What Is the Least Expensive Way To Buy Life Insurance? (A Deeper Dive Into Life Insurance that Wall Street and the Mainstream Media Won't Tell You About)

There are a many options for purchasing life insurance and because each person's situation is different, I'm writing this blog article to help you better understand the different options and what will work best for your situation.

In doing so I'm going to take a much deeper dive into life insurance than you'll find in mainstream articles in the likes of the Huffington Post, Marketwatch, and other traditional Wall Street based financial outlets. Mainstream financial information is quite good at dumbing down life insurance so much that the overall lack of depth most articles have do an excellent job in getting people to thinking life insurance is a bad thing and something to have only as a last resort.

First, you have to understand, Wall Street biased media have an objective to sell you on managed money assets. That's their ticket to drive revenue. To pigeon hole life insurance as only for a select group of people (for example: young, married, has kids) or only for a death benefit need for specified time period only (example: to cover a mortgage or loss of income during working years) lowers the competition for your discretionary dollar you aim to save for the future.

And the future is what it's all about. You either control your wealth or you are helping Wall Street and traditional banks maintain the status quo. Americans are conditioned to think there have limited choices (401k/IRAs, mutual funds, bank loans, term insurance only are the typical American know) but this simply is not true when you pull back the curtain.

To be fair, life insurance companies share some of the blame. The industry gets a black eye because most agents never really understand what they are selling. They are given a limited product line with mediocre training and a mandate to sell to their immediate network of family and friends. Rinse and repeat.

If the training is bleak for licensed agents, you can imagine how hopelessly inadequate the training on life insurance is for asset based advisors who don't even want you to buy life insurance. It's almost like the blind leading the blind. No wonder the average American makes such poor decisions about life insurance. We as consumers don't know any better making it extremely challenging to know the best options are available.

In order to answer the main question of this article appropriately, I'm going to help you look at the difference between term insurance (which covers only a period of time like 10, 20, or 30 years years) and permanent insurance (Whole Life and the different variations of Universal Life policies).

First, Let's cover the basics.

Term vs. Permanent

To really understand the difference between Term and Permanent life insurance, you must first understand the difference between a liability and an asset.

I'll explain it the way Robert Kiyosaki does in his best selling book on finance "Rich Dad Poor Dad" where he writes that understanding the difference between liabilities and assets is the single most important financial concept to learn because doing just this one thing will help you build wealth alone.

In the book Robert writes that his Rich Dad taught him how the rich were buying assets (things that maintain it's value or increase in value) while the poor and middles class spent their money on liabilities. Rich Dad taught Robert that liabilities are things where you put your money in and your money goes down in value, and many times disappears all together, like a car or a boat.

An easy way to explain it is owning vs renting your home.

Now owning your home might cost a little more on a monthly basis, however, down the road you have an asset which goes up in value. Renting a home might be a little less per month, but when you’re done, you’re left with nothing, zero to show for it.

The life insurance most people buy requires that they pay, pay, and pay and at the end of the Term, there's nothing left making it a liability. So while Term insurance might seem like the least expensive life insurance policy to buy, it's actually the most expensive life insurance you'll ever buy because 99% of all term policies expire worthless. Quite simply, you outlive the term policy and you are left with nothing to show for all the premiums paid into it.

From a cashflow perspective, it's like driving down the freeway with your windows open and letting your cash fly out the window each year. Well, just remember, the wealthy don't buy liabilities when presented with an option to acquire an asset. All things being equal, how would you rather buy your life insurance, like the rich or the poor and middle class? Make sense? It's pretty simple, right?

As Infinite Banking authorized advisor, I recommend looking into the value of Permanent life insurance. Specificially, I recommend a dividend paying Whole Life policy structured for maximum cash value upfront which is the complete opposite in its design than the traditional whole life policies that most Americans, financial advisors, and financial entertainers like Dave Ramsey and Suze Orman even know about. I'll go into more detail about this unique type of Permanent life insurance policy in a just moment.

Different Types of Permanent Life Insurance

First though, I need to quickly explain that Permanent life insurance has two basic types: Whole Life and Universal.

Now the important thing to remember about all Universal policies is that they are all designed and built on the same foundation which is an increasing annual renewable term policy. This is true for the 4 different types of Universal policies: traditional Universal Life(UL), Guaranteed Universal Life (GUL), Variable Universal Life (VUL), and Indexed Universal Life (IUL).

Remember how you just learned buying term insurance is a liability? Let me ask you another question. Would it be appealing to you to have an increasing liability accumulating every year in your permanent policy? Well, the majority of time people have exactly this scenario and don't even realize it!

Consider it this way. If you were buying a house, you wouldn't want cracks in the foundation of your home, right? Of course, the advisors selling Universal policies won't ever talk about this risk increasing annual premiums but the cracks in the foundation of universal policies are there whether you've been told or not. Just read the contract if you own one. (Side note: It's really important to review what type of policy you have. Most people I meet for the first time think they have a Whole Life policy when in fact they were sold a Universal policy.)

With only one exception, which I'll get to in a second, universal policies are guaranteed to lapse when the cost of insurance eats into the cash value you've accumulated to the point where you must provide additional premium or lose the policy. (Liability alert!)

Meaning as you get older, the internal cost of insurance must go up in all Universal life policies. Because of this increasing cost of insurance, renting a term policy gets incredibly prohibitive to keep during retirement years. This is why most seniors discontinue to "rent" term, or even worse lapse their Universal policies after decades of paying premium into a policy they thought they would have for life.

In short, purchasing a Universal policy is like buying a liability just when you thought you were doing the smart thing and buying an asset. This is truly sad because the financial missteps most people make have real implications beyond their own lives. After 20 years in the financial industry, I've seen the financial damage that occurs in real terms when families are left without the financial resources they were meant to have when a loved passes away. It's painful for all involved.

There is one exception to the rule when it comes to fixed premiums on Universal life policies however. A Guaranteed Universal Life (GUL) policy has a no-lapse guarantee if you pay premiums to a specified contract age at a levelized premium.

Since the three other Universal life policies (Variable, Indexed, and orginal Universal) don't offer the guarantees that a GUL offer I'm not going to delve into any other type of universal policies in this article. If you are wanting to learn more about the dangers of universal life policies, you can read my blog post from here (http://bit.ly/IUL_Flaws) which I wrote in 2012. The inherent flaws in univeral life policies have not changed.

Good, Better, Best

There's a saying and I don't know who said it first but it goes like this: "Good, better, best. Never let money rest until good gets better and better becomes best." It applies here if your objective is buying the least expensive type of life insurance.

Option one which is a good option, you could buy a Guaranteed Univeral Life or GUL. It’s essentially a term policy guaranteed to age 85, 90, 100, or 121 depending on the contract you choose and remains in force with a fixed level premium as long you continue to pay the premiums without fail. Like a term policy, A GUL contract has a death benefit face amount that stays the same for life so you'll want to buy enough death benefit now to ensure it will have any meaningful value decades from now when the death benefit is paid out. If you buy a GUL, please remember to use the secondary addressee notification which mails an alert (most likely to your beneficiairy) that the GUL policy will lapse if a premium payment is not received in time.

Option two which is a better option depending on your situation, you can purchase a Whole Life policy. Whole Life has been around for over 150 years. That means it's been around since before the Great Depression, before the IRS was created in 1913, and even before the War of Northern Aggression (schools call it the Civil War but I digress...history is written by the victors after all). How is this possible that Whole Life policies have worked without fail for so long? Quite simply because it works! Now keep in mind if you buy a traditional Whole Life policy, it will not come with same premium payment flexbility nor will it accumulate cash values and death benefit as quickly as the preferred way to buy a Whole Life policy.

Infinite Banking Concept

Finally, the third option and the best option for most Americans introduces the Infinite Banking Concept to Whole Life insurance. Purchasing an Infinite Banking designed Whole Life policy (also simply called IBC which is short for the Infinite Banking Concept)is the least expensive way to buy permanent cash value policies. The reasons why are:

The policy base premium is guaranteed level for the life of the contract (the cost of insurance will not eat into your cash values at later age like with Universal policies.) In fact, because your premium is guaranteed to never increase, this guarantees the cash values will reach a breakeven point whereby all the paid in is now available to withdraw or borrow. What's the true cost when an asset has more value than what was paid? Buying life insurance as an asset the way Rich do makes a lot more sense when life insurance options are presented and taught properly. I really can't emphasize this point enough.

With an IBC designed Whole Life policy, there is a PUA (Paid-Up Additons) rider. A PUA rider turbocharges the internal growth of cash values by increasing cash values while simultaneously adding to the death benefit. Think of it like a block of LEGO. Each dollar contributed into the PUA rider buys additional blocks of death benefit that require no further premium payments to support it

making an Infinite Banking Whole Life policy the least expensive way to own and control life insurance.

With each dollar contributed to the PUA rider, you are simply stacking blocks of permanent death benefit at no future cost. PUA contributions (also referred to as overfunding) acts as way to super charged a savings account and as an added benefit, this newly created cash value grows each year without you having to pay taxes on the growth like you would at the bank. (For a deeper dive into Infinite Banking, I encourage you to visit http://www.CashValueBanking.com and watch the videos there to learn all about how you bypass Wall Street and banks and build wealth safely.)

A properly designed Infinite Banking Whole Life policy will have the majority of premium dollars going to the PUA rider. This is the way I structure all Infinite Banking policies for myself and for my clients. It is an absolute must that in order to be a properly designed Infinite Banking policy, the policy must include this very special PUA rider. Only an IBC policy is capable of being super flexible and front loaded with cash value on a tax-favored basis. Without the rider, buyers of Whole Life policies will still get the guarantees that have been around for over 150+ years, but why get the Honda when you can get the Rolls Royce?

It's important to note that the life insurance company software used to create policies allow the advisor to pay themselves more by increasing the amount of permanent death benefit and lowering the contribution levels to the PUA rider when designing a policy.

Some advisors will do this because they are more concerned about their paycheck then creating cash value for you. I think I’m one of the few advisors that actually explain not only how we get paid (yes, a commission is earned) but I actually show you exactly how much I get paid per policy. I'm like a broken record in this regard because I tell my future clients: "Here's what's in it for you and here's what's in it for me." If full disclosure doesn't build trust, I'm not sure what will and I'm probably in the wrong business...

When my clients understand how an IBC designed policy is properly structured and, furthermore, how much I'm being compensated for my services, I've found this information cuts through through every doubt. When my clients know with certainty what's in it for them and what's in it for me, our objectives are uniformly aligned making the process to get started with IBC simple and easy.

My professional mission is very straightforward. If you are looking for a logical way to buy the least expensive life insurance while creating the most economic benefit, then I'm going to recommend an Infinite Banking designed whole life policy that works best for your lifestyle. By incorporating the strategy into your household finances, I'm going to help simplify your financial life and ease financial worries.

I've seen people choose to implement IBC for many reasons. Some want out of the market and an alternative to 401k's. Business owners want access to cash and financing on their terms. Some want to reduce taxes. Others like the legacy they are guaranteed to leave their family. And some want to leverage the banking aspect to finance car, boats, college, or even their next big investment without opportunity cost.

But if IBC isn't right for you, I'm not opposed to telling you that either because in truth, it's not one size fits all. If you like managed money, taking risk, and a year or two from retirement with all assets locked with your current employer, it may not be a fit. I'll tell you straight though. It's that simple.

If you're still with me, I'm going to add one more thought.

Despite everything I've shared in this article, some people will still believe that universal life insurance (remember it can be any type of universal) is cheaper because their quoted premiums to start may be lower but it’s a fallacy if you lift up hood and look at the engine.

Keep in mind most life insurance companies offer both permanent life products and we are guaranteed only 2 things in life: death and taxes... Since everyone is guaranteed to die at some point, the risk for a life insurance company to pay a death benefit claim is the same no matter which policy is sold. Follow the logic here. The cost of dying is the same regardless if you die with a term, universal, or whole life policy.

How Life Insurance Companies Price Products is the Key Difference

Like buying a mortgage, you can fixed the payments for life or you can choose an adjustable rate mortgage. There is no right or wrong answer. It just depends on what you are aiming to achieve. Same thing with all life insurance policies. (I also own and recommend term policies because each product can and does serve a purpose.)

From a risk standpoint when pricing a Universal life insurance product, insurance companies simply offset (read: postpone) the true cost of a Universal policy by backloading the majority of the cost of insurance to when people are older.

Make no mistake, the true financial burden for postponing the cost of life insurance (just like postponing taxes in a 401k/IRA...) will eventually arrive and it will arrive at a most unfortunate time in life just when retirees think expenses are supposed to be going down. Which is to say, the insurance costs in a Universal policy really begin to rise when retirees are possibly no longer insurable and/or the cost to insure is now prohibitive. The impact can leave people in a very difficult financial predicament who were relying on their policies to help supplement their retirement income or pass on a legacy.

The Reason Why Life Settlements Exist

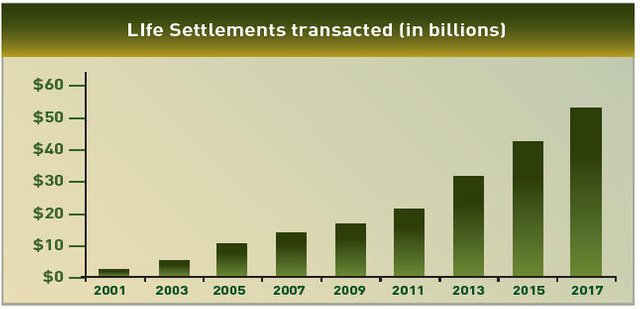

There’s a major reason the Life Settlements industry exists. People bought universal life insurance, got older, and can no longer afford the increasing premiums each year. This puts seniors in the undesirable postion of needing to cash out or sell (remember life insurance is asset-- you can sell it!) before there’s no cash left in the policy.

The Life Settlement industry only came into existence with the creation of the universal life policies which happened in the early 80’s. and I think it's interesting to note 90% of life settlements are universal with the remainder term because so many people have purchased all the different types of Universal policies likely because they thought they were getting a better "deal" over Whole Life, the market for Life Settlements has exploded.

Whole Life policies aren't very attractive to investors to speculate on because the premiums are fixed for life and there's also an option called Reduced Paid Up (RPU) that only exist with Whole Life policies. I'll write more about the RPU option in a future blog post and link it here so stay tuned for that, or in the meanwhile you can ask me about it by requesting an appointment in my calendar to discuss Infinite Banking by click here: http://www.vcita.com/v/john.montoya.

I truly appreciate you for taking the time to better understand your options. If only more people only were better financially educated. If you found this information valuable, it'd be an honor if you could please resteem, upvote, and share on other social media platforms like Facebook and Twitter.

Thank you,

John A. Montoya

JLM Wealth Strategies, Inc.

(925) 386-6639 Office

Infinite Banking® Authorized Practitioner

Bank On Yourself® Authorized Advisor

CA Life#0C42222

http://www.jlmwealthstrategies.com