Steemit Crypto Academy [Beginners' Level] | Season 4 Week 1 | The Bid-Ask Spread For professor @awesononso || by @small-ville

Question 1

Properly explain the Bid-Ask Spread.

To explain the bid-ask spread I will use a real-life scenario to paint a clear picture. In the 2019/2020 transfer window, Manchester united wanted to purchase the England star in the Person of Jadon Sancho from Borussia Dortmund Which is a German club. Manchester United Submitted a bid of £75 Million, But Borussia Dortmund was asking for £120 million. Manchester United was not Willing to go higher than the initial Bid and Borussia Dortmund was also not willing to go lower than the asking price, Because a favourable agreement could not be reached between the two clubs the transfer deal crashed.

Taking a look at the above scenario I will explain what the Bid and Ask price is.

The Bid Price

This is the price that a buyer is willing to offer for an asset, security or something of value, from the illustration given above the Bid price is the £75 million offered by Manchester United to Borrusia Dortmund for the sale of Jadon Sancho.

The Ask Price

This is the lowest price a seller is willing to accept for his asset, security, or commodity. From the illustration given above the £120 million is the lowest price that Borussia Dortmund is willing to accept for their player.

The Spread

The spread is the difference between the Bid and Ask prices. That means the spread is the difference between the Bidding price of Manchester United and Borussia Dortmund.

Therefore; The Spread = Ask(£120 million) - (£75 million)

Therefore ; The Spread = 120 million - £75 million = £45 million

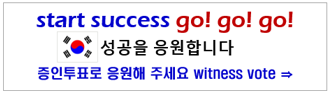

Below is a picture of the Steemit Market Zone which shows a graphical representation of the Bid-Ask Spread.

source

looking at the picture above you can see the Steemit Bid-Ask Spread. The Red area shows the Bid price while the Green area is the Ask price and the space between the Green and Red area is the Spread.

Question 2

Why is the Bid-Ask Spread important in a market?

When a market has high liquidity it means that there are a lot of buyers and sellers active on the trading market of a particular asset. The importance of the Bid-Ask Spread is to allow both the buyer and the seller to determine a more favourable situation to purchase a particular asset. Also, the Bid-Ask Spread helps both the buyer and seller know when there is high and low liquidity in the market.

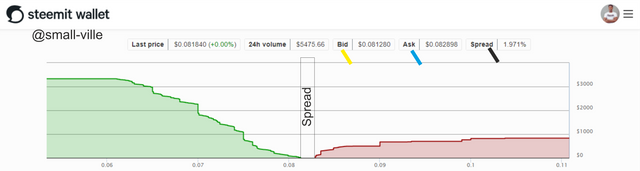

Below is a picture that shows a Bid-Ask illustration

source

With this information above a buyer or seller will know when to engage with the market. from the picture above it is visible that the spread between the Bid and Ask Price is very thin, which makes it a favourable market for both parties(Buyer and Seller), also it shows that the market is highly liquid.

Question 3

If Crypto X has a bid price of $5 and an asking price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Question a

To recap, the formula for calculating the Spread is;

Spread = Ask price - Bid price

If the Ask price = $5.20 and the Bid price = $5

Therefore the Spread = $ 5.20 - $5.00

Therefore the Spread = $0.20

Question b

The Spread can also be expressed in percentage as follows;

%Spread = (Spread/Ask Price) x 100

If the Spread = $0.20 and the Ask price = $5.20

Therefore the %Spread = (0.20/5.20) x 100 = 0.0384 x 100

Therefore the %Spread= 3.84%

Question 4

If Crypto Y has a bid price of $8.40 and an asking price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Question a

To recap, the formula for calculating the Spread is;

Spread = Ask price - Bid price

If the Ask price = $8.80 and the Bid price = $8.40

Therefore the Spread = $8.80 - $8.40

Therefore the Spread = $0.40

Question b

The Spread can also be expressed in percentage as follows;

%Spread = (Spread/Ask Price) x 100

If the Spread = $0.40 and the Ask price = $8.80

Therefore the %Spread = (0.40/8.80)x 100 = 0.4545 x 100

Therefore the %Spread = 4.545%

Question 5

In one statement, which of the assets above has the higher liquidity and why?

Crypto X has higher liquidity than Crypto Y because Crypto Y has a wider Spread than Crypto X.

Question 6

Explain Slippage

This is a situation that mostly comes into play when there is high volatility in the market, also it can occur when there is low liquidity. For example, if I placed a buy market order for Cardano at $2.50 but then the order was not executed because of either low liquidity in the market or a very volatile market. This made the asking price fall to $2.45, which has already exceed the original order that I placed and that order cannot be executed until the price of Cardano hits my original order. Therefore slippage is the delay that occurs due to a change in price from the original order placed by a trader.

Question 7

source

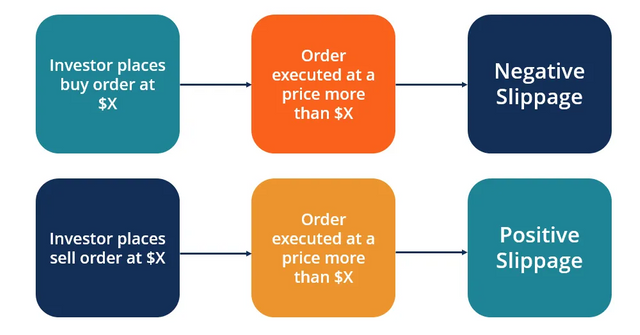

Positive Slipage

A positive slippage occurs when a buy or sell order placed by a trader executes at a lower or higher price respectively than the original order made by the trader. To make it more understandable, if I placed an order for 3 Solana at $150 each and the order was executed at $145, this would be considered a Positive Slippage. This scenario can also be applied in a situation where I have to make a sale of an asset, for example, if I set an asking price of my asset at $20 and the trade was executed at $30 this will also be considered as a Positive slippage.

Negative Slipage

A positive slippage occurs when a sell or buy order placed by a trader executes at a lower or higher price respectively than the original order made by the trader. to illustrate this scenario better, let's take for example I placed a sell order for my asset at £30 and then the order was executed at £25 this would be considered as a negative slippage, likewise, if I placed a buy order for an asset at £50 and then the order was executed at £55 then this would be considered as negative slippage.

Conclusion

The Bid-Ask Spread is very important information for traders who want to have detailed information about the trade they want to engage with. But regardless of the vast information gotten from the Bid-Ask Spread Traders are also meet with the Slippage which in turn also comes with its positives and negatives.