Capital Management and Trading Plan - Crypto Academy / S4W8 - Homework post for @ lenonmc21 | By @syedmraza01

Hello Steemians,

I hope you all are doing great in your life and learning from @cryptoacademy. It's a great platform for the growth of beginners. I am honored to be a part of this platform. Before I proceed with the task, I want to thank professor for his efforts to make us learn a lot.

Q. Define and Explain in detail in your own words, what is a "Trading Plan"?

Trading plan is defined as an individual set rules, techniques, and objectives for effective trading himself.

The term "Trading plan" refers to a formal arrangement for identifying and trading securities which is based on several factors such as investment objectives, risks, and price levels. This plan specifies how to search for asset classes and the procedures to follow.

However, for traders and investors, a trading plan guides them in maximising profits and minimizing market risks.

Understanding Trading Plans:

Basically Trading plans are made to meet the aims and goals of investors, and level of guidance are determined by the trader's style.

Simple Trading Plans and Automated Investments

Investment in periodic contribution plans, also known as automatic investment methods, allows investors to implement automatic transactions on a regular basis. Mostly the investors use automated investment into funds and other assets in order to maximize their profit.

It prepares the investors for potential outcomes; however, this plan is used to provide them with alternative options in trading that the market does not perform as expected.

For example: An Old man decides to deposit $300 in some funds every month. After some years, like 5 years he came to know that he lost some of his money. He deposited $15000 and he summed up his holding around $13000. By having a trading plan, it would be easier to decide how to monitor the investments and how to enter and exit from the positions.

Tactical Trading Plans:

Investors with short-term and long-term objectives should establish a tactical trading plan. A trader aims to enter and exit a position at an exact price level or under special requirements in tactical investing.

Those investors who are doing short and long term trading, use tactical trading plans which guide traders about when to get in and out from the trade on the basis of movement of price, charts and statistics and it's also based on technical indicators. It also guide the traders when they should get in and out from that position even when an individual is in profit and loss.

Q. Explain in your own words why it is essential in this profession to have a "Trading Plan"?

A trading plan plays a vital role and is very essential for traders and investors. It tells how a trader will locate and proceed with trades, What securities will be appropriate on trading further how they will manage the position, he or she will take.

For Example: A man with the age of 35, decides to deposit $400 every month to maximize the profit. But after several years, like 4 years, he summed up money around $16000. He decided to check his balance. He came to know that he lost his money. So this is what a trading plan makes him able to monitor his investment and make him know when to get in and out from his particular position.

Q. Explain and define in detail each of the fundamental elements of a "Trading Plan"?

Below are some fundamental elements of the Trading plan.

1 - Market Entry and Exit:

It is easy to start trading by clicking the Dom button and exiting or entering positions through a broker, but choosing to buy and sell through a trading strategy will give an individual the competitive edge.

A strategy made by the traders through trading plan guides when to get into and out from the position which defines the following attributes.

Trading plan strategy promotes an individual efficiency and consistency of its trade.

It reduces selfishness, greed towards profit and also reduces fear of loss.

It records all statistically viafied trading.

Consistency and efficiency is the key of trading through which one can maximize the profit after some time. However, understanding the market through a trading plan makes an individual know when to buy or sell, when to get into and out from the position in order to achieve the profit target.

2 - Risk Management:

It is critical for traders to manage risks aggressively. When you invest in the market, you are actually putting your capital at risk and with the hopes of generating a high return. Trading involves some risk, but aggressive behavior is not. because you can not avoid risk.

Some of the trading professionals after successful trading address some factors that traders must consider in a trading plan are mentioned below.

Inherent Volatility: An individual must give respect to the targeted product.

Risk and Rewards: Risk and rewards need to be balanced in order to enhance economic growth for the available resources of capital.

Money Management: Maintaining account liquidity is a key component of money management.

3 - The Psychology of Successful Trading:

There are several types of trading and it's not necessary that every type is suitable for everyone; however, psychology is a key factor to enhance the profit margins and to trade successfully. Below are some attributes of successful trade.

User-friendly: The aims and objectives should be clear to the users of the trading plan and the implementation of strategy should make sense to users.

Comprehensible: It is necessary for the traders that they must be comfortable in execution of strategy made through trading plan method and technology.

Promotes discipline: For a plan to work efficiently, it must be trusted by the trader. This allows the strategy to be executed consistently in the long run.

4 - Capital Management:

It is essential to determine the risk ratio you will be comfortable with in order to trade. Professional traders can risk up to 10% of their capital on one trade. How much risk you are comfortable with will determine your own patience and forbearance for risk.

Q. Build a “Trading Plan” and cover all the basic elements discussed in the class. For this, you should NOT take the examples that I put in my class (Including the example amounts), use your own examples and your own images to make said plan, you must also base this "Trading Plan" as if you were operating on the platform of " Binance ”, taking into account that the minimum amount of exchange or investment is $ 10.

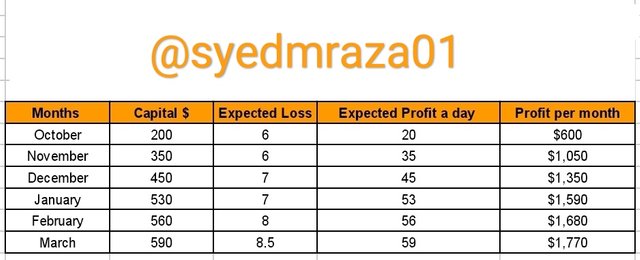

Chart is created in excel sheet.

- In first column of the chart i have mentioned the months to trade.

- The second column shows the capital I want to invest in that particular month.

- In third column I assumed the loss to maintain the risk from my capital capital.

- In fourth column I set the profit return of my capital I am investing.

- In the last column I mentioned the expected return of the profit in a month according to the profit of per day.

1 - Market Entry and Exit:

In order to make my trading successful I will be carefully understand the time management when and how to enter and exit from my selected position. And I will make sure of consistency and efficiency in my trade.

2 - Risk Management:

As I know that the key factor of Trading plan is Risk Management. I will avoid aggressiveness and pay attention to the trade where I have invested my capital to generate the high return.

3 - Psychology trading:

In order to make my trade successful I will control my emotions as I am not trade where my friends are trading and will not trade for revenge Moreover to make it successful I will disobey the risk and capital management.

4 - Capital Management:

Capital Management is also key element of Trading Plan. To generate high return I will make sure to add the expected loss in order to save my whole capital.

From the lecture, I have learned that Essentially, a trading plan is simply a set of rules that investors establish for themselves, in order to get complete control over their capital to minimize the loss and maximize high return, by executing trades and implementing their trading plans and strategies. Moreover, an individual can generate more profit margin by following the essential elements of a trading plan. If we make a practice of implementing a trading plan we will have a highest number of chances to make a successful trade.