Why Global Crisis is Inevitable? Part 4 - Finale: The 2nd Great Depression will start in 2017!

In this article I am going to explain why the Great Depression and 2008 crisis happened, what dilemma we have nowadays and why there is no way out of it.

If you haven’t read yet Part 1, 2 & 3 of this article I strongly advice that you start with that. Please follow these links: Part 1, Part 2, and Part 3.

The First SYSTEM Crisis of Capitalism

It began with a severe banking crisis in 1907-1908. The reason was quite obvious: in the production chain example from Part 2 with 10 firms where each had profit of 10…

The bank could give a loan to everyone and if one firm does not pay it back, the loss can be covered out of interest coming from the other 9 firms. Your interest rate needs to be at least 10% to break even. But if the profit is reduced to 7, banking system can still lend them but more companies will not be able to service / repay their debt. Finally, when profit goes to 2 bank effectively cannot lend to anyone because no one will repay its debt and the whole banking process stops.

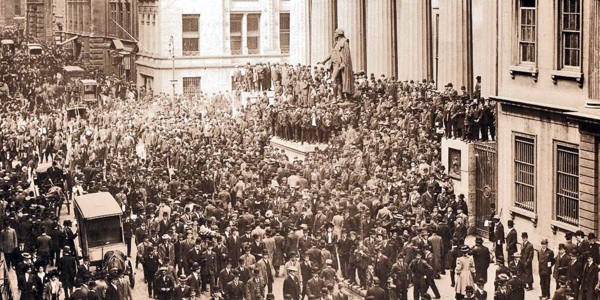

Bank Panic of 1907 – People trying to withdraw their money

The solution to 1907 crisis

This is exactly… what happened in 1907 – banks stopped lending not only to producers, but also to each other. The solution was found by John Pierpont Morgan when he gathered heads of all major banks, forced them to pay what each owed to another, and the gap J.P. Morgan covered with his own money.

Following the bank crisis, a secret meeting took place on Jekyll Island in 1910 where J.P. Morgan and other heads of the banks together with government lobbyists developed a concept of Central Bank (now called “FED” - Federal Reserve System) which would refinance / provide money to a struggling bank going forward. In other words, the FED started doing with the banks the same thing that banks were doing with the rest of the economy: The FED started taking over part of the risks from the banking system. Following debates in Congress, FED was created in 1913.

However, as I explained in Part 3, the banking system, in our case FED could only redistribute risks, hence could only postpone the crisis. However, the main event that occurred and helped to overcome crisis was World War I (“WWI”). The main reason of the WWI (which was economic) was to conquer markets from another technological zone. As I wrote earlier, by the beginning of the 20th century there were 4 technological zones. As a result of WWI, Germany lost the majority of its markets which were redistributed between others, and Russia Empire (USSR) commenced formation of its own technological zone.

The Second SYSTEM Crisis of Capitalism – the Great Depression

However, given that the geopolitical situation didn’t dramatically change, the additional markets could provide growth for only 10 years and in 1929 the Great Depression started. It’s worth noting that the only country where this crisis didn’t happen was USSR because it was an early stage technological zone, developing its markets. All other technological zones where maturing and experienced the consequences of Great Depression.

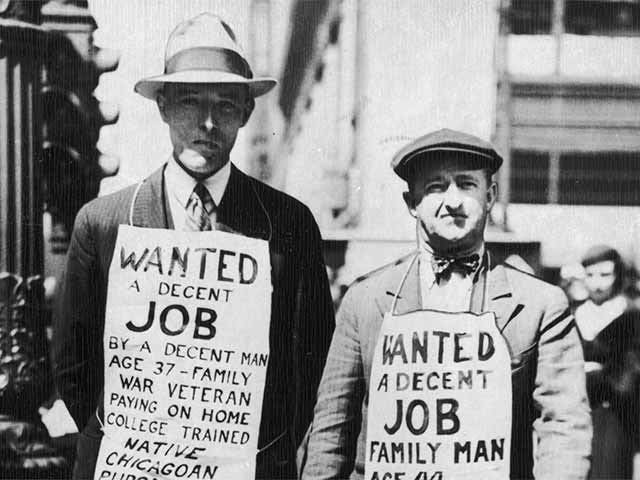

Men seeking jobs during the Great Depression

The Great Depression lasted until 1939 – the beginning of the World War II (“WWII”). Germany started the war for a clear reason – it was in a disadvantaged position after WWI. The reasons for the WWII were similar to those for WWI – conquering new markets. However, after WWII out of 5 technological zones only 2 left: the US and USSR; British was taken over by the US, Asia mostly by USSR and German was split.

Churchill, Roosevelt, and Stalin. Yalta Conference Feb 1945, when spheres of influence were agreed

The world after WWII – the Crisis of 1970’s

Following 1945, both the US and USSR were developing very dynamically; the growth rates were phenomenal, +15% at the peak. However, by 1960’s both the US and USSR reached their full market capacity and to grow further required market expansion which was impossible without a war between each other. The diminishing growth rates took place in USSR for quite a long time of ~15 years until they got to zero and the economy started declining: this was driven by the planned nature of the economy.

In the US the decline happened much quicker and already in 1971 the US cancelled the Gold Standard to stimulate domestic demand. Although this didn’t help and the US economy was continuously falling over the period of 1970’s. The negative effect was not as bad as during the period of the Great Depression thanks to the suspension of the Gold Standard which allowed printing more money, ie conducting monetary stimulus.

But what to do next?....

President Nixon suspends the Gold Standard on TV

The banking system (even with created FED) was not able to lend money further and no market expansion was possible, because everything which was not covered by the US, was covered by USSR. The question “What to do next?” was a matter of life and death….It took 10 years, but the answer was found!

The "Answer" that is killing us now

The logic was the following: given we cannot increase demand by accessing new markets, let’s increase the demand of our existing consumers. Consumers will increase their spending if they get more money. However, the government cannot just print and give more money to consumers because it will just create inflation.

If you want to avoid inflation you need to LEND money.

But if you borrowed Year 1, you will increase your consumption Year 1, however, Year 2 your consumption will decrease even greater than it was increased Year 1 because you will need to repay the loan AND annual interest. That’s why, in order to overcome this problem, they COMPLETELY CHANGED THE WHOLE CREDIT FINANCING CONCEPT. And I think best is to explain it with an example:

Here’s where the plot thickens and we start to realise the implications of the house of cards that’s been built!

A gentleman returns to his home and finds out that his washing machine is broken. His wife asks him to buy a new one, but they don't have any spare money and his next salary is only at the end of the month and he needs $5,000. He decides to go to a bank:

Bank Manager: "What is the maximum amount of money you are ready to spend per year out of your salary?"

Gentleman: "$1,000"

Bank Manager: "No problem. Our bank's policy is to get 20% on every $1 invested. So we are going to give you a 6 year loan, $6,000 in total. Year 1 you will pay us interest (20%) and then $1,000 each year as a principal"The gentleman agrees and comes in one years time with $1,000 of interest instalment.

Bank Manager: "The whole economy is experiencing a boom, and our shareholders decided to change our interest rate policy to 10% per $1 invested. We know that you can pay only $1,000 per year, so why don't we give you a $10,000 loan for 11 years. Next year you will pay $1,000 of interest and then $1,000 per year of principal repayment. Out of this loan we will use $5,000 to repay your previous loan and the rest you will use to buy a new dish washing machine".

The gentleman agrees and comes in one year time with $1,000 of interest instalment.

" You have an excellent credit story", - Bank Manager says: "We would like to offer you a new $20,000 loan at 5% over 21 years. Still $1,000 per year. We will use $10,000 to repay your current loan and the remaining $10,000 you can use to buy a car."The gentleman agrees and comes in one years time with $1,000 of interest instalment.

Bank Manager: "Congratulations! You got a special offer, only for you, the bank is offering a $40,000 loan at 2.5% - would you like to take it?"

I would like to focus your attention on the fact that the family's wealth is constantly growing…Their yearly payments are constant: $1,000 per year

Although two problems exist: 1) the family's debt is constantly growing; and 2) the interest rate has to fall in order to make this model work

In real life, in fact, these families don't buy washing and dish-washing machines. They buy gadgets: iPhones, tablets, laptops - everything which was growing massively over the last couple of decades. All the cheap production was outsourced to China.

This new policy of constant lowering of interest rate and refinancing of consumer loans was named “Reaganomics” which has been in place since 1981 can no longer provide growth. And here is why:

And now PURE FACTS…

…which by the way, may give you a 100% clear picture of why the crisis started in 2008.

By the time the new economic policy started, in 1981 the FED’s interest rate was 19%. Since then it has been gradually decreasing and reached 0% by December, 2008……and kept there until December, 2014 (it was then slightly raised by 25bps).

The interest rate CANNOT be raised further because all the US households accrued a lot of debt. In 1980 average household debt in the US didn’t exceed 60-65% of the annual disposable income, which became 132% (!) by the beginning of 2008. This, by the way, does not include mortgage, only personal loans! Currently it is slightly lower, roughly 120% of annual income. Clearly, this is sustainable as long as interest rate is very very low. If it increases, households will not be able to keep on servicing it, i.e. paying interest, and will just stop buying anything.

Today, the US households spend $3trn more then they earn.

The difference is covered via an increase of personal debt, government debt (subsidies, Obamacare etc). The average wage level (how much they earn, rather then how much they spend) in the US, based on the purchasing power (ie corrected for inflation), currently stays at 1958 level.

Further debt increases are impossible because interest rate is already at 0% and the gentleman from our example above already has a $40k loan for 41 years ahead. The next loan he simply won’t be able to repay in full (it will be for 80 years and beyond average life!). Broadly speaking, further ledning will just result in an increase of the non repayment rate the collapse of the banking system.

However, keeping interest at 0% and printing money further will create inflation in the US which will cause a permanent decline in the US real economy. Conversely, an increase of the interest rate means all the international banks (JPMorgan, Goldman Sachs etc) will go bankrupt.

Everything will be decided in the next months

To conclude, this conflict as you can see from the above came to a whole new level and there are of course beneficiary groups that support either one of these ideas. The last chance for them to put forward their decision makers is the US Presidential Elections which will take place already November this year. Whoever wins, there is no point for him / her to wait! One will quickly add more monetary stimulus and low interest rates; another one will raise it immediately.

In any case, everything will be decided this November and we can see the future already in 2017!

Please feel free to leave your comments / questions and follow me if you liked this and want to read more: @conspi-theorist

About me:

In my Blog I write about Politics and Economics, analyse the News, and give advice where to invest. I studied economics and finance in Russia, UK and Italy and worked in Banking, Consulting, and Investment firms. If you follow me I will be able to provide view with lots of arguments and very balanced view.

PS. Maybe a bit empty right now, but more to come!

Great write up, this deserves many more up votes for the amount of time you put into this. I agree a major depression is coming and all people want to do is buy worthless crap. Your stats and charts show we are headed for a major down turn. Im going to follow you I enjoy staying up on things like this please follow back! keep up the work.

@jacobcards - thanks a lot, man! I read yours, especially liked those you wrote on politics. Will follow you back :)

Appreciate it :D!

This is some scary stuff, but sadly I think you are right. I just hope that we all live through it.

Really enlightening series. I haven't looked too much into the broad brush strokes of central banking.

What would you recommend for further reading?

If you could sum it all up in a nutshell what would you say?

Wow - tough question. I see a few very good articles here and there, and always study various facts. And then you make conclusions. There are also economists who study these topics but very very few because as I explained Part 3 - in Economics it is a TABOO to speak about "End of Capitalism" crisis.....

FOr example at my work (finance sector) I can not say "Hey Guys, lets sell all our assets because the world will end tomorrow". Instead, we need to say that it is a recovery path, assume like 1-2% growth, because we raised money from the investors (and we pay for this money), and this money needs to be deployed !

"The Creature from Jekyll Island" by G. Edward Griffin is one of the best books on the subject.

A superb analysis of the coming days ahead. Rock solid writing! 11/10!

@mindhunter - thanks mate, I read your last article as well. Decided to follow you

Apologies to you that I don't follow any man - check my followed #'s :)

Great piece and thanks for sharing. Happy to upvote and share this on Twitter✔ for my followers to read. Cheers. Stephen

We have to stop capitalism. Someone has to find an alternative.

@kimal73 - that's the problem. For now alternative has not been found yet.... I read several economists who write about this....This is very lenghty project that takes money and time.. and a group of smart people)

Capitalism is terrible.

The problem is that it's much better than anything else.

@everittdmickey - I see your point and agree, it is better if you have money.... But if you talk with Uber drivers in London, those from Eastern Europe, they all want to go back to Soviet Union.

WHy?

The great answer I got last week: "It is was bad when you had money and you had to queue 1 hour in order to get 500 gramms of meet or 300 gramms of cheese. But it is much better than when you see nowadays a great variety of meet, cheese, and other products in the shops, but you can't buy them just because you don't have monney"

Oddly enough. The data does not agree.

Most of the time, for most of the people, it's better now than it ever has been in the past, on average.

@everittdmickey - several points here:

Is this a real or nominal? If the last one, then it should be divided by the accumulated inflation.

US statistics is a separate great thing... i think i need to write a separate article on that one. You may know that over the past decades, when you see this growth, they were constantly changing the definition of GDP: adding there Goodwill, Intelectual Property rights which no one knows how to appraise etc etc... If you calculate it based on 1960's GDP definition you will get the piicture that GDP is already falling for several years.

And last thing, who is getting all money? Here is a nice graph - Gini Index measures level of inequality in the economy. The higher it is, the poorests become even more poorer....

Welcome to the platform Nikita :)) great stuff!!! I love your dedication!!! hahah

Very well written up, hitting all the points necessary but keeping it concise. Well done. :)

@getonthetrain - thank you very much for the feedback!

Great post, following you now.

Thank you @jasonstaggers for the feedback! Much appreciated! Following you as well ;)

good analasyis of why the fiat system is collapsing around our ears !

@ladypenelope1 - thank you for your feedback. Putting a more in depth analysis on the history of finance world post WWII... hopefully will be also interesting )