Analyse des prix Monero - Tenir ses promesses

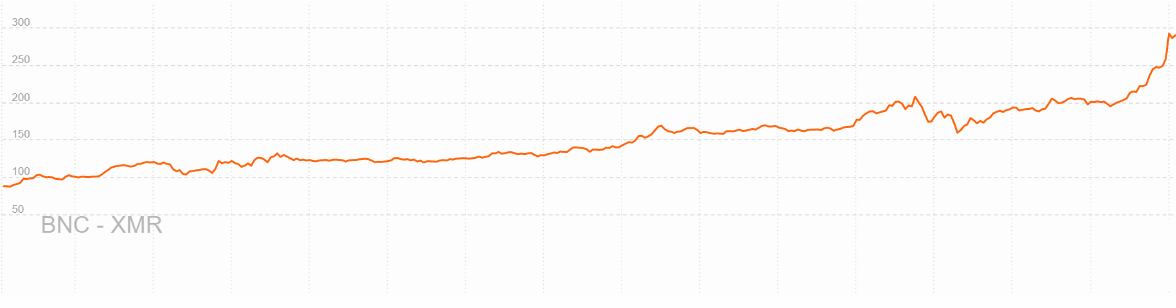

Monero (XMR) has been continually growing over the past month, and now holds a market cap of US $ 3.88 trillion with US $ 310.8 million in trading volume over the past 24 hours. The coin has risen 1600% since January of this year.

Monero Price Analysis 6 Dec 2017 1XMR is a SHA-256 Proof-of-Work coin launched in 2014 by thankful_for_today on BitcoinTalk. Early development decisions in 2014 were made by Riccardo Spagni, aka FluffyPony.

The coin has a two minute block with limited block size based on use. XMR also regularly hardforks for updates, about every six months. Unlike Bitcoin, XMR is not deflationary. After 18.4 million coins are mined, 0.3 times per minute and the block rate holds at 0.3 coins per minute indefinitely.

XMR uses ring signatures to the receiver and receiver of each transaction. The system is based on the CryptoNote protocol, which also uses a consensus algorithm that mixes CPU and GPU mining. This system makes the corner ASIC-resistant.

All possible XMR senders referenced in the transaction are equiprobable, and there is no way to determine the exact private key used for signing a transaction, while the receiver generates a new public key for each transfer. Using this method, all transactions are completely confidential.

Despite Bitcoin's seemingly anonymous nature, addresses are actually pseudo-anonymous. All transactions are openly stored on the blockchain and identities. Truly confidential transactions are 100% amoral, they are basically returning to the untraceable nature of cash, they do make criminal activity easier. They also guarantee 100% fungibility to all corners, making each corner and transaction indistinguishable from one another. A lack of fungibility can lead to blacklisting and advertising based transaction spending.

Other privacy focused coins include DASH and ZEC, both of which use an opt-in method for confidential transactions. It has been uncovered that private transactions on ZEC are able to be linked to non-private transactions unless the sender and receiver are part of the "shielded pool" of anonymous transactions. Only 3.5% of the available places meet this criteria.

Of the three privacy corners, XMR holds a market cap in the middle of the pack, while it has the fewest transactions. However, both DASH and ZEC include non-confidential transactions as well.

Privacy focused coins on their value chain of transactions. The metric was devised by Willy Woo and Chris Burniske and is similar to the traditional price to earnings ratio when selecting stocks. XMR does not always have a larger block size than ZEC and DASH.

XMR trading volume has been led by Bitcoin (BTC), Korean Won (KRW) and the United States Dollar (USD) peers on Poloniex, Bithumb, and Bitfinex respectively. The KRW peer holds a large premium, and is currently typical with all crypto assets. This is likely to restrictive banking policies which make it difficult to arbitrate.

echnical Analysis

After a multi-month consolidation period, the price broke through a bull pennant. The break of the pennant coincides with a breakout on the daily doubled Cloud chart and a bullish breakout of Bollinger Bands. All Cloud metrics flipped bullish on the following candle with a bullish TK cross.

Bien que les bandes de Bollinger ne prédisent pas nécessairement la direction d'une cassure, mais plutôt quand s'attendre à la volatilité, le prix inférieur à la 20SMA pendant une période prolongée a suggéré un résultat baissier.

Néanmoins, un commerce déclenche la violation des bandes dans les deux sens, et dans ce cas s'est avéré être une excellente entrée. Le prix a remonté les bandes depuis la cassure, suggérant une forte continuation haussière. Si le prix atteint un plus haut mais ne se déplace pas plus loin des bandes, un type de divergence baissière apparaît sur l'indicateur% B (non représenté).

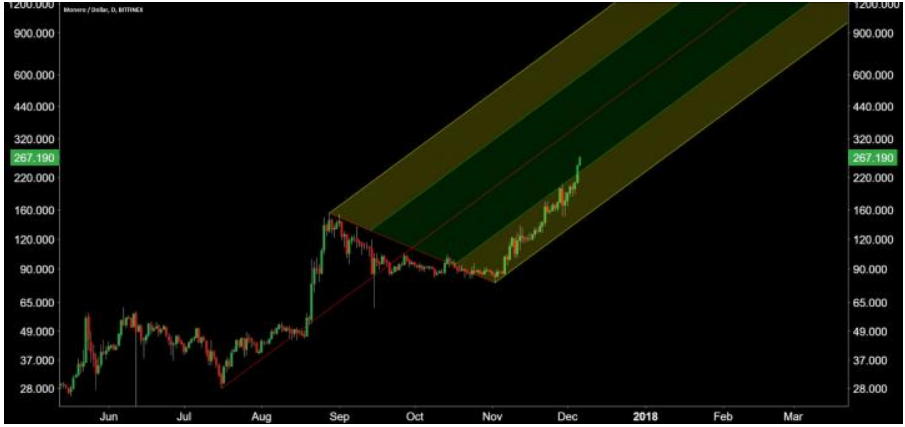

The daily chart using Kumo breakout on the same day, and continuing to show a strong bull trend. Stop losses for any active US $ 140 level.

Un Pitchfork peut être dessiné sur le graphique journalier en utilisant trois points d'ancrage pour démontrer une fourchette de négociation en diagonale. La ligne médiane (en rouge) représente la réversion moyenne de la tendance. La zone diagonale supérieure représente le territoire de surachat et la zone diagonale inférieure représente le territoire survendu, selon la tendance. Le prix revient maintenant à la réversion moyenne autour de US $ 380 +.

On the four hour chart with clouded support, all Cloud metrics remain bullish with Kijun support at $ 210. A long entry signal triggered on the bullish TK recross above the Cloud (yellow), the strongest signal of bullish continuation in the Cloud system.

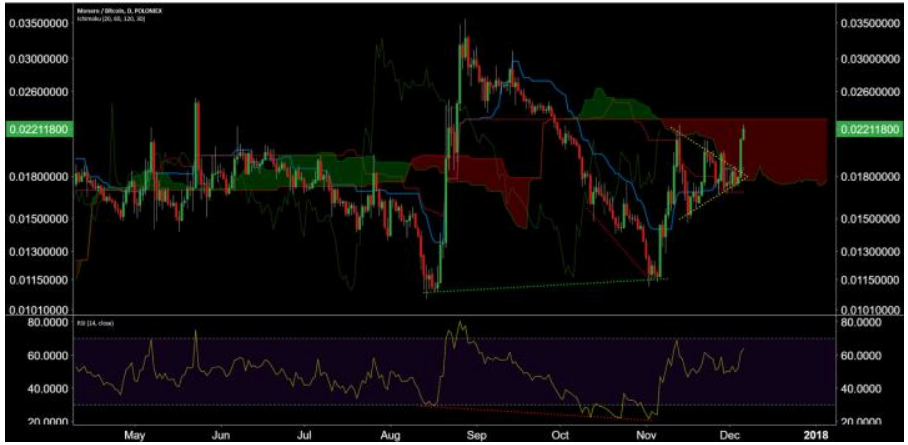

On the daily XMR / BTC chart, there is an active Edge to Edge with a target of 0.023BTC. Leading up to the Edge to Edge was a bullish pennant that was preceded by a hidden bullish divergence with a higher low price and a lower low on RSI. This divergence has been established for a divergence to confirm before taking action.

Bien que chaque bas ait connu un retour significatif, la consolidation et le rejet d'un creux extrême horizontal antérieur est le meilleur de ces trois signaux. L'option ici aurait été de prendre le long après chaque bougie d'inversion haussière avec des pertes d'arrêt à de nouveaux plus bas.

Enfin, il existe depuis longtemps un Pitchfork, qui a débuté en 2015 et qui a tenu bon sur plusieurs points de support et de résistance. Le cours a rebondi de la zone d'achat et recule vers une réversion moyenne à 0,038BTC.

Conclusion

Avec le développement de nombreuses pièces axées sur les transactions privées, les pièces spécifiques à la vie privée peuvent avoir peu à offrir pour aller de l'avant. XMR est la seule pièce de grande capitalisation qui semble tenir ses promesses. Le développement et la communauté autour de XMR continue de croître, et continuera seulement à attirer l'attention avec les prix à ces niveaux.

Les aspects techniques suggèrent fortement la poursuite de la tendance avec des arrêts au stand à 0,023BTC et 0,038BTC. Le ratio BTC / USD est entré dans la phase de découverte pure et simple des prix et se consolidera très probablement au-dessus de 380 USD.