Wall Street punches back against GameStop and Wallstreetbets, which could push people to Bitcoin

The Cancel Culture has now shifted to Finance, and that is good news for bitcoin

In case you have been living under a rock, the hottest story of the last week or so has been GameStop.

The well known retail game store where many kids (mine included) love to buy their new and used video games.

Well, it had a short interest of roughly 140% for over a year when a well known stock trading group called Wallstreetbets decided enough was enough.

The group, with more than a million members, decided they were going to start buying up call options and shares and squeeze those short sellers.

The plan worked like a charm as the stock rose from $5 back in August to almost $500 today.

However, that is actually the secondary story to what is really going on.

After several of the hedge funds that were short started facing existential threats, the regulators and gatekeepers stepped in.

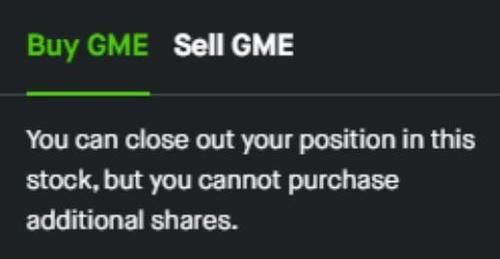

The SEC issued a comment yesterday saying they were monitoring the situation, and then TDAmeritrade as well as several others, including Robinhood, have since restricted trading in GameStop.

While it's not clear exactly what those restrictions are, some are speculating that they are preventing people from buying the stock, however, much more likely is that they upped margin requirements which impact margin buying as well as options positions.

I can't say for sure which it is as I don't have an account with either platform.

Then, Discord decided to ban the wallstreetbets discord channel and their Reddit group has since gone private, and now the Nasdaq is talking about potentially suspending trading in stocks that this group is planning to squeeze.

When you add it all up the end result is a retail investing class that feels they are being censored, canceled, and discriminated against by a rigged system.

This all benefits Bitcoin...

One thing that is very interesting to note about the above situation is the conflict of interest that there is out there...

Melvin Capital is one of the hedge funds short GameStop, Citadel is a major investor of Melvin Capital, and Robinhood sells its order flow to Citadel in order to be able to offer commission free trading to its customers.

Then, as I mentioned above, Robinhood comes out and prevents its customers from buying GameStop stock, which again a major partner of theirs is indirectly short that stock...

Sounds like a conflict of interest much? It's no wonder that people are about to fully lose trust in a system they already were skeptical of.

Bitcoin is the ultimate large scale censorship resistance financial instrument/platform out there.

Everything that is happening right now in the stock market is pushing people away from the current legacy financial system and into something else.

What is that something else?

My guess is that it will be bitcoin and crypto.

Defi is set to be a huge benefactor to what is going on right now.

Even if the benefits aren't seen immediately I suspect over time this money is going to continue to move to the decentralized world of crypto for their social and financial needs.

With every story like the one above about Wall Street seeming to operate by unfair rules, it's like a big advertisement for bitcoin and crypto.

I look forward to the day wallstreetbets transitions to cryptobets and starts mooning some altcoins. :)

Stay informed my friends.

-Doc

Thank you very much jrcornel for this good news, i hope that will be real early and everybody use Bitcoin.

Hey, so how ‘bout that #Dogecoin? Stranger than fiction for sure. Cooling off as of tonight so that one might not be sustainable this time, but shows what the wisdom/madness of the crowd can do.

Sort of wondering what happens now to all of these folks who pumped GameStop, and what they are going to do with shares that (even they would admit) are so clearly overvalued.

Anyway, great post with some insightful points - hoping more of the Reddit and Robinhood crowds make their way into crypto so we can get some real adoption happening!