Understanding support and resistance levels in trading: how to identify and use them in your investment strategy.

In the world of trading, support and resistance are two key concepts that every trader should know and understand. Support and resistance are price levels that mark the area where supply and demand balance, which can influence an investor's decision to buy or sell an asset. In this article, we will discuss what supports and resistances are, how to identify them and how to use them in making trading decisions.

Supports are price levels at which demand exceeds supply, which means it is a point at which the uptrend may have difficulty continuing. Supports are important because they indicate that there is interest in the asset at a certain price, and traders can use them as a signal to buy, as the price may bounce upwards from the support level.

On the other hand, resistances are price levels where supply exceeds demand, which means it is a point where the downtrend may have difficulty continuing. Resistances are important because they indicate that there is interest in the asset at a certain price, and traders can use them as a signal to sell, as the price may bounce down from the resistance level.

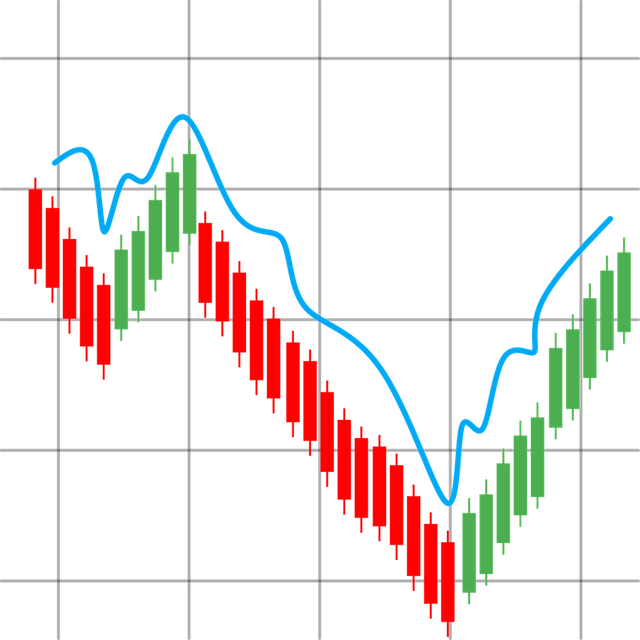

To identify support and resistance levels, traders can use different tools and techniques, such as technical analysis, trading volume, price patterns and technical indicators. Technical analysis is a technique that uses charts to study past price behavior and trading volumes, which can help identify support and resistance levels.

Source

Price patterns can also be useful in identifying support and resistance levels. For example, a "double bottom" pattern may indicate that there is a support level at a given price, while a "double top" pattern may indicate that there is a resistance level at a given price.

Technical indicators can also help identify support and resistance levels. For example, the Relative Strength Index (RSI) indicator can indicate whether an asset is overbought or oversold, which can be a signal to buy or sell at support and resistance levels.

Once support and resistance levels have been identified, traders can use them in making trading decisions. For example, a trader can buy at the support level and sell at the resistance level, or use the support and resistance levels as a stop loss or take profit in a trade.

In summary, support and resistance levels are key concepts in trading that every trader should know and understand. Traders can use different tools and techniques to identify support and resistance levels and use them in making trading decisions. Support and resistance levels can be a useful tool to help traders identify buying and selling opportunities in the market.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.