Meme trading changed investing

Are investors still interested in meme stocks like AMC and Gamestop?

Fuelled by market volatility, a plethora of cheap trading apps and a social media frenzy, a new generation of DIY investors has emerged from the pandemic.

It came to a head in January when Reddit thread r/wallstreetbets sent shares in so-called meme stocks flying.

Whether a battle between small investors and Wall Street or a get-rich-quick scheme for others, it captured the imaginations of thousands of young investors.

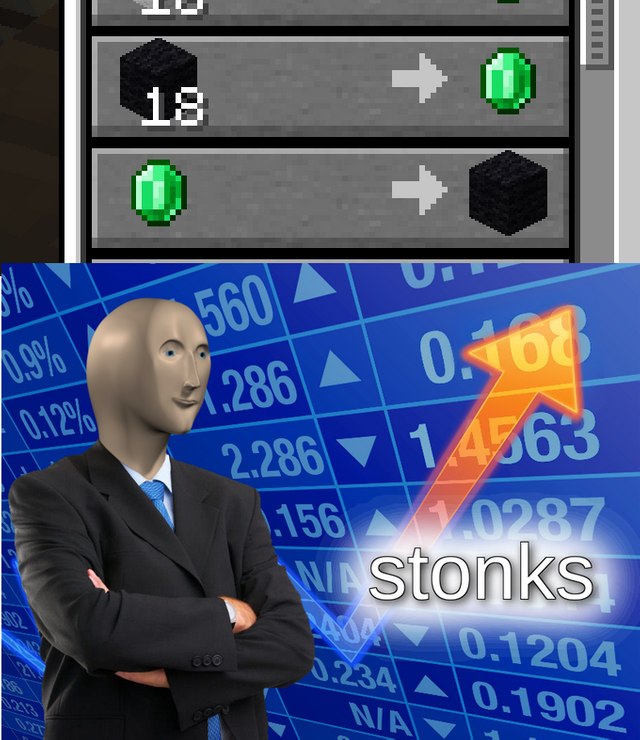

The popularity of Gamestop, which sells shrink-wrapped video games, had dwindled in recent years as consumers move online.

Last autumn, activist investor Ryan Cohen stepped in to help revive the company but other investors and hedge funds were unconvinced. They took out short positions against the retailer.

In January, Cohen joined the Gamestop board which helped to boost its share price from $19.95 to $39.12 in just 9 days.

An army of novice Reddit traders then flocked to Gamestop lifting its share price to nearly $350 after Elon Musk's 'Gamestonk' tweet.

Attention then turned to other stocks that had fallen out of favor, like cinema chain AMC Entertainment and even Nokia at one point.

Investors are still backing meme stocks

Now the dust has settled, it seems those who bought at the peak in mid-January are nursing losses.

Gamestop is trading down nearly 50 percent from its January highs, although it has soared 880 percent in the year-to-date.

This volatility means that in the worst-case scenario, Gamestop investors could have lost over two-thirds of the value of their investment in a month.

Analysis by Boring Money reveals a £10,000 shareholding would have been worth just £3,129.

In the best possible scenario, an investor could see a £10,000 investment soar to £168,744 if they'd bought a month before the price surge and then sold at its peak.

At the time, many experts warned the Gamestop saga would end in tears for the majority of investors.

But the pull of meme stocks is understandable in the current economic environment.

'The allure of investments tipped to "go to the moon and back" is strengthened at a time where banks and building societies offer a pittance on cash savings amid the persisting record low-interest-rate environment,' says Interactive Investor's Myron Jobson.

Some investors are still banking on meme stocks: the r/wallstreetbets has switched its focus to cannabis stocks in recent months but Gamestop and AMC remain popular choices.

'As retail stores and cinema chains open up again, AMC Entertainment and Gamestop have been partly in demand with investors more confident about their longer-term prospects,' Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown said.

'There also appears to be a hangover from the revenge saga which played out earlier in the year when Gamestop was one of the targets of an army of retail investors.

Both companies are still in the top 10 of most popular shares trading by Hargreaves Lansdown clients in June and July.

AMC was the most popular overseas share to hold over the past two months, with Gamestop in second place.

However the number of net buys has also fallen over the past month, with net buys of Gamestop shares falling by around 70 percent by 19 July since a peak in early June, and net buys of AMC shares also fell 77 percent.

Gamestop and AMC face an uphill battle

Some investors may well be keen to hold their positions in Gamestop and AMC as the economy starts to reopen.

Gamestop's revenue in the first quarter exceeded expectations and as of 1 May, it said it had paid off its long-term debt, but it has lost money in 3 of the 4 last quarters.

'The biggest issue would-be investors need to consider is whether Gamestop's turnaround plan gives the business a shelf life beyond the next few years.

'Embracing an online marketplace will only take it so far,' Danni Hewson, financial analyst at AJ Bell says.

'Gamers are increasingly choosing to download content and we've already heard from streaming giants like Netflix that this is the arena where the next big tussle for subscribers will take place. Will Gamestop still have a place as the sector evolves or will it get lost in the tussle?'

AMC has taken a beating in the pandemic but it is widely expected to claw back some of these losses as restrictions ease and confidence returns.

'The clock is ticking on all that debt ($5.4bn and $4.9bn in lease liabilities) and some costs that had been put on the back burner, like deferred rent payments will come due very quickly. Its current valuation makes little sense even if it does return to its glory days,' Hewson says.

Like Gamestop, it is battling a changing landscape as people stream films from the comfort of their own homes.

'Realistically AMC needs to evolve and expand, to take advantage of competitors that fall by the wayside and snap up property on the cheap, but that will take faith and a whole load more cash and it seems investors may not have the appetite for any more risk.'

Lessons learned

The allure of Gamestop and AMC, and perhaps meme stocks, seems to be drifting, but the online investment communities and trading apps are not going anywhere.

'The cat is out of the social media bag as far as the financial markets are concerned and the influencer trend and investment chatter in internet forums is unlikely to wane,' Streeter says.

'Although in many ways it is encouraging that it's sparking an interest in investing among younger people, there is the danger that if first-time investors get their fingers burnt by investing in very risky stocks, they may walk away from the stock market and not return for a long time.'

Max Rothery of the online financial community Finimize strikes a more optimistic tone: 'The most exciting thing is we're seeing evidence that these viral moments can lead to good investment habits. If new investors continue to learn together then this could be the smartest generation of investors yet.'

For the people whose first exposure to investment was the Gamestop frenzy, it may well have taught them a lesson.

Trading platform eToro reveals investors in the UK have more balanced portfolios, holding equities (64 percent), bonds (46 percent), and cash (43 percent).

By contrast, just 13 percent of their retail customers invest in meme stocks.

Finimize member David Middleton says the meme stock saga prompted him to look closer at his investments moving forward.

'The Gamestop rollercoaster made me realize how much share prices can be influenced by sentiment and has made me focus on creating my own valuation and investment criteria, as well as making sure I'm well-diversified.'

Robinhood CEO on the meme stock craze: 'I think it's a real thing'

Robinhood's Vlad Tenev said retail clients who invest in so-called meme stocks give embattled companies access to the capital they otherwise wouldn't have.

The millennial-favored stock trading app found itself in the middle of a firestorm in January amid the short squeeze in GameStop.

Robinhood CEO Vlad Tenev on the rise of meme stocks: It's a real thing

Robinhood CEO and co-founder Vlad Tenev on Thursday defended retail clients who invest in so-called meme stocks, saying the phenomenon gives embattled companies access to the capital they otherwise wouldn't have.

"I think it's a real thing. There are customers that love these companies, they want them to thrive," Tenev told CNBC's Andrew Ross Sorkin on Thursday ahead of the stock trading app's Nasdaq debut. "You're seeing [meme stocks] also get resources that allow them to hire really good management teams, in some cases, and then build for the future."

Robinhood helped draw unprecedented levels of new, younger traders to the stock market during the pandemic. That surge has continued into 2021, marked by frenzied trading around meme stocks.

The millennial-favored stock trading app found itself in the middle of a firestorm in January amid the short squeeze in GameStop, which was partially fueled by Reddit-driven retail investors.

"I think what's interesting with what we've seen in retail investing over the past year is that a lot of these companies have been hit hard by the pandemic," Tenev said." "It started with some of the airlines and then followed with some of the retailers, some movie chains, and brick and mortar. You have the institutions that are basically writing these companies off and then retail investors coming in and keeping them up and supporting them."

At the height of the meme stock surge, Robinhood restricted trading of certain securities due to increased capital requirements from clearinghouses. Robinhood raised more than $3.4 billion in a few days to shore up its balance sheet.

"I don't know if people have understood the ramifications of what high retail participation in the markets means but I think fundamentally it's a very good thing," added Tenev.

Trouble selling shares

Robinhood, which is expected to start trading Thursday under ticker HOOD, sold shares in its IPO at $38 apiece — the low end of the $38 and $42 range — valuing the company at about $32 billion. The online brokerage sold 52.4 million shares, raising close to $2 billion.

It was not until roughly 9 a.m. ET that Robinhood and its underwriters were finished allocating its IPO shares, an unusual circumstance for a syndicate at that point in the process. Goldman Sachs and JPMorgan Chase are the lead investment banks on the deal.

An institutional source said, "They're begging us to take Robinhood shares," CNBC's David Faber said on "Squawk on the Street" before Thursday opening bell. "And I said 'what do they got left?' and he said 'lots,'" Faber added.

Robinhood — which planned to allocate 20% to 35% of its IPO shares to its retail clients — was reportedly sending messages late Wednesday to those retail investors about buying shares, according to CNBC's Leslie Picker.

"Mad Money" host Jim Cramer said Robinhood's IPO is a "must-work deal."

"I think the retail sentiment is on the line because these are people who want very much to make money and don't really understand the process because the process is pretty arcane," Cramer said.

Robinhood is a five-time CNBC Disruptor 50 company and topped this year's list. Sign up for our weekly, original newsletter that offers a closer look at CNBC Disruptor 50 companies like Robinhood, before they go public.