Bitcoin is the Uber of cryptocurrencies: the biggest, baddest and best-known

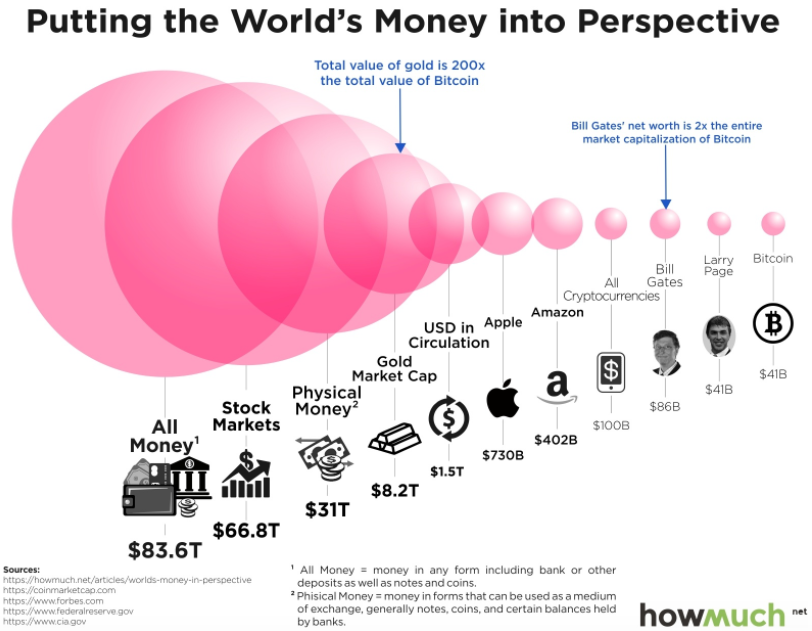

Did you know that the total amount of money in the world is an eye-popping, head-spinning $84 trillion. Of this physical notes and coins are a modest $31 trillion. Money in the banks form a part of the rest. This gave the ground for the germination of bitcoins and other cryptocurrencies. Bitcoin is a cryptocurrency that refuses to die. Though it's death has been predicted over and over again. It is 18 times more volatile than the US Dollar, says an expert and yet this virtual currency keeps going from strength to strength.

courtsey- howmuch.net

The above image is self explanatory in its own, yet some facts are worth to be noted

● Bitcoin was more stable than gold last year.

● Bitcoin's price surpassed that of an ounce of gold for the first time earlier this year .

● The worth of all cryptocurrencies is about as much as the current GDP of Morroco, the 60th largest economy in the world.

● Money, ofcourse is, fiduciary, that means it only has as much value as the trust we place in it. The same goes for gold. It derives

it's value solely from its rarity combined with desirability.

● 171,300 metric tonnes is the current world supply of mined gold.

There are 2 kinds of money.

Narrow money is defined as physical money, the coins and notes that used to be standard form of currency, before the rise of more derivative forms of payment such as electronic money. The sum of money under this definition is $31 trillion.

Broad money also includes the deposits in easily accessible bank accounts and investments that could be converted into cash relatively quickly. The sum of money under this definition is $83.6 trillion.

SEE THE FLAW IN THE SYSTEM

If the amount of money that can be easily converted into cash is almost three times the volume of actual world wide supply of cash, we would have a problem if we would all want to empty our accounts at the same time. Or we could all buy shares. A blind run towards or away from stocks could deregulate the global economy (demand and supply chain) and lead to collapse of world civilization.

Number of bitcoin transactions per month (logarithmic scale) - source wiki

If the rise in market cap of bitcoin tells us anything, it is that people are losing trust in money and other traditional measures of wealth. Each day a fraction of world population is breaking their fixed deposits and investing that future safe money in cryptocurrencies. This drift is the main reason why we could expect that eventually someday the total value of all cryptocurrencies will surpass that of the world's supply of gold...

If you like my post please upvote and follow me to support the cause "Journey to going green with steem! " To know more about this initiative please visit this link.

https://steemit.com/introduceyourself/@sambaran/journey-to-going-green-with-steem-please-support-the-cause

This is probably a very good analogy when you consider that Wall St took the Silly Con Valley, Cali idea of a "glorified" taxi service (that doesn't even own any taxi cabs) and drove it to a valuation of $62 biliion. That's Uber. No telling how big of a bubble bitcoin is but I like the analogy. :-)

The biggest badass...

Crypto will grow tremendously in next few years...

One point about the "fiduciary" aspect of bitcoin that you may not have even recognized. The U.S. dollar is "backed" by the assets of teh entire country that is the United States of America. Gold has established its fiduciary relationship as it is now deemed by just about everyone that it is in fact a store of value. That fiduciary took 100's of years to establish. That has not yet been established for bitcoin. If bitcoin was to go into a "fat finger" type freefall here like ETH did ...and fell to say $800...what would bitcoins "fiduciary" be then? Bitcoin is a "fiduciary" puppy dog. I know I don't want to own a single crypto coin of any type. I'm not "unusual" in teh real world. But here at a site like steemit I am certainly the guy who just doesn't get it. Lots of us out there and for good reason too. ;-0

Congratulations @deepmala! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!