User friendly Capital Efficient Crescent Dex is upgrading to evolve into a more enhanced Protocol!!

Existing features of Crescent Dex that set it apart from other Dexs

Crescent Dex, in its current form, is pretty cool as it is, as it has impressive features that differentiate it from other Dexs.

- Visual representation of Trading Data for traders to analyse and conduct smart trades

Really neat Order book that provides visually represented data on Trade Orders; providing details of buy and sell orders of an asset.

The buy and sell market prices of an asset are represented following the standard Orderbook tick system. A trader can easily understand the trading price and the depth of buyers & sellers for that asset at that particular price range.

Trading Data is also represented in a graph providing insights on an asset’s price movements and volume. The trading graph has tools for traders to conduct trading analysis.

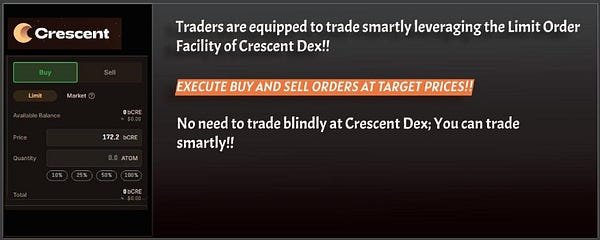

2. Strategic trades made possible with traders able to trade setting Limit Orders

Crescent Dex has a limit order feature, so traders can strategically trade setting up buy and sell limit orders.

So, trades get automatically executed when the assets touch the trader’s target price, rather than traders just trading assets at current spot market price.

You can learn more about Crescent’s advanced order book features from my article here -

Special features of Crescent Dex’s orderbook Module that makes it a convenient trading platform

3. Specialised Ranged Pools that provide quality Capital Efficient liquidity

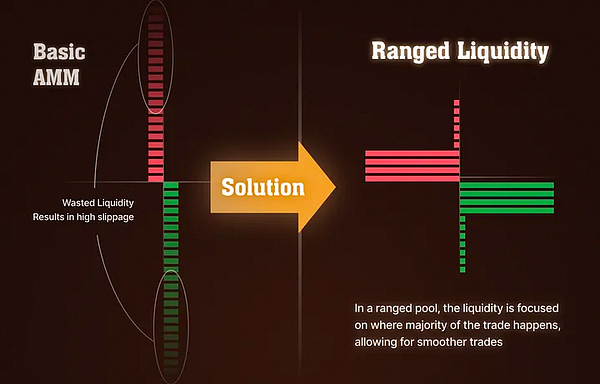

Providing liquidity to asset pair pools in AMM Dexs are a way for liquidity providers to earn LP rewards. However, generally pools in most Dexs are designed to provide liquidity to all price ranges. So liquidity is spread out to all price ranges from 0 to infinity. There is diluted liquidity for each price point which includes price points where trades just don’t take place.

There is a lot of wasted liquidity or inefficient liquidity that just does not get utilised for execution of trades. This in turn means LP providers get less amount of LP rewards.

Crescent Dex provides Ranged Pools, where liquidity providers provide liquidity between two specific price points. As a result these pools will have concentrated liquidity. Trades that take place between these price points which have concentrated liquidity will find good prices with low price slippage!!

Meanwhile, Liquidity providers get more amplified LP rewards for the same amount of liquidity they provide in basic pools. This is because they have provided effective liquidity that’s utilised more for execution of trades in Crescent Dex.

LSD pool pairs & Stable coin pairs LPs get best out of Ranged Pools

This is known as Capital efficient liquidity where your capital is utilised effectively to derive maximum possible rewards.

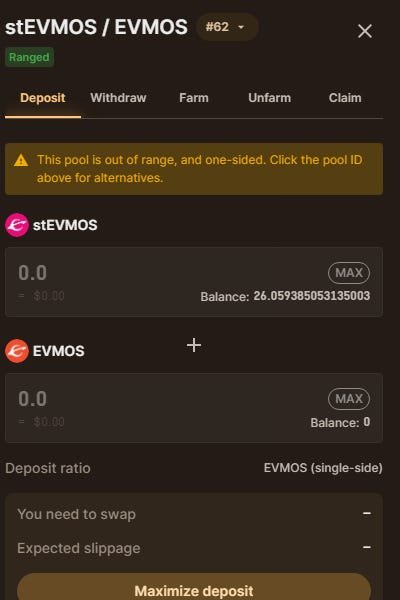

Although Ranged pools carry the risk of impermanent loss, there are ranged pools of stable coin pairs and Liquid Staking Derivative(LSD) pairs, which give liquidity providers maximum rewards without the risk of impermanent loss.

This is because asset pairs like USDC.axl/USDC.grv, stATOM/ATOM and stEVMOS/EVMOS deal in same asset pairs that have same price, so LP providers get maximum rewards for the liquidity they have provided with no risk of impermanent loss.

LSD asset pool pair stEVMOS/EVMOS

CRE Farming rewards distributed proportionately according to the effective liquidity provided by LPs

Crescent Farming incentives reward CRE tokens to pools according to the effective liquidity they provide, so the protocol incentive mechanism is also capital efficient. Else, generally Dexs provide farming incentives equally without having a mechanism that rewards coin pair pools according to the effective liquidity they provide.

Thus Crescent is a capital efficient Dex by rewarding pools that provide effective liquidity with more CRE farming rewards!!

I have explained this indeptly in my previous article which you can read here -

How Crescent Dex manages to provide decent volumes of Capital Efficient Liquidity

Let’s sum up how Crescent Dex offers more utility to users than other general Dexs…

So, already Crescent Dex has some features that common Dexs don’t offer, making Crescent Dex a Capital Efficient Dex.

Crescent Dex is already an appealing Dex with its Orderbook feature for traders.

It has tools that aid traders in executing smart trades conducting Technical Analysis, while the limit Order Feature makes it possible for traders to conduct strategic, intelligent trades.

Besides this, Crescent Dex provides various asset Pool investment options for LPs who can put their assets in Basic Pools or ranged Pools according to their risk appetite. While there are asset pairs where LPs can earn maximum rewards without having any risk of experiencing impermanent loss in ranged pools.

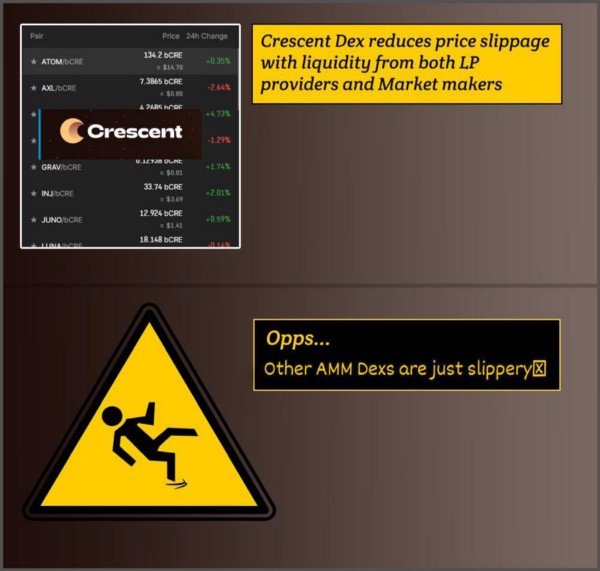

Crescent Dex has created mechanisms to ensure that protocol receives quality liquidity from LPs, so traders too can trade with less slippage with concentrated liquidity at certain price ranges in Ranged pools.

All in all, these current features of Crescent Dex make it a Trader friendly and Capital Efficient Dex which is also appealing to LPs and other users.

Crescent Network is introducing even more features that will further level up its utility!!

Crescent Network’s 2023 roadmap outlines the new features that are in plans to be incorporated into the Dex

However, Crescent Network does not stop from evolving into a more enhanced Dex from here. Crescent Dex’s 2023 Roadmap outlines new innovative features that will be introduced and incorporated into the Dex making it a more user friendly, capital efficient Dex.

Crescent Dex is levelling up its utility with new features getting incorporated into the Protocol.

The new features that are going to be incorporated into Crescent Network are -

1. Custom LP Pool besides Ranged Pools & Basic Pools.

Here, users will be free to set their own price ranges to provide liquidity.

2. Market Makers will be integrated into the Orderbook.

Maket Makers(MMs) will be incentivized with CRE rewards for providing constant liquidity to listed assets. CRE rewards will be proportionate to the quality of liquidity provided by MMs.. This will attract abundant, stable & sustainable liquidity to Crescent Dex and make Crescent a Hybrid Dex with the protocol getting liquidity from its AMM Module and MMs.

3. Fiat on-ramp integration with Crescent

So, users will find it convenient to use Crescent Protocol as they can purchase assets in Crescent Dex directly with their fiat. There will be no need to purchase asset using the services of CEX for this.

4. LPs can earn additional yields participating in External Defi

LP tokens that are also earning CRE yield farming rewards, can be lent in external DEFI protocols like UMEE. These LP tokens can also be used as collateral to borrow more assets.

5. Besides all this, Crescent Network’s UI will have sections that provide users with valuable information with -

A Portfolio section that provides users with an overview of their Portfolio and trading activity on Crescent Dex

An analytics section providing data on Pools, trading volumes, liquidity, Total Value Locked etc.

Users will get needed data that will aid them in evaluating suitable asset Pools for them to provide liquidity to.

I have outlined some of the main new features that are in plans to be incorporated in Crescent Network according to the 2023 roadmap of Crescent Network Team. You can learn about all other new features outlined in Crescent Network’s 2023 Roadmap here -

https://commonwealth.im/crescent-forum/discussion/11282-proposal-the-crescent-roadmap-2023

You can also read my Articles in these platforms -:

Publish0x — https://www.publish0x.com/@greenchic

Medium - https://medium.com/@kikctikcy