Steem Bounty - Your 1 Million Dollar Portfolio for 1 Year - How Would You Diversify? Cash, Real Estate, Gold/Silver, Stocks and Crypto

Imagine you've had some luck and suddenly you have $1,000,000 in savings. Awesome right?! Unless you had more than that already, than it kind of sucks. Let's assume you didn't have that million yet ;-)

You decide to take one day to think about how you want to invest that $1,000,000 into different assets, all with their own risk profile. Let's assume you can only choose: cash, real estate, gold/silver, stocks and crypto. At the end of the day you've made up your mind and put things in motion to create the (un)diversified portfolio you feel most comfortable with.

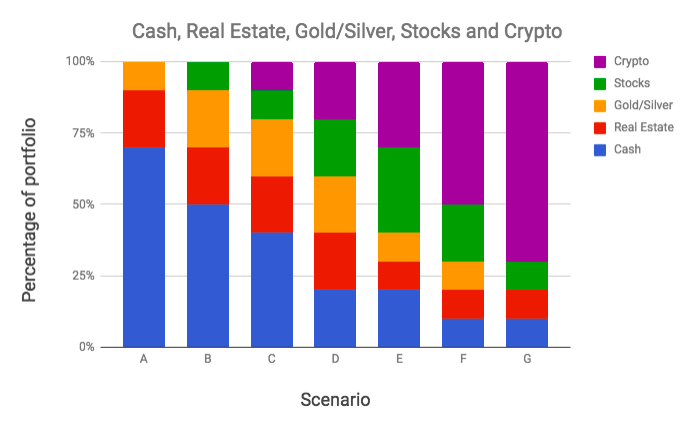

What would that portfolio look like if you know you cannot change/sell for 1 year? Do you prefer to have everything at the bank in cash like the way it is now? Everything in cryptocurrencies? Pick one of the scenarios below or come up with your own diversification :-)

Some examples

Please let me know how you would diversify your wealth and explain why :-)

There is a bounty on this post (see the comment section) for the most insightful answers/thoughts in the comments :-)

---> 👍🏼 Follow me for regular updates on my cryptocurrency portfolio, crypto related articles and inspiring articles about personal time & life management.

---> 👍🏼 Resteems and upvotes are appreciated ;-)

Disclaimer: I am not a financial advisor, trader or developer. I am just a blockchain & cryptocurrencies enthusiast. Make sure you do your own research, draw your own conclusions and do not invest any money that you cannot afford to lose.

20% Stocks

10% Steem

10% Bitcoin

10% Ethereum and othe cryptos

20% cash

20% real estate

10% other assets like cars

Cool, so mostly crypto I see. Why did you choose this portfolio?

I like Steem and cryptos. Maybe I would go higher on stocks though. I think Steem could skyrocket in value.

10% precious metals as a hedge against a severe correction, 20% commodities stocks because they are looking attractive, 20% bluechips, 20% money market/cash, 15% small caps, 15% cryptos.

@cryptotem very interesting post with an question here is answer from me :

Cash 10 %

I will put 10 % in cash because if I have to buy something or do shopping then I need cash for faster use. soon some cryptos will be acceptable then it will be reduced.

Gold & Silver 20 %

I will put 20% in Gold & Silver because it's good alternative to the crypto. as the demand increases the rate increases.

Real Estate 20%

I will put 20% in real estate because it's also a good option to get profit by holding property in undeveloped area & sell after the area get developed. Because as the area develop the rate of property automatically increase.

Stocks 10%

Stocks also good option to earn money it need long time holding maximum times. Their is very few chances to get profit within small time.

Cryptocurrency 40%

I will put 40% in the cryptocurrency. I know here is big risk but where is the risk their is big chance of earning huge profit. We all know the crypto is future so I invest 40% inn present.

Here's how I would construct my portfolio:

Cash 10%

This is strictly money to be set aside in case of emergencies where I need to get my money out immediately. The cash would go into money market accounts, and/or short-term CDs and bonds -- the potential returns may be lower than other investments, but they are practically guaranteed and my liquidity would be assured.

Real Estate 0%

This will really depend on where each individual lives and the laws in effect there. In my case, the risk potential of hassles involved (different rules in different nearby areas based on HOA rules, landlord/renter legal relationships, etc.) is too much to make investing in real estate worthwhile to me.

Gold 20%

Gold holds a secure value and can be used as a hedge against inflation, but it's not a very liquid asset -- unless the fiat system suddenly collapses, in which then it becomes very liquid. For this reason, I definitely want to own and have ready access to some gold [coins].

Stocks 40%

I would split the stock section of my portfolio into two parts: 20% for long-term holding and 20% for short-term momentum/day trading. As long as I'm using a competent online brokerage, I should have little trouble finding the stocks I want to trade in based on my personal tolerance for risk and personal desire for potential gains. Because it's more liquid than crypto (in that I expect to be able to convert my holdings into cash and withdraw it more quickly should the need arise), I weigh my portfolio slightly more towards stocks.

Crypto 30%

These offer the highest potential risks and rewards, but isn't quite as liquid as stocks. If I was confident in crypto's liquidity and my ability to completely trust the crypto markets, then I'd probably be going with 70% crypto and 0% stocks.

Good post. Love these kinds of scenarios :) I suppose mine looks a lot like E)

Cash 5%

This is for if you have to FLEE because of war or some other reason, and you need to buy things really fast. A lot of food, equipment etc.

Gold silver: 15%

Reason: Even if it has some usecase in electronics and tech, it's basically mostly a hedge or insurance in a catastrophic event or hyperinflation. But with cryptos, we have another and IMO better alternative.

Real estate: 35%

Whith "only" 1 million USD I would own my own house without any debt.

25% is a house worth 350,000USD, and anything cheaper than that is not possible to get anywhere near civilization in my country. It's a two bedroom.

Stocks: 15%

In robotics and AI funds like Robo or Botz

Crypto: 30%

It's the future.

Personally I actually have more like 50% of my money/assets in cryptos, but that's because I got in early. If I would go in now, I would go for about 30% of all my assets.

@cryptotem Assuming if I had $1,000,000 for investment, then here is how I would distribute into assets - (Region India)

1. Cash - 1 %

I need basic cash for daily needs, 1% of $1,000,000 is enough for living in India for a year. I have my own house, so I won't need to pay any rent and my maintenance is low as well.

2. Savings Account / Fixed Deposit - 9 %

I would keep some cash in Savings Bank Account at 4% ROI and some in Fixed Deposit at 7.5% ROI annually.

3. Gold, Silver & Diamonds - 25 %

I would put a quarter of million dollar into precious metals. It's my long term investment and also emergency backup. They won't give higher returns but its the safest investment.

4. Real Estate - 20%

Real estate is one of the booming sector in India, as we have stable government the property rate sees a healthy growth of 10% per year. It is also one of the safest asset as we hold legal documents and we usually don't fall into any trouble.

5. Stocks / Mutual Funds / Provident Funds / Bonds - 15%

Past decade saw a healthy growth in Stocks and most likely I would purchase BlueChip shares as well as Government Bonds. It reduces risk of losing money and also gives healthy dividends annually.

6. Cryptocurrency - 20%

This 20% is probably the most profitable investment subject to market risk. The volatility of coins makes it boom in prices overnight. If everything falls correctly it can make another $1,000,000 in coming times. The 15% of it will be in Top 30 currencies while the remaining 5% will be in Alt coins.

7. Donate - 10%

I would donate 10% to needful NGOs and development projects and further 10% on profits I gain thereafter on the investments.

None of the above I'm afraid. For me it would be a three-way split:

Gold and Real Estate don't appreciate fast. Looking at an investment time of one year, I would expect little to no appreciation in value from these two asset classes. BUT - they are both very secure long-term markets.

Gold is limited in supply. With modern money being fiat in nature, gold has been removed from the money equation. Gold reserves are being jealously hoarded by the super-rich, making them difficult to obtain and consequently valuable. The long-term gold price movement is always positive. You can't go wrong with gold if you are looking at holding for a decade or more.

Property is similar to gold, and a good way to hedge your bets. Secure, stable and always in demand. The explosive growth of global population will continue to drive up property prices. It's another great hold if you're looking at investing for a decade or more. The great thing about property is that it can also generate income (in the form of rent), but it's less liquid than gold and impossible to physically move around (which might be a nice option to have in the case of e.g. a hurricane/riot/wildfire/earthquake).

If you want ROI then you can't beat crypto, you just cant. Especially if you want it within a year. the obvious downside to crypto is volatility and market uncertainty as it is still so new. Of course it is this "newness" that also works in it's favour. Because the majority of the population have yet to even touch it, it has enormous growth potential. The longer you hold, the more it works in your favour too (because it compounds and the effects of volatility are also evened out). But holding crypto alone is too risky if you want a return within a year - crypto can (and has previously) dropped in value over the space of a year. That's where the gold and real estate come in - to secure at least half your investment.

Cash is a terrible way to store wealth. Unless your surname is Rothschild, you'll spend that year fighting the effects of inflation. Hold cash and you'll end up with less than you started with. Obviously a bank account can earn you a little interest, but only about enough to just keep up with inflation. Maybe.

Stocks will not make you a decent return within a year. they are basically fast becoming the old world dinosaurs that crypto is replacing. Bye bye stocks.

Cash 10%

Amount of money just for live

Physical gold 30%

Gold actually is really undervalued because of contracts, if only some bank financial problem would happen, gold would go up

Real estate 40%

I prefer to buy flats under market price, renovate them, and sell with big profit, so that's the area in which i would earn the most

Stocks 0%

Movement there i so low, i wouldnt bother my mind doing that

Crypto 20%

I would put around 10% of my money into some promising projects, and other 10% in BTC and ETH

Just set 100% crypto

I guess you like the high risk / high reward scenario ;-)

My thoughts on these kinds of things are heavily influenced by Harry Brown's permanent portfolio, which is a 25/25/25/25 weighting of cash/bonds/gold/stocks. The basic idea is that in different economic environments, different asset classes outperform. So when one does well you can reap the gains from the winner and rebalance them into the losers to reset for the next economic season.

This kind of approach has done very well over the last 40 years or so. It underperforms 100% stocks by about a point, but you get much less volatility.

if you are just looking at one year, it's not so important to get things exactly right. Only crypto is volatile enough to return really meaningful gains on 1M USD, but it could go either way!

So for me, a portfolio would look something like this:

Cash: 20%

Gold/Silver: 10%

Real Estate: 30% - real estate would be rental real estate that is generating yield

Stocks: 15% - and this would be dividend payers like the dividend aristocrats

Crypto: 25%

Crypto and gold/silver actually perform a similar function. They aren't investments per se. They are savings in competing currencies. If your national fiat goes down too far, the alternative savings compensate.