Steemit Crypto Academy - Season 2, Week 6 : Elliott Wave Theory by @verdad

I am deeply grateful for this excellent task on Elliott's wave theory(EWT). I have read and done a lot of research about this particular theory that enables us to know more about cryptocurrency market trends. It is a very great theory, and I think every investor should master it. Below is my submission.

In my viewpoint, the utilization of Elliot Wave Theory (EWT) is to decide the factual wave patterns (uptrend or downtrend) or examples of a resources in the market which empowers financial backers to know precisely the leaving and entry positions with in the market during exchanging. The theory aids investors to foresee the cost in brief time frames (as per Elliott Ralph's hypothesis) perusing exhaustively and making an example in the candle graph. It’s very necessary for every investor to consider the 3 corrective waves and the 5 impulse waves since this hypothesis relies totally upon accurately distinguishing them to decipher a future value gauge either bearish or bullish.

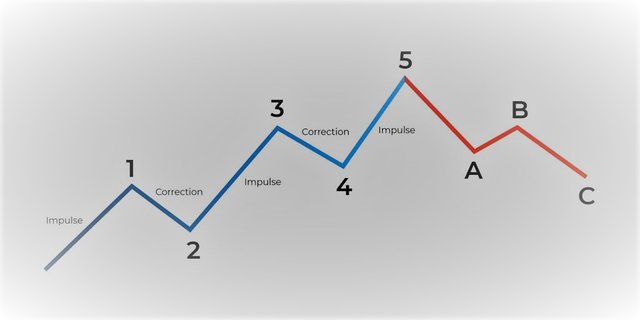

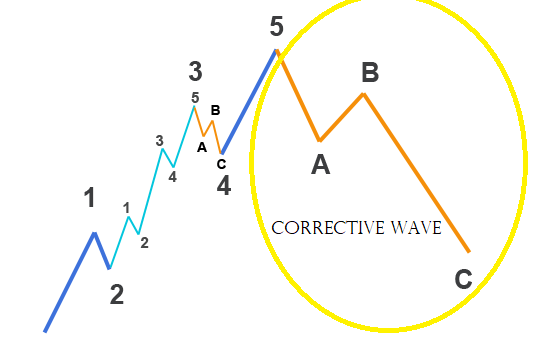

Impulse wave is a term that portray a specific example found in the Elliott Wave hypothesis. The wave is one among two rationale wave examples and demonstrates to the dealer the course of the on the brink of term pattern. The impulse wampulse wave design may be a five-wave pattern named 1-2-3-4-5 or I-ii-iii-iv-v. The admired state of the motivation wave will appear to be just like the picture underneath. The impulse wave structures in both up patterns/movements/movements and downtrends. In Elliott Wave, we place the wave marks toward the finish of the wave. The featured area within the picture underneath is wave 1, placed at the finish of the wave.

Notice the two distinct breaks of comparable size within the pattern, roughly 1/3 and 2/3 of the route through the pattern. Those breaks address waves 2 and 4 of the impulse wave. Discovering a pattern with breaks like that's an oversimplified method of distinguishing an impulse wave from a far distance.

Corrective waves are the three (3) foremost important factors that come into play just after the fifth impulse waves and moves in the opposite direction (are mostly written as A, B, C, respectively). Corrective waves are generally somewhat hard to imagine, unlike impulse waves.

1. IMPULSE WAVE

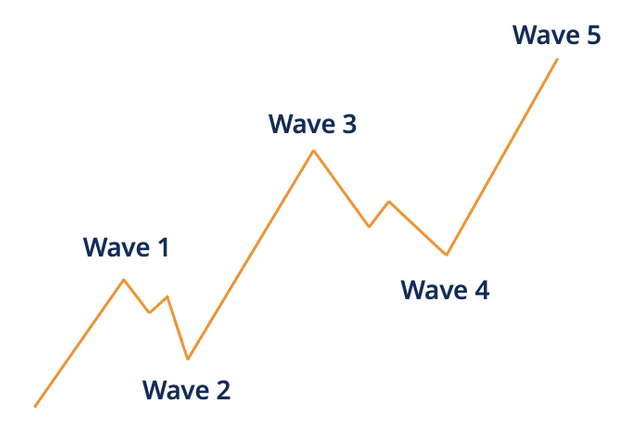

WAVE 1: addresses incautious confidence among the primary gathering of Buyers - they have tracked down a valid justification to Buy (for specialized or crucial reasons), thus they start pushing the market higher.

WAVE 2: The impulse grows dim as the first Buyers close exchanges with benefits, while different financial backers who missed/ didn't engage sit tight and wait for another chance to jump in.

WAVE 3: Usually, this is the longest and most difficult wave to identify. Any financial sponsors/investors who must buy (those who missed the first wave and those who did not buy on the first wave) will start to buy immediately. In addition, in the middle of the third wave, people who do not believe in an upward trend will be persuaded at this point.

WAVE 4: At some point, it is a perfect chance to reap the benefits, a hasty step begins to blur again. Either way, the review is fugitive as there are still various buyers to affix the pattern.

WAVE 5: The uptrend is re-established once again at this point, but the market is currently overbought, and it becomes clear that an inversion is expected. The end of wave five (5) is often set apart by oversold (in an uptrend) markets and differences.

1. CORRECTIVE WAVES

ZIGZAG: If the waves that were seen appear in an incredibly crisscross arrangement, at that time, we'll see that wave B is going to be more limited than C and A. In wave B, we will see that the worth/price goes marginally up, as its ordinarily debilitating to travel against the pattern from the beginning.

FLAT:There's an association between the three waves, it's simpler to identify, and therefore, the waves will all have an identical length.

TRIANGLE: The formation of this sort of wave is hard to imagine and pretty tough to determine.

My assessment of this theory (EWT) is that, it provides us with all the necessary information or ideas needed to accomplish a successful trade. Although its analysis is not always assured to produce or come out with a positive result its a tool I recommend for every investor because it enables us to know and identify the movement of assets in a market with the help of other tools and trader/investor developed skills (technical analysis). In other words, Elliott wave theory is a very important strategy every investor should be aware of in other to gain profits from their assets and can also cause you a greater loss when not used carefully.

A BTC/USDT cryptocurrency chart which spots/shows all impulse and corrective waves

.png)

From the technical analysis carried out by me on the Binance tradingview tool (BTC), it can be seen from the picture above that Wave 2 hasn't retracted more/high wage than wave 1 original price. ), thus; investors started to push the market higher. Also, wave 1 indicates a small number of buyers in the market. It can also be seen that As some investors sold and made a profit, the price fell slightly, causing the price to fall again slightly in wave 2. Wave 3, the longest among all the waves and also the most difficult to determine is where all the traders or investors who didn’t buy in the first wave will begin to purchase and sell to gain more profits. Investors start to withdraw their benefits again in wave 4 and wait for another chance to jump in due to the fall of market price and Wave 5 also indicates retracement. The corrective wave (A, B, C) also kicks in immediately after the fifth wave with a downtrend A. These waves are designed to offset the main trend. At this time, a new trend may appear, but it may not develop, and a new wave sequence 1-2-3-4-5-A-B-C may appear.

This theory (Elliott wave theory) has really taught me a good cryptocurrency market strategy, which can help me distinguish the types and behaviors, causes, and purpose of fluctuations, and to all the newbies in crypto, you shouldn't use this technique without expert advice. Thank you very much @fendit, for such a great lecture, I learned a lot.

@fendit

@steemcurator02

@steemcurator01

Thank you for being part of my lecture and completing the task!

My comments:

Your work was ok, but I believe you could have developed a bit more your answers. They seem too brief and I'm not that sure that you completelly get the concepts.

As well as that, in the chart that you provided, wave 3, 4 and 5 have been wrongly addresed!

Overall score:

5/10