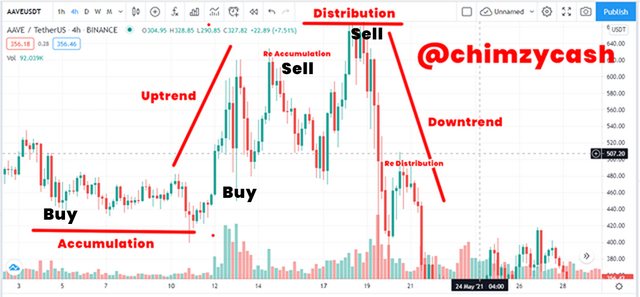

Blockchain and Cryptocurrency Beginner - The Whale's Cycle and The Different Phases of The Market

For this demonstration, I will be using the AAVE/USDT pair to show the different phases. Looking at the chart, the accumulation phase of AAVE was around $420 - $475 range. During this phase, the volume also increased which showed the buying power of the whales. As the price began to increase, smaller investors began to enter into the market and buy. This increased the demand of AAVE and the price increased to about $650. There were multiple re-accumulations during the accumulation phase as price increased. This led to an uptrend, causing the price to increase to $650.

When the price of AAVE increased significantly, the whales made a lot of gains and they began to sell off their holdings to take profit and sell some of their positions, this led to the distribution phase. The volume began to decrease as whales continued to sell their positions. This caused the price to enter into a downtrend. There was multiple re-distributions as the moved into in a downtrend. The price of AAVE decreased down to $380.

.png)

AAVE/USDT pair

Accumulation

In the accumulation phase, we can see on the chart that the accumulation phase began when the price of AAVE was around the $480 region. The whales began to accumulate large amounts. During the accumulation phase, there were multiple re-accumulations due to fluctuation in the price. Horizontal movements is more visible in the accumulation phase.

Uptrend

The uptrend phase is as a result of the accumulation of the whales which drove the price of the asset up. As more and more investors enter the market, the market enters an uptrend. Looking at the AAVE chart, we can see the uptrend phase is visible. The price began to increase as more and more buyers enter the market. As the demand increased, the volume increased as well, forcing the price of AAVE to increase to about $650.

Distribution

After the whales have made a lot of increase in their holdings, the whales began to sell in order to take profit from their AAVE positions. This is the distribution phase. Looking at the chart, we can see the areas where the whales began to sell off their coins to make a profit. The whales closely follow the rule of buy low and sell high, The whales have already accumulated at low prices, they begin to sell at high prices due to the buyers that FOMOed into the market. As the whales continue to take profit by selling and pushing the price down, the demand continue to decrease as well. Because of the selling pressure by the whales and FUD in the market, the price continue to decrease. There were re-distributions due to few buyers, but the selling pressure is greater and the price goes into a downtrend.

Downtrend

The downtrend phase is as a result of the selling pressure of the whales and the FUD in the market by other buyers who bought at higher prices and are afraid of losing all their investments. As more and more AAVE was sold, the price went into a downtrend, this resulted in a decrease in the price of AAVE as we can see on the chart. The price continued to move downwards and went all the way down to $380.

Using the Whale's Cycle for Buy and Sell

I will be using the same AAVE/USDT chart to demonstrate how I will buy and sell based on the market phases.

Accumulation

As a whale, I will begin to slowly accumulate the coins, this is the accumulation phase. Because it is difficult to identify because there is nothing concrete to show that the market would move upwards. Other investors usually stay away from horizontal movements in the market because the price can move in any direction at any time. This will allow me to continue to accumulate strategically to build my position and acquire a large amount at low prices. I will keep buying as prices fluctuate sideways.

Uptrend

As my buying power continue to increase, the price would slowly begin to increase, this will alert other investors and buyers on the potential uptrend. My buying power help push the price up, other new investors and buys enter the market due to FOMO and signals. The price will continue to increase due to the increased demand.

Distribution

Once the price have reached a certain price, I will begin to slowly sell my coins. I will take profit at the top and wait for the price to push up due to new investors entering the market and are not aware of the situation of the market. Once the price has increased again, I will sell off my coins to make the most profit.

Downtrend

This would cause the price to decrease. As the selling pressure increases, fear enters the market, FUD begins, small investors who are afraid to lose all their investments begin to sell out of fear. I have sold all my coins and have made enough profits prepare for the next cycle. I would wait for the downtrend to settle so as to begin the next cycle and accumulate again.

Conclusion

When it comes to cryptocurrency investments, the whales play a major role in the cryptocurrency market. The whales represents the large investors and are also referred to as market makers because of their influence in the market and their ability to move the market up or down. This is the main reason why small investors fear the whales. The main goal of the whales is to make maximum profit by buying low and selling high. In the cryptocurrency market, there are 4 phases; accumulation, uptrend, distribution and downtrend phase. The whales have a huge influence in each of the phases. Understanding these market cycles and phases is very important so as to make better investment decisions and make more profits.

During the Downtrend moment in the crypto space it is a time for the whales to actually invest and buy their necessary token which they will cash out for profit during the uptrend