Cryptocurrency: Funds of the future?

Bitcoin, whose price topped US$2,000 per coin for the first time in May, has arguably entered the mainstream. You can actually use it to buy stuff now, at retailers such as Microsoft, OkCupid and even Subway.

VIRTUAL currencies have been said to capture the imagination of some, strike fear among others, and confuse the heck out of the rest of us. What exactly are they? Should we invest in them? Where do we even start? Here are some of the most popular questions answered.

What is cryptocurrency?

Cryptocurrency is digital money created from code. Most cryptocurrencies are built on blockchain, an incorruptible digital ledger of all economic transactions made in virtual currency. The cryptocurrency economy is free of all government oversight and monitored by a peer-to-peer Internet protocol.

What are the major cryptocurrencies?

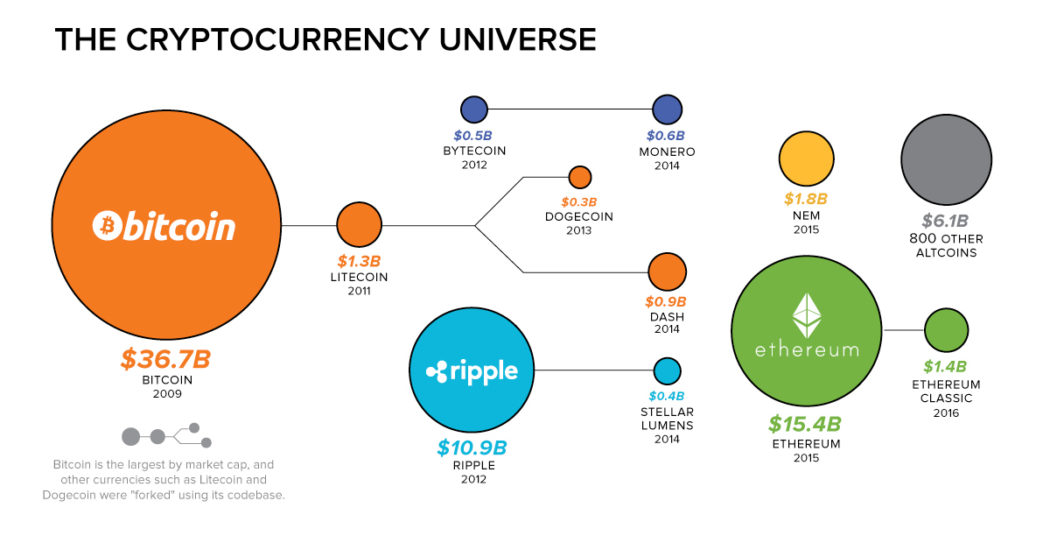

Bitcoin (founded in 2008), Ethereum (2015) and Ripple (2014).

How much are these worth today?

Let's just say anyone who's bought cryptocurrency before 2017 would have made astronomical gains (see graphs below).

Why invest in cryptocurrency now?

Cryptocurrency is said to be one of the best-performing assets in the last two years. Its market added nearly US$7 billion in value in just the first quarter of 2017, going by a CoinDesk report.

Bitcoin, whose price topped US$2,000 per coin for the first time in May, has arguably entered the mainstream. You can actually use it to buy stuff now, at retailers such as Microsoft, OkCupid and even Subway.

How to invest - where to even start?

First, there are two ways one can invest using cryptocurrency:

- Buy and sell cryptocurrency. One can do this through platforms such as Coinbase, Coinhako and CoinMama using a credit card, debit card or bank transfer. Identity verification may be required for large transactions on some platforms.

Notably, a majority of cryptocurrency investors conduct only this form of investment, where they wait for prices of virtual currencies to appreciate before selling them.

- Buy cryptocurrency, and participate in initial coin offerings (ICOs). One can do this on token markets or cryptocurrency crowdfunding sites such as TokenMarket or FundYourselfNow (Singapore-founded).

An ICO allows startups with innovative products to issue their own digital tokens that can be bought by investors or backers using virtual currencies. Digital tokens typically entitle backers to monetary rewards (such as profit sharing), or non-monetary rewards (exclusive products).

Notably, only a minority of cryptocurrency investors buy virtual currencies and participate in ICOs. The latter is considered a more speculative form of cryptocurrency investment, as it entails backing a young and thus high-risk company, and profiting only if the company succeeds.

How much to invest for the first time?

The rule of thumb is to not invest what you cannot afford to lose. The cryptocurrency market is uniquely unregulated and extremely volatile: prices can one day rise by 100 per cent and plunge 50 per cent the next day. Panic selling is very common.

One should therefore not invest in cryptocurrency if he or she is unaccustomed to wild price fluctuations.

Early adopters recommend S$4,000 as a good first amount to set aside for such investing, and to never let cryptocurrencies occupy more than 50 per cent of one's portfolio.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.businesstimes.com.sg/life-culture/disrupted/cryptocurrency-funds-of-the-future

With new users into coinbase reaching 7 digits per month the amount of fiat that is being converted into cryptos is just growing... basically just buy whatever you can lose, those extra dollars that you don't spend in the weekend and keep doing it each week/month.... if you think about it as a saving account in 5-7 years you are going to see the big jump of your portfolio...