The $98 trillion reason to be worried about 2018

Interesting Bloomberg article published today and written by Mark Gilbert and Marcus Ashworth:

As 2017 enters its final month, here are 12 charts to illustrate what a year it's been in markets. Far be it from us to be party-poopers; but let's just say what we see makes us slightly nervous about 2018. The total value of companies listed on the world's stock markets as of Friday's close was $98,750,067,000,000 -- within touching distance of $100 trillion for the first time.

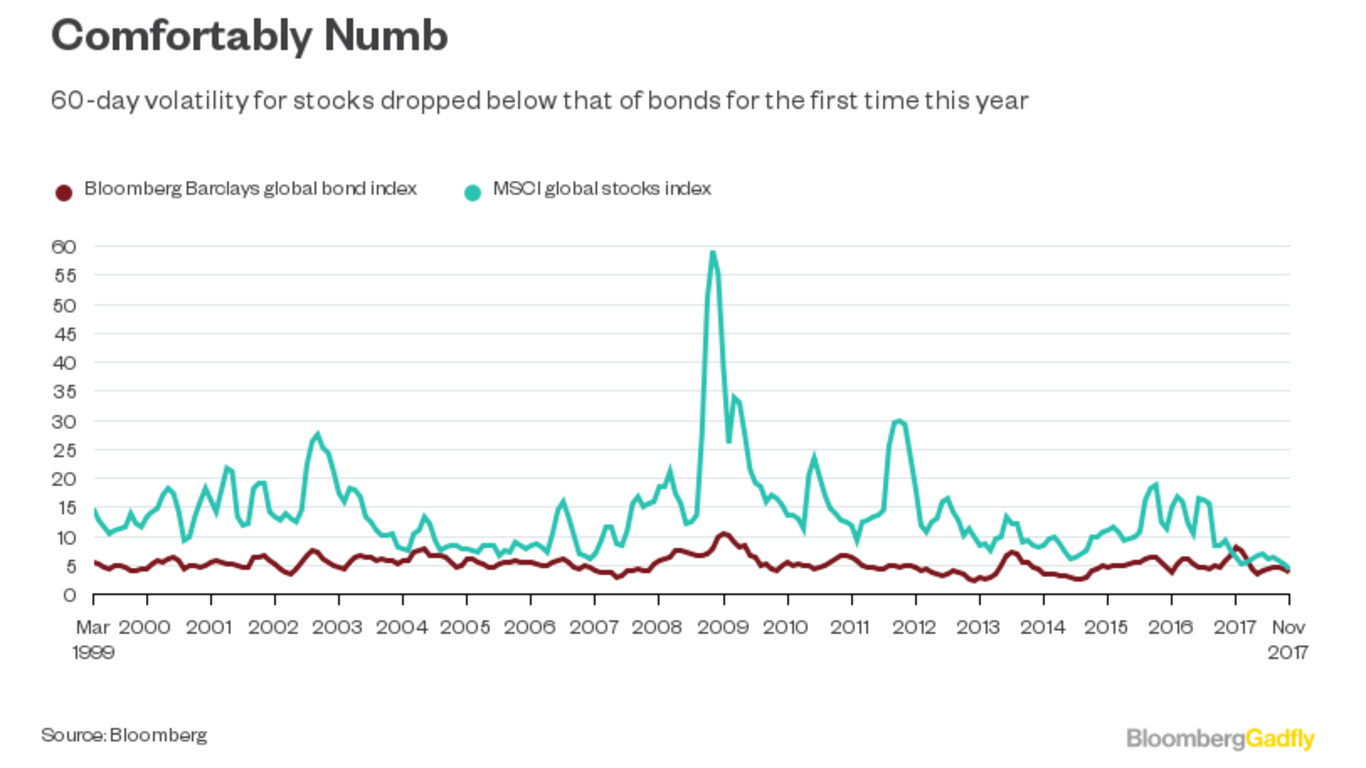

That surge in equity values has been accompanied by a drop in price swings. As our Bloomberg News colleague Wes Goodman pointed out last week, equity market volatility has dropped below that of bonds for the first time ever this year.

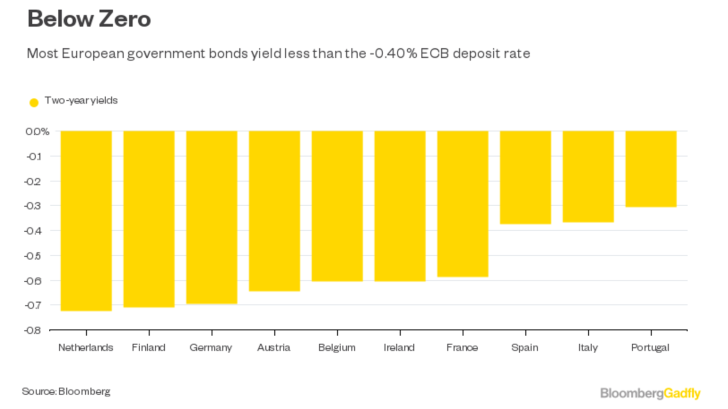

Pockets of the bond market also look troublesomely bubble-like. Two-year euro zone government bonds have raced below zero this year: most governments can borrow at an even lower cost than the European Central Bank's deposit rate.

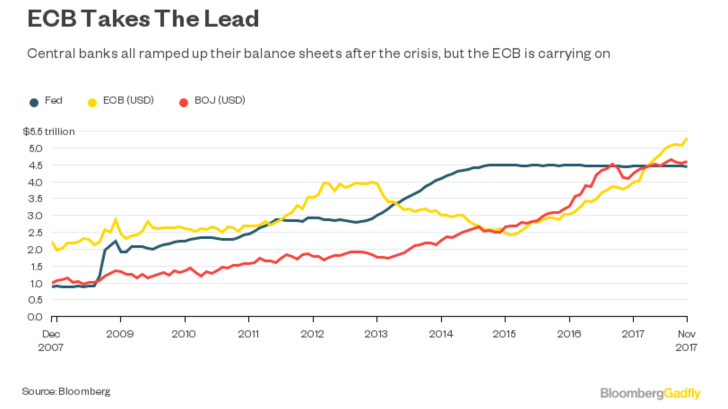

Yields are being driven lower as the ECB continues to expand its balance sheet by buying bonds.

In the U.S. Treasury market, the flattening of the yield curve is worrying some bond investors, including billionaire fund manager Bill Gross.

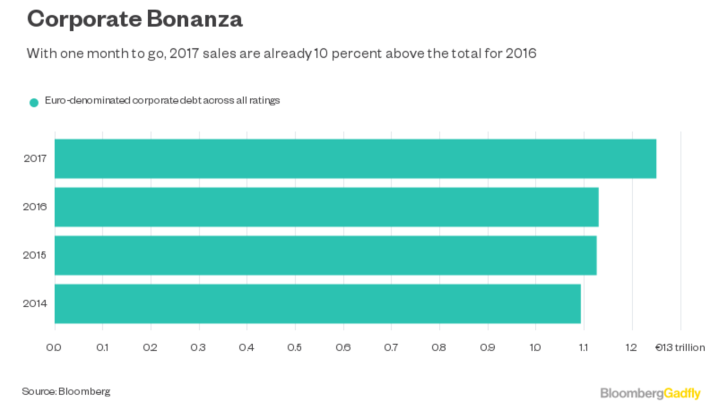

With government paper offering such meager returns, money has been flowing into corporate bonds. European investment-grade bond funds have taken in cash for 45 consecutive weeks, according to analysts at Bank of America Merrill Lynch. Inflows are poised to set a record for the year.

Sales of new corporate debt denominated in euros are also setting records this year.

Spreads on non-investment grade European debt briefly dipped below U.S. 10-year Treasury yields in August. As investors clamor to buy the bonds, their yields are making the moniker "high yield" increasingly unsuitable.

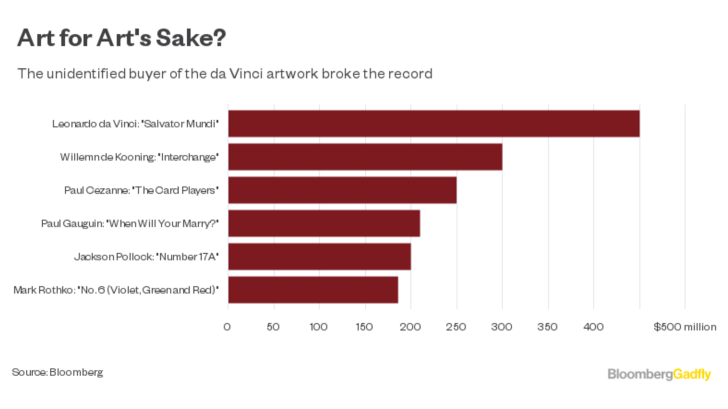

Last month saw the record for the highest price paid for a work of art obliterated by an unidentified buyer who bid $450.3 million for Leonardo da Vinci's "Salvator Mundi" at a Christie's auction -- compared with its pre-sale estimate of $100 million.

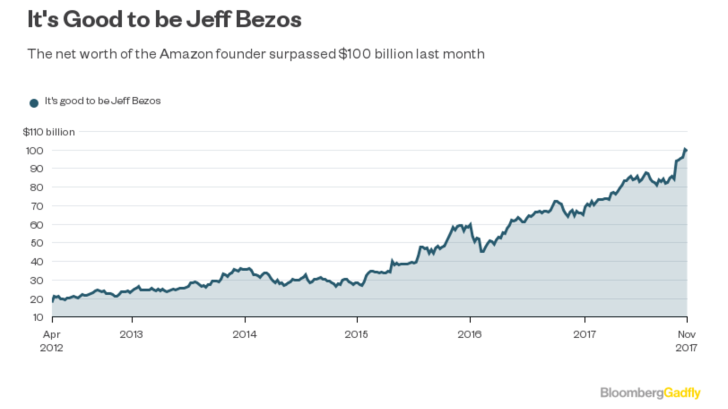

This year's more than 55 percent rise in Amazon.com Inc.'s share price has been particularly good for its founder and CEO Jeff Bezos. He's only the second executive ever to top the magic $100 billion mark, according to Robert LaFranco, who runs the Bloomberg Billionaires team; Microsoft Corp. founder Bill Gates reached that milestone in 1999.

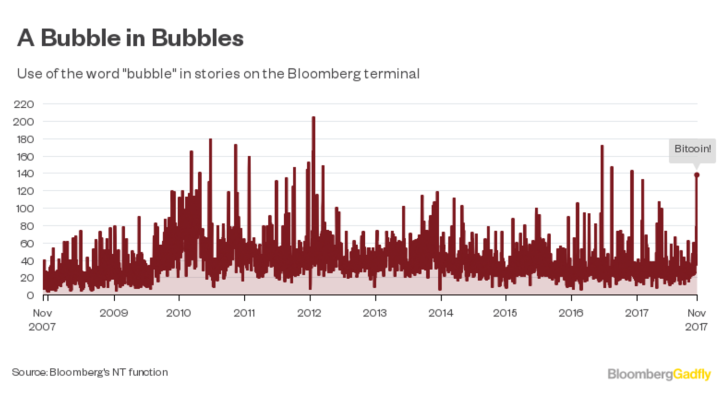

And then there's the bubbliest market of them all: Bitcoin. The price of the virtual currency recently crossed $10,000 for the first time.

Despite that move, the number of times the term "bubble" has appeared in news articles is still below previous peaks. Still feeling comfortable about 2018?

I believe the article makes a quite compelling case that 2018 will be a year to watch very closely.

What do You guys think?