Algorithmic Trading with Moving Averages on Steem.

Explain the concept of algorithmic trading and its significance in modern markets. Provide an example of a basic algorithmic strategy using moving averages and show how it could be applied to the STEEM/USDT trading pair.

The concept of algorithmic trading and its significance in modern markets.

Algorithmic trading means automated trading which involves the use of computer algorithms to place trades according to defined parameters. These algorithms triggered buy and sell trades in markets automatically without requiring human participation. The importance of algorithmic trading depends from its capacity to increase trading accuracy through avoiding emotional making choices and allowing trades to take place at a high speed.

The use of Algorithmic trading has resulted in higher liquidity, lower transaction costs, and more precise performance in nowadays markets. Large organizations, financial institutions, as well as individual traders employ algorithms method to benefit from market flaws and implement complicated plans.

Basic example of a algorithmic strategy using moving averages.

The use of moving averages in algorithmic is the most easy and popular strategy. Mainly a moving average crossover method which is Golden Cross and Death Cross are used in algorithmic strategy which includes two moving averages level one is short term level and one is long term level. This algorithmic strategy use to find possible buy and sell points on the price chart.

Moving average duration 50 is used for short term like 50 hours, days, week. Moving average duration 200 is used for long term like 200 hours, days, week. Including the above details the algorithmic strategy is like below for buy and sell.

Buy Trade: The buy trade executes when the short term moving average crosses the long term moving average from below to above, this pattern is also called as Golden crossover and it indicates a possible uptrend. Accordingly, the Algorithmic places the buy order.

Sell Trade: The sell trade executes when the short term moving average crosses the long term moving average from above to below, this pattern is also called as Death crossover and it indicates a possible downtrend. Accordingly, the Algorithmic places the sell order.

How it could be applied to the STEEM/USDT trading pair.

Algorithmic strategy using moving averages can be applied by adding 2 moving averages 50 MA 200 MA on STEEM/USDT trading pair. The chart example along with buy and sell explained above will be like shown in below image. The red line is 50 MA and the blue line is 200 MA.

Compare different types of moving averages (SMA, EMA, WMA) and discuss their benefits and drawbacks in an algorithmic context. Which one would you prefer for your algo-trading strategy and why? Provide a practical example on a Steem chart.

Simple Moving Average (SMA),benefits and drawbacks in an algorithmic context.

The Simple Moving Average (SMA) is computed by taking the average price of an asset during a given time frame. A 50 period SMA will calculate the average of the previous 50 price points. This kind of moving average is popular due to its ease of use. It is simple to use and understand, making it suitable for both beginner and experienced traders. One of the SMA's primary advantages is its capacity to smooth over price fluctuations which allows traders to understand the overall trend better and decreasing market noise.

However, the SMA has certain drawbacks. It delays after current price movement because it gives the same importance to all data points in the selected period. This creates delays in reaction to volatile market fluctuations or fastest changes in prices. As a result, traders who use the SMA could lose the early chances to react to changes in the direction of the market. Furthermore, its lack of response to recent price data may make it less successful in volatile markets where immediate action is required.

Exponential Moving Average (EMA), benefits and drawbacks in an algorithmic context.

The Exponential Moving Average (EMA) is created by weighting recent prices which makes it more responsive to the market situations compared to the Simple Moving Average (SMA). This capability helps the EMA to respond faster to price fluctuations, making it a popular choice for traders who want to react fast to market movements. Because of its balanced procedure, the EMA is very good at detecting momentum in advance and providing traders with faster buy and sell indications, this helps mostly in shorter time frames when market changes are fast.

However, the EMA responsiveness towards the recent price movements can be a drawback. In unstable or during sideways markets, the EMA can give false indications, resulting in trades that do not get to long term trends. Also, the EMA is less smooth in comparison to the SMA, which might give an overreaction to the short term volatility market. This makes traders at greater risk to price unnecessary noise which can cause traders to make quick decisions based on temporary false price changes.

Weighted Moving Average (WMA),benefits and drawbacks in an algorithmic context.

Weighted Moving Average (WMA) is computed using the prices Averages which assigns an equal weight to the most recent prices. This makes the WMA more responsive to the current market conditions than the SMA, while also taking a more systematic strategy than the EMA. Through focusing on current price data, the WMA better catches current market patterns accurately which makes it beneficial for traders who understand the current market activity and improve tardes decision making.

The WMA has its drawbacks that It is more difficult to figure out than the SMA and EMA, which may make it less attractive to traders. Furthermore, the WMA is also responsive to price movements just like the EMA,, which can lead to incorrect signals in extremely volatile markets. The growing noise may lead to confusion of market direction, particularly in situations when prices are moving faster.

Which one would I prefer for my algo-trading strategy and why with practical example on a Steem chart?

I prefer safe trading with money management hence Simple Moving Average (SMA) will be my preference in my algo-trading strategy. The reason, as mentioned above, the SMA is mostly used by new and experienced traders because it's easy to understand its signals and easy to apply on the price chart. In my personal trading I traded based on SMA for a long hold and honestly till now I have not get any false signals and got 100% results. Sometimes the holding period may increase more but all trades closed in profits.

Simple Moving Average (SMA) works smooth on a price chart and is good for identifying a long trend in a market. The 50 SMA and 200 SMA have a better success rate than others with minimum loss. It's easy to apply 50 SMA and 200 SMA on a chart and understand their buy and sell signals.

The practical example of using SMA in algo-trading strategy, I can show the below image which is similar as shown above.

In this image we can see how it is easy to use SMA with 50 and 200 period, also its easy to understand its buy and sell signal. By using different time frames we can find the one correct pattern to use SMA in algo trading. Also since this is why I prefer for long trend for long holding, we can get time to monitor the performance of this tratergy in algo-trading.

Create an algorithmic trading strategy for the Steem token using moving averages. Define your entry and exit signals, risk management rules (such as stop-loss levels), and explain how you would backtest your strategy to ensure its effectiveness.

The algo trading means automatic trading. This means when we see a buy or sell pattern on a price chart we place trades manually. We need to use the same method to command the trades so that according to our method that we have added in the algorithmic trading, it will automatically place the trades whenever such a pattern forms on the chart. The Following will be my simple algorithmic trading strategy for the Steem token using moving averages along with entry, exit signals, and stop loss.

For risk management, the 50% capital use from the total available fund. If I have 100 USDT then only 50 USDT will be used.

The chart time duration will be 1 hour (for short term) to 1 day (for long term).

Entry trade when SMA 50 Golden crosses SMA 200.

Exit trade when SMA 50 Death crosses SMA 200.

Stop Loss 10%.

If needed, we can set a target ratio like 20% means after entry if profit reaches 20% the token will be sold.

For the backtest, we will use the historical chart from last year and will see according to the above strategy how many trades were executed wherein how many trades became profitable and lost. If loss trades are minor than the profitable trades and ratio is good then we can consider the strategy to implement in automatic trading.

Discuss the tools or programming languages you would use to implement your algorithmic strategy (e.g., Python, TradingView, MetaTrader). Provide a brief code snippet or logic diagram demonstrating how your strategy could be automated.

The tool that I will use to implement my algorithmic strategy is crypto exchange gate.io. The gate.io has bot trading features and you can create different bots based on your algorithmic strategy. These bots can perform the trades automatically based on the indicator parameter we set. Below are the snapshots breakdown I have given to demonstrate how my strategy could be automated. For this strategy I have selected bot categories "Combined Indicator-Spot" on gate.io.

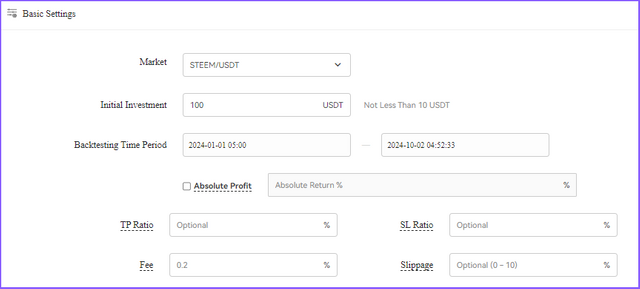

Basic Settings.

First we need to set basic settings. I have selected the market as STEEM/USDT. then set the total capital 100 USDT. The backtesting time period, you can set any but I have selected January 2024 to till date. I have not filled TP means take profit % and SL means Stop Loss % because I completely want to place my entry and exit trades as per the indicator pattern/parameter.

Parameter Setup Entry condition.

For entry I used 50% capital as risk management. The time duration is 1 hour. The condition I set SMA 50 Golden cross to the SMA 200. This means whenever SMA 50 crosses the SMA 200 above, the buy trade will be placed.

I have not set conditions to Increase and Reduce Position, but just for the information you can set here condition to add additional quantity and % from remaining capital if active trade is in profit or loss. Similarly you can reduce some quantity if active trade is in profit or loss.

Parameter Setup Exit condition.

For automatic exit trade, I set the time duration the same as 1 hour, The condition I set SMA 50 Death cross to the SMA 200. This means whenever SMA 50 crosses the SMA 200 below, the sell trade will be placed.

Next you can see backtest, the time period we set for backtesting in basic setting that is from January 2024 to till date, after clicking to the backtest button it will check the history and provide us details that how many trades were possible according to the above condition along with the count of profitable trades and loss trades.

Backtest result overview.

Here, we see the result like how many possible trades were executed based on the provided buy and sell condition, what was the maximum gain and loss. Overall return. The maximum gain in one trade was 23.72USDT which is almost 25% return and the maximum loss was -6.76USDT which is recoverable. After confirmation we can click to create a bot to perform real algorithmic trades according to the given strategy/condition.

Evaluate the performance of your algorithmic strategy using historical Steem market data. How well did it perform during different market conditions (bullish, bearish, sideways)? Provide your findings and suggest improvements.

In the above backtest we selected the duration from January 2024 to till date. It is quite difficult to club the chart for this entire duration with a 1 day time frame so I have clubbed it with a 3 hours time frame. Below image is historical Steem market data. from January 2024 to till date.

According to the backtesting starting from left, the STEEM/USDT market was quite up wherein some good trades executed and one trade has given almost 25% return. However, during the bearish means downside trend the algorithmic strategy did not performed well, even though there were some profitable trades executed but due to false signals multiple trades were executed which was really not needed. Then next, the STEEM/USDT market remain sideways till date in which also some good small profitable trades executed but some loss trade also executed.

The suggest improvements for algorithmic strategy, one of the most important is keep frequently monitor the trades and the performance of the algorithmic strategy, during the change of market direction it may be possible that multiple trades execute due to volatility at the time of trend change.

Always use 50% from the entire capital as an algorithmic strategy, sometimes do multiple trades on false signals due to which the capital will be at risk.

Due to changes in the market, keep checking the strategy and update it whenever needed, frequently understand the market with multiple time frame charts and update the strategy accordingly.

Disclaimer: The information provided in this blog is for educational and informational purposes only. It should not be construed as investment advice or a recommendation to buy or sell any securities mentioned. Investing in the stock and crypto market involves risks, including the potential loss of principal. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author of this blog is not liable for any losses or damages arising from the use of the information provided herein.

Author,

@Stream4u

If you like this blog, you can join me in the comment section of this blog.

On Twitter X - Algorithmic Trading with Moving Averages on Steem.

Upvoted! Thank you for supporting witness @jswit.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

This post has been upvoted/supported by Team 5 via @httr4life. Our team supports content that adds to the community.

Very well done ...

Thank you.

At first the contest was very difficult for me then when I saw your post and I understood everything and especially the bot setup I was afraid Alhamdulillah I understood later and was able to do it correctly I got a lot of help from your post Thank you so much Share to do

Thank you for your kind words. I am glad that this post help you.

@stream4u I appreciate how you have broken down the topic in such an easy to understand manner. Its clear that you have put a lot of effort into sharing valuable insights. I especially like how you have explained the key points it makes the subject more accessible to everyone. Keep up the good work! Its always great to learn from posts like this. Wishing you the best of luck in the contest