The market is sluggish! Bitcoin volatility hits a new low this year, and Ethereum gas fees hit a four-year low

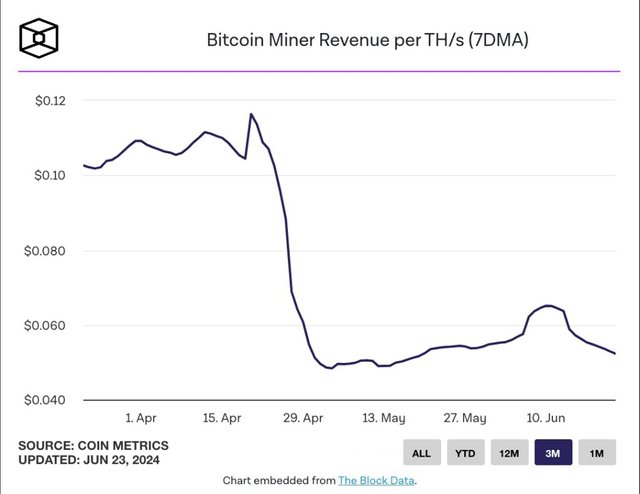

The cryptocurrency market continues to perform weakly, which has also led to a decrease in the activity of the ecological network. According to data from THE BLOCK, after the Bitcoin halving in mid-April, Bitcoin miners' income per TH/s (7-day MA) has hit a record low in the past two months; the upward trend in June was broken again and continued to decline.

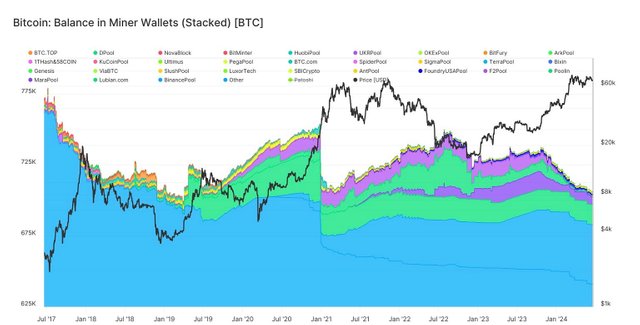

According to Glassnode data, the BTC balance in Bitcoin miners' wallets has continued to decrease by 30,000 since October 2023, and the current total is about 1.8 million.

The reason is speculated to be that after the halving of Bitcoin, the operating costs of mining companies have increased, and they need to sell Bitcoin to obtain operating funds or purchase new equipment to improve their mining capabilities; on the other hand, smaller mining companies may have been unable to continue, and can only sell Bitcoin for profit and close their mining business.

In addition, Coinglass data also showed that Bitcoin's 30-day average volatility has dropped to 1.25%, setting a record low since 2024.

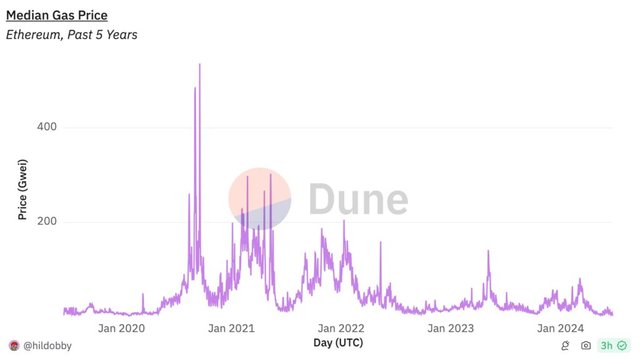

Ethereum Gas Fee Hit a Four-Year Low

On the other hand, Ethereum Gas Fee also fell below 3gwei over the weekend, hitting its lowest level since 2020. In addition to the reduced ecological activity, after the Dencun upgrade in mid-March, which brought "blobs" to Ethereum and reduced the cost of transactions on the Layer 2 network, the median price of Gas Fee has steadily declined.

The lower gas fee also caused the destruction rate of Ethereum to drop to the lowest point in 12 months. According to Ultrasound.money data, due to the low burning rate, Ethereum currently has slight inflation, and the average supply growth rate in the past 7 days is 0.56%/year. (But in the longer term, it is still deflation, which needs more time to observe)

The options market says there will be a turnaround in the second half of this year?

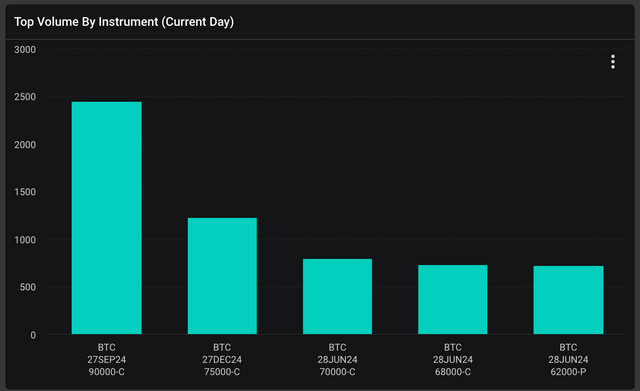

When will the sluggish market turn around? Digital asset trading company QCP Capital also published an article over the weekend to share its views. QCP Capital said that in the options market, they observed that call options expiring within 1 month were sold in large quantities, but call options from September to December were bought in large quantities.

This shows that the market expects little price change in the short term, but there may be potential for a sharp rise before the end of the year. In other words, the market will consolidate in the summer, and the market is expected to explode during the US election.

On the other hand, due to the expectation that the ETH spot ETF will be launched soon, ETH's implied volatility is 18% higher than BTC, indicating that investors are more bullish on ETH.

According to data from options trading platform Deribit, the Bitcoin call option with a strike price of $90,000 expiring on September 27 and a strike price of $75,000 expiring on December 27 are the top two Bitcoin call options in terms of trading volume, indicating that the market highly expects Bitcoin prices to hit new highs in the fourth quarter of this year.