ICO Analysis: Omega One

December 31, 2017

With cryptocurrency markets still in their infancy, exchanges are suffering from structural issues such as: lack of liquidity, lack of security and lack of transparency. In general, these structural issues inhibit large, sophisticated investors (institutional money) from participating on these exchanges. With this in mind, Omega One is developing a trade execution platform that can fix these issues and provide greater liquidity to market participants, than what is currently available.

Token

The Omega One token (OMT) will initially be implemented using the Ethereum ERC20, with plans to be available for tokens across all blockchains. OMT holders generate value from the token through membership access and the payment of trading fees. For OMT holders, a high balance of tokens leads to preferential liquidity treatment and discounted trading fees.

Since the company’s ICO date has yet to-be-determined (TBD), the white paper doesn’t list any formal allocation guidelines for the use of funds. Rather, the company lists four “potential” allocation guidelines for the use of funds:

1 – Platform Balance Sheet

The majority of funds raised will go towards building the balance sheet. According to the white paper, the company’s “ability to handle trading volume is proportional to the size of (the) balance sheet.” Basically, the larger the balance sheet, the more trades the company can settle on both public and private exchanges.

2 – Operational Expenses

The white paper listed typical operational expenses, such as: office space, equipment, employee salaries and benefits, and security measures for funds.

3 – Legal Expenses

In addition to standard lawyer fees, expenses will also cover licensing fees (both country and state level) in effort to adhere to any and all regulatory requirements.

4 – Foundation

A portion of the funds raised will go towards a charitable and impact investing foundation. Further details are expected to be released closer to the ICO date.

Recently. speculative reports have been released saying that Omega One will be looking to raise $950 million for the ICO. This amount has yet to be confirmed by the company, but is a reasonable expectation based on balance sheet needs.

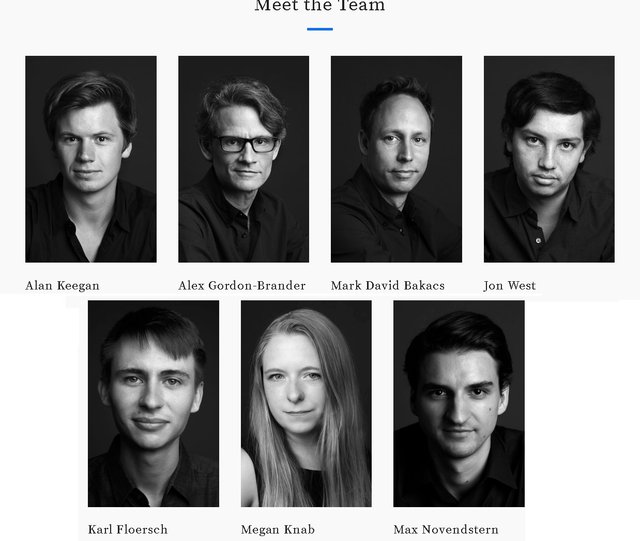

Team

Omega One’s core team consists of credible professionals with deep domain expertise in currency trading.

The company’s CEO, Alex Keegan, was previously an investment associate at Bridgewater (the world’s largest hedge fund run by the legendary Ray Dalio). The company’s CTO, Alex Gordon-Brander, is also the Chief Business Architect at Consensys and was previously a designer/engineer of trading platforms and APIs for various firms (including: Bridgewater & MarketAxess). The company’s Chief Strategy Officer, Mark David Bakacs, is also the founder of venture one (a blockchain venture fund) and ideapod.com (a collaborative network), and was previously a financial derivatives attorney. The Chief Trading Officer, Jon West, was previously a currency trader and crypto- portfolio manager for an unidentified UHNW family office.

The rest of Omega One’s team consists of a smart contract engineer, an operations lead, and a finance lead.

Omega’s One’s advisory board consists of nine senior professionals, including heavyweights such as Joseph Lubin (Ethereum co-founder & ConsenSys founder) and Jose Marques (Head of Trading at Bridgewater).

It’s also worth noting that Omega One has been backed and endorsed by John Mack, the former CEO of Morgan Stanley.

Verdict

Omega One presents a highly speculative buying opportunity for investors interested in long-term capital appreciation.

In order for cryptocurrencies to advance to the level of traditional asset classes, cryptocurrency trading technology needs to rival what’s being used in traditional markets. With this in mind, both liquidity and custodian services are the required next step in the evolution of cryptocurrency trading – the former is what Omega One is offering. Between the combination of robust market potential and a strong team, Omega One has a fighting chance to be a leading liquidity provider for cryptocurrency markets.

Overall, Omega One has a solid team with deep domain expertise and a clear vision that fulfills a dire need for the evolution of cryptocurrency trading.

Risks

Currently, there’s no working prototype or beta version of the company’s trading platform available for test-use. Since the platform is still in early-stage development, the risk of glitches and inefficiencies is high – as is the risk of failure. -1

The company faces tough direct competition from Liquid by Quoine, Quantave, Exchange Union, Rialto.AI, B2BX, Keyrock, and others. For example, Quoine Liquid already has a working beta platform and has raised funds from a successful ICO (first-mover advantage) – the company is also a subsidiary of a popular exchange. -1

Omega One will be taking the risk of trades on the company’s books and will be paying customers from their own funds until they sell each cryptocurrency on the market. Without access to credit, Omega One’s platform could become stressed if trading volume exceeds expectations. -1

Growth Opportunity

As institutional investors continue to embrace cryptocurrencies, sourcing liquidity will be their primary concern. If Omega One can create a superior technology by the first half of 2018 and partner with trading desks at large banks (i.e. Goldman Sachs), demand for OMT would skyrocket as the frequency and average ticket size of trades would dramatically increase. +4

Omega One’s core team has in-depth experience in currency trading from one of the top performing hedge funds of all-time. The company is also partnered with ConsenSys, so technological capability shouldn’t be called into question. Additionally, John Mack can help facilitate large, lucrative deals with leading banks for the company. Needless to say, the company’s core team, advisors, and investors have the ability to create significant runway for growth. +3

Settlement intermediation not only allows traders to access liquidity more efficiently, it also allows for more stability in the market as a whole. As cryptocurrency markets stabilize over-time from increased liquidity and increased participation from institutional players, volatility will likely decrease in response. A decrease in volatility coupled with price stabilization, means average daily trading volume would likely increase to unprecedented levels – which is highly beneficial to Omega One. +3

Disposition

While Omega One faces technological development risk, heavy competition and significant balance sheet risk, the company still has the potential to become a leading liquidity provider for cryptocurrency markets. Even though Quoine Liquid has a first-mover advantage, Omega One’s emphasis on balance sheet build-up may give the company a strong competitive advantage when courting institutional customers – they’ll be able to handle a higher volume of trades as compared to Quoine.

Against this backdrop, we believe that a score of 7.0 out of 10 is warranted.

Investment Details

Type: Crowdsale

Symbol: OMT

Pre-ICO Sale: TBD

Public Sale: TBD (likely in Q2 2018 after product launch)

Payments Accepted: TBD

Disclaimer: no position in Omega One at the time of writing.

Featured image

Important: Never invest (trade with) money you can’t afford to comfortably lose. Always do your own research and due diligence before placing a trade. Read our Terms & Conditions here. Trade recommendations and analysis are written by our analysts which might have different opinions. Read my 6 Golden Steps to Financial Freedom here. Best regards, Jonas Borchgrevink.

credits: hacked dot com

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hacked.com/ico-analysis-omega-one/