BTC/USD, ETH/USD ||Bullish Reversal,Bitcoin, Ethereum Forecast||

BITCOIN, ETHEREUM, GOLDMAN SACHS, CITIGROUP, CRYPTOCURRENCIES – TALKING POINTS:

Citigroup and Goldman Sachs ongoing support of the digital money market could prompt further potential gain for Bitcoin and Ethereum.

BTC/USD ready to move higher after the development of a Bullish Hammer inversion light at key help.

ETH/USD looking at a retest of the yearly high in the wake of skipping off of 55-EMA uphold.

Digital forms of money have been enduring an onslaught as of late, with the cost of Bitcoin and Ethereum falling 26% and 36% separately from their yearly highs set in mid-February. In any case, this may end up being just a counter-pattern remedy, as both computerized resources ricochet off of key help and quicken higher.

Additionally, the support of the cryptographic money market by two significant speculation banks, Citigroup and Goldman Sachs, could additionally approve the advanced cash advertise and increase capital inflows in the close to term. Citigroup's Global Perspectives and Solutions research organization expressed that Bitcoin could turn into "the cash of decision for worldwide exchange", while Goldman intends to offer Bitcoin fates by the center of this current month.

This returns on the of Bank of New York Mellon's explanation that it would treat BTC equivalent to some other monetary resource and Mastercard's obligation to incorporate Bitcoin into its installment organization. Tesla additionally declared a $1.5 billion interest in Bitcoin and plans to start tolerating it as a type of installment. These improvements will presumably support both Bitcoin and Ethereum in the coming weeks and may even bring about resumption of the essential upswings stretching out from the March 2020 nadirs. Here are the vital levels to look for BTC/USD and ETH/USD.

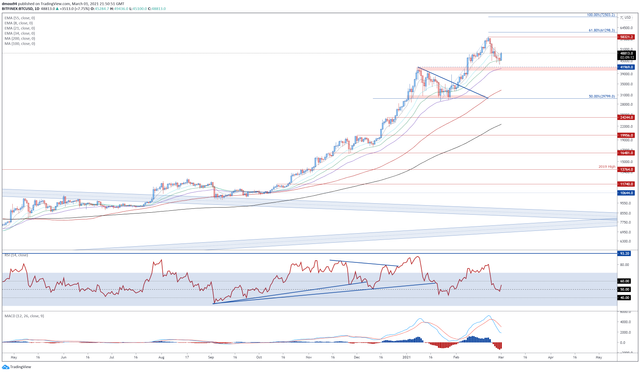

BITCOIN DAILY CHART – BULLISH HAMMER HINTS AT KEY REVERSAL

The development of a bullish Hammer inversion candle at the 34-EMA (45176), trailed by a Bullish Engulfing light as approval, proposes that Bitcoin's 7-day rectification lower could be at an end.

With the RSI blasting back over 50, and the MACD following solidly over its impartial midpoint, the easiest course of action appears to be slanted to outdoors.

An every day close back above mental obstruction at 50,000 would likely increase close term purchasing pressure and create an incautious push to retest the yearly high (58,321). Leaping that brings the 61.8% Fibonacci (61298) and 65,000 imprint into the focus.

Nonetheless, if 50,000 holds firm, a more stretched out pullback to previous obstruction turned-uphold at the January high (41969) could be on the cards.

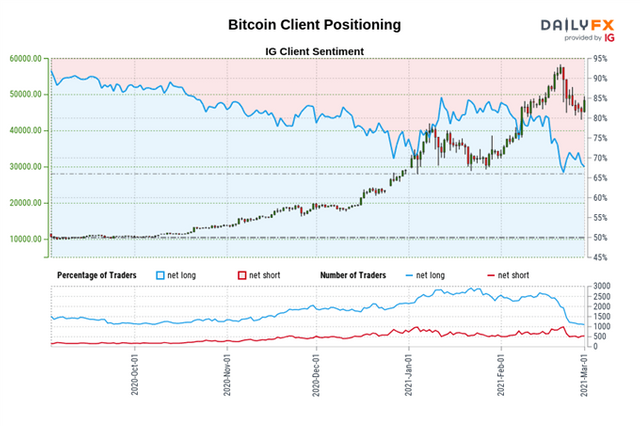

The IG Client Sentiment Report shows 69.56% of brokers are net-long with the proportion of merchants long to short at 2.28 to 1. The quantity of merchants net-long is 0.46% lower than yesterday and 25.31% lower from a week ago, while the quantity of brokers net-short is 12.22% lower than yesterday and 28.40% lower from a week ago.

We normally take an antagonist view to swarm opinion, and the reality dealers are net-long proposes Bitcoin costs may keep on falling.

Dealers are further net-long than yesterday and a week ago, and the blend of current assumption and ongoing changes gives us a more grounded Bitcoin-bearish antagonist exchanging predisposition.

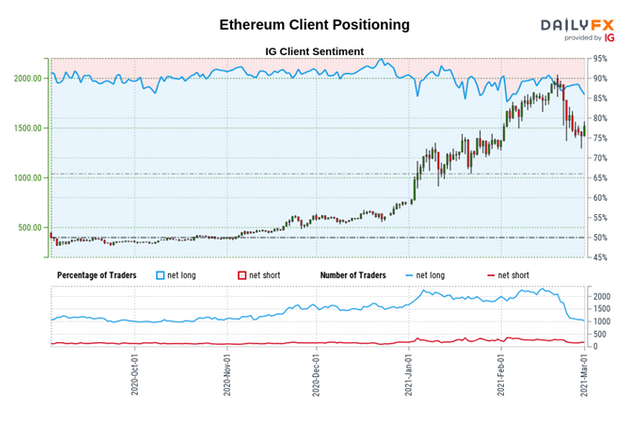

ETHEREUM DAILY CHART =RANGE SUPPORT TO TRIGGER BULLISH REVERSAL

Ethereum likewise looks set to move higher in the coming days, as costs flood away from blended help at the pattern characterizing 55-EMA and 2018 high (1424).

Recovering a firm traction above mental opposition at 1600 would probably make ready for purchasers to retest the yearly high (2036). An every day close above is at last expected to flag the resumption of the essential upturn and bring the 100% Fibonacci (2410) into center.

Then again, an every day close underneath range uphold at 1400 – 1440 could empower would-be dealers and result in a pullback to versatile help at the 100-MA (1108).

The IG Client Sentiment Report shows 86.84% of merchants are net-long with the proportion of brokers long to short at 6.60 to 1. The quantity of merchants net-long is 0.39% lower than yesterday and 24.39% lower from a week ago, while the quantity of dealers net-short is 16.22% lower than yesterday and 21.72% lower from a week ago.

We commonly take an antagonist view to swarm notion, and the reality dealers are net-long proposes Ethereum costs may keep on falling.

Situating is more net-long than yesterday however less net-long from a week ago. The blend of current notion and ongoing changes gives us a further blended Ethereum exchanging predisposition.

JustNetwork 7th Anniversary Airdrop Party

Get 350 STEEM Airdrop

This Airdrop is only for steem users with 40+ reputation score

Join And Claim Now

This looks highly suspicious and they are trying to get active key or password. Once they have that they will take whatever they can from your account. A similar scam is going on in Hive. Word has it there is no airdrop. This user's account is hacked. They need to change their password.

On steem-engine.org they have a warning: "ATTENTION: Please do NOT click on any links that promise you can claim a free airdrop!

Most of those links are created by scammers who want to steal your account keys."

In the event of a true air drop on the Tron network they already have your user name and that is all that is needed for an airdrop.