Charlie Lee (Litecoin) chats about fungibility and the Lightning Network

Today Adel de Meyer of The Crypto Collectors interviewed Charlie Lee a.k.a SatoshiLite. She talks with important people in blockchain, the chats can be found via the Blockhainchat hashtag on Twitter. She started with John McAfee and Sarah Austin will be next. I decided to follow Sarah Austin on Twitter and am looking forward to the Q&A on the 24th. If you guys are interested I might cover it. Let's focus on today's interview.

Q1: Do you believe in a solid future for cryptocurrency? What is the biggest challenge you feel we should overcome first?

(Source)

Q2: Do you believe government involvement in cryptocurrency is a good/bad thing and why?

(Source)

Q3: What are some of the developmental roadblocks (top 2) that need to be tackled before the widespread of LightningNetwork?

(Source)

Q4: What is your opinion on anonymity? You mentioned working on confidential transactions for LTC soon, something similar to Monero?

(Source)

Q5: Five years from now, you believe cryptocurrency will have taken over. What will everyday life look like as far as purchasing power?

(Source)

Q6: What is the first altcoin you bought, when and why?

(Source)

Q7: What's your number one piece of advice for the #crypto investors?

(Source)

A1:The biggest challenge is making it easy to use for the average person. Right now, we are in the early stages, so a lot of work to make things easy to use. In the future, people don't need to know that they are using cryptocurrency when sending money.

Source

A2:I think it's good. Cryptocurrency needs to be integrated with the current financial systems. So you can't not have the government involved. It's important for us to work with the regulators to make it easy for people to access cryptocurrencies. Just don't ban it!

(Source)

A3: LN needs to be easy to use. Channel opening/closing/splitting needs to be automated and behind the scenes. And routing needs to be flushed out and seamless. Once we have those 2, users can just easily pay with LN without even realizing it's LN and not on-chain.

(Source)

A4:I think of it as fungibility as oppose to anonymity. Fungibility is important for good money, and is one of the missing features from Bitcoin/Litecoin. It's definitely something that I want to add to Litecoin eventually. Something like Confidential Transaction.

(Source)

A5:I think it may take longer than 5 years. My guess is that in 20 years, the vast majority of people will be using cryptocurrencies in their daily lives. And some without even knowing that they are. People will then understand what freedom of money is all about!

(Source)

A6: It's either Namecoin or Ixcoin. I know at one point I also held some Solidcoins. This was mid 2011. Altcoins became a thing in 2011. Then I decided that these coins all suck, so I created Litecoin. Lol

(Source)

A7: Two advices:

- Only buy BTC and LTC.

- Don't invest more than you are willing to lose.

Follow those 2 and you can't go wrong. 😀

(Source)

Things I like most from this interview:

- make crypto easy to use

- play nice with regulators

- fungibility must be introduced

About that last one, Wikipedia explains fungibility with a diamond example:

Diamonds are not perfectly fungible because their varying cuts, colors, grades, and sizes. In contrast to diamonds, gold coins of the same grade and weight are fungible as well as liquid.

Some gold coins are more valuable, because they are scarce and coveted. But they're all always at least as valuable as their gold content. Maybe calling Litecoin 'digital silver' and Bitcoin 'digital gold' is ignoring their non-fungibility. Like diamonds, not all coins are created equal. Recently blockchain tech was introduced by De Beers Group to keep track of diamonds. If everyone follows suit, blood diamonds could become less valuable and non-tradable. Surely, that's a good thing. But similar problems exist for most cryptocurrencies. Governments are already actively tracking and blacklisting addresses and the coins associated with it. You can search OFAC's list here. Coindesk:

Kiss fungibility goodbye. Expect a premium on freshly minted coins, or traced "clean" coins on the market provided they come from a "clean" miner. This may cause a bifurcation in price between what was otherwise a functionally clean asset, and a "dirty" coin that has passed through a listed address. We may even see a trifurcation, as "grey" tumbled or mixed coins reside somewhere in the middle.

Trading on exchanges with IOUs and exchanging for fiat could become a necessity, or the only sure bet. What does this mean for decentralised exchanges? Are they still viable, while carrying the risk of tainting your coins? What about merchants? Do they need to install software that rejects coins associated with blacklisted addresses? Seems terribly inconvenient. I found a grant proposal, for researching the fungibility problem:

In the case of Bitcoin, a given unit of bitcoin is not identical to another unit because each possesses its own peculiar history as revealed in the blockchain. This history may show, for instance, that a given coin was once stolen from an exchange. This stain, or taint, could impact that unit's purchasing power. By hiding each coin's history, technologies used in cryptocurrencies such as Zcash restore physical fungibility—the structure of each unit is made identical. But even if cryptocurrency units can never be rendered exactly alike, there are also institutional ways to create legal fungibility—enforcing the same purchasing power across what are otherwise easily distinguishable units.

Those are interesting points and I will keep track of this. Non-fungibility can be a good thing though. Crypto collectables come to mind and I wouldn't mind receiving some Litecoin formerly owned by Charlie Lee. Send me some, SatoshiLite ;-). I don't own a Litecoin adress right now, but will make one to receive it... There are projects like Euro Bill Tracker and Where's George that trace bills. This doesn't influence their fungibility, because banks and governments treat them equal. Dollar bills that become tainted by dye packs lose their fungibility. But I'm almost certain a bank will refund money to trustworthy merchants when they give them the dyed notes back. Banks print and mint. But there is no central authority for most cryptocurrencies and the bulk of them are mined. You cannot freely mine someone a new coin. So a tainted coin is a form of capital destruction. Like burning coins, it can add value to the other coins. But is this fair to the owner?

Clearly the problem is not with blockchain tech, but with government enforcement. If you can proof you acquired your cryptocurrencies via legal means and at market price, you should be able to get rid of the taint. Can't we automate this? Coins bought from a trusted source should be automatically whitelisted. Cash is being used for criminal activity, but the government doesn't blacklist cash. 90% of US banknotes contain trace amounts of cocaine:

Money can be contaminated with cocaine during drug deals or if a user snorts with a bill. But not all bills are involved in drug use; they can get contaminated inside currency-counting machines at the bank. When the machine gets contaminated, it transfers the cocaine to the other bank notes," Zuo said. These bills have fewer remnants of cocaine. Some of the dollars in his experiment had .006 micrograms, which is several thousands of times smaller than a single grain of sand.

The government isn't burning all this money, right. The taint level should also give them an idea of how closely the banknote was associated with illicit activities. Blockchain tech allows for tracking the level of taint. Not every coin that travelled through an address should be considered part of illicit behaviour. Nor should everyone owning a tainted coin, become a suspect. Guilty till proven otherwise is not how the law should work. Even if certain banknotes are associated with drug users and dealers, the government still doesn't actively destroy it. You would be able to exchange them. When they do burn worn-out cash, new money is created.

What happens when you find out you have tainted coins? You can already appeal. In a perfect world you will succeed, but for now non-fungibility seems a threat to widespread adoption of cryptocurrencies. Clearly a clean coin is more valuable than one requiring appeals to get whitelisted. While bifurcation can be interesting for miners, it heightens risks for people that already own and trade cryptocurrencies. You wouldn't want to be the one left holding a coin that is tainted.

Hard forks might offer a solution... This doesn't stop governments from blacklisting the addresses that receive new coins from stained crypto. Maybe not if confidential transactions are introduced, which Charlie mentioned. Governments are probably not too keen on this and pushback can be expected, especially if it enables laundering blacklisted coins.

We could introduce another solution. What if governments allowed banks to hold these tainted coins for their owners and do research according to government guidelines. I'm thinking along the lines of Know Your Customer. Blockchain should ease this process, it already does for diamonds. After the audit the bank would (digitally) print the equal amount in fiat, deduct their fee, buy stablecoins with the rest of it and send this to the owners. Then the bank would do a proof of burn for the tainted cryptocurrencies. The next time the bank creates money, it deducts the fiat they created during the crypto exchange. It's a radical idea and I hope something like this will come to fruition, fee-less would be even better. Whatever solution we agree on... Honest people shouldn't lose their capital, because malicious actors in the past used addresses their coin passed through.Charlie Lee said (with a smiley) we should invest in LTC. So what do others think of that buying advise?

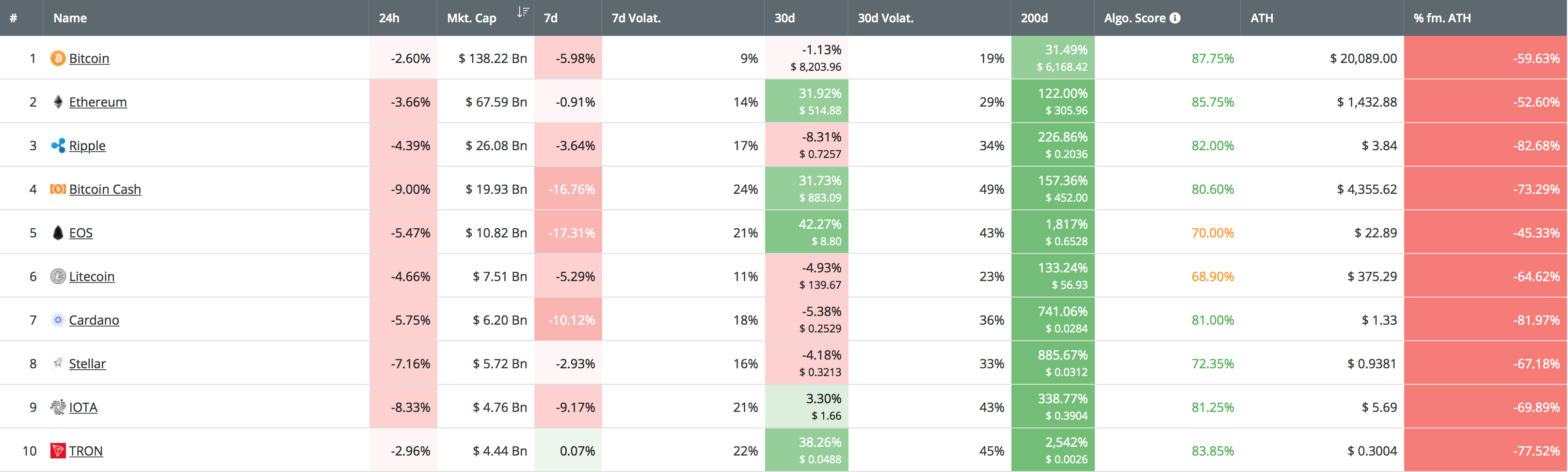

Weiss rating only gives Litecoin a C+

Litecoin (C+), the 1st successful altcoin, has excellent adoption, but our ratings model says its first gen technology is only marginally different from Bitcoin’s.

China rated it 21st, compared to Bitcoin Cash 25th, Bitcoin 13th and Ethereum 1st.

Source

Coin Checkup gives it the worst algorithm score (only 68,90%) of the top 10 coins by marketcap.

Source

Wallet Investor sees a lot more potential

Historical index: A+

LTC is an awesome long-term (1-year) investment*.

Google Trends reports more interest in Litecoin (66), than Bitcoin Cash (38) for the last 30 days. Source

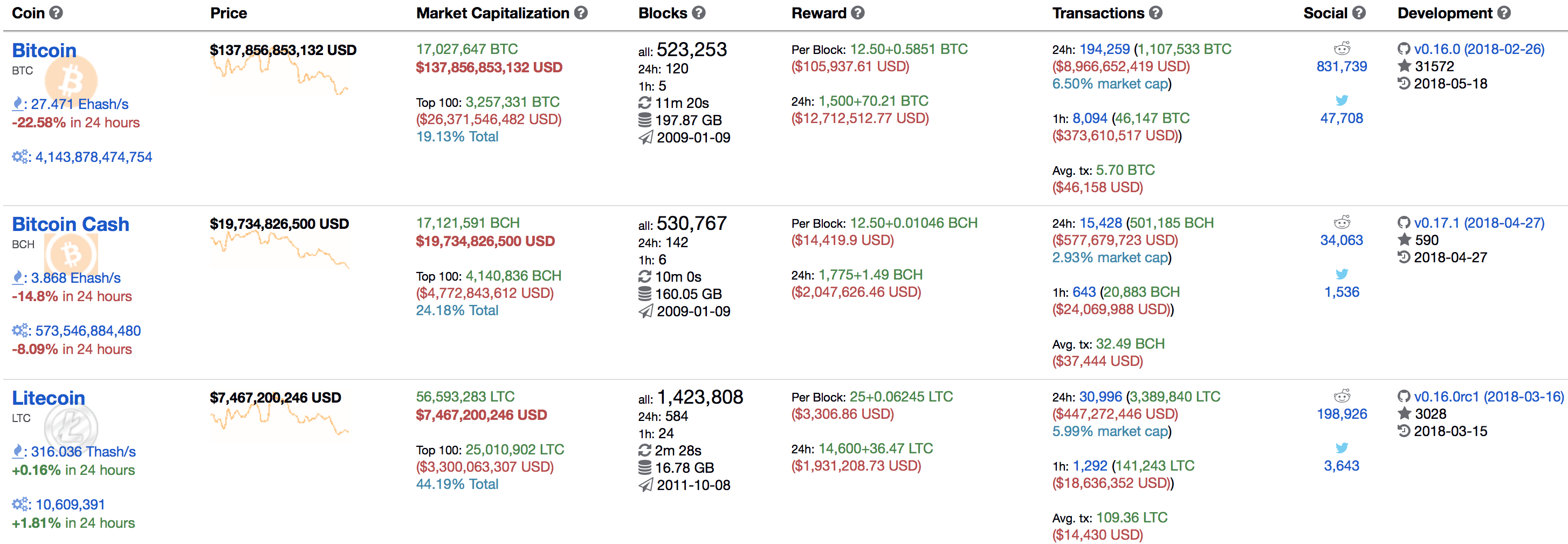

Bitinfo Charts shows transaction volume is nowhere near BTC, but outperforms Bitcoin Cash by a factor of two. I wrote about BCH before: Does Bitcoin Cash even have a scalability problem to solve? Warning to investors from Weiss Ratings. Litecoin performs extremely well on social media. On Reddit it scores 6 times higher than BCH and 4 times lower than Bitcoin. Another important measurement is development, on Github they score 5 times higher than Bitcoin Cash and 10 times lower than BTC. Which is still good when you divide it by market cap.

Source

Median Transaction Value is almost equal to Bitcoin cash and when you compare it to Bitcoin it's clear Litecoin is being used for smaller transactions. But BTC might become more usable for such transactions, because of the Lightning Protocol. Charlie Lee has a positive view:

Today, Bitcoin is packed full of cars and Litecoin is empty. Even with Bitcoin packed, the cars are not coming to use the Litecoin highway today because it’s not connected and it’s inconvenient (centralized exchanges and slow on-chain transfers) to go across. LN will build bridges over the highways. But a side benefit is that these bridges will connect both highways together. Maybe the bridges on Bitcoin are enough such that cars will still stay on the Bitcoin highway. My bet is that the convenience and the cheaper tolls on Litecoin highway will convince cars to cross over and use Litecoin. But we won’t know until both are built.

What Charlie is talking about is known as an Atomic Swap. The first of these swaps required people to download the whole blockchain of each coin they wanted to swap (source), which is impractical. But Blocknet and Komodo are providing solutions. To learn more, read: Atomic Swaps & Etomic Swaps, Explained in Plain English,

I think SatoshiLite might be right, Litecoin (and probably Bitcoin Cash) have a place. On a personal note, I appreciate Charlie Lee. He seems like someone that is willing to grow Litecoin organically, without overpromising or attacking the original. No Bitcoin Core shenanigans here... Maybe it's not the best performing coin. But... Litecoin exists since 2011 and with their progressive and positive attitude I expect it to stay relevant for quite some time. Certainly if they manage to help find a fix for the fungibility problem.

GIF sources:

Fire gif

Litecoin gif

Atomic Swap gif

Disclaimer: I'm not a professional trader, just interested in cryptocurrencies and I like showing people what information is out there if you want to trade. Cryptocurrencies are highly volatile, so it's wise to only invest money you can afford to lose.

Follow me @bullhashbear

Thanks so much for the amazing write up here about our interview and diving deeper into Charlie's insights, some facts and giving such a constructive opinion about it all. I thoroughly enjoyed reading your piece!

Wow, thanks. I really enjoyed your interview.

For people reading this comment, Adel bundled the interview with Charlie Lee: #BlockchainChat Interview with Charlie Lee, Founder of #Litecoin

Here's the one with John McAfee: #BlockchainChat Launch with John McAfee

Her past and future Twitter Moments can be found via: AdeldMeyer/moments