Is Defi Hype for real?? and what are the risks??

Defi stand for decentralized finance. By using defi protocols people can lend and borrow digital assets globally. For details pls refer to what is defi

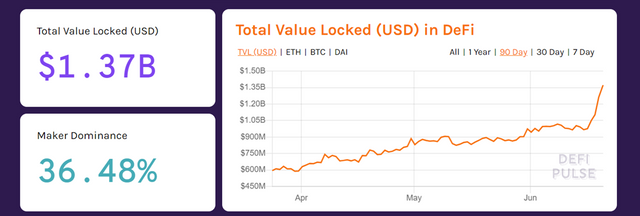

The picture above shows the growth of total value locked in USD under all defi protocols. And it is showing a consistent growth except last few days due to hype in compound.

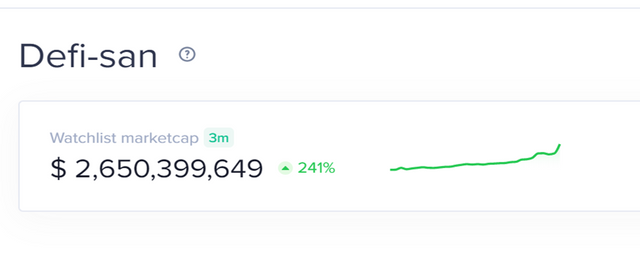

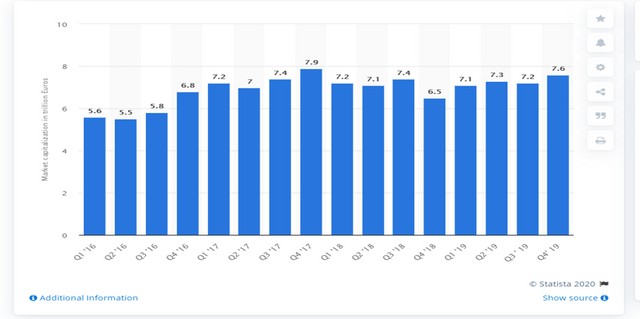

The picture above shows the growth of market value of these protocols. And it also shows a consistent growth similar to locked asset growth.

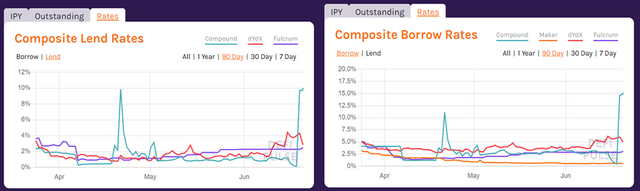

But I want to analyze if the market value is justified. The revenue of the protocol is from the difference in lending and borrowing rates. Below picture shows that difference between the two is 1-2%.

Below are the computations from above data:

Revenue of all the protocols (1.5% of locked assets) = (1370*1.5/100)=20.55 mn$

Lets assume all of above is profit, Earning = 20.55 mn$

Price of all the protocols, Mcap = 2650 mn$

So PE = 2650/20.55 = 128

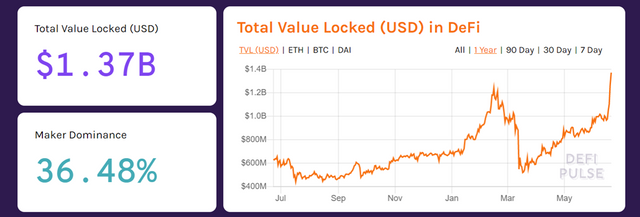

The picture below shows annual growth of locked assets in Defi protocols which grew from 628mn$ to 1370mn$. That makes projected earning growth of 100% a year. And it can be assumed to grow with this rate or even higher as the entire market size is very small today in comparison to global financial market.

So PE projections for next three years would be

PE (1 year forward) = 64

PE (2 year forward) = 32

PE (3 yr forward) = 16

And locked assets size at the end of three yrs would be 5.48bn$ which also is not very significant of global banking sector market size of 7.8tn$ as shown below:

Therefore, based on these computations as of today the mcap of defi assets is too high but looking at growth and size of the market that is available to be captured under defi - this is probably a good bet.

This is all about valuation of defi protocols. But what about the trust of these protocols. Currently most defi projects are on Ethereum. Lately some projects have started coming on Tron, EOS, Steem, and Hive. Below are few issues:

- There is single UI, developed by protocol developers, to deposit, lend, borrow, and withdraw digital assets. If for whatever reason the UI is not functional as a result of fraud by developer team, government restrictions, hacked etc then there is no way one can get back locked assets. Ethereum, Tron, and EOS based defi products suffer with this but Steem and Hive are resistant to this issue. Some points discussed in This tweet chat

- Both borrowers as well as lender deposit their digital assets to the protocol meaning transferring the assets to protocol address. And private key of protocol address is with developer team. That leaves all the assets, deposited by protocol users, at the mercy of protocol developers.

- The base layer of these protocols is based on POS/dPOS consensus protocols, except ethereum as of today but soon to move to POS. And recent episode of The drama with Steem and Hive and Is delegated proof of stake (Dpos) to blame for the Steem/Hive drama?captures trust related issues associated with pos/dpos.

Comments and feedback are welcome.

To the question in your title, my Magic 8-Ball says:

Hi! I'm a bot, and this answer was posted automatically. Check this post out for more information.

Hello dear @prameshtyagi.

Much has been said about the level of protection of the keys. I don't think the developers on Steem Blockchain have access to our keys. These are randomly generated and maintain a level of encryption. When the hive fork occurred, many users insisted that new keys should be generated. But in my opinion, this was only conspiracy theories.

I am very struck by the way you affirm that DeFi is totally possible to run on Steem Blockchain, in fact, apparently, it would have some advantages over Ethereum.

This is extremely important to me as I am currently trying to implement strategic partnerships that would involve some transfer of funds to the Steem Blockchain. My underlying idea is to bring greater value to the ecosystem.

Maybe you could share some of your opinions and knowledge with me? I would appreciate it very much.

All best, Piotr.

Dear @prameshtyagi

Solid summary what DeFi is about. It seem that there is much hype around DeFi those days. Just like there was so much hype and hopes around STO in 2019. Wouldn't you agree?

One can only hope, that this time around there will be more to that than just a short term hype.

Enjoy your weekend,

Yours, Piotr