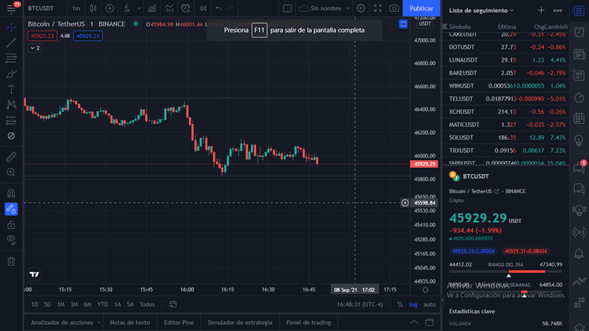

Crypto Academy Season 4 Week 1- Homework Post for [@awesononso]

The Bid-Ask Spread

Hello professor @awesononso and #SteemitCryptoAcademy ! this time I am posting the proposed task, I hope you enjoy it as much as I did when doing it. With nothing more to say, I leave you my work.

%20(1).png)

- Bid-Ask Spread is typically the difference between ask (offer/sell) price and bid (purchase/buy) price of a security. Ask price is the value point at which the seller is ready to sell and bid price is the point at which a buyer is ready to buy.

For example, if an investor wants to buy a stock, they need to determine how much someone is willing to sell it for. They look at the ask price, the lowest price someone is willing to sell the stock for.

- It is of the utmost importance since with this it is possible to maintain a balance in the market, consequently, a good liquidity. Because if there is a good supply and a good demand, the market economy is sustainable in the short and especially in the long term.

- The Bid – ask spread of the X crypto is: 0,20$ 5,20$ - 5$ = 0,20$

The percentage of this is: 3,84%

- The Bid – ask spread of the Y crypto is: 8,80$ - 8,40$ = 0,40$

The percentage of this is: 4,54%

- Asset Y is the one with the highest liquidity, since its spread percentage is higher, thus having a higher market capitalization and therefore greater liquidity than asset X.

- Displacement occurs due to the volatility of the asset, in this case in the crypto market, making the market order subject to change at the time the order is executed. Causing the order to be made at a price different from that intended by the buyer / seller, causing a slippage to occur.

In the crypto market, this type of phenomenon occurs frequently, with a greater margin of supply and demand. Slippage occurs in this market due to the great volatility suffered by cryptos, caused by low liquidity.

- Positive slippage occurs when an order placed by the trader is executed at a favorable price, better than the one entered by the trader. In the case of a buy order, positive slippage occurs when the buy was executed below the expected price. And in the case of a sale, it is when the order is executed above the placed price.

Negative slippage occurs when an order is placed in a negative way for the trader. In the case of a purchase, the order will be executed above the price that the seller was willing to pay. And in the case of being a sell order, it will be made below the expected price.

I want to thank you for the time you took to read this post, keep learning about things you like.

Hello @pjalzu,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You should have presented your work better. Try to section your work.

You did not get the answer of the fifth question.

You did not give illustrations on the slippages.

Thanks again as we anticipate your participation in the next class.