Trading Cryptocurrencies- Crypto Academy / S4W6- Homework Post for @reminiscence01 by @yarhassan

made on canva

Hello Steemians!

I hope you are doing well in your life. I hope you are keeping your health in this pandemic as first priority. So this is my homework post for @reminiscence01. The topic today is Trading Cryptocurrencies. So, let's get started.

QUESTION 01

Explain the following stating its advantages and disadvantages:

- Spot trading

- Margin trading

- Futures trading

ANSWER:

If you want to trade in the cryptocurrency market you can't just jump in knowing nothing about the basics of it. The most basic knowledge you can get is about how the market works and how to place your orders and how different exchanges work and what they offer you and how to use their interface. And also you must know the different types of trading styles that you can choose based on what suits you the best. Below are some trading styles given;

- SPOT TRADING:

Spot trading is the most fundamental and basic type of trading styles. It gives the investor full ownership of the asset that he buys, which means you can buy and sell your asset anytime in the market. Spot trading is basically buying an asset and selling it on a higher price, even if the price of the asset falls down you can always hold your asset and wait for the price to appreciate back so that you can sell your asset on a higher price. Spot market is the market where buyers and sellers transact their assets on prices called spot prices. You need big investments in order to make some good profits in this trading style, otherwise the profit will not be that much, although there is no minimum investment capital which means you can always start with little investment to practice as a beginner.

Advantages

- One of the merits of spot trading is the asset that you buy is completely yours and you claim the ownership of that asset until you decide to sell it.

- In spot trading you face no liquidations and your investment is always safe. Even if the price goes against your prediction, your initial investment is safe until you decide to hold it and not sell in loss, because you can cash out your initial investment when the price appreciates back again.

- You can practice your way through trading in spot market with little investments.

Disadvantages

- Although spot markets are comparatively safer but this doesn't mean that you should be careless. Cryptomarket being highly volatile, if you buy an asset when it is on its all time high or somewhere near around it, you will not be able to recover you loss anytime soon if the price goes against your will. Spot market being the best for beginners the above mentioned mistake is the most common one. New traders will be a prey of FOMO.

- In spot trading you can make profit one way only, which is the most common one that is when the price is low buy an asset and when it appreciates sell it. You can't make profits when the market is in its bearish cycle which is a big demerit of spot trading.

- FUTURE TRADING:

Before moving towards the explanation of future trading, I have to make clear that this type of trading is highly risky and the risk factor associated with it can even washout your whole account. This type of trading style is used by professional traders where they anticipate the upcoming prices of a certain asset and make profits with the up or down movements of the price. Future trading provides the traders with two trading options that is "long" which means to buy and "short" which means to sell, which means that the traders here can make profits two way that is in bullish and bearish phases of the market.

Future trading enables the traders to buy future contracts of an asset with prices pegged to the real value of the real asset and make profits when the price moves in favor of their prediction.

Future trading also provides you with leverages which means that you can start here with little capital and maximize it using 5x, 10x, 20x, 50x and even 100x leverages which gives a boost to your capital and you make profits according to the leverage that you've taken. But, bear in mind that the risk associated with it is high as you move up and up on leverages you also are maximizing your risk and your chance to liquidate your whole account. A slight movement against your prediction then can cause you huge loss.

Advantages

- Hedging is a concept which makes the future trading interesting which allows you to protect your portfolio even when the market goes against your prediction.

- The leverages offered in the future market is another attraction as it gives you more purchasing power and helps you to make profits upto 100x just with a single trade.

- Traders can make profits two way here which is either by shorting or longing the asset respectively when the market is bearish or bullish.

Disadvantages

- The high risk associated with future trading is a big demerit of it causing traders to lose their initial investment capital and in the worst case scenario their whole account can get liquidated.

- Unlike spot trading, you don't own the asset in future trading instead you buy or sell the future contracts of the it.

- MARGIN TRADING:

Margin trading as the name suggests itself gives the trader a margin on his / her trading capital, basically gives leverages to traders which gives them more purchasing power jus like futures trading. This purchasing power or margin that the traders get is by a third-party provider which either can be a trader or the exchange itself. For example, a trader has 10$ in his account so the 20x leverage on his funds will make his funds 200$ with which he'll trade then. This helps the trader to trade assets greater than his initial / original investment capital. Just like future trading, the losses here too are maximized as you use more and more leverage on your initial funds and the risk is equally high and the probability of washing out of account too.

Advantages

- Margin trading provides opportunity to make huge amounts of money to traders with low investment capital.

- Margin trading provides the users with the chance to split their positions using low funds by offering more purchasing power.

Disadvantages

- The high risk associated with margin trading is a big demerit of it causing traders to lose their initial investment capital and in the worst case scenario their whole account can get liquidated due to the leverages offered and if they can't provide the third-party with the funds that they have borrowed.

- This type of trading style is also for expert traders only and not beginners. You have to be extremely skillful in order to execute the correct margin trading strategy.

QUESTION 02

a) Explain the different types of orders in trading.

ANSWER:

Orders in trading exchanges are advance tools to help traders gain a better trading experience. Not every trader can sit in front of the screen staring at the screen for hours and hours and wait for the right time and conditions to be met in order to execute a trade. That's where the orders in the cryptomarket come in. Different exchanges offer different types of trading styles and hence different types of orders. Some of them even help you manage the risks of your trading too. Let's take a look at the different types of trading orders.

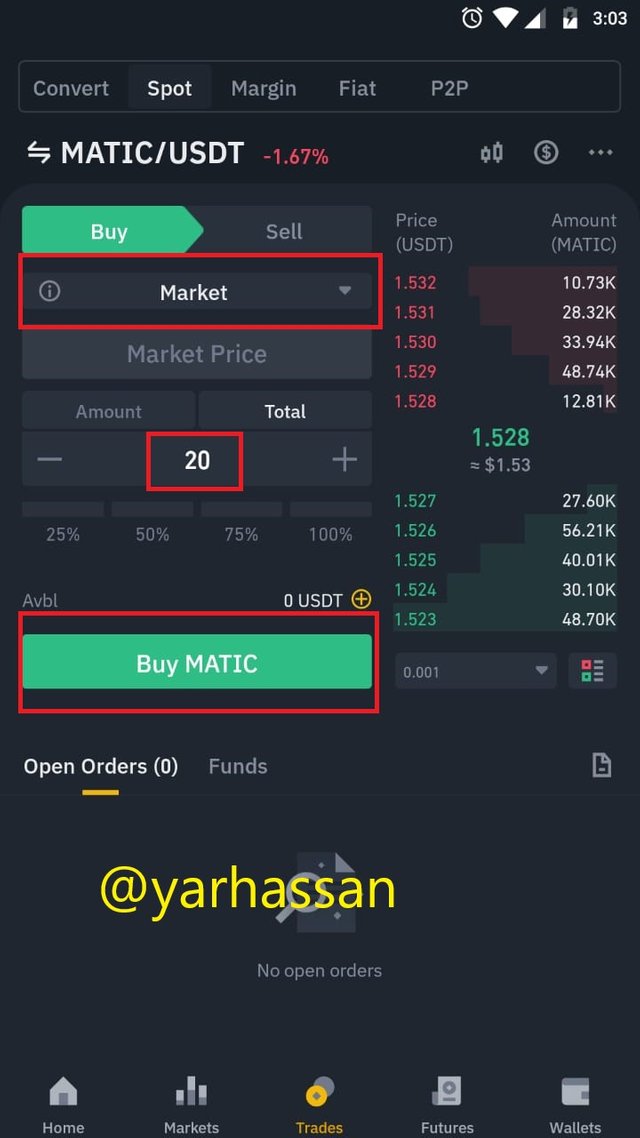

MARKET ORDER:

Market orders are the most simple type of orders that let's the user carry out simple orders at the current best market price in the order book. It may be a buy or sell order. Market orders are the easiest and fastest way to exchange one cryptocurrency to another. Here we can see the market order on binance exchange for MATIC/USDT. I've feed the total amount of 20 USDTs which means that the market order will be executed and 20 USDTs worth of MATIC will be bought after pressing "Buy MATIC" at the best price in the order book.

screenshot by Binance

PENDING ORDERS:

Pending orders as the name suggests itself are the orders that execute when a certain limit of a cryptocurrency's price has been met, and if they are not met these orders are pending until then. You can place buy and sell orders by setting the price limit in which you want the order to be executed. These orders help traders to best use the facilities provided by different exchanges in the best way possible.

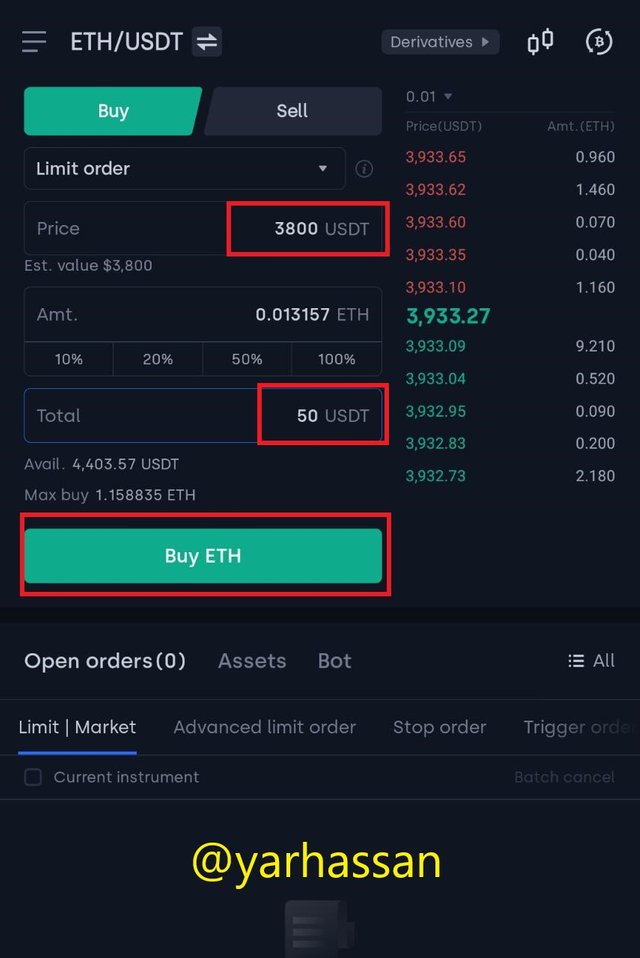

- Limit Orders

Limit orders are the orders which are used when you have to buy or sell an asset at a specific price that isn't the current price of the asset. You can set limit orders on any exchange and it is a type of pending order that is easy to understand and use. For example, take ETH/USDT's current price which is 3933.27 at the time of writing. If I want to make a buy order at say for the sake of understanding at 3800. I will not wait staring at the screen all day long to make the order at the price that I want, here's where the limit order comes into play.

screenshot by OKEx

- Here in the screenshot above we can see that I've set the limit of ETH at 3800 and the to buy it for 50 USDT. Now, we click on "Buy ETH" to place the order.

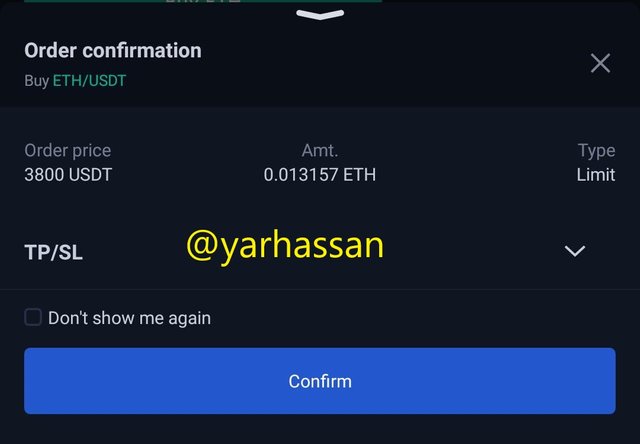

screenshot by OKEx

- the next step is to confirm the order placement.

screenshot by OKEx

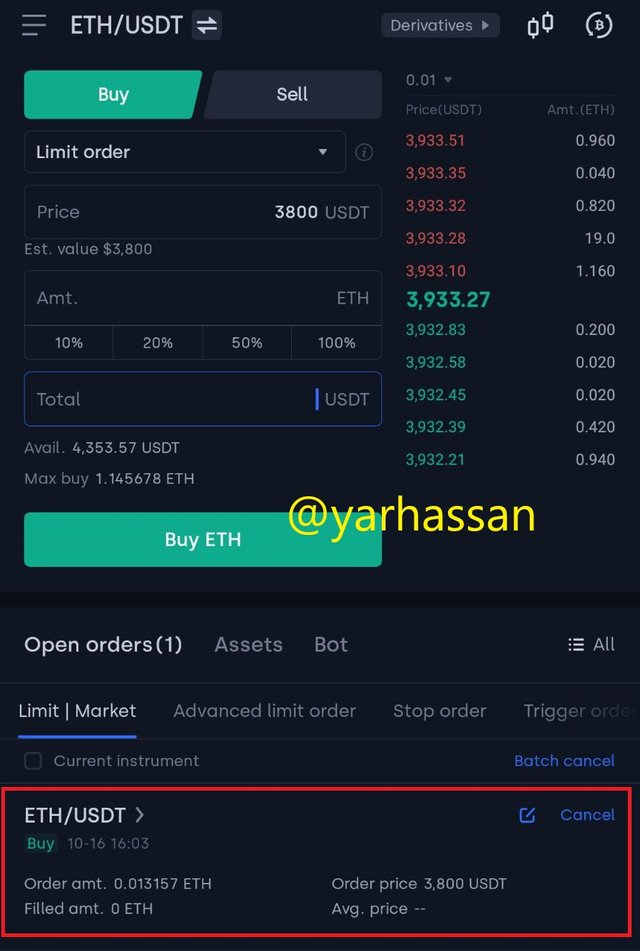

and in this last screenshot we can see that the order has been placed and it will execute when the limit is met with the price provided that is 3800.

Stop Limit Orders

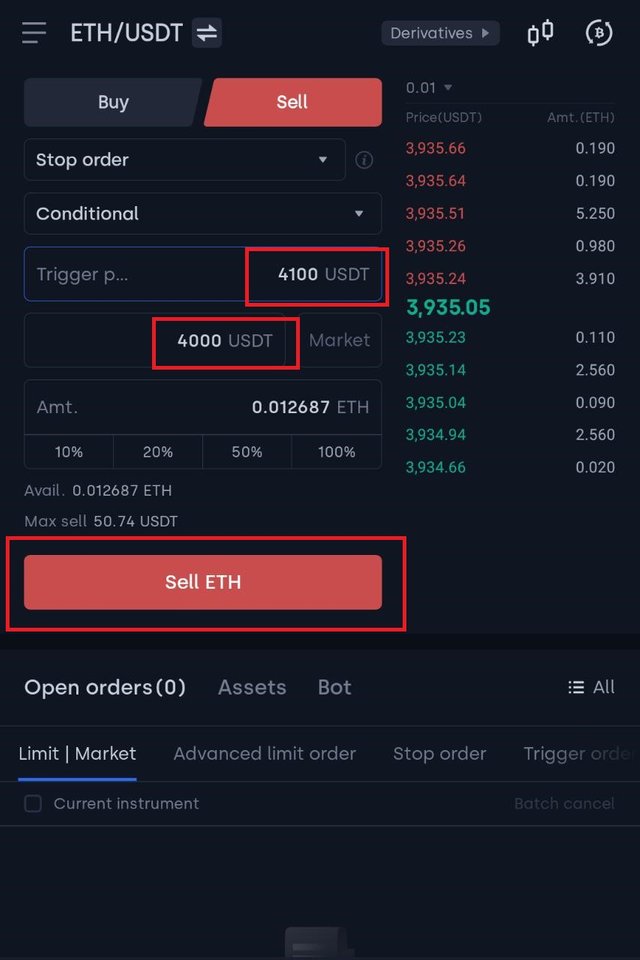

Stop limit order is somewhat same as the limit order with the primary difference being that the limit order that we set by ourselves isn't the case here, instead we'll provide the exchange with a stop price which means that if the stop price is hit by the asset's price then the limit order is placed. For example, take ETH/USDT again, the current price is 3935.05 and I want my sell order of 4100 to be placed at 4000 if the price of ETH appreciates.

screenshot by OKEx

- Here, I've set a stop price at 4000 that is when the price of ETH will hit this price my sell limit order will be placed at 4100.

.jpeg)

screenshot by OKEx

- OCO Orders

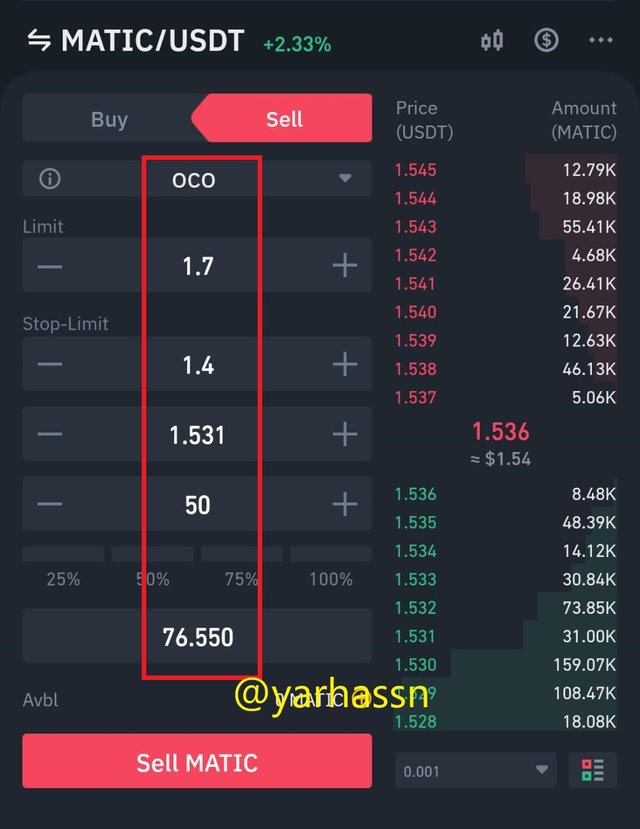

OCO orders means one cancels the other and it is the mixture or limit orders and stop limit orders. These are the most commonly used and are the most popular type of trading orders as they help traders to take profit if the market goes in their favor and if not they allow them to place stop losses to avoid further loss.

OCO orders work both way, the reason being them so popular among the trading personalities is quite clear. They allow the traders to manage and minimize risk and maximize profits in uncertain conditions. Here's a screenshot of an OCO order.

screenshot by Binance

- Here, we can see that the current price of MATIC is 1.536 and I want to sell MATIC at 1.7 which will be my limit order and the stop order will be 1.4 (stop price) which means if stop price is hit the stop limit order will execute cancelling the limit order of 1.7 and will trigger at the price of 1.38 minimizing the risk of potentially huge loss.

EXIT ORDERS:

- Stoploss Order

Stoploss orders provide the traders with the facility to minimize their risk of losing their investments. They can be placed alongside market orders and pending orders and are very useful when it comes to professional trading. Cryptomarket being highly volatile, crashes in this market are regular. You don't know when a possible next crash might be. Stoploss orders helps the traders avoid those crashes and exit the market bearing minimum to no loss at all.

- Take Profit Order

This order can also be placed alongside market and pending orders and helps the trader to book profits while the market's in his / her favor. These are automatically placed to exit the market like stoploss orders.

QUESTION 02

b) How can a trader manage risk using an OCO order? (technical example needed).

ANSWER:

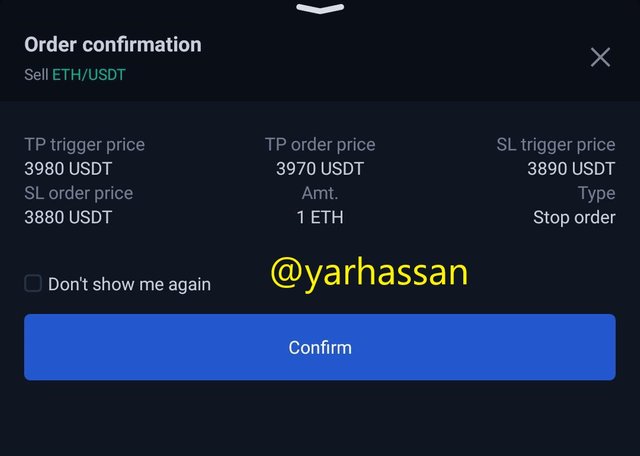

screenshot taken from Tradingview

Market is in bull run. BTC's performing well and so does ETH. It is only a matter of time that ETH will be on its psychological resistance which is a good opportunity to sell it on a good price. The fundamentals are also good. Here in the screenshot we can see that ETH is giving a sell signal and according to A/D, the asset is in accumulation cycle, The next Fibonacci resistance is at 3984. There is a strong support at around 3700 too. So, I will place an OCO sell order with the following details.

screenshots by OKEx

These are the details of an OCO order which I have placed keeping in mind the above technical analysis of ETH. My risk is reduced here by the order details that is if my sell order is executed successfully I'll be in profit and if it doesn't go as expected I've placed a stop limit order with the order price 3880 and the trigger price at 3890. There my risk is managed as you can see with a technical example too.

QUESTION 03

a) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

ANSWER:

- Step no. 01: Open any exchange on your mobile phone or on your desktop (I've opened OKEx on my mobile phone). On the bottom of the screen a panel is available with the middle option being of "trade". Click on it.

screenshot by OKEx

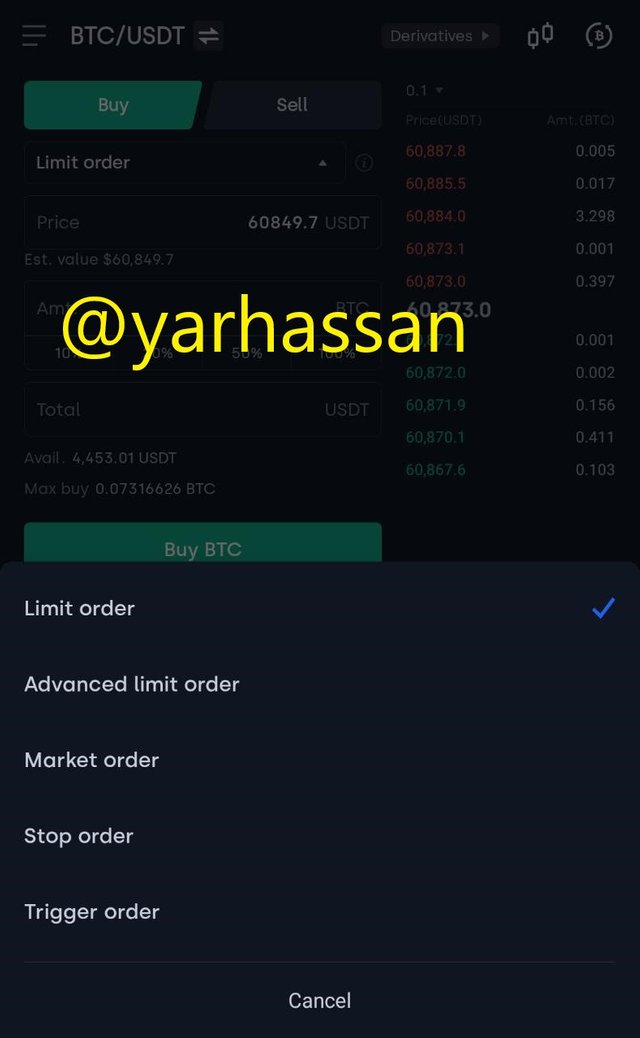

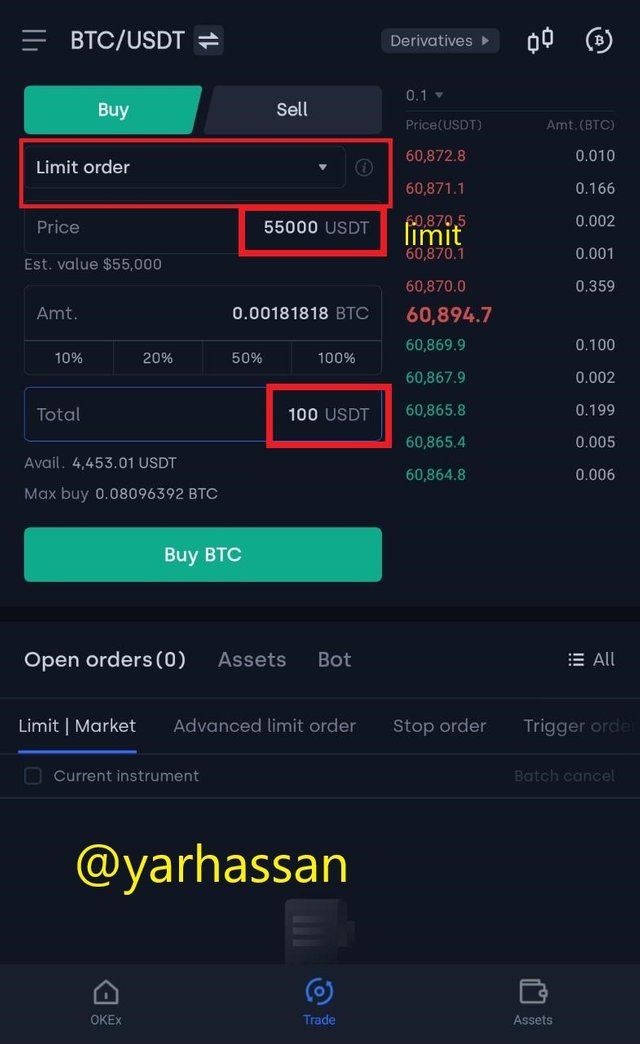

- Step no. 02: Select a pair (I've selected BTC), you can select buy/sell from the top. Now there is a drop down with limit order already written on it. Open it to select the other types of orders if needed.

screenshot by OKEx

- Step no. 03: Set the limit and the total amount of USDT of which you want to buy the crypto. Here you can also see the drop down bar that I mentioned in the previous step. I've fill out the limit at 55K which means that the 100$ worth of USDTs will be converted into BTC once the price drops to 55K. Click on "Buy BTC" to place the order.

screenshot by OKEx

- Step no. 04: Confirm the order placed after reviewing the details.

.jpeg)

screenshot by OKEx

- Step no. 05: The limit order is placed and you can view it at the bottom of the screen.

.jpeg)

screenshot by OKEx

QUESTION 04

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

i)Why you chose the crypto asset

ii)Why you chose the indicator and how it suits your trading style.

iii)Indicate the exit orders. (Screenshots required).

ANSWER:

screenshot taken from Tradingview

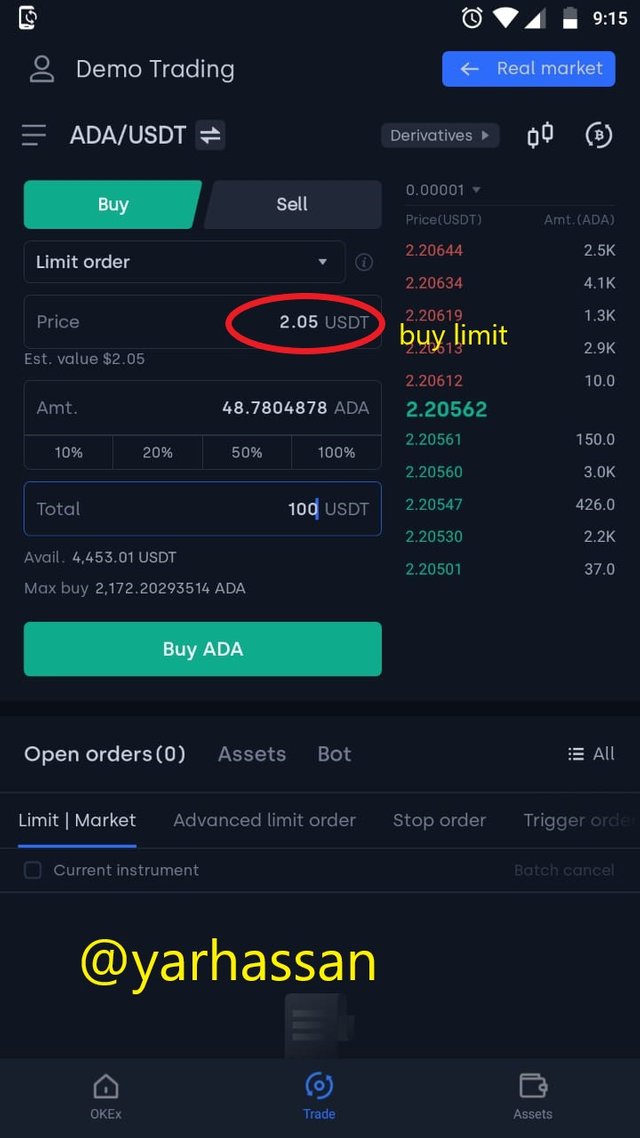

This here is the technical analysis of ADA/USDT. as we can see here it has been retesting the Fibonacci support level at 2.05-2 and is a quite strong support. Also the RSI is showing that the price action of ADA goes halfway up and then comes down to the mean value and it is quite clear from the orange bearish trend line connecting the lower highs of the price action that the price of ADA will retest its support yet again and we can place a buy order around that price. And if it goes down to its support price and my buy order is executed and it continues to go down I'll place a stoploss order and will sell my already bought asset with a minimum loss and exit the market minimizing the risk.

i)Why you chose the crypto asset

The reason why I chose ADA is because the fundamentals of ADA are quite good as it aims to solve the interoperability and scalability issues faced by many users and it's accepting of smart contract dApps can cause the price of ADA to appreciate much much higher.

ii)Why you chose the indicator and how it suits your trading style.

RSI has always been one of my favorite indicator as it gives the overbought and oversold signals of a certain crypto asset and also tells how a price of an asset is behaving, which in this case is true too. The horizontal line on the RSI is telling us that the price will retest it and will come down to its mean value.

iii)Indicate the exit orders. (Screenshots required).

- Here are the screenshots of the buying limit order of ADA/USDT at the buy limit of 2.05. Click on "Buy ADA".

screenshot by OKEx

- The order confirmation will pop up with exit orders that are SL and TP options (I've set the TP at 2.5 and stoploss order at 2 here). After placing the exit orders confirm the order to place it.

.jpeg)

screenshot by OKEx

- Here in the last screenshot we can see that our buying limit order of ADA/USDT has been placed alongside the exit orders (SL/TP orders) and will execute when the conditions provided are met.

.jpeg)

screenshot by OKEx

CONCLUSION

Today in this lesson we learned about the most basic thing that a beginner level trader/learner must know in order to perfectly execute and learn the trading techniques. We learned and explained the different types of trading styles, different types of orders and how to place and execute them, and to use them in our benefit. We also learned about the risk management by means of order placing which will help us minimize our risk.

cc; @reminiscence01

Hello @yarhassan , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for submitting your homework task.