Neluns - The Modern Financial Ecosystem

Neluns is the modern financial ecosystem, bringing together a bank that will operate both with fiat and crypto. Also, it will include itself a cryptocurrency exchange and insurance company, making the best conditions for the quality evolution of the cryptocurrency market.

To solve current problems like limiting cryptocurrency in daily use, the possibilites of market participants, it is need for an innovative and wide solution. Neluns goal is to combine the cryptocurrency market with the financial one. Also, Neluns is going to brake down all barriers and to solve some of big problems which are present now and prevent the interaction of human with cryptocurrency world. Neluns is coming with a solution of current problems, bringing innovative idea and technologies.

Neluns Bank

The first element of the ecosystem is the Neluns Bank. Which is a licensed commercial bank, officially registered in accordance with all regulatory requirements.

The Neluns Bank presents a broad spectrum of services for physical and legal entities. While all operations are available in fiat and in cryptocurrencies.

During the first stage, Neluns Bank will carry out activities combining classical banking and banking on the Blockchain. In the future, Neluns Bank, together with its partners, will transition to its own Blockchain for international settlement purposes. The utilization of leading technologies allows us to create financial products, access to which will be available around the clock from any part of the world.

Neluns Exchange

The Neluns Exchange strive to become a global cryptocurrency exchange and establish itself as the foundation for a new and complex banking architecture, which does not suffer from the shortcomings of the existing system. We are creating an innovative solution, eliminating the drawbacks of existing cryptocurrency exchanges.

Neluns Insurance

A separate element of the Neluns financial ecosystem, is the insurance company - Neluns Insurance. On demand of the bank and cryptocurrency exchange users, it will carry out insurance coverage for financial risks, tied to trades and transactions.

Ecosystem users will have access to full and partial risk insurance.

• Full insurance. Provides insurance coverage in full when an insured event occurs.

• Partial insurance. Limits insurance coverage as certain insurance amounts, as well as the system of specific insured event occurrence conditions.

The base insurance premium amount with full coverage comprises 10% from the total trade/transaction sum. It can change depending on a row of criteria. The cost of partial coverage is determined individually for each specific case.

After the insurance payment is paid, the claim right of the defaulting party is transferred from the insured to the insurer.

Clients will have access to the following insurance services:

• Risk insurance for defaulting counterparties when executing transactions. • Insurance in case of unforeseen circumstances during transactions.

As the ecosystem develops, the set of insurance products will be expanded. The following services will be added to the basic services:

• Insurance of credit and deposit risks.

• Insurance of investment risks.

• Insurance of financial guarantees.

ROADMAP

Issuance of bank cards

After receiving a bank license and connecting to SWIFT, we will connect Neluns Bank to a variety of payment systems (Visa, MasterCard, American Express, and others).

As an issuing bank, Neluns will perform the following functions:

• Issuance of bank cards to clients.

• Authorization of payments at the request of retail outlets.

• Payment of merchant accounts by writing off corresponding amounts from the client accounts.

• Issuing cash money in any partnering ATM’s of Visa, MasterCard, American Express, worldwide.

• Security (blocking of accounts in the case of lost cards, etc.)

Holders of cards issued by Neluns Bank, will be able to pay for purchases. At the same time, payments in both fiat and cryptocurrencies are allowed. In case of payments being made in cryptocurrencies, they will be converted into fiat based on current Neluns Exchange market rates.

To make it easy, card issued by Neluns Bank use Contactless payment systems (MasterCard Contactless, Visa paywave, Apple Pay, Samsung Pay, Google Pay), modern, innovative technologies consistent with EMV (Europay+Mastercard+Visa) in accordance with the ISO/IEC 14443 standard.

Aside from this, Neluns Bank users will be able to deposit fiat in any ATM, anywhere in the world, onto their bank accounts.

In the future, we plan to develop our own POS-terminals. They will be installed in sales outlets of bank clients. Thus, Neluns will combine the functions of an issuer and acquirer in the future.

We have developed software products with 4 types of bank cards:

Lite – bank card released for first level verified users (email address). Users can participate in trades on the Neluns Exchange (with 1:5 margin trading). Trade sums cannot exceed $300.

Silver – bank card released for second level verified users (verification through social networks and mobile number). Users can participate in trades on the Neluns Exchange (with 1:10 margin trading) and the P2P lending platform. Trade sums cannot exceed $500.

Gold – bank card released for third level verified users (verification through identity verification and mobile number). Users gain access to all Neluns Bank services, Neluns Exchange (with 1:20 margin trading), Neluns Insurance. Restrictions on trade amounts are absent.

Platinum – bank card released for third level verified users (verification through identity verification and mobile number), who have deposited no less than $5000 in the Neluns Bank. Users gain access to all Neluns Bank services, Neluns Exchange (with 1:20 margin trading), Neluns Insurance. Restrictions on trade amounts are absent.

NLS Token

The NLS token is created in accordance with the ERC-20 standard.

The NLS token is a security token.

The NLS token will provide holders with dividends in the amount of 50% of the profits of the Neluns ecosystem (Neluns Bank, Neluns Exchange, Neluns Insurance). Dividends will be distributed each quarter in proportion to the number of tokens held comparative to the total number of tokens in circulation.

Aside from this, NLS token holders will have an access to bonuses and privileges when using products of the Neluns ecosystem. The more NLS tokens a holder has, the more privileges he will receive.

NLS tokens can be acquired throughout the Pre-Sale, Pre-ICO, and ICO. The acquisition of NLS tokens in the secondary market will be possible immediately after listing on cryptocurrency exchanges.

Unsold tokens will be frozen after the ICO. Each year, 3% of the tokens will be burned.

NLS token emission

During the ICO, 200 000 000 NLS tokens will be released

Base price of 1 NLS token = 1 USD

NLS token distributions

80% tokens will be sold during the ICO

12% tokens will remain with the platform development team

5% tokens will be directed towards the Bounty campaign

3% tokens will be retained by project advisors

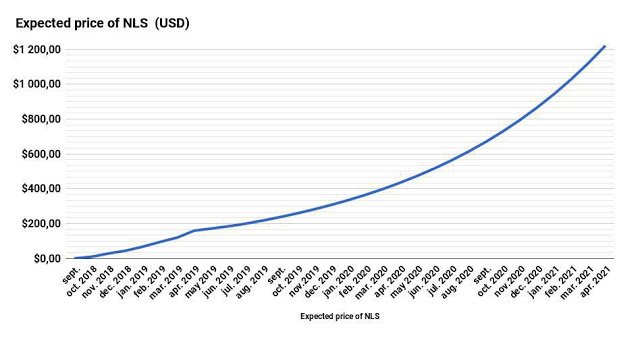

Expected price of NLS

The economic modeling of business process allows us to forecast the NLS token price growth over a short, medium, and long-term perspective.

Neluns ICO

Stages (rounds) ICO

Pre-Sale

Hard Cap - $2.000.000

Soft Cap - $500.000

1 stage (round), pre-sale, stage (round) length 14 days,

from 08-01-2018 to 08-15-2018.

Pre-ICO

Hard Cap - $10.000.000

Soft Cap - $2.000.000

2 stage (round), pre-ICO, stage (round) length 21 days,

from 08-15-2018 to 09-05-2018.

ICO

Hard Cap - $112.000.000

Soft Cap - $10.000.000

3 stage (round), ICO, stage (round) length 31 days,

from 09-05-2018 to 10-05-2018.

Whitepaper : https://neluns.io/static/ver165/whitepaper/whitepaper.pdf

Facebook : https://www.facebook.com/The-Neluns-2038488129802279/

Telegram : https://t.me/TheNelunsChat

Twitter : https://twitter.com/TheNeluns

Channel Youtube : https://www.youtube.com/channel/UCap59w27OBC_Cn9nsQxthTA

Medium : https://medium.com/@iconeluns

PROFIL BITCOINTALK : https://bitcointalk.org/index.php?action=profile;u=2275669;sa=summary