In-depth Study of Market Maker Concept]-Steemit Crypto Academy | S4W6 | Homework Post for Prof. @reddileep

.png) Cover Image Created on Canva

Cover Image Created on Canva

1- Define the concept of Market Making in your own words.

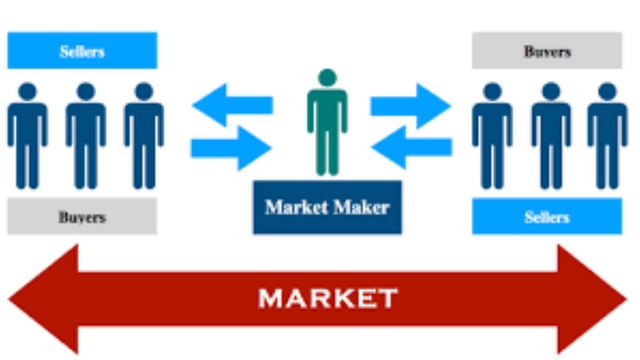

Market maker helps to create the market that allows traders and investors to partake in. The common types of market makers are large banks and big exchanges, but individuals like you and I can also act as market makers. Through the activities of market makers, they help to ensure there is enough volume of trading so trades can be done seamlessly. This means that without the involvement of market makers there would be little liquidity. For example, an investor who decides to sell part of his assets, would not be able to do so because there are no buyers on hand to buy the asset.

They also help the market to function regularly. That is, they are always there to buy and sell an asset from a market participant. They are of high importance because they are on hand to buy or sell an asset as long as the investor is willing to do business at the price specified by the market maker.

The price at which they buy and sell an asset reflects the demand and supply for that asset. So if the demand for an asset is low and the supply is high, then you should expect the price that the market maker would quote on the asset to be below. In the same vein, if the demand for an asset is high and the supply is low, therefore the price of that asset set by the market maker would be high.

Once the market maker has set the price, they must be able to fulfill buy and sell orders at that price.

Market Maker Profits

Markets makers make a profit off the spread of the buy and sell quotes of an asset. Their buy (bid) price that they quote is usually lower than the price of the market and their sell (ask) price is slightly higher than the price of the market.

They make profits from the spread that the market participants encounter, from the difference between the market price and the price they set (quote), and from commissions earned for providing liquidity to the exchange.

It is important to note that the level of spread for an asset is determined by the number of market makers in that asset. If the market makers are much, then their prices would be competitive thus lowering the spreads and also increasing liquidity. Also if the market makers are few, then their prices wouldn't experience much competition this, in turn, leads to higher spreads which then makes the market illiquid.

2- Explain the psychology behind Market Maker. (Screenshot Required)

As human beings and as traders we all have a psychological factor towards us. We are all composed of fear, greed, pride, joy, etc. It is through this psychological factor that the prices of assets move. Because it is we the human that is responsible for the upward and downward movement of an asset. Market makers know about all this and try to use it to their advantage. This is especially true for the small and inexperienced traders.

Market makers always try to mislead small and inexperienced traders to create the necessary liquidity for them so that they (market makers) can buy or sell the assets of the small and inexperienced traders and make some profits for themselves.

When a market maker keeps the sell orders at the Ask price that is high the small and inexperienced traders are left with no choice but to buy at that price. This the small and inexperienced traders to keep on buying until it reaches a certain point that the amount of sell orders that are executed makes the price go down and at that instant, the market maker is buying the assets at lower prices to obtain large profits. Look at it this way, you are selling an asset at a high price, and then later on you buy that asset at a low profit, this means that you would make good profits.

Screenshot from Tradingview

Screenshot from Tradingview

Imagine buying an asset for 2 and selling it 0.5 and making a loss. This is the kind of experience that we can see in the image above. The market maker has set the Ask price high at let's say 2.336 ADA. A lot of small and inexperienced traders were buying at the high price of 2.336 ADA until it reached a certain point the sell side of the order was reached and no more supply, so the price plummeted.

As the price fell, the small and inexperienced traders began selling the assets that they bought at a high price and started selling at a low price. This made them experience a loss. On the other hand, the market makers were busy buying the asset at a lower price.

3-Explain the benefits of Market Maker Concept?

These are some of the benefits of the concept of market-making. They are:

Typically, they provide liquidity to the markets as they set the prices at which buyers and sellers can engage the market.

As a primer to the benefit listed above, market-making also ensures that trades are executed easily and quickly without any difficulties experienced.

It allows experienced traders to have an investment opportunity through knowing the time the market maker is manipulating the market. The trader can take advantage of this situation and make profits with his operations.

Market making attracts traders to a platform because of the level of liquidity in that platform which translates to the speed at which trades are executed.

It allows smaller traders with low capital to invest in the markets.

The presence of a market maker can increase the value of an asset. This is achieved when he places a higher quote on the Ask Price.

4- Explain the disadvantages of Market Maker Concept?

As much as market makers always provide liquidity, it is not available to all asset classes. It is usually found in the most popular assets. That said if the market maker feels that providing liquidity in an asset wouldn't be profitable to him, he leaves the asset and looks for an asset that would be beneficial to him.

The market maker can manipulate the price to his benefit which is to the detriment of the market.

The market maker can conveniently manipulate the signals generated by indicators and use them to mislead small and inexperienced traders. Thereby profiting off the investments of the small and inexperienced traders.

Due to the manipulative actions of the market makers, smaller traders can experience loss of their assets which can lead to a loss of their account. They can also fall into depression and sometimes death.

There is less regulation on the activities of the market maker

5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

Bollinger Bands (BB)

Bollinger Bands (BB) is a technical indicator that uses two bands to give signals. It is composed of an upper band, a lower band, and a deviation band which is found in between the upper and lower bands.

The way traders use this indicator is that once the price of an asset breaks out from any of the bands it indicates a signal. That is if the price breaks the upper band then it is expected that the price would move upwards, likewise, if the band breaks the lower band, it is expected that the price would move downwards.

So as usual the market makers know about this strategy and they are always ready to pounce on the markets.

Screenshot from Tradingview

Screenshot from Tradingview

The chart above is a 4 hour of ADAUSDT with the Bollinger Band indicator installed in it. As you can see the price of the asset broke out from the indicator. This signaled a buy signal. The market makers knew that the traders were buying more of the asset, so they were selling to the traders, in the process generating a lot of selling pressures that drove the price downwards

Screenshot from Tradingview

Screenshot from Tradingview

Also, the price of the asset broke out from the lower band. This indicated a sell signal and traders were on hand to sell their coins. But the market makers knowing that the traders are selling the coins started buying them. The effect of their buying activity caused the price of the asset to rise due to their buying pressures.

Relative Strength Index (RSI)

The relative Strength Index (RSI) is a technical indicator that shows the present conditions of the market. It is also called an oscillator because it moves up and down its scale on the indicator. It tells when the market is in an overbought condition and when it is in an oversold condition.

The number that traders use to indicate if the market is in an overbought condition is 70. And the number used to indicate an oversold condition is 30. This means that at these numbers it is expected that a trend reversal would occur.

This is where the market makers come in. They know the exact moment when the market has reached certain conditions in the market.

Screenshot from Tradingview

Screenshot from Tradingview

The image above is a 4 Hour chart of XRPUSDT with the RSI indicator installed on it. The chart shows when the RSI indicator showed when the market was in an oversold condition. Ordinarily, traders were on hand to start buying XRP coins.

However, the market makers thought otherwise and started selling their coins as the traders were buying. They use this opportunity to obtain maximum profits.

Screenshot from Tradingview

Screenshot from Tradingview

Just like the chart above, the market makers spotted an overbought condition and knew that the traders would be on hand to start selling their XRP coins. So the market maker started buying the coins from the traders and made so much profit doing this.

Conclision

Market making is a very important aspect of the trading industry simply because it ensures liquidity. Also, they make sure the trading activities are being done every time as this is part of their obligations as a market maker. Because of the market makers trades are executed quickly and without any delays and frictions. This makes traders be less concerned about their investments.

However, we should be acquainted with the activities of the market makers. This is to prevent gullible traders from being manipulated by the market makers. They usually use the indicators of traders to manipulate signals for their advantage, they can also increase the Ask price of an asset to their satisfaction.

CC: @reddileep