Think Economics – Part 1 – Interest Rates

Interest Rates

What are interest rates? Lenders sell money in the form of loans. When they do this, there is a charge for this money, the cost of it. Interest rates indicate the value of the revenue that is being sold and is heavily influenced by risk and scarcity.

We’re going to start with this by looking at it at a very basic level. When we jump into interest rates it’s a broad subject in the financial world. There are rates that apply to banks that participate in overnight trading, and there are rates that apply to your average individual marketplace consumer. There are other factors that can influence interest rates, such as alternative interest rates, credit scores, and other elements.

For the sake of this exercise, we are going to ignore all of those elements (we will get into them later on in the article) and focus on how interest rates work from a fundamental level.

Please understand, this scenario is watered down a bit. The purpose is to show what the fundamental nature of interest rates serve to communicate to a consumer, and how government intervention of those rates muddles market signals to consumers.

A credit supply is the amount of money that a bank has available to borrowers. When a bank has a higher amount of revenue, it has a higher amount of credit supply to offer borrowers. This will naturally decrease the interest rate. And as we’ve now covered, the opposite is the case when the revenue available is lower.

Understanding Overnight Lending Interest Rates

As we dive into this topic, it’s important to outline some rates, and the part they play :

- The Federal Discount Rate: This is set by the fed, and it’s the rate that the government lends to banks and financial institutions that need to lend money to prevent their financial reserves from dipping below the legal minimum threshold. When the discount rate moves, the prime rate will move with it.

- The Prime Rate: This is the rate that’s offered by corporate banks to their least-risky customers. The prime rate is always in lockstep with the discount rate and will adjust accordingly in reflection. If the discount rate goes up, as does the prime rate. This rate is the benchmark for most credit lines offered by commercial banks. (There is also a secondary, and seasonal rate offered to higher risk customers.)

- Federal Funds Rate: This is the rate for banks that borrow from one another, in situations like that of the discount rate. The Federal Reserve does not set the Federal Funds Rate, but they do set a “target rate.” By setting a target rate, the Federal Reserve can then control the range of the rate by creating more or less money (buying or selling government bonds.) If the federal rate is low, banks will be more likely to borrow among themselves, using reserves to offer a larger volume of loans. If the fed raises the target rate, this slows things down a bit as banks will stop loaning among themselves, and will issue less new loans.

How does this affect you?

Let’s put it into the perspective of how that affects the individual, let’s think of it as an interest rate on a monthly payment for a credit card. Commercial banks will normally add an amount they decide to their credit lines per individual, this is based on an individual credit score. For this exercise, we’ll say that’s 6 percentage points.

Discount Rate (This is the bank’s interest rate for borrowing): 1%

Prime Rate (This is the bank’s interest rate for lending): 5%

Bank Credit Rate to the consumer: 6%

Consumer Pays: 11% interest

If the Federal Reserve raises the discount rate, the banks will raise the prime rate to compensate for the difference.

Discount Rate: 2%

Prime Rate: 6%

Bank Credit Rate to the consumer: 6%

Consumer Pays: 12% interest

The discount rate is not appended to the consumer interest rate, as it’s the rate that the bank pays to borrow money during overnight lending.

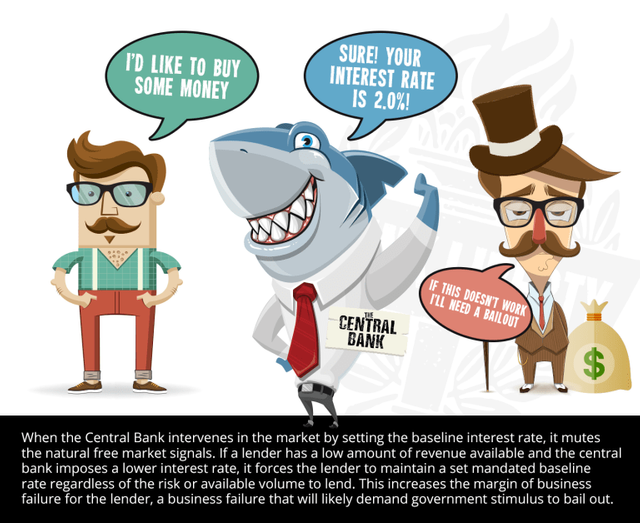

Knowing what we know about the nature of interest rates and the purpose they serve in the economy, let’s take the same approach and look at how the central bank influencing interest rates throws that process off.

What is overnight lending?

Banks have a legally set minimum amount of funds they are required to have in reserve. This minimum required reserve percentage is viewed as one of the most powerful financial tools the Federal Reserve has, because of that it rarely changes. At the end of every business day, depending on consumer activity such as; lending, deposits, withdrawals, they can experience a surplus or a shortage. Banks experiencing surplus lend overnight to banks experiencing shortages. This overnight lending is either done between banks, at the federal fund’s rate, or through the federal reserve using the federal discount rate.

Intervention from the federal reserve

The federal reserve will set the federal discount rate to accelerate or slow down economic activity. If the federal reserve makes it easier for a bank to buy money, the bank will buy more money to have a higher availability of credit to lend to borrowers. This surplus of available credit will lead to a lower interest rate to the consumer.

What’s bothersome about this approach to a free market supporter is this puts the entire economy in a reactive position and limits market opportunities. It’s a crafted plan from a central entity and interest rates are a tool used to control the economy and limit its ability to organically and freely grow. When you consider that the federal reserve has the power to create revenue, the power to control the interest rates which ultimately lead to control of the market direction as a whole – you can begin to see how the potential of a recession or downturn becomes far more relevant.

Individuals and businesses base their futures, and business plans off large purchases and investments. Interest rates reflect the health of the economy, which in turn reflects the risk of investment to the borrower. If the interest rates are high and the individual or business is in no dire need to make a large investment, then it is natural to wait until the interest rates are lower. When different agents and groups make financial decisions based on market signals like interest rates, and those interest rates do not reflect the actual health of the economy, but rather what the centrally controlling agency would like the health to be – the margin of possibility for financial irresponsibility leading to financial failures expand.

Read this article on our website

Check out Think Liberty all across the web:

Think Liberty Website

Minds

Facebook

Twitter

Podcasts on Soundcloud

I think this article needs a major correction: borrowers do not buy money, they rent it. The interest rate is cost of this rental. This is different from wages because the employee retains no rights to the work he has done, unless specifically provided otherwise. Then, wages are a part of total compensation.

This is meant to express the Austrian viewpoint of how interst rates work in the borrowing/lending sense.

I suppose that’s fair as far as “renting” however, the wage bit is a little odd, as this isn’t discussing wages and workplace relationships, rather borrowing.

I prefer the Austrian explanation because the interest rate is determined by supply and demand like everything else. I wish I had time to write about it for a high quality econ journal.

You just planted 0.03 tree(s)!

Thanks to @rufusfirefly

We have planted already 3275.33 trees

out of 1,000,000

Let's save and restore Abongphen Highland Forest

in Cameroonian village Kedjom-Keku!

Plant trees with @treeplanter and get paid for it!

My Steem Power = 19480.03

Thanks a lot!

@martin.mikes coordinator of @kedjom-keku