股市热潮背后的冷思考:为何A股难以持续上涨?

昨天我发帖聊了聊股市,特别是A股市场的真正目的是什么。这样就可以建立一个基本的框架来分析是否应该入市,也就不会被一些鼓励大家入市的夸张言论所迷惑。

其实A股诞生这么多年,虽然次数很少,但也经历过几次牛市。每次牛市都是以暴跌收场,特别是2015年的那次牛市更是达到了史诗级别。记得那时在网上有一个非常形象的动图模拟当时的情景,有人在地上的一个区域内集中撒了大量的饲料,一群鸡在里面低头啄米,吃得不亦乐乎。突然头顶的鸡笼落下,将它们一网打尽。这个时候鸡意识到是陷阱,奋力地扑腾翅膀,想要逃出,但已经是插翅难飞了。

当然,俗语说,金鱼的记忆只有七秒钟,人类又何尝不是如此呢?每次类似的历史一再重演,但每一次人们都会自作聪明地认为这一次不一样。

网上看到一个短视频,一个年轻的小伙子煞有介事、头头是道地说道:"现在银行里躺着几百万亿的存款。以前作为货币蓄水池的房地产也已经停摆,那么股票市场就会肩负起这一历史使命,像之前的房地产市场一样无限暴涨。"然后越说越兴奋,说什么"一定会涨的,让那些还没上车的人追悔莫及,让这些银行的存款全部流入股市。那个时候一万点也不是梦,所以我现在借钱杀进去,直接就财富自由了。"

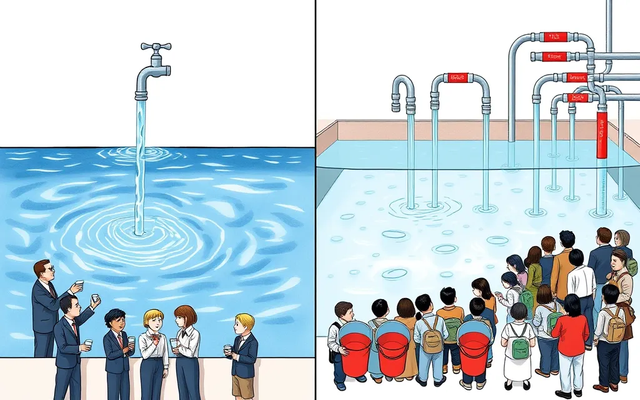

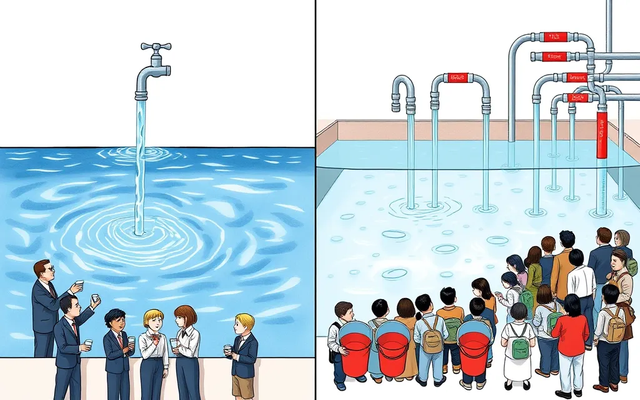

这个视频很可能只是蹭热点赚流量的,而未必真的这么做了。但这确实反映了很大一批新股民的真实想法。股市将成为房市之后新的货币蓄水池的说法,并非这一次才有。前几轮股市上升期都有类似的,甚至一模一样的观点在股民群体中流行。而且现实中也有现成的例子,那就是美国的股市确实是美元重要的蓄水池。从2008年金融危机,美联储实行货币宽松政策以来,美股大指数就一直在上涨。

结合昨天帖子中提到的中国股市真正的功能,就能理解为什么A股不会像美股那样成为货币的蓄水池了。因为A股的作用就是为经营困难的国企和财政困难的政府提供提款机。在A股发行股票的企业很大程度就是这些政府和监管部门有关系的企业,而不是经营良好的企业。这些股票也大都不分红,正常的定价方式无法使用,仅仅是博弈大小的赌场。所以很难有持续的赚钱效应。

另一方面,这其实是一件好事。美国的股市成为蓄水池持续上涨的这段时期,恰恰就是美国去工业化、经济完全金融化、空心化的时期。

而且这一次A股上涨的背景,恰恰就是房地产持续低迷,严重影响到地方政府的主要财源和财政收入。此前中央一度要求地方政府砸锅卖铁,缓解财政危机。所以这一次上涨,也是为了从股市里面圈钱,支持地方政府的财政。从这个角度来说,政府是不可能让股市在短时间内暴涨的。因为暴涨必暴跌,地方政府的融资还没开始就会结束了。

昨天的盘面来看,情形并不乐观。开盘之后指数几乎涨停,然后就一路下行。虽然最后收盘相比节前仍然上涨了4个百分点,但对于节后贸然杀入股市的新股民来说,可以说是全军覆没,全部以亏损告终。

从这个情形来看,今天的走势将非常危险。我们看到昨天晚上央行又宣布了降准降息的利好来托底指数,但是政府总不可能不断抛出利好吧,这样牌很快就打完了。而一个靠利好政策不断刺激的股市又能持续多久呢?也许接下来很大的概率指数就是维持在3000点上下。而这也许是最好的情况了。既没有赚钱效应,新入场的股民的情绪也会很快消退,市场又会陷入之前的一潭死水当中。这也许就算是最不坏的结局吧。

Yesterday I posted to talk about the real purpose of the stock market, especially the A-share market. In this way, we can establish a basic framework for analyzing whether we should enter the market, and we will not be confused by some exaggerated statements encouraging people to enter the market.

In fact, A shares were born for so many years, although the number of times is very small, but also experienced several bull markets. Every bull market ends in a slump, and the one in 2015 in particular reached epic proportions. I remember at that time there was a very graphic GIF on the Internet to simulate the scene at that time, someone concentrated in an area on the ground scattered a large amount of feed, a group of chickens in the lower head pecking rice, eating happily. All of a sudden, the chicken coop falls overhead, killing them all. At this time, the chicken realized that it was a trap, and struggled to flap its wings, trying to escape, but it was impossible to fly.

Of course, as the saying goes, goldfish have a memory of only seven seconds, so what about humans? Each time this kind of history repeats itself, but each time people smartly assume that this time is different.

In a short video on the Internet, a young man said in a serious way: "There are millions of billions of deposits lying in the bank now. Real estate, which used to be a reservoir of money, has also stopped, so the stock market will take up this historic mission, just like the real estate market before it." And then the more and more excited, saying something like, "It will definitely rise, so that those who have not yet boarded the car regret it, so that all the deposits in these banks go into the stock market." At that time, 10,000 points is not a dream, so I now borrow money to kill in, directly wealth freedom."

This video is likely to be just a hot spot to earn traffic, not necessarily done. But it does reflect the real thinking of a large group of new investors. The idea that stocks will become the new reservoir of money after housing is not unique. Similar, if not identical, views have prevailed among the stock market community during previous stock market rallies. And there is a ready-made example that the US stock market is indeed an important reservoir for the dollar. Since the financial crisis in 2008, the Federal Reserve has implemented monetary easing policy, the US stock market index has been rising.

Combined with the real function of the Chinese stock market mentioned in yesterday's post, it is understandable why A-shares will not become A reservoir of currency like US stocks. That is because the role of A shares is to provide cash machines for struggling state-owned enterprises and financially struggling governments. Companies that issue shares in A shares are largely those with connections to the government and regulators, rather than well-run companies. Most of these stocks also do not pay dividends, the normal pricing method can not be used, only the size of the game casino. So it's hard to have a sustained moneymaking effect.

On the other hand, it's actually a good thing. The period when the stock market of the United States has become a reservoir of continuous rise is precisely the period of deindustrialization, complete financialization and hollowing out of the United States economy.

And this time, the background of the A-share rise is precisely the continuous downturn in real estate, which has seriously affected the main financial resources and fiscal revenue of local governments. Beijing had previously ordered local governments to break the pot and sell iron to ease the financial crisis. Therefore, this time, the rise is also to collect money from the stock market and support the finance of local governments. From this point of view, it is impossible for the government to let the stock market soar in a short time. Because booms must fall, local government financing will end before it even begins.

Yesterday's plate, the situation is not optimistic. After the opening bell, the index almost rose by the daily limit, and then went down. Although the final closing was still up 4 percentage points compared to before the holiday, it can be said that the new investors who rushed into the stock market after the holiday were completely wiped out and all ended in losses.

From this perspective, today's moves will be very dangerous. We saw last night that the central bank announced the good news of lowering the reserve ratio and interest rate to support the index, but the government can not keep throwing good, so the card will soon be finished. And how long can a stock market that is constantly stimulated by favorable policies last? Maybe the next big probability index is to stay around 3,000. And that's probably for the best. There is no money-making effect, the mood of new investors will soon fade, and the market will fall back into the previous backwater. That might be the least bad outcome.

Upvoted! Thank you for supporting witness @jswit.

有点道理