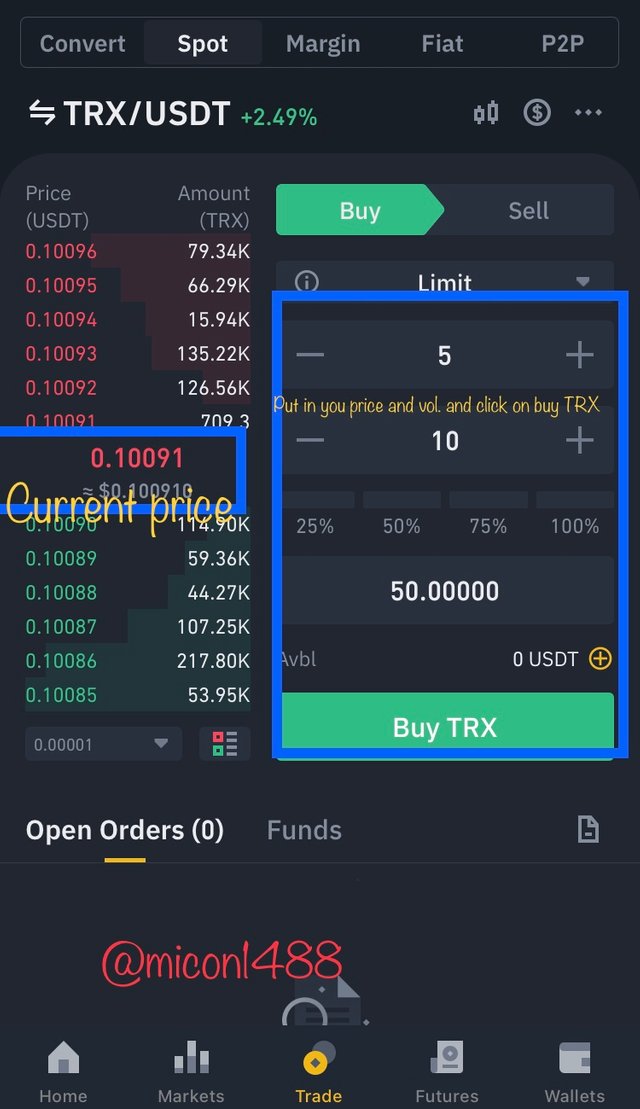

for this transaction I will be using by binance app with the crypto pair of TRXUSD with a price of $5 and volume of 10Trx

These are the various steps I took;

Step 1

I login to my binance account and I clicked on market, next I clicked on spot

Image From my Binance App

Step 2

Next I click on the search bar to find the crypto pair I would be using for this transaction

Image From my Binance App

Step 3

I click on buy from the section displayed

Image from my Binance App

Step 4

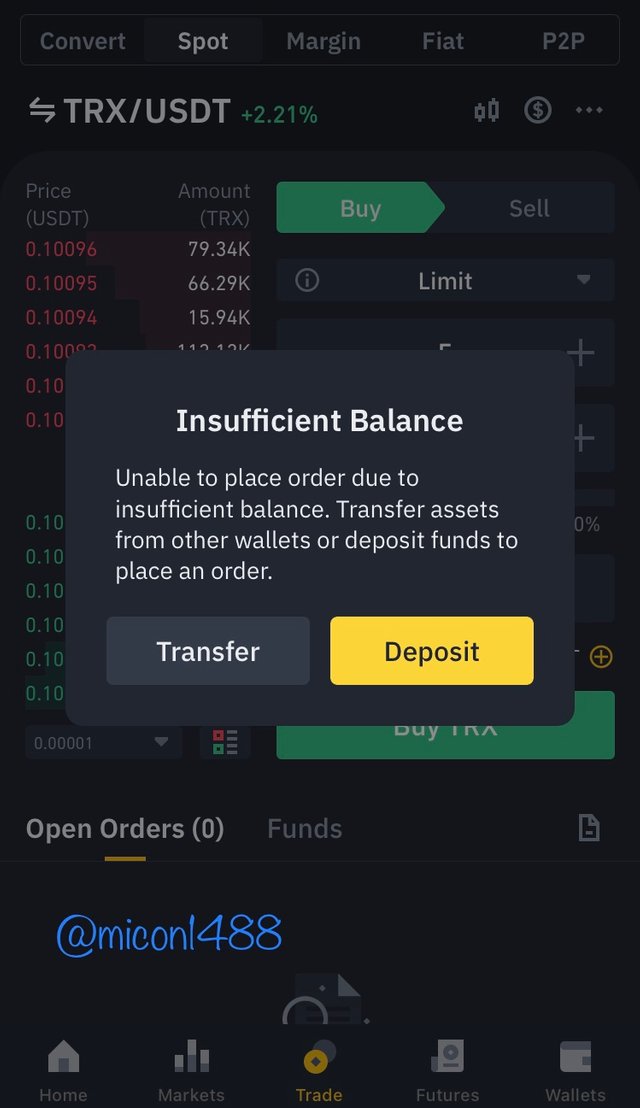

I set my order to limit and proceeded to pit in price and Volume as seen on the image below, after which I click on buy Trx, the order is set to be executed but I do not have enough balance in my account to perform the trade hence the image on the right.

4 Using a demo account of any trading platform carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected (i) why you choose the crypto asset (ii) why you choose the indicator and how it suits your trading style.

For this demo trade I would use my MetaTrader5 with the crypto pair BTCLTC and the **Stoch oscillator indicator.

I choose to sell the LTC for the crypto asset BTC because in respect to BTC, LTC was fast falling and I was sure to make profit if my trade went through.

I used the stoch oscillator because if fits my style of ranging market, the stoch oscillator lets me know the market trend easily for instance when the stoch green line (main) moves above the red line(signal) and continuous in an upward movement it indicates a buy but if it moves below the red and starts a downtrend movement it indicates a sell.

The below Image is the outcome of my trade

Conclusion

Having background and in-depth knowledge of the various trades in the crypto market is essential as this can enable a beginner or expert trader know what trade and it’s risk to enter with the endgame of maximizing profit and minimizing loss. I am grateful to @reminiscence01 for this wonderful lecture.

Hello @micon1488, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Thank you, I would keep improving.