METAVAULT. TRADE — USEFUL PROJECTS FOR OLD AND NEW INVESTORS AROUND THE WORLD.

Introduce

When we want to invest or spend a lot of money in something, we all have high demands on quality and end result. To achieve good results, management must be very tight and always under our control. If you are an e-marketer or your work is related to the e-market, then I am sure you have a good understanding of the transparency and clarity of blockchain.

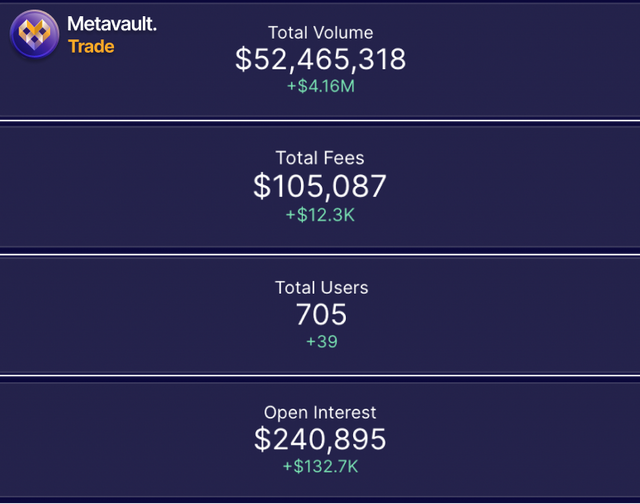

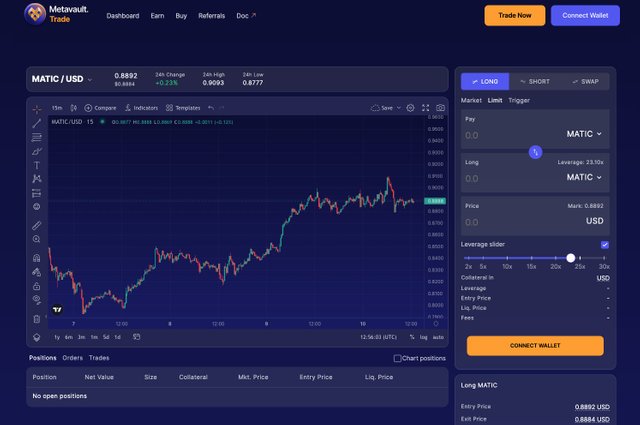

Metavault Trade is a decentralized spot and perpetual exchange with low swap fees and priceless trading. Multi-asset pools and liquidity providers support trading.

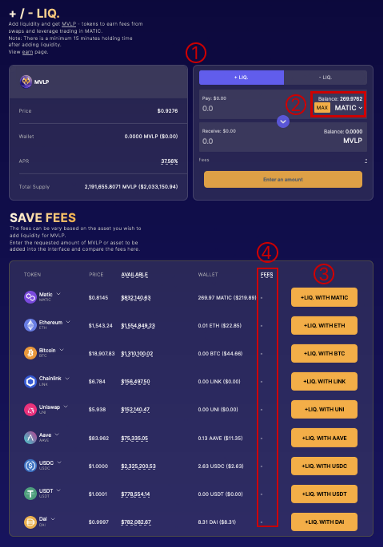

Multi-asset pools and liquidity providers support trading. Liquidity providers are rewarded through swap fees, market making, rebalancing and leveraged trading. MVX uses Chainlink value and TWAP price from a large number of decentralized exchanges for dynamic pricing.

Der Multi-Asset-Pool

A major innovation at the heart of GMX and now Metavault.Trade is multi-asset integration. All assets supported by the platform are pooled together, and a token called MVLP represents an index of these tokens. The price of the MVLP fluctuates based on the price of the underlying assets in the basket and the trader's profit and loss (PnL) - if they lose their trade, their losses will be dumped into the MVLP.

How does this shared liquidity cause swaps to have adverse effects? For example, suppose an asset pool is equally divided among five assets (BTC, ETH, MATIC, USDC, and DAI) in USD value: 20% per asset. If a trader wants to buy 50% of the BTC supply with USDC, they can buy it immediately without affecting the price. After placing the order, the status of the mining pool simply changes to BTC: 10%, USDC: 30%, and the rest remain unchanged. To understand what makes this feature unique, I recommend using an order book or a DEX like Uniswap to test the price impact of very large orders on CEX!

At launch, Polygon-backed assets will be six large-cap stocks and three stablecoins:

BTC, ETH, MATIC, LINK, UNI, AAVE

USDC, DAI, USDT

Now let's go back to the pool in the example above. After the exchange, it is out of balance with the original state. Liquidity providers will be encouraged to deposit BTC and discouraged to deposit USDC, which will cause the pool to rebalance.

Metavault.Trade will also allow traders to buy and sell these assets with up to 30x leverage. The key innovation here is pricing: the Chainlink price aggregator and time-averaged price (TWAP) platform for major DEXs and CEXs. This greatly reduces the risk of temporary wick liquidations you find on some exchanges. These are sometimes caused by large players deliberately manipulating the order book to liquidate other users. In this case, they are called "wick scams"!

The Alpha

In my opinion, Metavault.Trade can be accepted by two different types of users:

Use it for traders looking for a decentralized platform and/or fraud protection.

Users need to exchange large amount of assets and find better prices than any other AMM or even CEX.

The general consensus is that decentralized perpetual exchanges, still vertically undervalued, will account for a growing share of the crypto exchange market - mainly CEX.

That alone makes it an item worth considering. Also, I think you have to consider the GMX situation: it's a big hit for those who provide liquidity early in the game or buy platform utility and the $GMX governance token.

In my opinion, Metavault.Trade offers everyone an early opportunity to participate in a project of similar quality to GMX, even with specific advantages:

It is built on Polygon, a fast, cheap and easy chain for users to get started. Without going into too many technical details, the Chainlink feed on Polygon is more active than the GMX chain, which is important for easier pricing and listing of new assets.

Its token economy allows for more incentives. The history of GMX is a bit complicated, it is the rebranding of the BSC Gambit project and a large part of GMX's incentives have previously been allocated to Gambit investors. Metavault.Trade previously had no such investor, which allows the protocol to hold a larger percentage of tokens for farming rewards than GMX.

A vibrant and engaged community. Metavault.Trade is part of an entire ecosystem of technology and blockchain projects under the umbrella of the Metavault DAO. They have a team of developers and many community members dedicated to supporting their business.

There are two ways to participate in Metavault.Trade, the easiest way is to become a liquidity provider and create MVLP by offering any of the assets listed on the platform. MVLP holders receive 70% of the platform fees.

There is also an option to hold the platform's governance and utility token, MVX, as detailed in the previous section.

$MVX-Token

Metavault.Trade will issue the $MVX token, a utility and governance token for the platform.

The MVX token is especially well designed in terms of staker rewards. Rewards just stack.

MATIC rewards from platform fees

MVX players receive 30% of fees charged by the platform in the form of MATIC (on the Polygon network).

Deposited MVX

MVX Stakers get Escrowed MVX, esMVX, which can be used in two ways:

esMVX is being staked, so holders will receive the same rewards as MVX staking: MATIC rewards from platform fees, additional esMVX and point multipliers.

esMVX can be removed and broadcast to be converted to MVX and distributed. However, in this case, they will stop receiving the wagering bonus. The esMVX jacket will be unlocked linearly over a year, with MVX distributed to you after each unlock.

To transfer your esMVX, you also need to store the average MVX/MVLP that gave you this esMVX. MVX/MVLP cannot be sold in this vault, but rewards will still be generated.

MVX/MVLP locked in vault can be withdrawn at any time, but this will stop any esMVX distribution.

Multiplier points

MVX staking earns a point multiplier, and holders enjoy a login fee reward: each multiplier earns the same amount of MATIC as MVX tokens.

But splitting MVX or esMVX will cause the multiplier to be scored. It's a gambling system that rewards you with points if you keep betting longer, because the only way to get a coefficient is to stick with it for a long time.

Social media

Website : https://metvault.trade

Telegramm : https://t.me/MetavaultTrade

Twitter : https://twitter.com/MetavaultDAO

Medium : https://metvault.medium.com

Discord: https://discord. com/invite/b2fPrbmPza

Proof of authentication;

Bitcointalk name: BryantAsa

Bitcointalk url : https://bitcointalk.org/index.php?action=profile;u=3439157

Telegram username: @Penaz1

Campaigns applied: video

BSC address : 0x6Db39b2Aa122033a6123966B760783Ab0ffBFFAE