Tutorial : Understanding Dollar Cost Averaging (DAC)

Designed with PowerPoint

You are highly welcome to my tutorial post. Please bear patient with me because I know you might have being expecting me to drop another tutorial lesson after reading through my previous lesson. Well am sorry for not doing that. Anyway that is now the past. So let's take a look at our today lesson which we are going to focus on Dollars Cost Averaging (DCA).

The word DCA came into my mind after seeing how a lot of users were asking to know the full meaning of DCA and how its works in the crypto market when the short word was posted by someone in a WhatsApp group.

Well another member of the group answered most of the questions that was asked by some of the members very well and to that I feel that there are still a lot of Steemians that might haven't heard about DCA or what DCA is all about. However, should Incase you didn't know today you are going to know it since I have break everything down in a way that you will understand.

What is DCA?

DCA is an abbreviation that is use to describe the words Dollar Cost Averaging. It is one of the Investment strategy that Investors, traders use in the crypto or forex market to distribute capital to an asset(crypto) over time. In a nutshell, Dollar Cost Averaging (DCA) is a strategy that Investor follow to invest a total amount of money in small increments over a given period of time (i.e investing bit by bit for over a period of time) as opposed to investing all his/her capital all at once.

We can now see that Dollar Cost Averaging (DCA), is a strategy that helps Investors or traders like you an me to negates the effects of short term market volatility. The strategy also helps Investors/traders to accumulate enough welth and build one stream of investment (capital portfolio).

DCA helps you not to spend your capital (money) all at moment where the asset might become bearish. Let's say that for instance, you want to buy an asset and the price of the asset drops down at the time you are dollar cost averaging (DCA), then you have a better chance of making profit from the asset if the price moves up.

Dollar Cost Averaging is one of the best strategy that I do recommend for anyone that is till learning how to trade or want to be a good Investor. The reason why I do recommend DCA is that it save your time from monitoring the market in order for you to buy the asset at the best price.

Since you have now known what DCA means. Let's now practically look at it using an example below for a better understanding.

For a clear understanding, let's say that Mike is an accountant who earns $5,000 in a month. In late 2021 he heard about STEEM and he decided to invest 10% of his monthly salary which is ($500) into STEEM. Now since Mike is already aware of DCA, he settled on sharing his allocation (Investment) in each of the week.

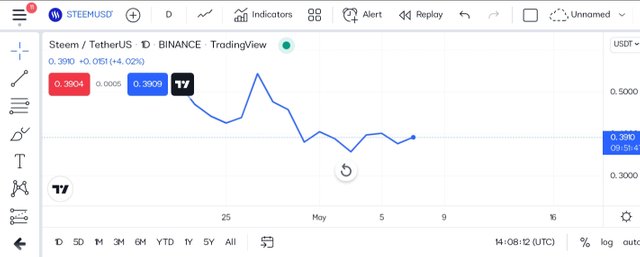

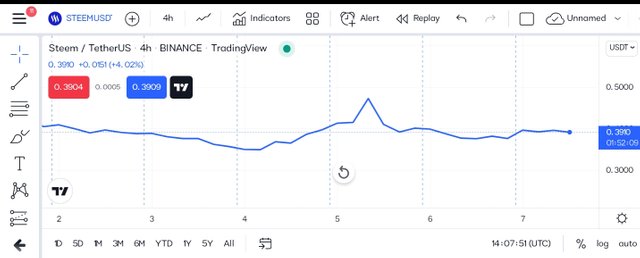

screenshot gotten from TradingView

Now with $500, Mike bought STEEM worth $125 in each of the week that pass. Mike continues buying using his knowledge of DCA for the whole year and ends up spending $6,200 as the total amount he spent in purchasing STEEM in a year. Now this means that at the end of the year Mike Investment turns into $8,000 which he has gain over 32.7% percent.

screenshot gotten from TradingView

Now still on our exampe, had it been that Mike had follow the same strategy earlier before 2021, Mike would have make over 109% after turning his $6,200 into $12,638.

Again if mike continue the same strategy, he would have turned his $12,638 to about $41,243 which is a good some of money.

Looking at the example of Mike above, it has make us to understand that dollar cost averaging is something that keeps on giving us double of our money and I will like you to think about it and make a proper research about DCA.

How to Increase your portfolio using Dollar Cost Averaging (DCA)

|  |

|---|

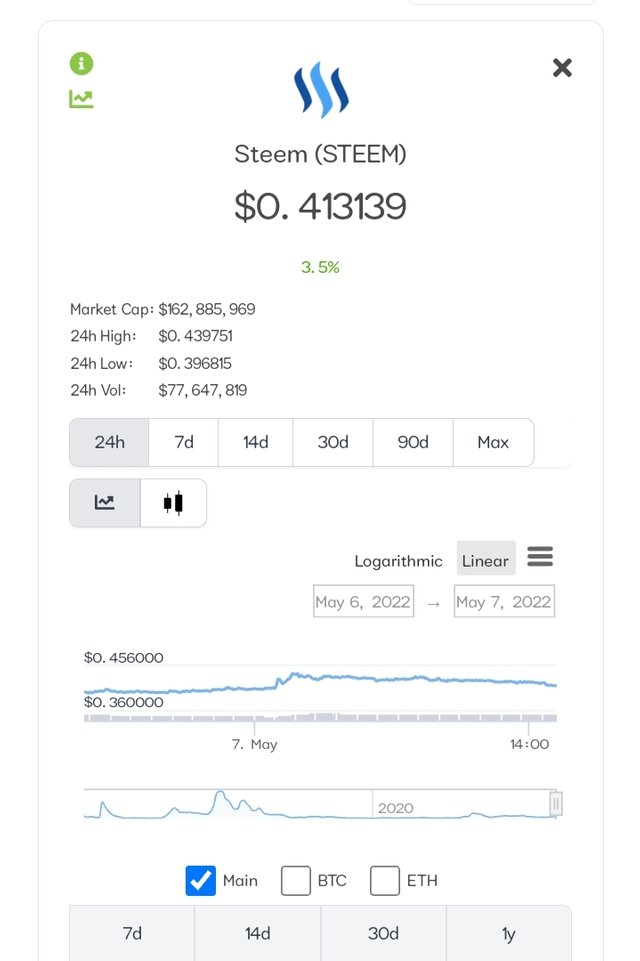

screenshot gotten from coingecko

In order for you to be able to increase your portfolio Investment using DCA there are three things you ought to know and follow which are;

- The asset you are to buy

- How much you're to invest

- At what period you're to buy

Let's start by looking at them serially.

The asset you are to buy:

There are a lot of us that are afraid of taking risk. The best thing is to spent little time first and research on the cryptocurrency you want to buy.

For instance, while researching you then now find out about a cryptocurrency that are widely known and has a huge market capitalization like Bitcoin (BTC), Ethereum (ETH) and Solana which are all cryptocurrency that performed very well and you invest your money in any of them. The probability of you earning a reasonable amount of profits is very high than you investing on a cryptocurrency you don't too know much about.

How much you're to invest

After knowing the asset you want to invest in. The next step is for you to make sure that the capital you want to use for your Investment is ready.

Firstly, you need to decide how much you can allocate into your portfolio (i.e invest in what you can afford to lose). At this point, it is good and advisable to use the strategy of that of Mike from our exampe above.

At what period you're to buy

After getting your capital ready, what you should know is the fixed interval of time that you should be buying. A lot of traders/Investors usually buys they crypto on week basis. Whereas as some love buying at the end of the months when they had been paid they salary.

Buy when the asset is relatively low so you can make a good profit when it's high.

Conclusion:

DCA is a good strategy for we to buy cryptocurrency using a relative low amount of capital and gain Profit. There are a lot of things to understand about dollar cost averaging (DCA). But it will be best if will can be taking our lessons gradually than trying to finish it once. So to this we have come to end of today tutorial on DCA

10% rewards goes to @steem.studios

Note: You must enter the tag #fintech among the first 4 tags for your post to be reviewed.

Thank you for your support