The Fed expects to cut interest rates only once this year! Powell: I don’t have the confidence to let go immediately! Bitcoin soars and plummets

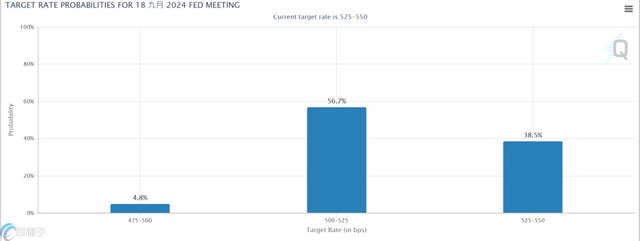

After the latest CPI and interest rate decisions were announced, Federal Reserve Chairman Jerome Powell said at the post-meeting press conference this morning that inflation data has slowed significantly, but it is not enough to support interest rate cuts, but no one will raise interest rates. As a basic expectation, after the FOMC meeting, the market's probability of an interest rate cut in September has dropped to 56.5%.

The latest CPI (Consumer Price Index) data released by the U.S. Bureau of Labor Statistics last night showed that the CPI in May increased by 3.3% year-on-year, lower than the market expectation of 3.4%, driving the cryptocurrency and U.S. stock market to jump.

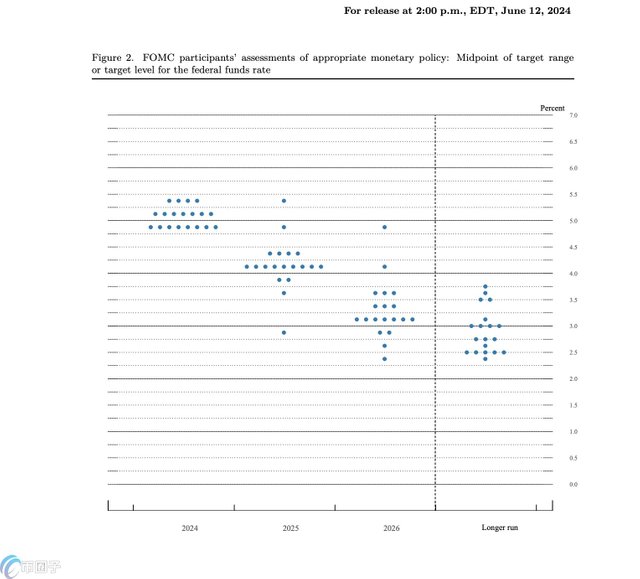

But then, the U.S. Federal Reserve announced at 02:00 this morning that the interest rate will remain unchanged at 5.25% to 5.5%, freezing for the seventh consecutive time. Although in line with market expectations, the latest interest rate dot plot shows that the Fed's decision-makers seem to expect only one rate cut this year. Nick Timiraos, a reporter known as the "Federal Reserve's mouthpiece", also interpreted that four Fed officials do not expect a rate cut this year, higher than the two in the March forecast. Seven officials expect one rate cut this year, and eight officials expect two rate cuts. This means that a slight majority believes that the basic situation this year is that there will be no more than one rate cut.

Inflation slows, but not enough to support rate cuts

Jerome Powell, chairman of the Federal Reserve, said at a press conference after the meeting that the May CPI "is undoubtedly a better inflation report than almost everyone expected." The data helped the Federal Reserve build confidence in the cooling of inflation, but it is not enough to support rate cuts.

Powell emphasized that recent inflation data has slowed down, but more good data is still needed to boost confidence in the anti-inflation process, and will continue to pay close attention to inflation risks... So far this year, the Federal Reserve has not yet increased its confidence that inflation will slow down enough to cut interest rates.

In addition, the Federal Reserve generally expects that the GDP growth rate will slow down from last year, and the pace of employment growth will be slower than in the first quarter but still strong, and the labor market is expected to remain strong.

"The Federal Reserve is closely watching whether there are signs of weakness in the labor market, but no such signs have been seen so far. It has noticed that the number of job vacancies and wage increases have declined, and the unemployment rate has risen slightly. This is an important data. The overall situation is that the job market is strong, but it is cooling down."

Not specifying when to cut interest rates

As for the market's biggest concern, when to cut interest rates? Powell said that no one among the FOMC members has made a strong commitment to the interest rate forecast. The Fed needs further confidence and more good inflation data, but will not specify when to start cutting interest rates.

In addition, Powell also mentioned that officials are gradually realizing that it is impossible to reproduce the extremely low interest rate environment before the epidemic.

Can interest rates be cut in September?

After the release of CPI data last night, the market bet that the probability of a rate cut as early as September rose to more than 70%. However, after the FOMC meeting ended and the dot plot showed that there would only be one rate cut this year, CME Fedwatch data showed that the probability of launching the first rate cut in September and a 1-code rate cut has dropped to 56.7%, the probability of maintaining interest rates unchanged is 38.5%, and the probability of a 2-code rate cut is 4.8%. The market's estimate of the probability of a rate cut in September has been lowered compared to earlier.