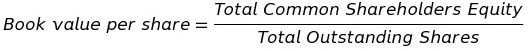

How to calculate a book value per share

This is a bit late, but I got busy with work unexpectedly. Here is the last installment to the fundamental analysis portion book value per share. As always we start off with the formula.

The book value per share formula is,

In words, it the total shareholders equity, divided by the amount of shares in circulation.

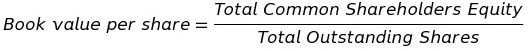

A better definition of shareholders equity is broadly assets minus liabilities, simplifying the formula to,

This is exactly the same as the net asset value or NAV on which I have previously posted

here. The fundamental analysis is more than 7 days old and cannot be edited.

Normally book value per shares are used solely for stocks while NAV is used for stocks, exchange traded funds (ETFs) and Real-estate investment trusts (REITs). In crypto these conventions don’t exist and they are the same. In this case NAV will be enough as an analysis tool.

Till next time,

Tinus

** Images courtesy of ‘

http://valueinvesting-wealthvidya.blogspot.co.za’ and LateX Equation Editor

happy to see a fellow South African on here :) just joined this week and very exited.

Yeah, I think it will take a while for more Saffers to join, but this is a really nice way to share interests :) See you are into football

It really is. Enjoying it so far. Yeah, into crypto as well but don't really know enough to write about it haha.

Im looking forward to your posts!

Thanks man. I appreciate the support

I enjoyed reading your post. There is a lot of good stuff.

Thank you, I spend quite a bit of time on them. Glad you found them educational

img credz: pixabay.com

Nice, you got a 7.0% @minnowbooster upgoat, thanks to @boontjie

Want a boost? Minnowbooster's got your back!