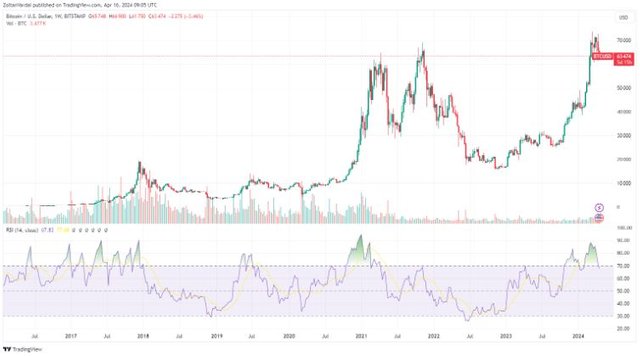

Bearish assumption for Bitcoin price action

There is a high probability of a war between Israel and Iran, which will trigger a price collapse in the financial markets and where Bitcoin would not escape such a disaster, which leads to believe a bearish assumption for the Bitcoin price action in the short term.

However, it would be enough to see the outcome of the current escalation of the conflict between Israel and Iran, where world economic powers would come into play, namely the United States, Russia and China, and not least the oil exporting countries grouped in OPEC.

A scenario like the current one is feasible to see prices retreat beyond what may happen with the halving of BTC units after the next Halving, this because we must take into account that for some analysts there are high probabilities that there is a significant correction of stocks and cryptocurrencies.

In this regard it is vital to note that according to Markus Thielen (founder of 10x Research), "Risk assets could be at an inflection point, which has announced the sale of all its technology stocks as it turns bearish."

In contrast to Thielen's not-so-optimistic outlook, it has been mentioned in Bitfinex's research report that, "There has been a shift in the composition of the bitcoin investor base: new entrants (short-term holders) are absorbing the supply sold by long-term holders (LTH)."

So, "This is evidenced by the increase in the ratio of market value to realized value for STHs, although it is still below the peak levels seen in previous cycles"

SOURCES CONSULTED

Cointelegraph. Stocks and crypto at the edge of ‘significant’ correction: 10x Research. Link

OBSERVATION:

The cover image does not belong to the author: @lupafilotaxia, the image was taken from: Cointelegraph

The bitcoin price value might really be in for some serious work out there in the coming weeks but I am so sure that the market will definitely recover soon