The Return of Inflation

On the Road to Riches, one's goal does not end with merely amassing said Riches, but keeping them.

As Rich Dad is fond of saying: "It's not what you make, but what you keep!"

Now for most of us, the biggest threat to our wealth is going to be TAXES.

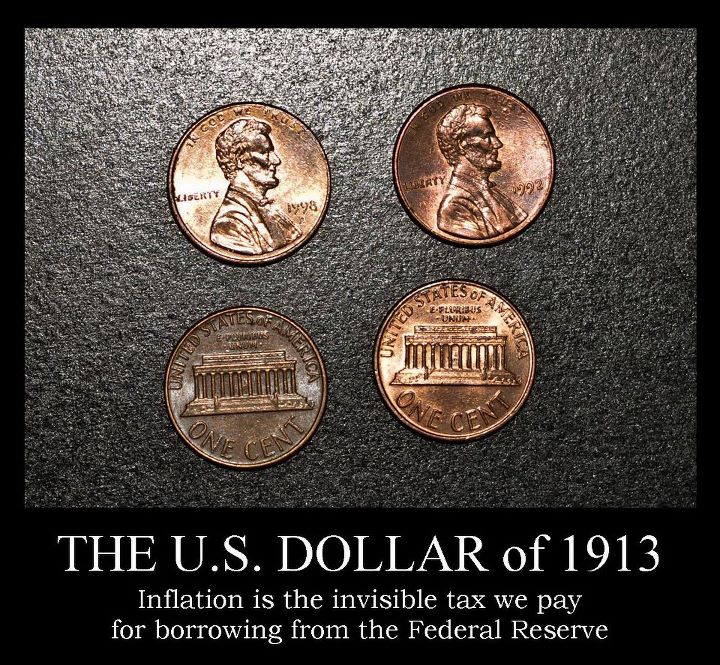

Today however, we're going to talk about a particular type of tax.. the sneakiest and most insidious of them all. A tax so diabolical, not one man in a million will detect it's theft.

The INFLATION TAX

Right now the dollar is crashing at it's fastest pace in 31 YEARS!

If you're an American, the problem with a weaker dollar is everything we import suddenly becomes more expensive.

While Inflation is technically a monetary phenomenon, the average man on the street experiences it as higher prices.

Said differently, life will become more expensive the longer this trend continues.

Inflationary Trends:

- Money Printing trillions of dollars have been printed since the '08 recession. After years of Banks not lending, now they are; potentially accelerating the velocity of money.

- Home ownership has stopped its multi- year decline and has started to gain traction as interest rates rise. New home owners don't just buy homes; they buy couches, t.v's., refrigerators, paint, lawn mowers etc.

- Dollar crashing. The US imported half a trillion in good from China alone. All of those goods in the form of cheap stuff we buy from Walmart and Amazon will suddenly become more expensive.

- Tax Cuts While you're certainly better off if you're rich than middle or lower class, most people will end up having some more money in their pockets at the expense of the national debt. More money chasing fewer goods = price inflation!

- Infrastructure Spending Both the US and China in particular with it's OBOR (one belt, one road) project, will spend trillions of dollars combined on infrastructure, pushing up the cost of production and commodities.

Invest-able Action

So who are the winners and losers in an inflationary environment?

- The losers will be old people, savers, and the middle class. If you're on a fixed income or do not have significant upward mobility in earnings, the prices of goods and services will far outpace your income over the next 10 years.

- The winners will be the closest people to the money. If you're an investor, the place to be is COMMODITIES. Resources like Uranium, Gold, Zinc, Copper, etc will do very well over the next 5 years. Historically the stock market tends to go up as well, though as these frothy valuations, this writer is not willing to go there until a size-able correction.

This is not a Short term Forecast

I believe volatility is eerily quiet outside of the cryptocurrency space, and I expect it to return this year. Having said that, the resource sector has the most to gain from this trend shift, and I expect commodities to explode over the next three years.

Until Next Time

It's your move.

JESS

Thanks for reading, if you enjoyed this rant, you might also enjoy some of my Recent Articles:

You are absolutely right. If nothing changes, the dollar will decline against other currencies, which are in turn depreciating.

The real nail in the coffin will be the rising velocity of circulation, which will lead to a higher interest rates.

Higher interest rates will make funding the national debt more costly, which will mean printing more and faster. Then we will spiral out of control.

Except

It wont happen like that.

There is a secret plan. I can’t tell you what it is. It’s soooooo secret. When implemented, it will be of immense benefit to mankind. In one executive order, the world will return to high growth, low inflation, low interest rates, higher employment, higher spending, more money in the pockets, lower taxes, higher corporate profits, and a solution to the national debt.

Lol Secret plan! Don't keep me in suspense @swissclive, I promise I won't tell anyone. Nor will the blockchain hold your intel publicly for all eternity.

Okay let's review the clues:

Basically everything that everyone would want.. a scenario so perfect and implausible...

OKay I think I have the answer.

Very good. You spotted the clues correctly, except it’s not a return to the g..d st.....d.

Here are some more clues.

There will be no losers - only winners. The biggest winners will, as is always going be the case, be the wealthiest 5%. We can’t avoid that. The next biggest winner, at least in terms of positive impact on their lives, will be the poorest 50% but only in the countries which make the change. This will include USA, UK, Japan, Europe and maybe China.

The relatively affluent middle 45% of the population will profit much less.

Last clue: Switzerland, unfortunately for them , will not need to make the change. Things will stay the same for most of the Swiss.

Gold and commodities will do OK, but there is one asset class which will just blow the brains of the staticians. It will have an upwards crash. Maybe a 10 or 20 standard deviations move.

You have enough clues now to know what that asset class is.

Interesting, so let's review:

Conclusion

We are on a pro blockchain site, so you must be talking about BTC or some other type of cryptocurrency.

It's often sited that the un-banked poor have much to gain from honest accounting and transacting from their phone.

As I stated earlier I'm not familiar with Switzerland, but a quick google search suggest they are pro-cryptocurrency and could be an early adopter.

My only other guess, is that the Swiss put their biggest asset, the Swiss Franc on the blockchain and it become the world's reserve currency, which would explain clue #2.

But no losers? Come now @SwissClive, EVERY transition has winners and losers!

The magic solution has nothing in particular to do with crypto or Blockchain. It’s a great idea to crypto the Swiss franc, but that isn’t related.

Concentrate on why the poor benefit. What does a poor person have that a well off person may not have as much of?

Ha, this sounds "magical" alright.

Hmm, I've definitely been poor before... I can't think of anything I had more of then than I do now. Maybe hair! lol

Do the Swiss all have hair?

Is hair an asset class?

Did the Swiss vote for Universal basic income?

I seriously have no idea. :/

The Swiss voted against the Universal basic income. It will be interesting to find out how the swedish experiment worked. It is just ending now.

No, I was not talking about a univeral income.

It’s not hair either. I don’t think poor people are more hairy than the rich.

Here’s another clue: The poorest 50% have a lot (as a percentage of their net wealth), the next 40% have a little, the richest 10% have a lot as an absolute number. The poor wish they could get rid of it, the rich would like to use more of it to further enrich themselves. The middle 40% advise against having any.

DEBT

@theroadtoriches, you came out of nowhere and you are killing it in Steem with stunning content. This truly shows that when one is dedicated success does not take long to follow.

@theroadtoriches is a straight shooter and I am glad to see that he continues to give solid advice.

Great Article Thanks!

No, problem, thanks for reading!

I'm making bit bets on silver. The silver to gold ratio is at a high point and the entire sector looks ready to move much higher this year.

Selling cryptos and buying silver is looking like a smart move. Especially as I sense the tether/bitfinex scam is soon to come crashing down like bitconnect and drive all cryptos to the depths as I stated in a recent article of mine.

No one sector gets the glory forever, you gotta rotate between'em.

Yeah, I saw your recent purchases. I think that's really smart. I'll probably sell 90% of my silver on the next high myself.

Agreed. I think we are on the same page @getonthetrain. I remember reading Mike Maloney's Gold&Silver book some 10yrs ago, and really first introduced me to the concept of cycles and buying under weight assets then selling them for stocks/ realestate once those become cheap again.

Cycles generally last 6-8 yrs, so the strategy does require some patience, but it's worked for me thus far!