Steemit cryptoacademy homework task for @allbert

Hey steemians

In this post i will be submitting my homework task for @allbert.

Q1. Select two Crypto, perform fundamental analysis and based on your fundamental analysis explain why you chose them.

Cardano(ADA)

Cardano is a blockchain platform developed and launched by Charles Hoskinson(co-founder of Ethereum) in 2017. Cardano(ADA) serves as an alternative to Bitcoin and Ethereum as it mitigates the limitation of Bitcoin and Ethereum blockchain.

The platform of Cardano provides better scalability, faster transaction and less transaction fee than Ethereum and Bitcoin blockchain.

The native digital currency of the platform of Cardano is ADA(named after a mathematician or first computer programmer).

Fundamental analysis of Cardano(ADA) Or Why should we invest in ADA?

In the world of cryptocurrency where you get a lot of options to choose from and invest in, it's totally up to you which crypto asset you choose based on your analysis or sentiments.

So to answer why we opt for ADA crypto assets to invest in, I will be doing a fundamental analysis that comprises strengths and other relevant features or information about Cardano(ADA).

My reasons for choosing Cardano and its fundamental analysis:

(1) Consensus algorithm

The algorithm is something that is the foremost thing to see in a blockchain as an algorithm is used to generate new blocks and to validate transactions on the blockchain.

Cardano(ADA) uses proof of stake consensus protocol same as Ethereum, proof of stake consensus protocol minimizes the energy consumption involved in the formation of a new block by eliminating the use of ASIC miners of hash power(power used by computers and hardware to operate and solve an algorithm to claim a block.)

Well, that consensus protocol is already present in Ethereum so What it is that made Cardano(ADA) more efficient or energy saving than Ethereum.

Ouroboros

This is the main algorithm used by Cardano(ADA), there are many slots of a fixed period and these slots constitute epochs. As of 2021, an epochs has a lasting period of 5 days and a slot has a lasting period of 1 second. The period I just mentioned are not fixed and can be changed according to the number of users working on a blockchain.

Same as proof of elapsed time consensus protocol there is a lottery system in Ouroboros too but the difference is that you must have to stake your holdings to participate in mining and you have a greater chance of claiming a block if you are staking a large number of your holdings.

Ouroboros comes up with 2 methods to reduce energy consumption while mining:

(A) by reducing the number of holders that must remain online to mine a block.

(B) by using the concept of stake pools, in which holders can elect some of them to participate in mining while others can remain offline to save energy.

Less energy consumption leads to the less transaction fee and this is one of the main reasons for choosing Cardano(ADA).

(2) Listed on exchanges:

Liquidity is something that must be at the top of the list of an investor while investing. If an asset has good liquidity it means that it can be easily converted into any other crypto asset or in cash.

So it is very important to look for the listings of the particular asset you are choosing to invest in into exchanges.

I searched for the list of exchanges that support Cardano and I came to know about the 74 exchanges that support Cardano.

To get listed on 74 exchanges is a good sign and a strong reason to invest in Cardano. This is my 2nd reason for choosing Cardano(ADA).

(3) Whitepaper of Cardano:

The whitepaper is the foremost thing an investor should see before investing as it contains all the details regarding the features and the services that will be provided by a platform or an organisation.

The whitepaper of Cardano tells us about the open-source and decentralised nature of the Cardano blockchain, it further tells us about the consensus algorithm(Proof-of-stake/Ouroboros).

It tells us about the team that created or developed Cardano and still working on Cardano are the top engineers and academic experts.

The main features that Cardano will be providing to its user according to the whitepaper are sustainability, scalability, security and transparency.

Moreover, Cardano has used Haskell language to program the functions to ensure the security of its users, adding on to these points the white paper of Cardano further mentions the integration of smart contracts that will lead to the development of several DApps on the Cardano blockchain.

The last section of the whitepaper focuses on governance and giving rights of voting to its holders or stakers by giving rights to users, users can influence the future developments and updates of Cardano and that makes it a more decentralised platform than others.

(4) Roadmap of Cardano along with some features:

A roadmap of a crypto asset tells us about the developments or commits fulfilled by a crypto project and further tells us about the future goals of that crypto project.

I opened the roadmap of Cardano and came to know about the 5 eras of Cardano(ADA), each era tells us about the development of Cardano during that era.

The 5 eras of Cardano are:

(A) Byron: This era tells us about the starting of Cardano as a third-generation blockchain. It tells us about the consensus algorithm Ouroboros which is the first proof-of-stake protocol based on research and has proven to be secure. Further, it tells us about the wallets that were created for fast transactions of ADA, these wallets Daedalus wallet and Yoroi. Further reading tells us about the number of exchanges that listed Cardano(ADA).

(B) Shelley: It focuses on the decentralised nature of Cardano, Cardano aim to include its user in mining process which was earlier controlled by the Cardano, this will lead more users to participate in mining and run a node, this will ultimately lead to a decentralised and secure platform(Cardano). This era also tells us about the development of delegation or staking in the staking pool in Cardano and mining pool, in return liquidity providers and delegators will get the reward.

(3) Goguen: This era deals with the introduction of smart contracts in Cardano and permits users to develop Dapps on the Cardano foundation. It could be a perfect move by Cardano to integrate smart contracts because of the high fee in the Ethereum blockchain for a smart contract transfer. Investors or users will switch from Ethereum blockchain to Cardano.

(4) Basho: This era will focus on providing good scalability by introducing sidechains or forks, main work of the sidechains and forks will be to reduce the load from the main blockchain.

(5) Voltaire: This era focuses on the governance of Cardano and proposes to provide its users with the voting rights

The last option is a status update where you can check the status of the development made by Cardano, the data is uploaded weekly but you can go to any date to see the development made by Cardano in that particular week.

(5) Partners:

Cardano works with 2 other platforms to fulfil their commitment and these 2 partners are:

(A) IOHK: IOHK is a company related to making cryptocurrencies and blockchains, Cardano collaborated or contracted with IOHK to make Cardano a decentralise secure and scalable platform, IOHK is one of the top companies that build decentralised technology and computing system. Charles Hoskinson(Founder of Cardano) and Jeremy wood developed the IOHK.

(2) EMURGO: EMURGO helps Cardano in commercial purposes by adding business to the Cardano blockchain. EMURGO is also providing blockchain education and there are some courses also related to blockchain engineering.

(3) The Cardano Foundation: it is an independent body that supervises the development and works in Cardano blockchain as it is the main body of Cardano it works on making partnerships, fostering the use of Cardano blockchain and growing community around the globe.

These all 3 partners are the best at what they do and that makes Cardano a more reliable platform and easy to invest in.

(6) Team of Cardano: Apart from Charles Hoskinson, the co-founder of a successful project Ethereum, there are lots of other people that are fully dedicated to the goal of making Cardano a successful project that surpasses even Ethereum. As I started earlier Cardano is in partnership with IOHK and EMURGO, these two are leading companies when it comes to making blockchains and decentralised technology so Cardano must include the best team from both the platforms Cardano is in partnership with.

There are 250 developera or researchers working on Cardano around the clock.

(7) Hydra: Cardano uses 2 layers system like any other blockchain, the first one provides security to the blockchain and the second one which is Hydra in Cardano is used to execute faster transactions, it is claimed that Cardano can execute 1 million transactions per second. Hydra limits the use or contact of the first layer via state channels, the data is transferred to Hydra from the first layer and then the transaction or smart contract runs on Hydra and then the final result gets sent to the first layer to update the blockchain.

Using Hydra layer in Cardano leads to running transactions or smart contract off-chain and after getting these transactions and smart contracts completed, then the final data is sent to blockchain for updating details.

Scalability is now become a must feature in the blockchain system owing to tye increasing popularuty of cryptocurrencies, and that is the reason why one should opt for a platform with a good scalability, you must have encountered the waiting period in Ethereum blockchain due to the congestion on its blockchain and not a good scalability. So it is my one of the reasons for choosing Cardano.

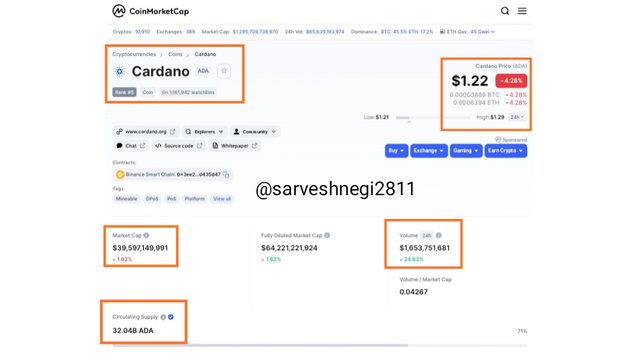

(8) Market related details:

Price: $1.22

Volume 24hr: $1.6B

Market cap: $39B

Ranking: 5

Circulating supply: 32.04B ADA

All time high: $2.46

All time low: $0.01735

Cardano ROI: 5526.93%(Return on investment)

High circulating supply shows a very good liquidity.

The number of coin traded in last 24 hours can be seen in volume and it is really a very huge number, it shows the popularity of Cardano.

Price is moving downward for now because of the ongoing bearish trend but it will bounce back and i am sure of it.

Ranking of Cardano shows the strong position of Cardano.

(9)Cardano on social networks:

Social media can be the best way to know about the popularity of a particular asset.

Twitter shows 724k followers of the Cardano community which is quite a large number.

Telegram shows 56k members of the Cardano community which is also quite a large number.

Source: My twitter and telegram account

I think through above mentioned specific points I have told my reason about choosing Cardano, but to be brief I would like to list my reasons for choosing Cardano(ADA):

(1) Scalability(Hydra)

(2) Liquidity(74 exchanges listing)

(3) Ranking(5)

(4) Ouroboros(less energy required/less transaction fee)

(5) Partners(IOHK and EMURGO)

(6) Team(Top engineers and analysts)

(7) Integration of smart contracts(can compete with ETH)

(8) Security, sustainability and decentralised nature of blockchain.

(9) If I were to add one more point, I would add a point related to Cardano ROI(5526.93%), and further adding on to this point the price of Cardano(ADA) is approx $2 that is not a very high price, so one can easily buy it, unlike BTC and ETH.

Fundamental analysis of Polkadot

Polkadot is a network of blockchains that support the sub-chains involved in a particular use case. The Relay chain serves as the first layer and provides security to the sub-chains( known as para chains) and create consensus It was the idea of Dr Gavin wood(one of the co-founders of Ethereum).

DOT is the native currency used in the platform Polkadot

My reasons for choosing Polkadot and its significant features:

(1) Interoperability: As the word is suggesting it is related to operation between two different blockchains. As we all know that Polkadot is a network of blockchains so there can be 2 types of interoperability:

(A) Interoperation between the sub-chains or para-chains of Polkadot: As we all know para chains are subchains of relay chain, so interoperation between two para chains can only be possible with the help of a relay chain, it all becomes feasible because of the same language used in para chains and para threads(same as we use the same language for 1st and 2nd layer in Cardano).

(B) Interoperation between external chains: To fit this purpose, Polkadot has para chains called "bridges" that connects an external chain to other.

This is one of the main reasons for choosing Polkadot as I don't have to worry about the different blockchains as I can interoperate with the external or independent blockchains on Polkadot.

(2) Governance: As we already talked about governance in Cardano that Cardano gives the freedom to ADA holders to influence the future development of Cardano. The same is the case is here in Polkadot, in the Polkadot platform, the Dot holders have the freedom or right to vote for upgrades or development proposals and council members.

And this feature of governance is what made a blockchain purely decentralised and this was my 2nd reason for choosing Polkadot.

(3) Scalability: Scalability is the ability of a blockchain to handle or support the increasing number of transactions, the more scalability, the more transactions can be easily made.

Polkadot consists of many sub-chains called para chains so it is easy for Polkadot to execute a lot of transactions at a time, it is all thanks to the para-chains which works in parallel to each other.

It is claimed that Polkadot can handle or support 1 million transactions per second which can come in handy when it becomes a successful project with the million users using it.

(4) Forkless upgrades: You must have heard about the fork( splitting of the main project and tackling the limitations of the main project with the help of a fork), BTC and Bytecoin have their forks called BTC gold and Monero(privacy coin).

Polkadot has a feature of upgrading its platform with the help of meta protocol and as we all know about the governance in Polkadot, the voting process will be held for the adoption of the upgrade, if the DOT holder agrees to an update, the Polkadot protocol will get changed by meta protocol(upgrade).

By this method, Polkadot doesn't need any fork to counter its limitations instead the whole protocol can get upgraded based on the governance of Polkadot.

(5) Whitepaper of Polkadot: the whitepaper of Polkadot contains 21 pages and I will not be able to convey all the information about it here so I will be talking about it in brief.

Whitepaper of Polkadot focuses on providing pooled security and trust-free interchain transactability.

It tells us about the role of the Validator in receiving and validating blocks, the role of nominators(stakeholders) and to nominate validator.

It further tells us about the ability of the consensus algorithm to resist Byzantine fault through aBFT(asynchronous Byzantine Fault tolerance) and reaching a low-level consensus.

And the final point worth mentioning here is the ability of Polkadot blockchain to support cross-blockchain transfers.

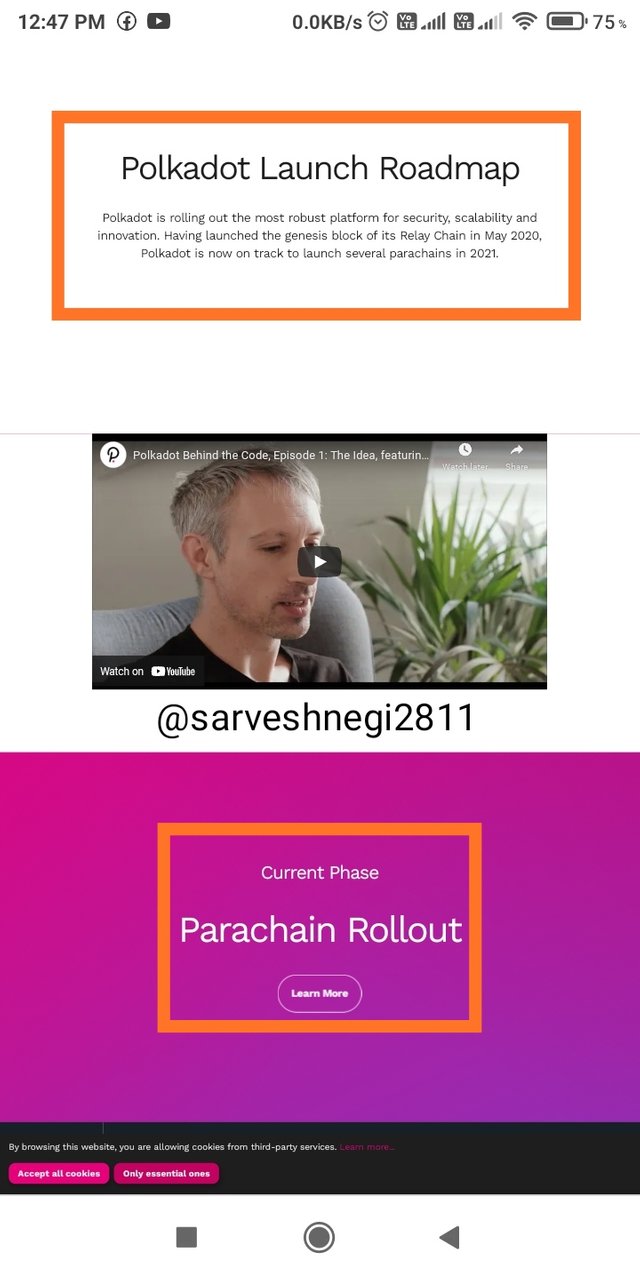

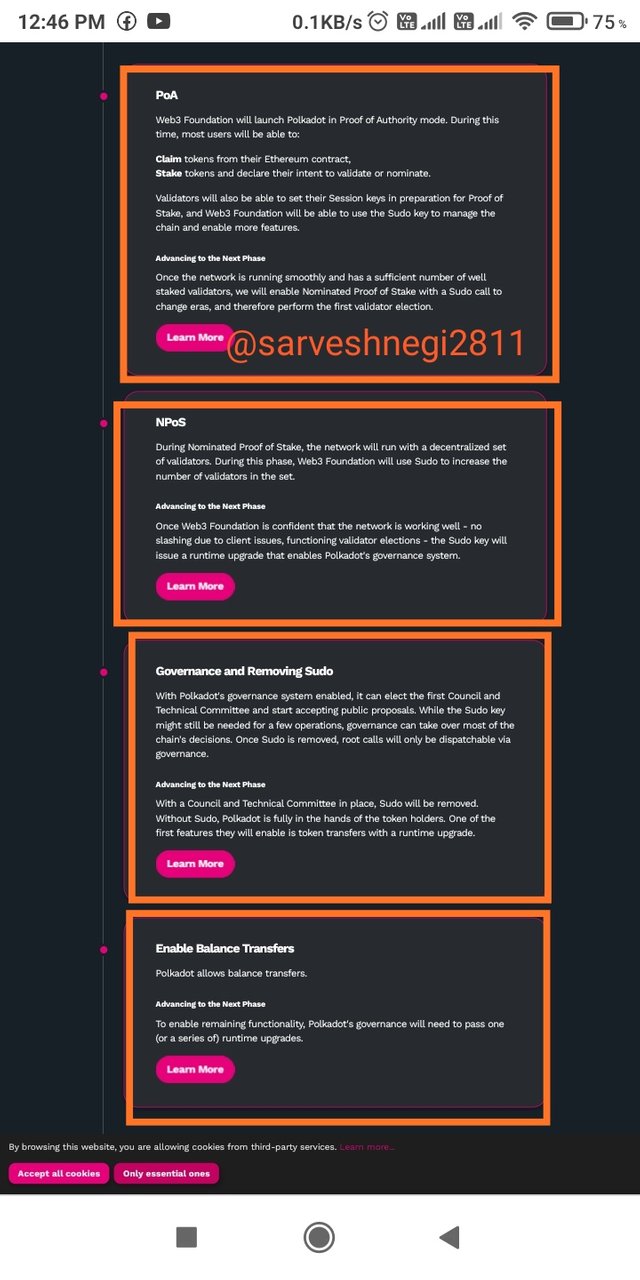

(6) Roadmap of Polkadot: When you visit the official site of Polkadot you will get to see the various features of Polkadot and Roadmap, by clicking on Roadmap you can see about the current phase known as para chain rollout.

Roadmap tells us about the adoption of proof-of-authority mode made by Web3( created by Dr Gavin wood) to avail its user the features to claim and stake(to participate in voting for the upgrade of Polkadot).

NPoS: Nominated proof of stake, in this consensus protocol all the validators, are nominated by the holders of DOT which makes it a purely decentralised system.

Para chain rollout: this section tells us about the auction of slots of parachains after being tested on parachain testnet and kusama by the governance of Polkadot.

The future upgrades section tells us about the cross-chain message passing and launch of para threads.

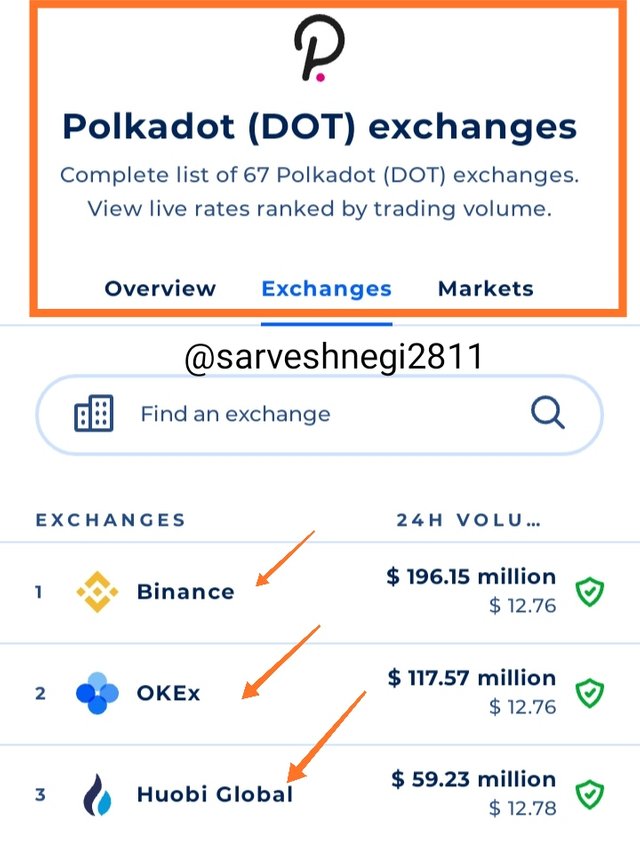

(7) Listed on exchanges:

Liquidity is something that must be at the top of the list of an investor while investing. If an asset has good liquidity it means that it can be easily converted into any other crypto asset or in cash.

So it is very important to look for the listings of the particular asset you are choosing to invest in into exchanges.

I searched for the list of exchanges that support Polkadot and I came to know about the 67 exchanges that support Polkadot.

To get listed on 67 exchanges is a good sign and a strong reason to invest in Polkadot. This is one of the reasons for choosing Polkadot(DOT).

(8) Team and communities: As I mentioned above the developer of Polkadot and web3 is Dr Gavin wood so the web3 foundation is collaborating with the top developers and researchers.

Researchers: Inria Paris and ETH Zurich

Developers: Parity technologies

This team is working its best to make Polkadot a successful project.

Polkadot is on most of the social media platforms and its following or popularity can be seen through the number of people following Polkadot. It has 500k followers on twitter and it shows the popularity of this project.

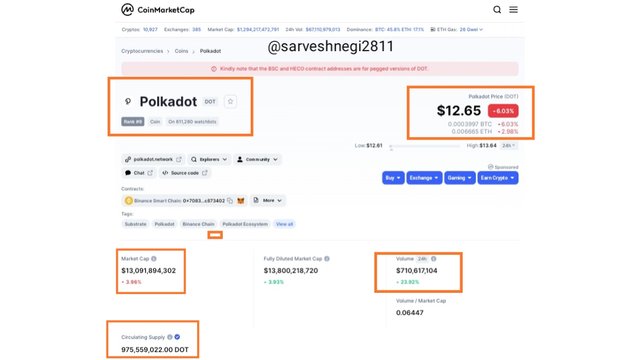

(9) Market related details:

Price: $12.69

Volume 24hr: $790M

Market cap: $12B

Ranking: 9

Circulating supply: 975 M DOT

All time high: $49.69

All time low: $2.69

Polkadot ROI: 352.45%(Return on investment)

High circulating supply shows a very good liquidity.

The number of coin traded in last 24 hours can be seen in volume and it is really a very huge number, it shows the popularity of Polkadot.

Price is moving downward for now because of the ongoing bearish trend but it will bounce back and i am sure of it.

Ranking of Polkadot shows the strong position of Polkadot.

I think through above mentioned specific points I have told my reason for choosing Polkadot(DOT), but to be brief I would like to list my reasons for choosing Polkadot(DOT):

(1) Scalability(with the help of para chains)

(2) Liquidity(listed in 67 exchanges)

(3) Interoperability(using the bridge)

(4) Governance(giving citing rights to the holders or stakers)

(5) Ranking(9)

(6) Heterogeneity(using para chains)

(7) Team(Top developers and researchers)

(8) Forkless upgrade(via meta protocol)

(9) If I were to add one more point, I would add a point related to Polkadot ROI(352.45%), and further adding on to this point the price of Polkadot(DOT) is approx $12 that is not a very high price, so one can easily buy it, unlike BTC and ETH.

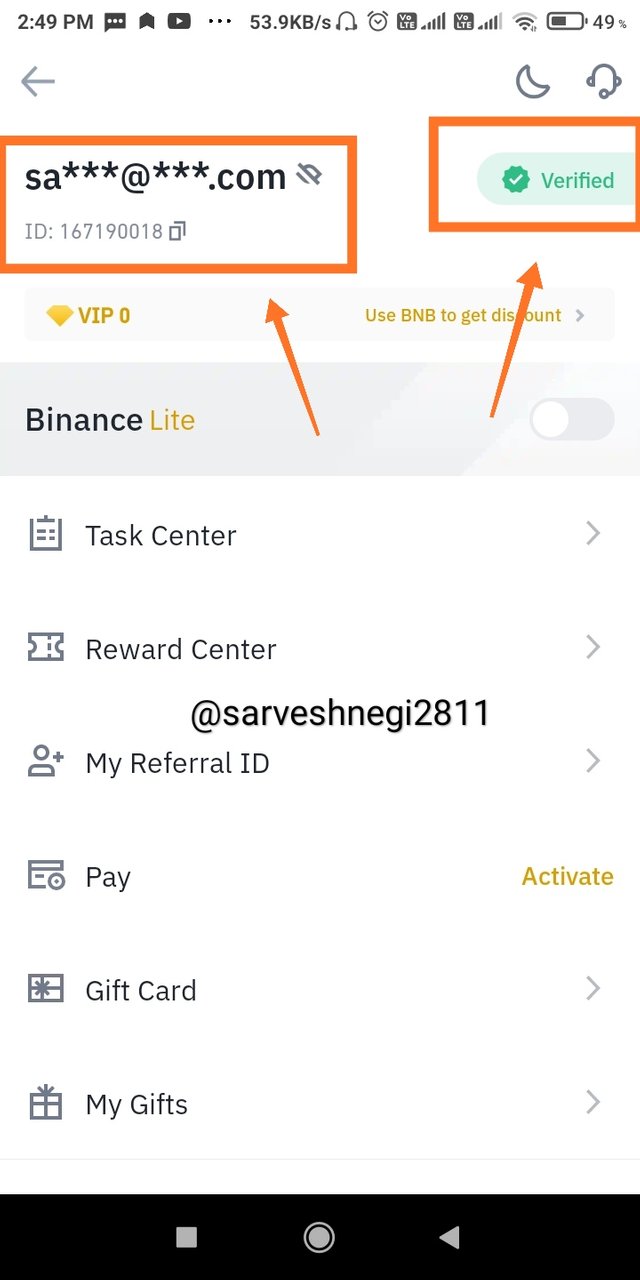

Q2.Through your verified Exchange account (screenshot needed), make a real purchase of one of the cryptocurrencies selected in the first assignment and explain the process.

I am going to purchase Cardano(ADA) and the steps for the process of purchasing are as follow:

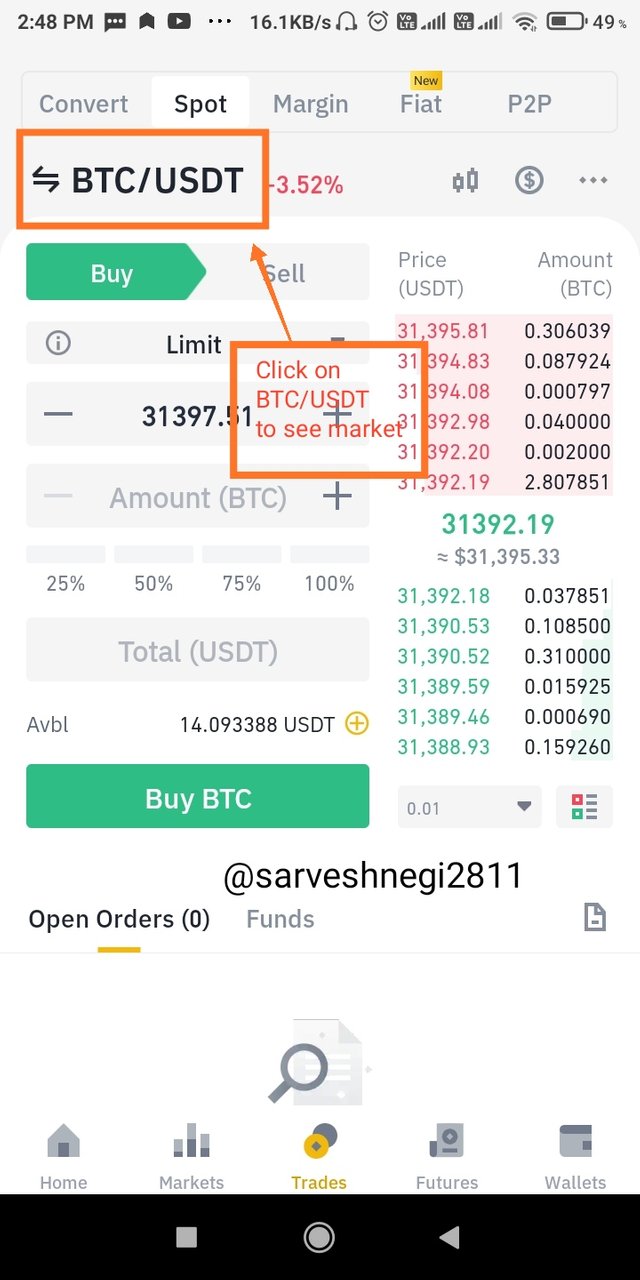

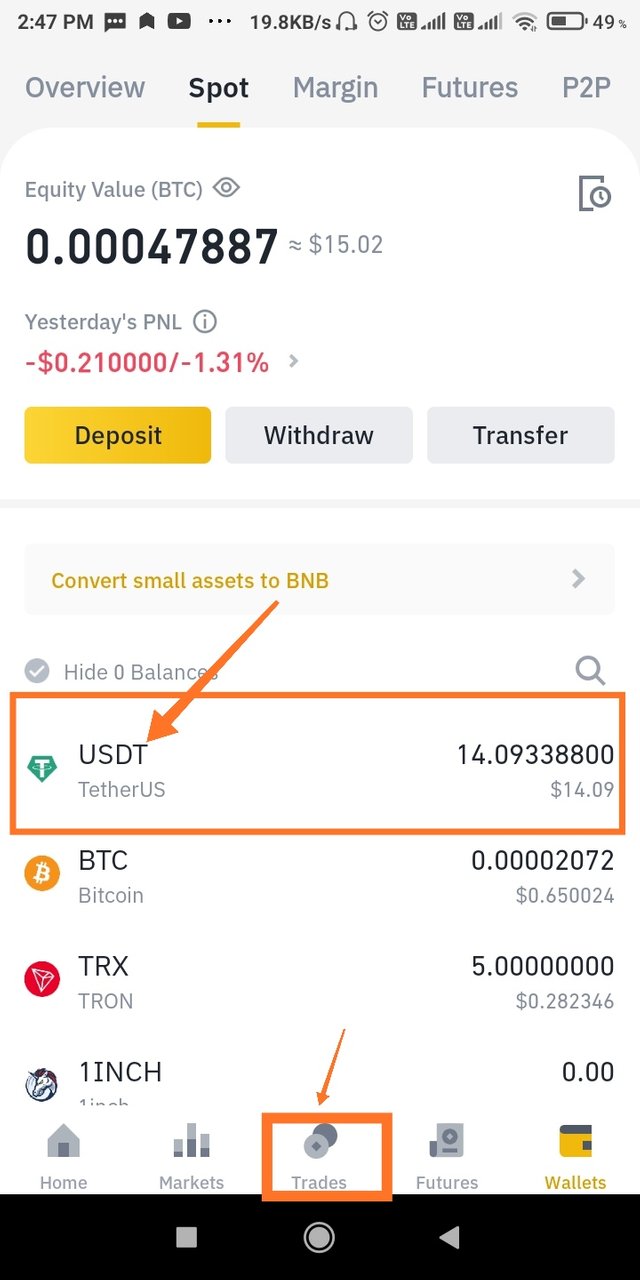

(1) I opened my Binance wallet and you can see that I had 14.09 USDT(a stable coin whose value doesn't fluctuate).

(2) Then I clicked on "Trade" to trade my USDT for ADA.

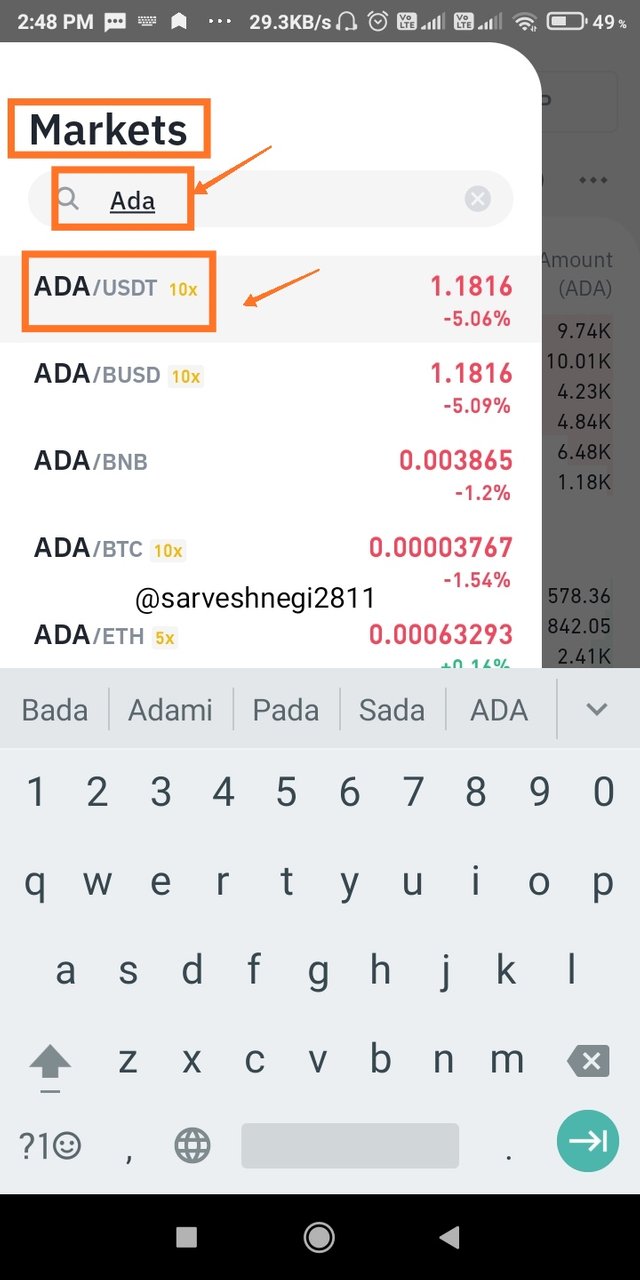

(3) Trade page appears in which you can see pair of BTC and USDT, I clicked on BTC/USDT and then the markets appear.

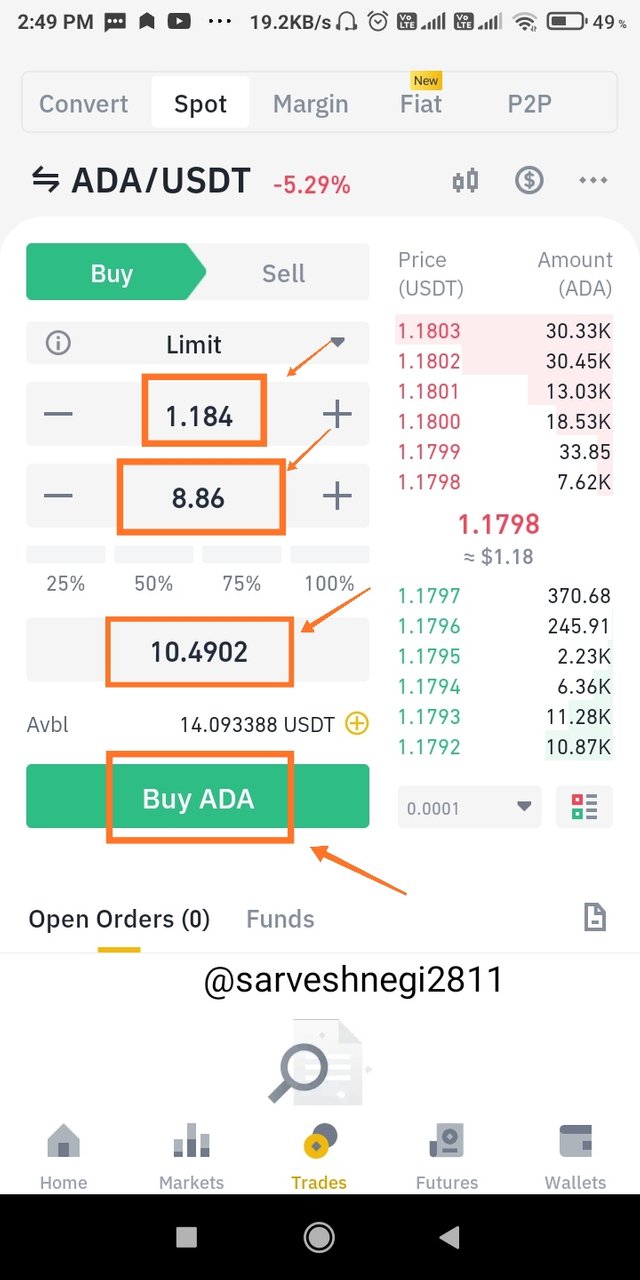

(4) I then searched for ADA/USDT pair and chose it to trade.

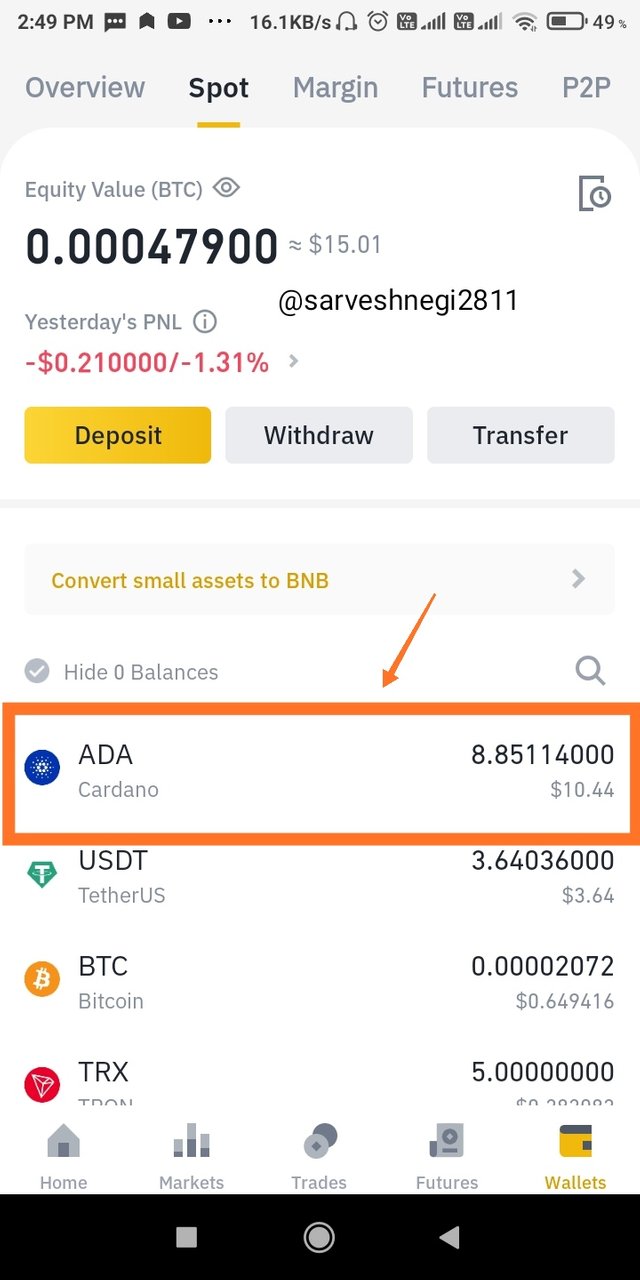

(5) ADA/USDT trade section appeared where I filled in the amount of USDT(10.4902) and I would get 8.86 ADA, the price of 1 ADA at the time I purchased ADA was 1.184 USDT.

(6) Then I proceeded with the process by clicking on the buy ADA option and the process of purchasing was completed.

(7) You can see Cardano in my portfolio of Binance wallet.

Trade details:

At the time I purchased ADA, its price was 1.184 USDT.

I purchased ADA tokens of 10.4902 USDT and I get 8.86 ADA tokens.

The first screenshot reflects my verified account on Binance exchange.

Q3. 3- Finally, make a simulated exercise, using the DCA method to perform the purchase of two assets and present charts showing the data of days in which the operation was performed, price of purchases, average price, sell point, percentage of profit or loss.

DCA stands for Dollar-cost averaging, this strategy is used to counter the high volatility in the cryptocurrency market by not investing a whole sum at a time, instead of investing a whole sum at the same time, a sum is divided into parts that get invested on different intervals irrespective of the trend of the market. One can invest till one gets a profitable amount to exit the market.

Using DCA strategy to purchase ADA:

I have made 5 trades and the period between the trades is of 12 days and I have also marked the date along with the price(approx) on that particular date.

I have divided an amount of $50 into 5 equal parts of $10.

Details of all my trades:

| Date | Price | Invested($) | ADA I got |

|---|---|---|---|

| 20 May | $2.0045 | $10 | 4.988 |

| 1 June | $1.6 | $10 | 6.5 |

| 13 June | $1.46 | $10 | 6.84 |

| 25 June | $1.4 | $10 | 7.14 |

| 7 July | $1.4 | $10 | 7.14 |

Total amount invested: $50

Total ADA purchased: 32.608

Average price: 50/32.608 = $1.55

Now my average price has come to a value of $1.55 if I sell my 32.608 Tokens at a price that is higher than my average price I will be getting a profit.

My selling point

As the price has fallen from $2.0045 I will set up my take profit level at $2.(scenario if the price goes up before my next investment after 12 days)

My stop loss level will be at $1.3, you can see that I have set my risk-reward ratio to 1:2.

Profit percentage if my take profit level gets hit:

Profit /Amount invested ×100

Profit price= $32.608×2 - $50 = $15.216

15.216/50 ×100 = 30.412%(profit)

Loss percentage if my stop-loss level gets hit:

Loss/Amount invested ×100

Loss price= $50 - $32.608×1.3 = $7.7

Loss percentage = 7.7/50 × 100 = 15 4%(loss)

Using DCA strategy to purchase Polkadot(DOT)

I have made 5 trades and the period between the traders is of 12 days and I have also market the date along with the price(approx) on that particular date.

I have divided an amount of $50 into 5 equal parts of $10.

Details of all my trades:

| Date | Price | Invested($) | DOT I got |

|---|---|---|---|

| 20 May | $37.863 | $10 | 0.264 |

| 1 June | $24 | $10 | 0.41 |

| 13 June | $20.13 | $10 | 0.49 |

| 25 June | $17.47 | $10 | 0.57 |

| 7 July | $17.47 | $10 | 0.57 |

Total amount invested: $50

Total DOT purchased: 2.304

Average price: 50/2.304 = $ 21.701

Now my average price has come to a value of $ 21.701 if I sell my 2.304 DOT Tokens at a price that is higher than my average price I will be getting a profit.

My selling point

As the price has fallen from $37.863 I will set up my take profit level at $32.1.(scenario if the price goes up before my next investment after 12 days)

My stop loss level will be at $16, you can see that I have set my risk-reward ratio to 1:2.

Profit level if my take profit level gets hit:

Profit /Amount invested ×100

Profit price= $2.304×32.1- $50 = 23.95

Profit percentage: 23.95/50 ×100 = 47.9%(profit)

Loss percentage if my stop-loss level gets hit:

Loss/Amount invested ×100

Loss price= $50 - $2.304×16 = $13.316

Loss percentage = 13.316/50 × 100 = 26.27%(loss)

Conclusion:

In a nutshell, i chose the two projects for fundamental analysis which were Cardano and Polkadot, these two crypto assets have gained my attention and compelled me to write about them, after that i purchased Cardano through my Binance verified exchange and at last i came to know about a strategy that can come in handy for the beginners. I performed a drill by purchasing Cardano(ADA) and Polkadot(DOT) using DCA strategy.

Note:All the screenshots are referenced to their sources except screenshots taken from my Binance exchange.

Thank you, that was all from my side

For the attention of @allbert

Hello, @sarveshnegi2811 Thank you for participating in Steemit Crypto Academy season 3 week 3.