Wondering how WOX DAO works? And if you still have old WOX tokens, I'll explain it here

The development has gone fast and we have already changed the PreSale token to the live WOX token and ask everyone to switch to the new live WOX token

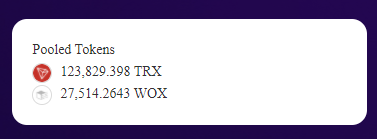

Remove old WOX and TRX if you have tokens left here

https://sunswap.com/?lang=en-US#/scanv2/detail/TQP5L7UfAjAbc6zL9VgncbeATLmcEgNCaK

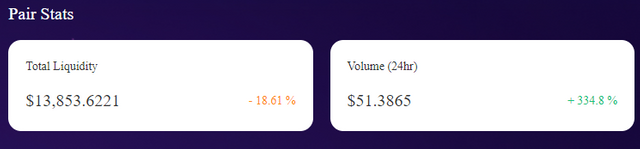

There is still a little left in the old pool:

Pooled Tokens 125.4385 WOX 783.9215 TRX

New links to swap TRX for new wox token on SunSwap

https://sunswap.com/?lang=en-US#/scanv2/detail/TUXJrfBdJPuAJbKJV3e7d3JeyeejedPxvM

Today's price

visit our discord channel

https://discord.gg/zh5PR9GZ

*We are very very near to launch the WOX DAO PROTOCOL onTRON network and would like to share some insights on what exactly is this . Please read the post till end

What is WOX DAO?

WOX DAO is the first decentralized reserve currency protocol available on the TRON Network based on the WOX token. Each WOX token is backed by a basket of assets (e.g., TRX, TRX-WOX LP Tokens etc etc) in the WOX treasury, giving it an intrinsic value that it cannot fall below. WOX also introduces economic and game-theoretic dynamics into the market through staking and minting.

What is the point of WOX DAO?

Our goal is to build a policy-controlled currency system, native on the TRON network, in which the behavior of the WOX token! In the long term, we believe this system can be used to optimize for stability and consistency so that WOX can function as a global unit-of-account and medium-of-exchange currency. In the short term, we intend to optimize the system for growth and wealth creation.

We intend to achieve price flatness for a representative basket of goods without the use of fiat currency, in order to allow the cryptocurrency industry to detach once and for all from the traditional finance world!

How do I participate in WOX DAO?

There are two main strategies for market participants: staking and minting. Stakers stake their WOX tokens in return for more WOX tokens, while minters provide LP tokens or TRX tokens in exchange for discounted WOX tokens after a fixed vesting period.

How can I benefit from WOX DAO?

The main benefit for stakers comes from supply growth. The protocol mints new WOX tokens from the treasury, the majority of which are distributed to the stakers. Thus, the gain for stakers will come from their auto-compounding balances, though price exposure remains an important consideration. That is, if the increase in token balance outpaces the potential drop in price (due to inflation), stakers would make a profit.

The main benefit for minters comes from price consistency. Minters commit a capital upfront and are promised a fixed return at a set point in time; that return is given in WOX tokens and thus the minter's profit would depend on WOX price when the minted WOX matures. Taking this into consideration, minters benefit from a rising or static price for the WOX token!

Who created WOX DAO?

WOX DAO is a fork of Olympus on the TRON Network. Our team is mostly anonymous, born from the DeFi Community. We aim at becoming a Decentralized Autonomous Organization, and we are actively working towards that goal.

Who runs WOX DAO?

Currently most of the decisions are taken by the core team, but we expect to be able to turn this into a DAO-governed model as soon as possible!

Why do we need WOX DAO in the first place?

Dollar-pegged stablecoins have become an essential part of crypto due to their lack of volatility as compared to tokens such as Bitcoin and Ether. Users are comfortable with transacting using stablecoins knowing that they hold the same amount of purchasing power today vs. tomorrow. But this is a fallacy. The dollar is controlled by the US government and the Federal Reserve. This means a depreciation of dollar also means a depreciation of these stablecoins.

WOX DAO aims to solve this by creating a non-pegged stablecoin called WOX. By focusing on supply growth rather than price appreciation, Wolrd Of Xchange hopes that WOX can function as a currency that is able to hold its purchasing power regardless of market volatility.

Is WOX a stablecoin?

No, WOX is not a stablecoin. Rather, WOX aspires to become an algorithmic reserve currency backed by other decentralized assets. Similar to the idea of the gold standard, WOX provides free-floating value its users can always fall back on, simply because of the fractional treasury reserves WOX draws its intrinsic value from.

WOX is backed, not pegged.

Each WOX is backed by 1 TRX, not pegged to it. Because the treasury backs every WOX with at least 1 TRX, the protocol would buy back and burn WOX when it trades below 1 TRX. This has the effect of pushing WOX price back up to 1 TRX. WOX could always trade above 1 TRX because there is no upper limit imposed by the protocol. Think pegged == 1, while backed >= 1.

You might say that the WOX floor price or intrinsic value is 1 TRX. We believe that the actual price will always be 1 TRX + premium, but in the end that is up to the market to decide.

How does it work?

At a high level, World Of Xchange consists of its protocol managed treasury, protocol owned liquidity, bond mechanism (minting), and high staking rewards that are designed to control supply expansion.

Bonding in the "Mint" page generates profit for the protocol, and the treasury uses the profit to mint WOX and distribute them to stakers. With LP bond, the protocol is able to accumulate liquidity to ensure the system stability.

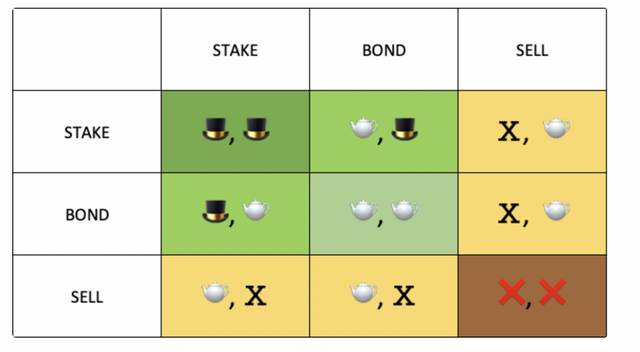

What is the deal with (🎩, 🎩) and (🫖, 🫖)?

(🎩, 🎩) is the idea that, if everyone cooperated in WOX, it would generate the greatest gain for everyone (from a game theory standpoint). Currently, there are three actions a user can take:

Staking

Minting (Bonding)

Selling

Staking and minting are considered beneficiary to the protocol, while selling is considered detrimental. Staking and selling will also cause a price move, while bonding (minting) does not (we consider buying WOX from the market as a prerequisite of staking, thus causing a price move). If both actions are beneficiary, the actor who moves price also gets half of the benefit (+🫖). If both actions are contradictory, the bad actor who moves price gets half of the benefit (+🫖), while the good actor who moves price gets half of the downside (Ⅹ). If both actions are detrimental, which implies both actors are selling, they both get the worst possible outcome (❌)!

hus, given two actors, all scenarios of what they could do and the effect on the protocol are shown here:

If we both stake (🎩, 🎩), it is the best thing for both of us and the protocol (both users gets the The Mad Hatter's hat).

If one of us stakes and the other one bonds, it is also great because staking takes WOX off the market and put it into the protocol, while bonding provides liquidity and TRX for the treasury!

When one of us sells, it diminishes effort of the other one who stakes or bonds.

When we both sell, it creates the worst outcome for both of us and the protocol (❌, ❌)

Why is PCV important?

As the protocol controls the funds in its treasury, WOX can only be minted or burned by the protocol. This also guarantees that the protocol can always back 1 WOX with 1 TRX. You can easily define the risk of your investment because you can be confident that the protocol will indefinitely buy WOX below 1 TRX with the treasury assets until no one is left to sell. You can't trust the FED but you can trust the code.

As the protocol accumulates more PCV, more runway is guaranteed for the stakers. This means the stakers can be confident that the current staking APY can be sustained for a longer term because more funds are available in the treasury.

What is a rebase?

Rebase is a mechanism by which your staked WOX balance increases automatically. When new WOX are minted by the protocol, a large portion of it goes to the stakers. Because stakers only see staked WOX balance instead of WOX the protocol utilizes the rebase mechanism to increase the staked WOX balance so that 1 staked WOX (sWOX) is always redeemable for 1 WOX.

What is reward yield?

Reward yield is the percentage by which your staked WOX balance increases on the next epoch. It is also known as rebase rate.

Can we help mint WOX PRIOR the Protocol Deploys?

Yes , since we need a tons of trx to grow the treasury strenth anyone can manually mint WOX TOKENS BY Depositing TRX to Contract OWNER Address and enjoy a 40% discount then what its been trading in sunswap right now and instanty start staking when the protool deploys .Our Mod The 100in discord can guide you through it .

NOTE : WOX DAO IS A FORK OF WONDERLAND SO IS THIS DOCUMENT

WOX TOKENS CAN BE PURCHASED NOW PRIOR LAUNCH ON SUNSWAP following the link

Dear @xpilar

Thank for your this informative publication. I've resteemed it already.

I'm trying very hard to understand that sentence and I'm still failing. Especially that part that its "value that it cannot fall below".

From my observation, most people who invest into new tokens are wondering on "where demand will be coming from"?

After all, high offered APY = high supply and high inflation. High APY means, that those who invest early will mind tons of WOX tokens and usually large part is being DUMPED on the market.

With time there it's becoming very challenging to bringm more investors, which would create demand stronger than could balance out all those dumped tokens. And either some utility or buy-back is usually a MUST.

I know, that I must sound like a broken record. But I've been already asked by few PH members about WOX token economics. Most of us would like to know if there are any buy-back being planned in the future? If part of trading fees will be used to buy-back and burn WOX tokens?

This is surely very important detail. At least it will give some more faith and trust towards WOX token holding some minimum price on the market.

Yours, Piotr

hello , i hope things are much clear now with the 3,3 concept . The backing value stated as 1 trx is a volatile value as well , but it will only increase overtime . DM us if you need more info