Stability in Digital Currencies- Steemit Crypto Academy- Season 4, Week 5- Homework Post for @awesononso

Question 1

Explain why Stability is important in Digital currencies.

Stability is essential for any economy in the world to prosper, come to think of it, in 2008 when the world economy crashed so many people lost their investments, those who could not cope with the crash filed for bankruptcy.

This problem of market crashing is also evident in the world of cryptocurrency, there is always a case that the crypto world is a Bubble, this is always brought up whenever its stability/progress is in question because investors pour in their money into these assets which are not backed by any commodity, economy or natural resource.

Volatility has always been a big issue in the crypto world because the value of these crypto-assets is only driven by the public interest, this makes it dangerous for investors because when prices of these assets rise and fall without major causes they tend to lose their capital that is why they cannot be considered as a store of value.

Cryptocurrencies are tradeable assets which means they can be bought and sold in the market. But every crypto assets need a pair to be traded within the market and using a volatile asset as a pair will always be dangerous, this is why a need for stability in the crypto space was introduced.

The first stable coin was created in October 2014, it was known as the Real coin but was later changed to Tether in November 2014. It was built on the Omni layer Protocol by Brock Pierce, Reeve Collins, and Craig Sellars, who were members of the OMNI foundation.

The Tether which is also called the USDT is a stable cryptocurrency that is backed by the Dollar, this means that every 1:1 of Tether is equal to 1 Dollar. The role of the creation of the stable currency (Tether ) is to serve as a shield against the volatility of the Crypto market, create more liquidity for the ever-growing market and also act as a store of value due to its stable nature.

Over the years Other crypto Blockchain adopted the use of Tether, while others created new versions of other stable coins such as the BUSD(Binance Blockchain), USDC and TrueUsd. But regardless of the creation of stable coins crypto assets, in general, have experienced huge crashes over the years, that is why investors still see it as a risky choice for investment, nevertheless, the introduction of stable coins have served a great deal of purpose for the crypto space, by serving as a hedge against volatility.

Question 2

Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

- What is the CBDCs

The CBDCs also known as Central Bank Digital Currencies, are cryptocurrencies issued and controlled by a sovereign government which means that it is centralised. They are the digital or Fiat versions of a county native or official currency.

- My personal View and Position on the Future of CBDCs

I do not think the CBDCs would be good in the future because it is controlled by a central authority, this alone goes against all the characteristics of the Blockchain ecosystem, thereby putting the privacy of its citizens in jeopardy.

The creation of CBDCs was instigated after the creation of Cryptocurrencies, currently, there are over nine thousand cryptocurrencies in the world with each of them claiming to solve a particular problem for the Crypto ecosystem. I do not think of any other problem that the CBDCs will solve even with their claims of inclusivity.

The world government is filled with corruption and so is their financial system which means that this can easily creep into the CBDCs. Over the years different countries have been trying to create their fiat versions of their currencies, but none has made a concrete move except Venezuela who in February 2018 launched the Petro (₽), or Petromoneda which was claimed to be backed by the countries oil reserve. Based on my assessment of this crypto there has not been any formal usage of this crypto coin various exchanges have refused to even list it as a legal asset because of the various controversial changes made by the government based on what the actual value is and even the company behind its creation.

There is no doubt that CBDCs will enter the Crypto space, Nigeria for example on October first have already launched the pilot scheme for their digital currency called the e-Naira, other countries such as New Zealand, Norway, Russia and China are all in the Hypothetical stage of creating their Crytpo Currencies. The major problem that will come with the CBDCs is regulation which in itself should not be much of a problem, but the question is to what lengths will they go in regulating Cryptocurrency.

The Pros CBDCs

Recognition as Legal Tender

Recognition of digital currencies as legal tender will go a long way in facilitating transactions from person to person without restrictions.

Backed by the Countries Offical Currency

They will be backed by the countries official currency which means investors or users will not be afraid of volatility or market crashes, unlike other crypto assets.

Regulation

Regulating the crypto space has been a major problem, but with the introduction of the CBDCs, the government will be able to regulate and control the overbearing security and scam allegations passing the crypto ecosystem.

Disbursements to citizens

BY late 2020 the US government was looking for ways to distribute stimulus checks to its citizens so that it can get to them successfully without scammers infiltrating the system, but still, over 10 million dollars was lost over illegal claiming of these checks. With the introduction of the CBDCs, the government through the central bank can easily disburse these checks straight to the digital wallets of its citizens.

The Cons CBDCs

Centralized Control

This alone goes against all the values of the Blockchain ecosystem. this means that the private information and identity of users would be put in jeopardy. For example, a Chain that has a well-fortified surveillance system that will have access to a wealth of transactional data which can be used to track the financial activities of its citizens without their consent.

Manipulation of supply

The government controls the currency without the consent of its citizens, which means they can mint new currencies, thereby increasing the supply which would cause inflation and in turn decrease the value of the cryptocurrency. which unlike Bitcoin has an already pre-minted supply which means its supply cannot be increased.

Monetary Policies

Unconventional monetary policies can cripple the value of these Crypto assets, also government can have the ability to manipulate the interest rates of these digital assets.

Elimination of Other Cryptocurrencies

Already, over 15 countries have banned the use of cryptocurrencies and some of them are using the opportunity of the vacuum left by the ban to create their cryptocurrency to rival other cryptocurrencies.

Question 3

Explain in your own words how Rebase Tokens work. Give an illustration.

Rebase Tokens or Price-Elastic Tokens are cryptocurrencies that alter their value by increasing and decreasing their supply based on demand and supply this is called Rebase Mechanism.

They are somewhat like stable coins because they have a price target to maintain and to do that they have to alter the supply of the Token to meet the demand of the market by either increasing or decreasing its supply without affecting or altering the actual value of the token in a user's wallet.

How Rebase Tokens works

As stated earlier Rebase tokens are similar to Stable coins which means they have a price target to maintain, but to do so they have to use the Rebase Mechanism.

For example, The RMPL has a target value of $0.6 and a rebase protocol every 24hrs. This means that when the price increases or goes above $0.6 the circulating supply will also increase during the rebase, thereby decreasing the value of every single unit of the token, also if the price goes below $0.6 the circulating supply contracts during the rebase, thereby increasing the value of every single unit of the token.

The Rebase % is calculated using the formula below;

Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

For a more comprehensive explanation, let's take for example if Daniel bought 1 RMPL at a value of $0.6 and the value doubles to $1.2, during the rebase the supply of the Token will Increase thereby causing the number of tokens in Daniels wallet to fall to 0.5, but the value of 0.5 RMPL will remain at $0.6 since 1 RMPL is now $1.2.

Question 4

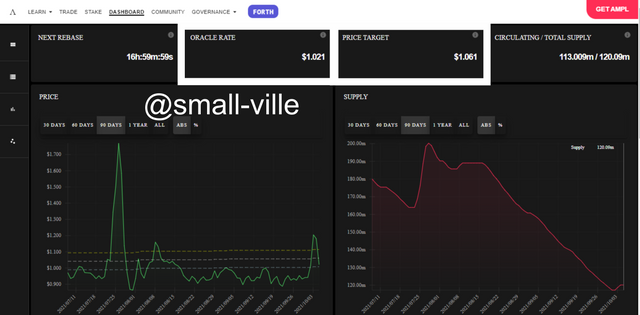

Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

I will calculate the Rebase% using the Rebase formula below

Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

Therefore

Oracle Rate = $1.021

Price Target = $1.061

Rebase % ={[(1.021 - 1.061) / 1.061] x 100} / 10

Rebase % = [(-0.04/1.061) x 100] / 10

Rebase % = (-0.03770 x 100) / 10

Rebase % = -3.770/ 10

Rebase % = -0.377%

NOTE: If the Oracle Rate is within the 5% threshold of the Price Target, no rebase will be applied. In other words, if -0.5 ≤ Rebase % ≤ 0.5, the effective Rebase % will be 0.00.

source

Question 5

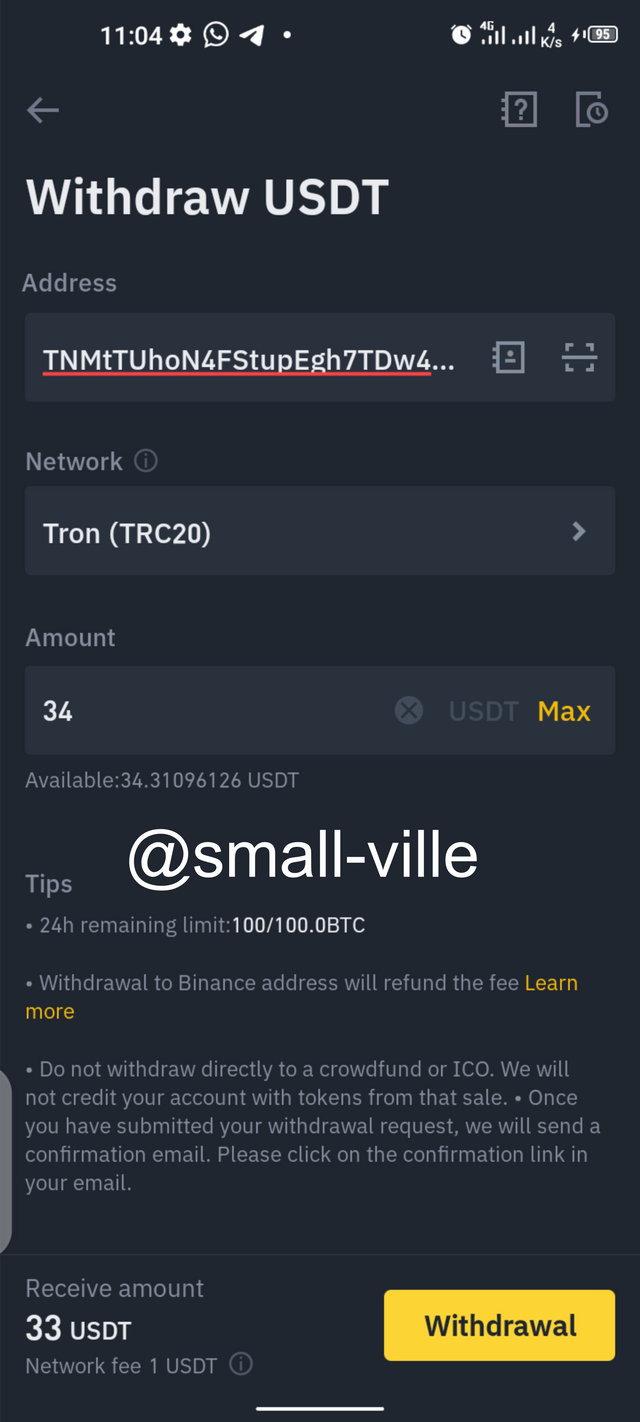

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

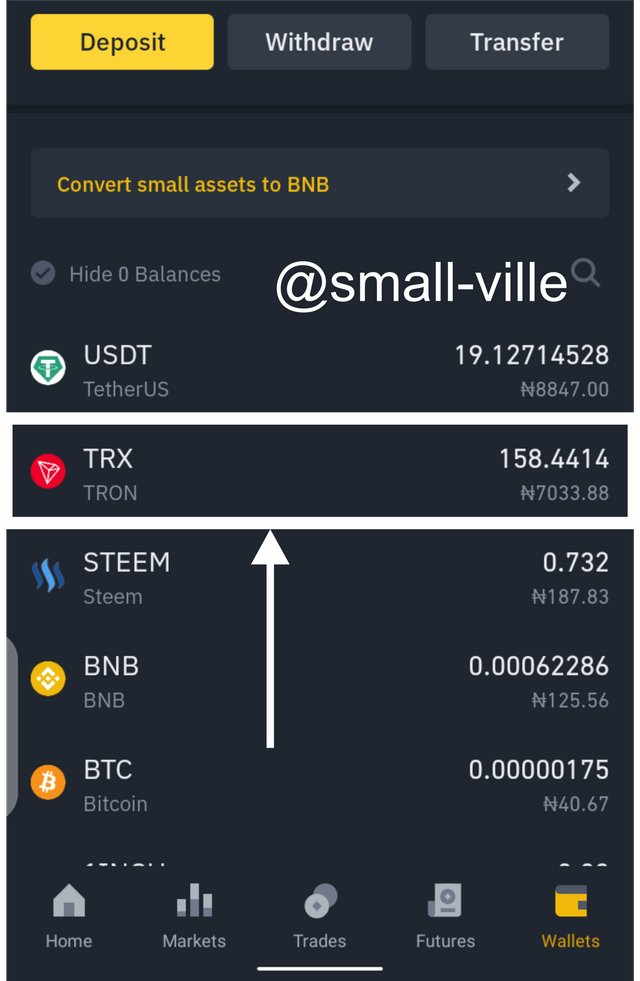

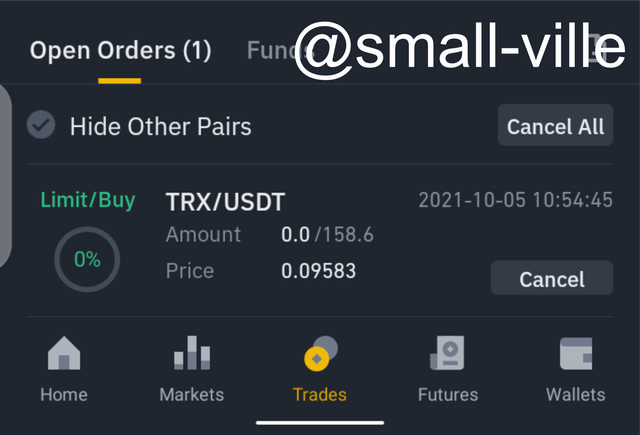

To execute this trade I had to log in to my Binance account, then I went to the Spot trade area of my wallet. I searched for the TRON coin, then I clicked on it and chose the TRX/USDT pair. I then put in $15 of usdt and clicked on buy, a Spot order was immediately created which later was executed,

Question 6

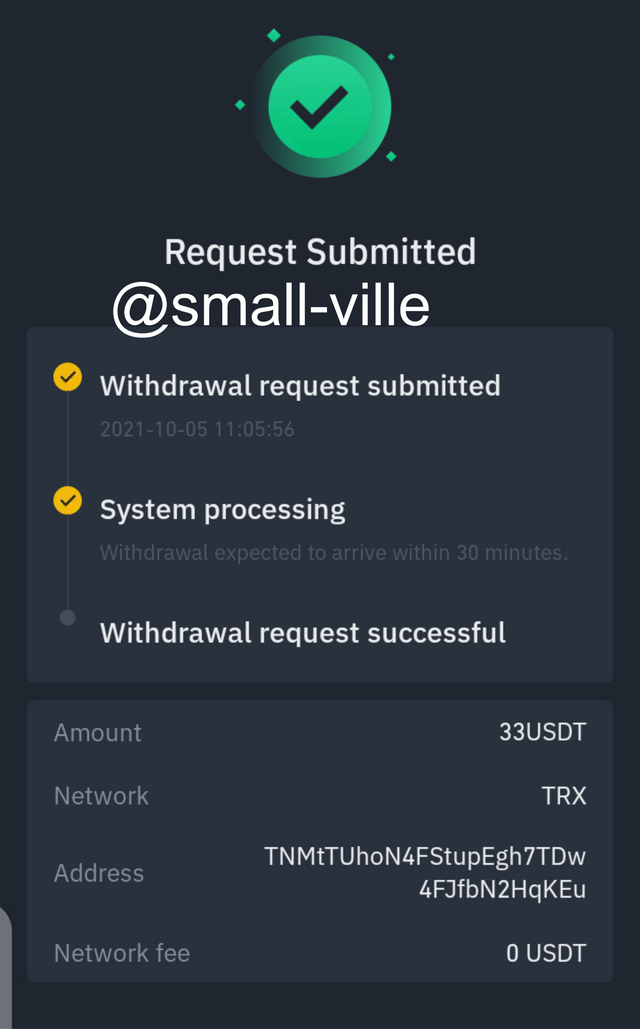

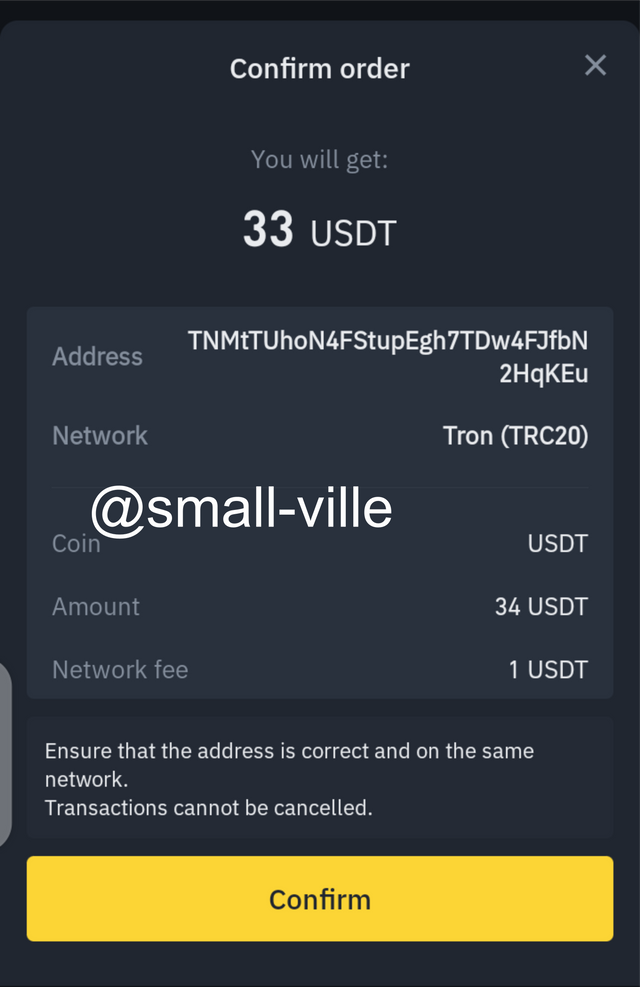

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stable coin over fiat money transactions? (Give a Screenshot of the transaction).

- Low cost

I observed from the transaction I made that I was given a low charge for the transaction to be executed, Unlike the Fiat currencies handled by the banks which charge you outrageous fees for both minimal and large transactions.

- Process Time

The Process time for this transaction was short, because it reflected in minutes to the recipient, unlike fiat currencies which could take days or even change over the network, also sometimes they have bounced back to the sender

- Transparency

Every blockchain has an explorer which shows the detail of transactions going on in that Blockchain, unlike the Fiat currencies only the sender and receiver have or know details of the transactions.

CONCLUSION

Stability is indeed needed in the crypto ecosystem to serve as a hedge against volatility. I also strongly believe that the CBDCs will surely enter and be established in the Crypto ecosystem, but the downside to this is that these governments will try the best they can to regulate these currencies, although there are some positives to its introduction, for example, inclusivity and safety against scammers.