Monero, the better new old Bitcoin?

Simple everyday payments are not a future model for Bitcoin, at least not as long as the lightning network is not running. Since this is clear, a competition has begun for the vacant place of the coin for everyday payments. One of the most exciting and popular contenders is the cryptocurrency Monero. I will show what speaks for and against Monero.

You do not have to be a friend of illegal trafficking to acknowledge the role that Silk Road and the other digital black markets have played in Bitcoin's history. They were a kind of proof-of-concept that the cryptocurrency works as a censorship-resistant, pseudonymous means of payment, and they were perhaps the first areas where there was a kind of ecosystem based on Bitcoin. It could be that the same thing is repeated with Monero.

Since Bitcoin denied the SegWit2x Hardfork in November, it is clear that the ability to make small, everyday, and cheap payments is not a bit of a privilege in Bitcoin's development. While Lightning promises to transfer payments in virtually any amount, virtually free and in real time, the potential for growing Bitcoin as a means of payment is extremely limited until that happens. Therefore try since November, several alternative cryptocurrencies as a coin for the daily payments set up. In addition to Bitcoin Cash, which has recently made a big leap forward with the acceptance by BitPay, Litecoin and Monero are the most popular performers.

Of all three candidates, Monero is probably the most interesting. While Litecoin and Bitcoin Cash are more or less clones of Bitcoin, Monero builds on a largely new, innovative design. This is why Monero has perhaps the most dedicated developer community behind it and has recently been accepted as a form of payment in Room77, the famous Bitcoin pub in Berlin. Thereby Kasisto is an easy-to-use point-of-sales system for Monero is helping.

Because Monero not only returns the fitness as a means of payment - but also makes them a lot better. But let's start at the beginning.

Click on the image below to see the Kasisto POS in 22 seconds video.

The Birth as Fork of Bytecoin

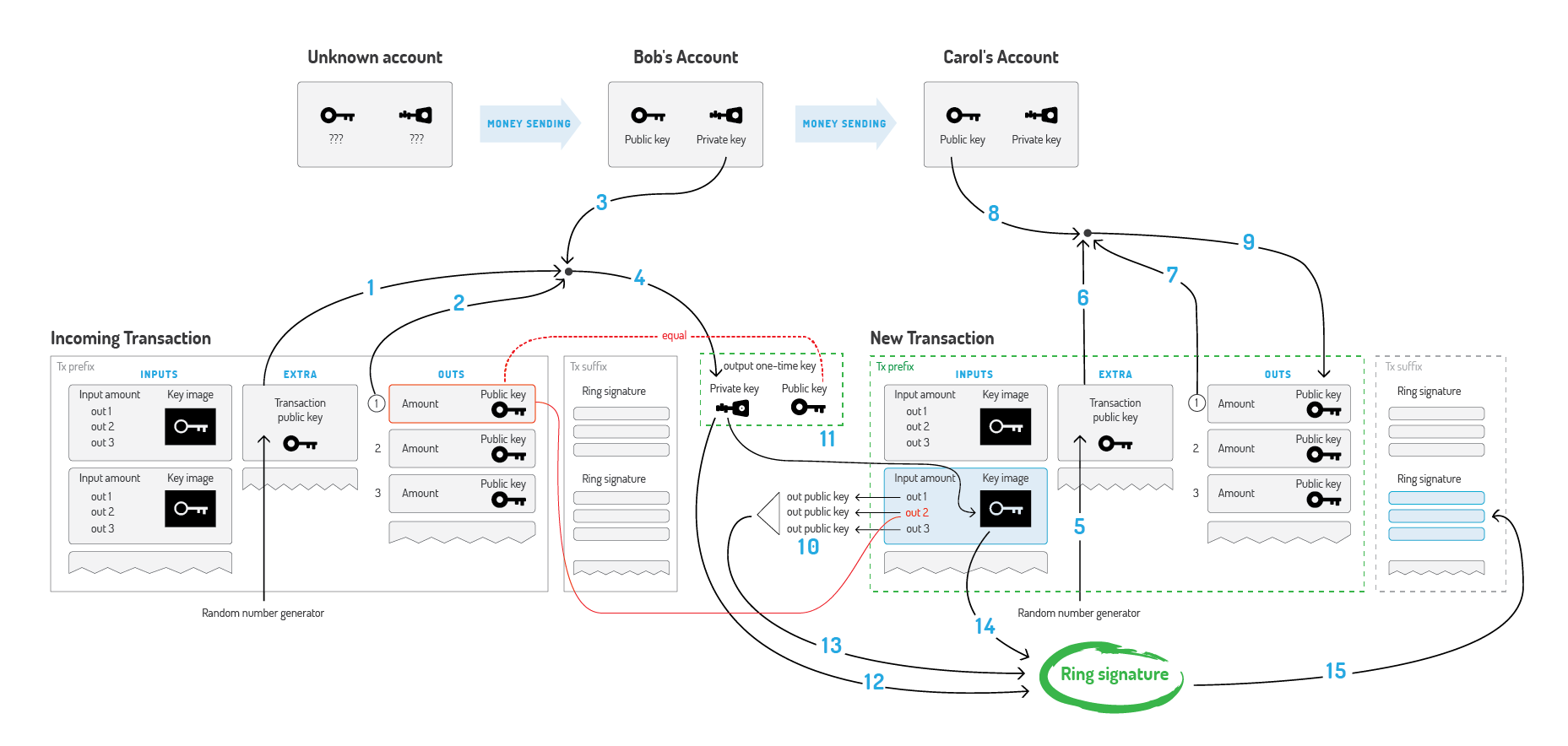

Monero is a fork of Bytecoin. This coin came out sometime in 2014 after being allegedly used in the Darknet for 2 years. Bytecoin had developed the Cryptonote technology. Most notably, it brought two innovations into play: making miners' work more resistant to Asics and, to a lesser extent, graphics cards, while ring signatures gave them unprecedented levels of privacy. Ring signatures mean that a signature can be recognized as being valid because it belongs to a group of authorized draftsmen, but it can not be said who actually drew it. Thus Bytecoin broke the verifiable connection between sender and receiver in a cryptographically clever way.

A standard CryptoNote transaction (click to enlarge)

However, Bytecoin was pretty much riddled with fraud. The years of prehistory were apparently fictitious, 80 percent of the coins were already distributed to a small group of people, before Bytecoin was even announced on Bitcointalk, and on top of that, it was revealed that the official mining software was artificially slowed down. The community found the concept exciting, but rejected the distribution of the coins. So they made a fork: Monero. This rapidly became the dominant incarnation of the cryptonight algorithm.

A Community for Privacy

Behind Monero quickly gathered a community that put privacy above everything. Virtually every development of Monero should serve the better privacy of users. The goal was and is to create a maximally anonymous cryptocurrency. And you have to say that the developers have already accomplished remarkable steps in this direction.

Thus, in addition to the ring signatures, confidential transactions has also been implemented, a procedure to disguise the amount sent. This completely eliminated a possible attack on ring signatures, which with a certain probability was able to discover the sender among the possible signatures.

Furthermore, Monero has set up stealth addresses, by which the recipient of a payment provides a code with which the sender can generate a one-time address. As a result, you can issue a public address without others knowing how many transactions were sent to them. Of course, one could ask whether this is still necessary in view of ring signatures and confidential transactions, or is it an overkill.

With Kovri, the Monero developers also try to bring the I2P procedure for obfuscating IP addresses in the node, to prevent an attacker can aspirate the IP addresses of the network participants. Should this succeed, Monero is relatively well placed against all possible attacks on the privacy of users.

In addition to these privacy features, Monero also comes with other attractive features such as the flexible adjustment of the mining difficulty and a decreasing, but never quite expiring block reward. By 2022, approximately 18 million units will be generated, after which the reward will fall to a fixed amount per block equal to less than one percent per annum inflation. However, the block reward has a mechanism to control the size of the blocksize: Miners that form blocks larger than the median of the last 100 blocks are penalized with a reduction in reward. While this makes the Blocksize flexible and adaptable to the needs, there is an incentive that prevents the miners from making them excessively large.

For many exhausted by the hard fork wars at Bitcoin, it is also refreshing to see that Monero makes a hard fork about every six months to protect himself from fossilizing the protocol.

The long Way to Mass Fitness

All these qualities make Monero an exciting coin, behind which stands a community that works with enthusiasm and skill on a vision and makes their currency better and better. A downside was usability for a long time. This was more of an ancillary construction site and sometimes not available. If you wanted to use Monero, you had to deal with the client and the command line or trust the online wallet MyMonero.

Since the confidential transactions are extremely large, about 10 times larger than Bitcoin transactions, the blockchain grew relatively quickly, without taking a particularly large number of transactions. The result is that even at Monero, the transaction costs are relatively high (but, at least, even cheaper than Bitcoin, while you get superior discretion).

But for some time Helium Hydra has had an optical wallet and with Monerujo a light wallet for Android. Also, a special hardware wallet just for Monero is in the planning and work - the development was funded by the Community itself - and the French hardware wallet Ledger allegedly already plans to integrate Monero. Finally, the development of Bullet Proofs promises to make Confidential Transactions marginally larger than normal transactions, which for Monero may mean that scalability will not be a problem for the time being. Once again, the community funded a comprehensive audit to implement bullet proofs as quickly as possible.

2018: The Year of Monero?

In the darknet Monero is already reasonably popular and is accepted by more and more black markets. With the acceptance in Room77 Monero now spreads in legal trade. If it depends on the followers of the cryptocurrency, this is only the beginning: Monero is ready to become the Coin, with which everywhere is paid. The fact that Bitcoin no longer fulfills this task, and makes room for something different, gets such a positive side effect: the new old Bitcoin, Monero, will not only have a variable block size, but also solve another weak point of Bitcoin, the lack of privacy.

Beautiful new crypto-currency world? Or is there some catch on the matter? I mean yes. In my opinion, there are some points that are likely to prevent Monero from becoming the new old Bitcoin.

It is new and different. All that Bitcoin already has is relatively easy to transfer to Bitcoin Cash or Litecoin, but has to be rewritten for Monero. So far, there is a very thin infrastructure of wallets and libraries.

The extreme privacy is Monero's greatest strength - but also the biggest weakness. The high degree of anonymity of Monero has undoubted advantages, and one could even say that it is necessary to create a digital cash that meets the requirements of good data protection. But it is obvious that there are drawbacks: it makes the cooperation of exchanges and other platforms with the supervision, anyway not a simple topic, more difficult (1), makes it difficult to look up transactions in the blockchain, for example in the customer support (2), makes many kinds of audits probably difficult or impossible (3) and increases the complexity of user guidance, as exchanges need about payment IDs to allocate payments (4).

In addition, I am not convinced that almost absolute anonymity is something you really want with digital cash. Bitcoin has a fine balance between transparency and privacy. It is, with appropriate use and good software, possible to realize the ideal of Cypherpunks: privacy for the little ones, transparency for the grown ups. Mass surveillance can easily be made impossible while observation continues to work. All those beautiful blockchain observations, such as the FBI confiscating Bitcoins from the Silkroad and having them auctioned, or how the bankruptcy trustee of Mt. Gox sends Bitcoins to crypto exchanges - all this would not work out with Monero. The little ones would undoubtedly have more privacy than Bitcoin, but so would the big ones, and mass surveillance would be impossible, but so would the surveillance of criminals. While there is a voluntary transparency that you create by publishing view keys, I'm not sure that changes too much.

This is probably a difficult choice. Monero would be better than a Bitcoin of mass surveillance. But it would not be better than a Bitcoin that realizes its privacy potential for the little ones, while forcing the big ones to be transparent.

Image Sources:

- Post header created by myself

- https://www.reddit.com/r/Monero/comments/7rsgi9/kasisto_pos_in_22_seconds/

- https://cryptonote.org/inside

Bitcoin is a massive ponzi scheme. It's in terminal decline for many reasons. Just wait until the IRS cracks down on Bitcoin tax cheats. Alot of people are going to get wiped out as the price declines further.

Time to sell and cash out.

Bitcoin is the ONLY decentralized crypto currency and ALL the other shitcoins are just following the trend of the bitcoin.

when bitcoin goes up all the other coins are going up and when bitcoin is crashing all the market is crashing.

The bitcoin has no CEO or developers that are being payed by the bitcoin company ALL the other coins have a CEO and a company that stands behind them, and if the CEO will die tomorrow in a car crash - you will see the coin loosing 60% of it's value in one day. It has happened to Ethereum last year when someone said that Vitalic B died in a car crash.

check the definition of Ponzi Scheme - https://en.wikipedia.org/wiki/Ponzi_scheme

Bitcoin is not the only decentralized token. You clearly don’t know what u are talking about respectfully...

i am not an expert

far from being one

..let me know what other currency is decentralized - no CEO or developers that are being payed and no structure of a company

The good news is that 2nd hand very high quality graphics processing cards will soon be available for deep discount.

Monero?

Agreed!

I don't think you can call BTC a ponzi scheme in the real sense. I agree that crypto's are going to go down to pre november price but there are new idea's coming out daily.. BItcoin cash has a new point of service device that will be launched in the autumn. No fees and instant,,

Monero is amazing buttt the transaction headers are to large I am looking forward to Monero V

MoneroV is a scam.

Bulletproofs are coming with the September hard fork, which will reduce transaction sizes by about 80%.

And anyway, you can already pay about 50c per transaction if you change the priority of the transaction to low.

Somehow this sentence hoovers ominously in the back of my mind after reading your article. Is this a bytecoin-specific problem, or could it also be true for Steem?

i will stick to my btc

Which suggests that they want the recent entrants (weak hands) out, so that they can take over.

If Smartcash can deliver on its promises, it will be my favorite privacy coin!

Yes,Rest In Peace Mr. Stephen Hawking

Great post! To be frank I'm surprised that we don't see money flocking into Monero whenever there is talk of potential regulations in crypto. It seems like a logical place to house assets in times of uncertainty. Done properly, your funds would be secure and hidden. Also, if you know where to look you could find active markets to use the currency even with a heavy crackdown on cryptos (which we hopefully won't see).

Monero's privacy tech is fascinating

A lot of people paint monero as some black market coin, however one particular application of monero will be that when institutions enter the crypt space seriously they aren't going to want to their competitors to know their positions. In this respect Monero is quite valuable .

It is much deeper than that.

Do you want your other employees to know how much you pay everyone else?

Do you want your competition to know who your suppliers are and how much of a good deal they are offering you?

Do you want your baker to know how many more thousands in bitcoin are in your wallet by virtue of change addresses?

Do you want your whole transaction history exposed to anyone you ever transact with?

Do you want your BTC to be rendered worthless by virtue of being tainted from previous use, possibly implicating you in a criminal case in the process?

That is not the way forward, that is the way to madness.

If 2018 is year of monero, sumokoin also benifited with that since it is a fork of monero.