The Adverse Affects Of An Oil Price War - Part 1

The International Energy Agency (IEA) cut its demand forecast for the first quarter of 2020. The IEA is predicting consumption will contract by over 400,000 bpd, the first decline year-on-year since the global financial crisis more than a decade ago. And for the entire 2020 year, the IEA cut demand growth by 365,000 bpd to just 825,000 bpd. That would be the lowest annual increase since 2011.

When Organization of the Petroleum Exporting Countries (OPEC) meet last week, to discuss cutting oil production, many investors were expecting a production cut of at least 600,000 bpd. However, many thought the cuts needed to be a lot more. But OPEC’s allies rejected additional production cuts proposed by OPEC. The meeting between OPEC and its allies concluded with no deal on additional production cuts. You see, Russian President Vladimir Putin, didn’t want to lose market share, especially to the shale producers and even announced that they were leaving the alliance. In response Saudi Arabia said Russia would live to regret the decision. And over the weekend Saudi Aradia announced an oil price war.

I have seen this before and it wasn’t pretty. It happened in 2014, when I decided to treat trading like a business.

After oil went up 4X between 2002 and 2012, coupled with low interest rates and advancements in horizontal drilling, the shale revolution was born in America.

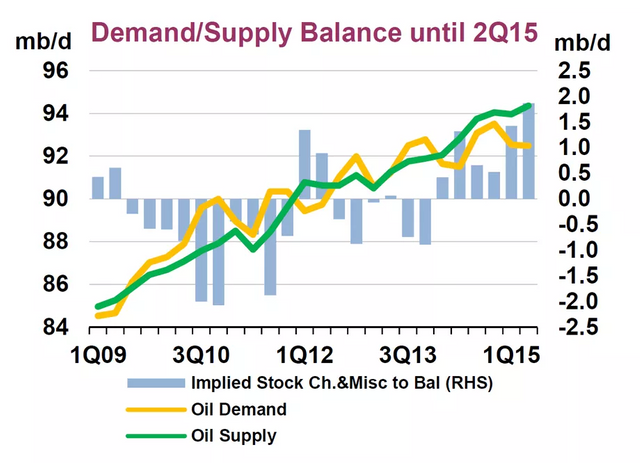

Output surged from 5 million bpd in 2008 to an average of more than 8.5 million bpd in 2014, and stood above 9 million bpd at the start of 2015.

By late 2014, world oil supply was on track to rise much higher than actual demand, as the chart below from the International Energy Agency shows. A lot of unused oil was simply being stockpiled away for later. So, in September, prices started falling sharply.

As prices slid, many observers waited to see whether OPEC, the world's largest oil cartel, would cut back on production to push prices back up. (Many OPEC states, like Saudi Arabia and Iran, need higher prices to balance their budgets.) But at its big meeting last November, OPEC did nothing. Saudi Arabia didn't want to give up market share and refused to cut production — in the hopes that lower prices would help throttle the US shale boom. That was a surprise. So oil went into free-fall.

In Nov of 2014, OPEC announced that it would maintain its production level, which saw the price of Brent oil fall from $77 to $59 over the next month. Until early 2016, the global economy faced one of the largest oil price declines in modern history and one of the three biggest declines since World War II.

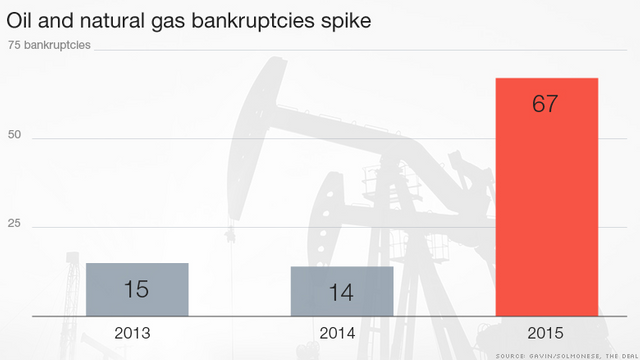

200, 000 jobs were cut, 96,000 cuts coming in 2016 along. Thousands of layoffs by non-energy companies that provide equipment used to drill for oil like Caterpillar and Joy Global. More than 60 companies went belly-up.

More than 15% of energy bonds made up over $1 trillion of the junk bond market in 2014. Many of those bonds went belly-up and those banks that issued those bonds were left hanging. Towns like those in North Dakota were booming.

High-school graduates were earning six-figure salaries in the oil fields. For seven straight years, North Dakota boasted the lowest unemployment rate in the country. But all that reversed when oil prices collapsed. Those same towns were infested with drugs and crime and unemployment.

So what will happen now that another oil price war is upon us, that's anybody's guess, but let history be your guide moving forward?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted via Steemleo

It's gonna get worse before it gets better.

Totally agree.

Posted via Steemleo