An objective thought of ETH 2.0

We are all no doubt pretty excited about the upcoming ETH merge, a move on which high hopes are attached to improve Ethereum scalability and efficiency, and thus, it has been heralded as one of the most monumental events of crypto history. However, nothing is perfect after all, and wherever there is a pivot coming, there must be side effects included. Of course, Ethereum's transition from proof-of-work to proof-of-stake is no exception here!

And if you've been following Ethereum news for the last few months, you certainly know that one of the major risks that could be posed after the merge is the potential centralization. Something that could trigger much bigger risks, not the least of which is compromising the censorship resistance nature of Ethereum...

As known, Proof of stake is not a new consensus mechanism, and it is already being used by multiple "Ethereum competitors" such as Cardano, Solana, Polkadot, and others. But the thing is that none of those "competitors" is even close to Ethereum capitalization or popularity. You know, A project the size and vogue of Ethereum is one hell of an attractive object for regulators to hit, and being very much centralized makes it both more attractive and easily accessible for them...This is where all the "centralization concerns" come from, so let's take an objective look to see if they are legit...

Where is decentralization? I can't see it, can you?

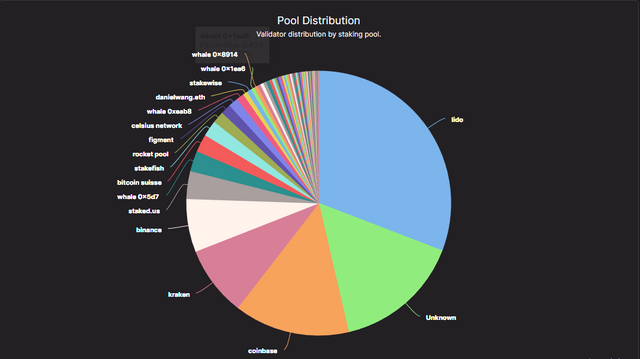

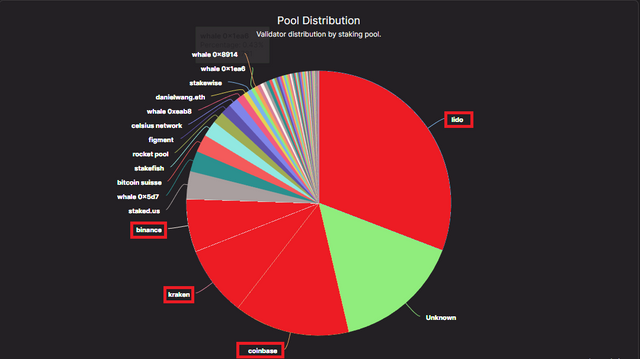

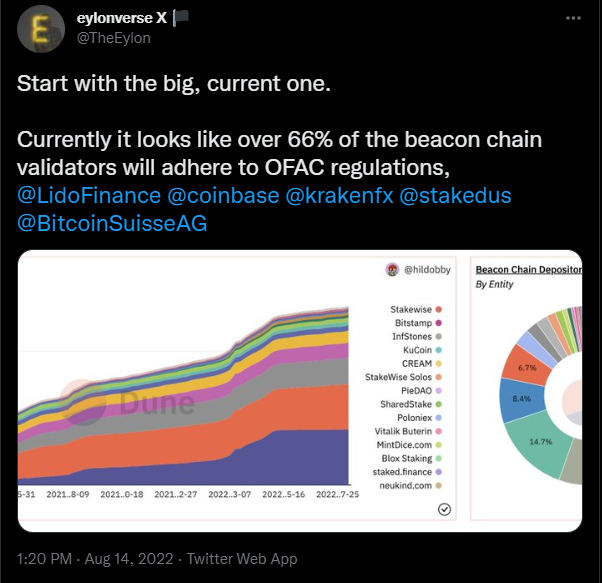

First of all, we have Ethereum 2.0 Beacon Chain Chart which is not that appealing. As you can clearly see below, the bulk of tokens staked belongs to a handful of big entities. More specifically, Lidofinance alone accounts for over 30% 0f the staking pool, then come Coinbase, Kraken, and Binance with 14%, 8,5%, and 6.5% consecutively. This is no fun because Coinbase, Kraken, and Binance are centralized regulated exchanges which effectively makes them subject to law changes in the jurisdictions in which they operate. What would happen if (hypothetically) regulators asked those exchanges to censor the Ethereum protocol?

And while Lido Finance (the largest staking provider) is theoretically a decentralized protocol, which implies that decisions like censoring would come down to a governance vote of the Lido DAO, it’s worth considering that Lido token distribution doesn't look any better...

It's also worth mentioning that all of the above must adhere to the United States Department of the Treasury's Office of Foreign Assets Control (OFAC) regulations.. In other words, they must obey whatever regulators ask!

Catastrophic Scenario:

Before going into my gloomy scenario, I'd like to point out again that I'm damn bullish on the upcoming transition to proof of stake and what it will bring to the Ethereum network. However, I think we should contain our enthusiasm sometimes and have a broader view of the situation. I'm no a FUD peddler, and I hate to be so, but being in crypto for several years now has taught me that only those who can ask hard questions will survive in the crypto market when others don't. Being critical and skeptical doesn't mean spreading FUD but it means looking at facts with objective eyes, right?

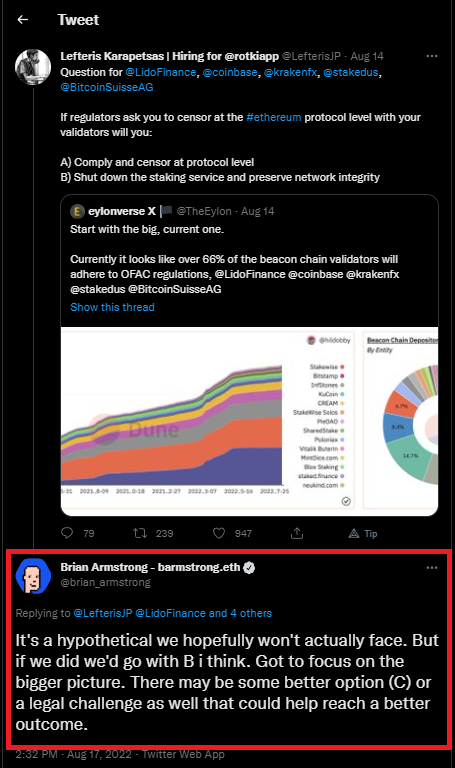

Well, the gloomy scenario I'm imagining is that regulators ask larger staking providers to impose new rules on the Ethereum blockchain. What's scary is that those validators who collectively control over 60% Ethereum staking pool are all regulated entities, and if they were to work together, they could easily censor the entire blockchain i.e reversing transactions, freezing wallets, or even deleting decentralized applications from the network! If such scenario were to happen, it would make Ethereum no different or even worse than the current financial system...Now, to be fair, Ethereum validators would never do this voluntarily as it would do devastating damage to Ethereum, and thus, their stake in the process. However, this would be less than a trivial consequence for governments and regulators who are willing to do whatever damage it takes to see their laws enforced.

As a reassuring sign, CoinBase has had the courage to answer that hard question as the CEO, Brain Armstrong, said they would prefer to stop staking than censor. But, it would be interesting to hear what the other large staking providers have to say!

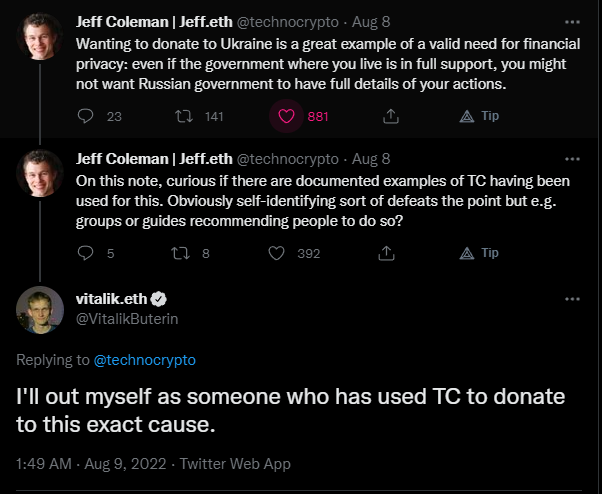

And if you think it is a bit far-fetched scenario, allow me to remind you of what happened with the Tornado Cash protocol where regulators went as far as sanctioning an entire open-source protocol just because there are some using it for "illicit purposes". They even went further to arrest the developers of TC just because they wrote up some codes! Can't you believe it? Me neither, but this is what really happened. And the fact that most TC users are law-abiding people and are using it for valid reasons didn't help either!

A solution is coming soon?

As you've seen, the centralization and censorship-resistance issues are a huge risk for Ethereum and its future, but we shouldn't forget that we're talking about the second largest cryptocurrency on the market which has an enormous community of innovative great minds. This is why I believe a solution will eventually emerge as there are many working hard at it. For what it's worth, though, there seems to be a proposal by one of the ETH community to ensure the censorship-resistance nature of the network until the issue of centralization is addressed. The proposal is quite straightforward and that is considering any attempt to censor as an attack on the entire network and thus slash and burn its stake via social consensus. And as draconian as this might appear, it seems to have gotten the blessing of most of the Ethereum community including Vitalik Buterin himself.

Will this measure be applied soon? Hard to tell at the moment but it seems the only solution until more validators come in and share larger slices of the staking pool pie.

What do you guys think about the ETH 2.0 centralization censorship-resistance issues? I'm keen to read your opinions and thoughts...

hello @qsyal,

I personally believe that the most important thing about this coin is the utility of its smart contracts, that is to say that no matter if they reduce the decentralization in their network the utility of their blockchain will be the same, In the past many previous projects wanted to destroy this coin but so far no one has been able to, I also share your optimism regarding the future of this project.

The utility of smart contracts is a crucial factor for Ethereum but there are competitors offering the very same utility, and they can't be ignored such as Cardano, Avalaunce, and others. That's why I think the ETH community should find a solution for the centralization issue at some point in the future, and the sooner the better

Thanks for reading. Have a good day :)

So great to see you on Steemit again @trabajosdelsiglo :)

Yay more Crypto! So much more than money.

Upvoted👍 Reshared🔁

Thank you

This is really a nice post. You spoke a lot about the upcoming Ethereum changes and it impact already. As for me change is the only constant thing in life so it is a welcomed development. Without changes we won't be able to knows what lies ahead. I haven't study the impact yet but I believe things will be fine as rim progresses.

I'm inclined to agree with you. I believe that Vitalik and the ETH community will have many solutions to create and things to offer in the future

Thanks for reading :)

Hi @qsyal

ETH doesn't enjoy the best time on the market to go throught this transition into PoS. Not the best timing for sure.

And with time (since large institutions will be entering the market) we will witness only even higher level of centralization.

My own personal opinion on this topic: what had happened to Tornado Cash could mosly happen, because it's a small project with people who have no resources to defend themselfs.

ETH would have an army of lawers. And that is a game changer.

It's a different story to go after some small business owner / programmer - simply to make an example, which would bring some fear within the industry. And it's a different story to go for war with well established and quite resourceful business (like Eth).

Also Tornado Cash has been involved in laundry money process number of time (after all it is a funds mixer). Did you ever hear about ETH having similar issues? I didn't.

ps. if anything, I would rather be concerned about privacy coins like Monero.

Cheers, Piotr

Hi @crypto.piotr

This is so true. Even BTC is liable to become gradually centralized as time goes on...

Maybe you're right. But the fact that Eth is well established and is on its way to mass adoption might be an additional motive for regulators to crack on (as it becoming a threat in their eyes)

Thanks for the constant support :)

I would rather expect that examples will be made by authorities destroying small projects and by authorities going after those who cannot afford good lawers.

However, big players (like eth) will be forced to follow regulations. Very unlikely that ETH would get into any real trouble. Otherwise, just like in case of XRP -> it will just end up with long-lasting lawsuit case.

That's my view :)