Verium/Vericoin (VRC) IPO - Where We Stand After Phase 1

Verium/Vericoin (VRC) IPO - Where We Stand After Phase 1

Hello steemit community! I just wrapped up my first post yesterday discussing how to become a successful investor. In between wrapping up part 2 of 2 for that post I thought I would take some time to write about the recent Verium/Vericoin ICO that began yesterday.

If you have not heard of Verium or Vericoin I will point you in the direction of the Vericoin ANN thread on bitcoin talk. This post isn't as much information on what either of these projects are about, but rather an analysis of where we currently stand less than 24 hours after Phase 1 of the ICO. So from this point on I'm going to assume you have a base understand of the projects. If you don't but are interested in learning, I suggest you head over to the ANN and then come back here after for my analysis ;)

Disclaimer!

The following article is the expressed opinions of only myself and should not be taken as investment advice. At the time of writing this article the author (myself) holds a long position in mentioned Vericoin/Verium. Please invest at your own risk and PLEASE do your research prior to making any investment decisions. Thank you.

Phase 1 is complete.

Yesterday was Phase 1 of a total 2 phases where 350,000 Verium was sold at a conversion rate of 6 Vericoin per Verium. As a result 2.1 million Vericoin was raised, which at the current prices as I'm writing this blog post would be equivalent to 290 BTC or roughly $193,000. Most members of the Vericoin community would consider the Verium ICO a huge success. Not only did they reach their Phase 1 goal, they did it in less than 2% of the allowed amount of time. Having phase 1 intended to last up to 12 days the max amount of 350,000 Verium was surprisingly sold off within the first 4 hours of beginning.

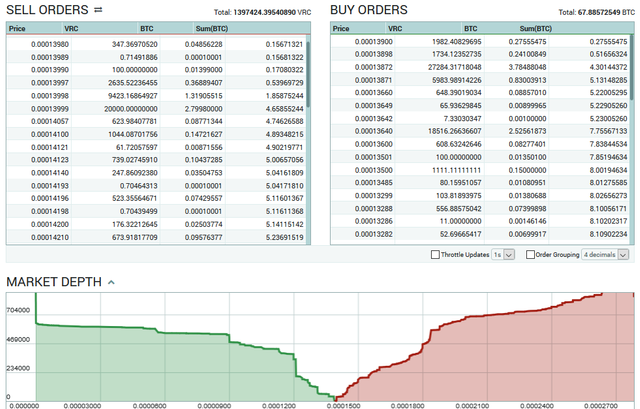

But wait... was it a surprise?

I don't think anyone with 100% certainty could predict how the community would react or the level of participation in converting Vericoin to Verium. I myself was quite curious whether or not they would be able to sell the 350,000 Verium. But in hindsight looking back on how things unfolded I think now it's pretty clear the 350,000 Verium was going to be sold off no problem. Why is that? Mainly because of the fact Vericoin currently has very little liquidity from a trading point of view. At the time of the ICO and throughout the entire 4 hour process the buy order books for Vericoin on poloniex (which currently is responsible for 90% of trading volume) had a maximum of 80 BTC worth of buy orders, half of which were priced at a 30% discount to the trading price at the time of the ICO. What this means is a lot of large Vericoin holders had no other option than to sit on their VRC waiting for something to do with it. They unfortunately couldn't sell it, at least without significantly damaging the order books. So when an opportunity to swap Vericoin for Verium presented itself - which in theory should drive the demand and price of Vericoin higher - it was really a no-brainer.

Now for anyone who was sitting on say less than 10BTC worth of Vericoin at the start of the ICO - they had more than enough liquidity to get out, if they wanted to. However for those top 15-25 private wallets that are holding a healthy 25%+ of all Vericoin - they didn't have as many choices.

As a result what we witness during the 4 hour period was a massive amount of Vericoin being sent over to the Verium ICO swap with little Vericoin actually leaving exchanges. Most of the Vericoin raised wasn't even coming from the order books but rather from those who had previously purchased Vericoin at an earlier date.

Now a couple things to note before we go any further...

- This is neither good nor bad. Any security is going to have liquidity issues for their largest holders. That's part of investing. Even the largest projects in crypto like bitcoin & Ethereum would present liquidity challenges to their largest holders.

- It's also not to say anyone who didn't sell out didn't do so because they would have incurred a loss. A lot of people who choose to hold Vericoin are very much in the green on their investment and choose to continue to hold it because they are optimistic about the project.

- There were still plenty of people last night who purchased Vericoin because of the ICO. Whether participating in the swap or simply to hold Vericoin itself - volume was still strong relative to historic averages.

So what does this all mean?

Well in my opinion we have to look at this from a couple different perspectives.

For the long term Vericoin supporters last night was a great success. Almost $200k was raised to be used as a reserve to Vericoin as well as generate some income for the development team off of staking interest. From a pure project management point of view, removing trading all together, it's hard to argue anything but optimism.

For the long term investors last night could have gone either way. Now using the term "long term investors" in crypto is a bit of an oxymoron. By 'long term' really what I am referring to are anyone who's been holding Vericoin for more than 14 days. Keeping in mind investing is a 0 sum game - there are going to be those who made money off of the Verium ICO and those who lost. That really comes down to a matter of timing and whether you got in/out at the right time.

For the short term investors those who bought Vericoin within the last 48 hours in hopes of making a quick flip it was most likely a bust of a night. No question there are plenty of people who could give a rats ass about Vericoin/Verium - probably don't even know what it's about - but jumped on the hype train simply to get out ASAP and make a quick buck in the process. Most of those people got burned because what they failed to take into consideration was the fact the price already reflected the removal of Vericoin from the market and going into the ICO last night we were already at the 24h high. This is part of the risk of investing and it's the unknown variable that makes it a gamble. What I saw following the ICO was a lot of salty investors chirping in the trollbox about how stupid this all was and to me - those were clearly the short term investors.

Now what is true for virtually every coin is the thought; what is good for the community is not always good for investors and what's good for long term investors isn't always good for short term. We'd call this conflict of interest. In the interest of the development team and those who are hoping to make long term gains by holding Vericoin - you should walk away from last night feeling pretty good. For those trying to make a quick buck - well it was probably hit or miss whether you did.

Post Phase 1 price dump.

A lot of people seemed surprised last night following the closed doors of Phase 1 that there was a 25%+ dumping of Vericoin on the market. I'll ask once again...

But wait... was it a surprise?

No, not really. Unless this is your first week in crypto - it's pretty easy to realize the market usually reacts opposite of what conventional logic should predict. As I'm writing this article Ethereum (ETH) is up 10% on a day when investors could argue should be one of the worst days in the history of the coin. Why is it up today? Because everyone assumes the HF (hard fork) is going to cause a price crash. When the market assumes the price is going down what happens? Yup, it goes up.

Going back to Vericoin - there is no question a large amount of people that were holding VRC at the time of the Verium ICO were doing so in hopes of a quick flip. Whether they bought in the last week, last month or last 3 months they were waiting for last night as their exit point. As a result you have a large amount of people with their finger over the button just waiting for the optimal time to exit. Once the ICO came to an end and investors realized buying is most likely over the dump began. For those who got in last and ended up with 15-20% losses, well that's part of the risk. But for anyone who was surprised by said dump probably needs to do a little more research on how the markets operating during events like last night.

Phase 2 and onward.

So where do we go from here? Personally I see consolidation occurring for a few days while the market digests what the next move is going to be. I think a settling price of roughly 0.00015 VRC/BTC is where that consolidation will occur. Now please don't take this as investment advice to buy or sell based on my prediction. It's simply my prediction and I'm really basing that opinion off of my own assumptions. As we approach Phase 2 I could see a second level of interest push the price high but what I believe will happen is that the market is going to ask for parity on the Phase 1 conversion rate of 6 VRC per 1 VRM. Since Phase 2 has a conversion rate of 10:1 the only way for parity to occur is for the price of Vericoin to be lower than it was during the time of Phase 1. I'll leave that up to you to guessimate what that value will be - but I would also be surprisingly happy if the price pushed forward and reached the .00018-.0002 levels again.

Regardless of what occurs between now and the end of Phase 2 I do believe the Vericoin community as a whole will be in a good place. At the least, if no more money is raised during Phase 2 the Vericoin community is walking away with more attention, more awareness, 1.05 million Vericoin to be removed from the trading markets and set to permanently stake as a community fund to be used to strengthen development & marketing that currently sits at roughly $200,000. I personally feel Phase 2 will struggle to raise more Vericoin if the price increases too much but should do well if the price remains static or even dips a little. To a degree it's a bit of a trade off but as I've said on a few other things in this article, I could be very wrong.

My last thought for those who are still with me. I personally find the Vericoin/Verium project an interesting experiment in the still young digital currency space. Like a lot of projects it's hard to predict how well the market will adapt to the technology, the marketing or the ideology of said project. But as someone who tries to stay atop of all things happening in the crypto space I think it's a project that everyone should keep their eye on even if that is passively from the sidelines. It's too early to tell whether the Verium experiment will be a success or not but early signs have shown the market is at least interested.

Interesting analysis. One thing that's great is that we now have around $100,000 worth we can use towards development, marketing, and third party collaborations. That, and the fact that we will be able to have $2500 a year in stake endowment profits for miscellaneous costs, is pretty great too.

Hey @pnosker thanks for taking the time to read & reply. Congrats on what I would call a very successful Phase 1 ICO and I'm excited to watch/participate in Phase 2. Also, thank you for pointing out the development fund is 1/2 of the money raised, which I did not state correctly - so I will go back and make the appropriate updates. Cheers!

No it's not 1/2, but the endowment fund is 50% and the development portion is 20%, 20% marketing, and 10% 3rd party.

Oh right... not sure why I am forgetting the setup of this. Once again appreciate the clarification on this. Thanks!!

Thanks for the insight. I have been a small holder for some time and I was actually kinda bummed on one level to see I missed out on the stage one swap, but happy to see it was a success. I plan on holding and buying in the dips and will be interested to see how stage 2 goes.

Yeah I do think if you are able to buy on the dips and invest in the 10:1 swap to a degree it will work itself out to similar conversions as last night. Also don't forget there is the 500:1 bonus for top 250 VRC holders at the end of round 2 ICO which will give you an extra 1.2% Vericoin based on the 6:1 conversion rate (if that makes sense).

It is a pity that not enough information in Russian. Poor understanding on English. You can express your opinion in a nutshell. Does it make sense to buy now VeriCoin the long term? Or wait for the Verium on the market?

Personally I'm keeping maybe 2/3rds as Vericoin and converting about 1/3rd to Verium. The current supply of Vericoin is about 30 times greater than the initial supply of Verium.. so it is possible that 1 Verium could be worth about 30 Vericoin. Chances are it will be closer to 10 though..but no one knows for sure. Short term I'm hoping that this becomes one of the most (or maybe the most) profitable CPU mined coin (verium) which could give it some well deserved attention and also raise the value.