IOTA Tangle – Diversifying your portfolio beyond the blockchain

There is a buzz of excitement in the air. Blockchain technology is poised to disrupt the entire internet based services industry with promises of increased security, transparency and transaction speeds. As the cornerstone of blockchain technology, Bitcoin has held over 50% of the total market value up until now, but this is not necessarily an indication of the future trend. Ambitious projects such as the IOTA Tangle are going beyond the blockchain in an attempt to solve the scalability issues inherent to Nakamoto’s blockchain design.

As the Cryptocurrency market continues to mature, it’s paramount that investors hedge their risk. As many new investors buy their first blockchain based coins from Coinbase – Bitcoin, Bitcoin Cash or Litecoin – they must be aware of the high growth potential assets out of reach of the Coinbase platform.

One prime example is IOTA where the team have already implemented what is considered by some as blockchain 2.0. The IOTA tangle achieves similar outcomes to blockchain technology with far fewer limitations. Here’s a brief overview of the IOTA Tangle project to help you assess whether it should be part of your investment portfolio.

Blockchain 2.0 – What’s limiting about blockchain technology?

The blockchain technology that powers Bitcoin, enables a decentralized, distributed public ledger that can be used for everything from currency to property rights. Whilst some praise the technology for its success, others criticise the increasing latency that is inherent with user growth, in some cases waiting 12 hours for a transaction to complete.

Why are transaction times increasing as the network gains more users? To answer this we need to understand how transactions are put into blocks.

For a transaction to be recorded, it is packed into a block before being approved by the miners on the network. Once the transaction has been packed, the block becomes part of the chain and miners begin to work on the subsequent block. As the technology gains more users, there are a greater number of transactions that need to be recorded, yet the rate that blocks are packed remains constant at around ten minutes.

Put another way, imagine a 1MB block holds 100 transactions, this means that 100 transactions can be approved by the network every 10 minutes. Now imagine that instead of requiring to fulfill 100 transactions in 10 minutes, the Bitcoin protocol has to fulfill 200 transactions, this will take two 1MB blocks in order to complete the backlog of transactions, which is around 20 minutes.

A transaction that took 10 minutes before could now take two or more times longer, increasing in line with the increasing network demand. Now imagine you wanted to send real time, secured and immutable data on the blockchain, you would constantly be receiving it long after it was sent. This latency in transaction times is a key focus of the IOTA protocol. The IOTA protocol does not rely on the linear transaction confirmations of a blockchain, instead using the IOTA Tangle.

What is IOTA and how does it solve the scaling problem?

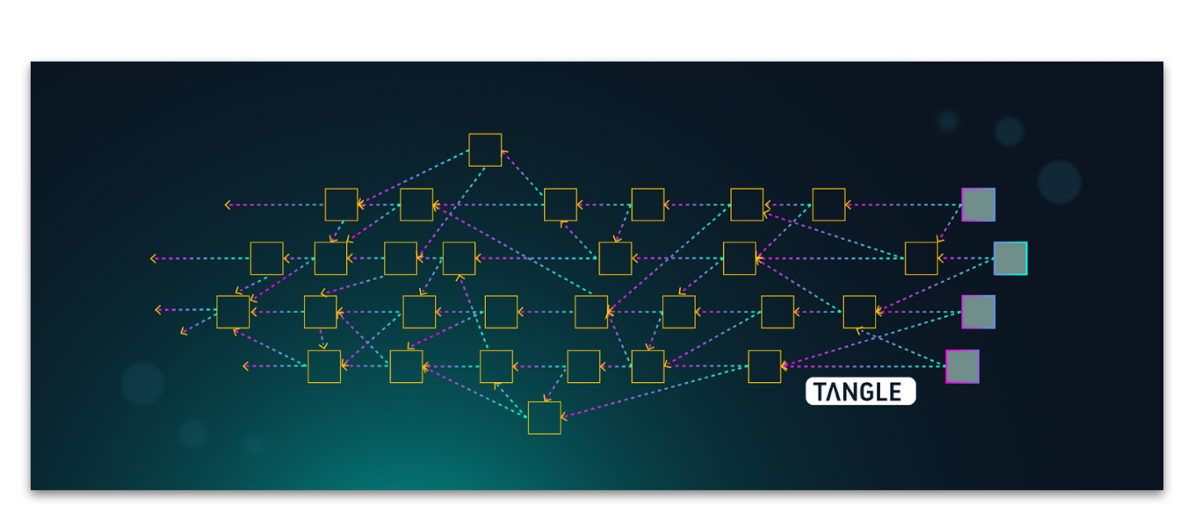

IOTA is an open-source distributed ledger that is primarily focused on providing cryptographically secure payments and communications amongst the Internet of Things (IOT). IOTA goes beyond the blockchain, using directed acyclic graphs (DAG) to help solve the scaling problem faced by the linear data structure of blockchain technology. Without the need for highly energy intensive mining systems, IOTA’s transactions can be free regardless of the size of the transaction. Confirmation times are fast since the DAG technology can handle unlimited transactions simultaneously across the network.

Having recently announced an arms length collaboration with the likes of Microsoft, Deutshe Telicom and Fujitsu, the IOTA team is well positioned to be a prominent player in the Internet of Things technology space.

Conclusion

With Bitcoin holding the lion’s share of the cryptocurrency market since its inception in 2009, the race for the top spot is hotting up. Analysts, enthusiasts and investors are eagerly watching the market in anticipation of the leaders of tomorrow. Whilst IOTA is not necessarily aiming for Bitcoin’s position as top cryptocurrency, the revolutionary application of directed acyclic graphs in bringing together a network of 2.5 quintillion bytes of data make it a strong contender for the position of largest market capitalisation of a distributed, open source, cryptographic database.

Whether it takes the top spot or not, we believe IOTA a promising successor to the blockchain and a worthy component of any investment portfolio. Diversify your Bitcoin, Bitcoin Cash, Litecoin and Ethereum holdings today with the assistance of BITASSIST.

W: www.bitassist.co.uk

Disclaimer: This should not be taken as investment advice and readers are urged to do their own research from a variety of resources prior to making any investments. The cryptocurrency market is an unregulated space within the UK and, as with any investment, carries an inherent risk of loss.

BITASSIST - Driving Digital Investments

Hi. I am @greetbot - a bot that uses AI to look for newbies who write good content.

I found your post and decided to help you get noticed.

I will pay a resteeming service to resteem your post,

and I'll give you my stamp of automatic approval!

Resteemed by @resteembot! Good Luck!

The resteem was payed by @greetbot

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.