Negative rates: Planned downturn?

source: ABCNews

First of all, in our current "western" economy (talking about Europe, North America, Japan and Australia) it's very hard for prices to go down. Because of the minimum wage and a lot of other different reasons. But if prices can't go down to create demand, there's a lot faster supply destruction. And of course the supply gives us the ability to consume. So if there's less supply happening, there's less consumption and less income.

So just to reiterate in our current economy - if we have a lot less credit we have less production, less consumption income, that leads us to an economic collapse.

In 2002 Lew Rockwell posted a quote from Paul Krugman, who told to New York Times, what will happen to housing market in case of every financial crisis in the future. But I guess, at that time, no one thought of Krugman's take to be 100% true.

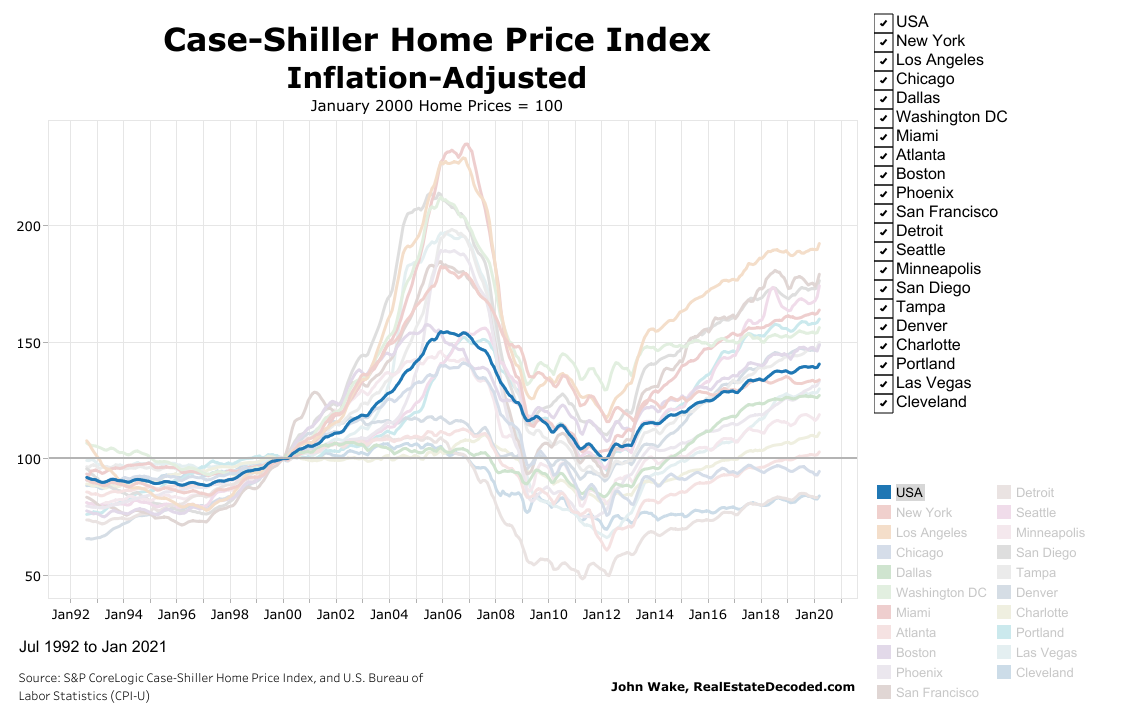

In 2007 housing prices skyrocket to an all-time high (197% on inflation-adjusted price index) and come crashing down. But what does this do to the younger generations? Because they didn't really allow the bubble to completely deflate, it only went back to its historic trend-line. Than the Fed started inflating the everything bubble to make up for the housing bubble that made up for the dot-com bubble.... you see how these things work?

Inflation tax

This works several different ways, but the bottom line is : the younger generation ends up paying for all the Boomers bubbles. First and foremost when they get into the job market, it's totally depressed because the corporations aren't investing for the long. They're not investing in creating more jobs, growing their business... Why? Because the central bank comes in, lowers interest rates, does quantitative easing, prints up all the funny money they put in the central bank.... So it incentivizes the corporations and big businesses to take that money and just buy their own shares back, invest in the financial economy as opposed to the real economy.

The younger generation ends up paying for this because, instead of getting out of college and finding a great job, they're left to go right into the gig economy and have 15 side hustles just to make ends meet!

Central banks in the past have created debt bubbles to destroy entire economies and they do so, because they want to restructure or consolidate power. As an example look at the United States in the 1920s where the central banks and the banking system itself created these huge debt bubbles that brought USA to the 1930s where a lot more government control came into American society. The American public would have never ever agreed to having this much government control in their society if it wasn't for the collapse that the expansion of credit in the 1920s created. The exact same thing happened in the 1980s in Japan, 1990s in Asia and is happening now in all the developed economies! They're trying to create these debt bubbles so when they burst and the recession comes, the powers that be, can consolidate the power or they can change the country or the entire economy in a manner that they see fit!

There are lots of superficial articles here on Steemit, but this one actually has value and something to say. To be honest, it is almost what I would call complicated, implementing that this isn't an article for everyone to understand. However, I liked it and followed you so that I can see your future articles as well! :)

Thank you for your comment. Well, thing is I trade indexes,stocks and sometimes even invest into industrials, energy or commodities. And if you want to do that, first you have to know every detail of economy and markets. And yes, I'm aware that some people will find this article a bit mind-boggling. But there's not so many sites you can turn to, where everything is written without bias. I want to tell it as it actually is. If you go to my history, you will find more articles like that. And most of them (which were not written due to daily/weekly economic changes) are still worth to read.

@tipu curate 2

Upvoted 👌 (Mana: 0/4 - need recharge?)