Dollar Earned VS Dollar Saved - Why a Dollar Saved is Superior

Book: Set for life

Hey there Steemit Community!

The post will discuss why I believe that saving a dollar (not spending it) is better than earning another dollar.

I am currently reading the book Set for life by Scott Trench.

In this book Scott Trench discusses how one can go from having a few thousand dollars, or even being in the red, and become, well, set for life.

Set for life discusses the true meaning and formula of Wealth.

Wealth accumulation happens when your assets' returns are high enough to sustain the lifestyle of your choice while your net worth continues to grow.

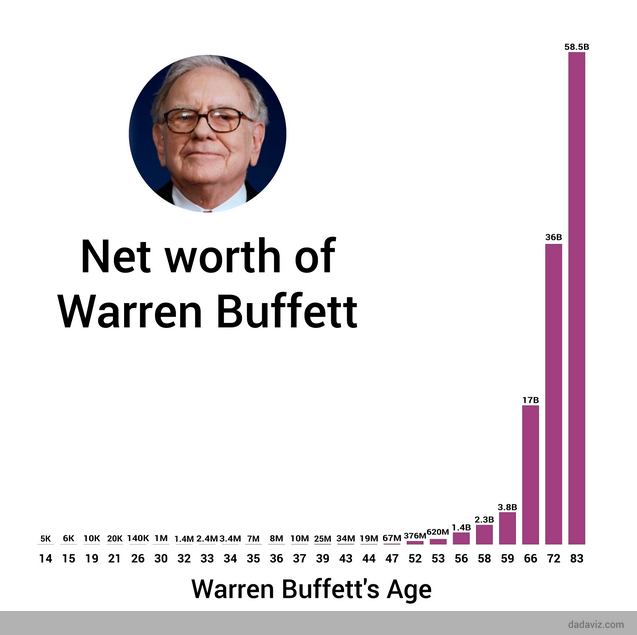

Over time, the money made from those assets can be reinvested and therefore your winnings multiply themselves as time happens.

Here we have legendary investor Warren Buffet's net worth histogram

The smaller the percent of gains made that goes into the lifestyle, the quicker the wealth accumulates. Investing 50% of your income will make you wealthy quicker than investing 10%, clearly.

So, why live a lavish lifestyle if you're just slowing down your financial freedom/early retirement???

The largest factor in wealth accumulation, at the beginning of of your journey to wealth & financial freedom, is your spending. If you can lower your expenses by living below your means (spending less on unnecessary things) it is equivalent to getting a pay raise. For every dollar you do not spend it's as if you earned another $1.33 (ish).

If you find ways to lower the cost of your lifestyle, without them having a large impact on it, you should do so.

For example, Fred could rent a fancy apartment in a nice neighborhood for $1,500 dollars a month, or he could live in an average apartment complex, in an average neighborhood that is only a few minutes away from his desired location, for let's say $900 a month. This means, he won't live in a place that he can boast about. But, he can boast about having saved $600 a month! $600 a month is $7,200 a year.

If you wanted to earn another $7,200 a year, you need to make ~$9,500 a year before taxes. So, living in a place that might not be as fancy is equivalent to receiving an almost $10,000 raise. Pretty crazy!!

Let's say Fred lives below his means for 5 years and invests all of his savings on a yearly basis.

According to google, if you invest your money in a Mutual Fund (the safest form of investment), you can expect around 10-12% returns annually. Let's use the conservative and round number of 10%.

Capital gains taxes are lower than on earned income - around 15% depending on earnings

Year 1) Fred saves $7,200; invests 100% of it.

= $7,200 in assets

Year 2) $7,200 x 110% = $7,920 ($720 in capital gains at 15% tax = $612 in net profit)

= $7,812 in assets

Year 3) $7,812+ $7,200 = $15,012 ---> $15,012 x 110% = $16,513 ($1,501 in capital gains at 15% tax = $1,276 in net profit)

= $16,288 in assets

Year 4) $16,288 + $7,200 = $23,488 ---> $23,488 x 110% = $25,836 ($2,348 in capital gains at 15% tax = $1,996 in net profit)

= $25,484 in assets

Year 5) $25,484 + $7,200 = $32,684 ---> $32,684 x 110% = 35,952 ($3,268 in capital gains at 15% tax = $2,778 in net profit)

= $35,462.

At the end of year 5, Fred has $35,462 plus another $7,200 of savings ready to invest. This puts him at a lofty $42,662 in assets & savings.

It only took two easy steps to have what could essentially become a down payment on a house, or ideally a multi-house property. 1) Moving to a location that is "beneath him". 2) Investing the difference between his current rent and the new & cheaper rent.

If Fred does this, in only a few years, he could go from renting to buying his first property.

The next step in financial freedom is house-hacking. An example of house-hacking is buying a duplex or triplex and renting out the other unit/units. In this situation, your tenants pay some, most or even all of your mortgage, allowing you to to live for free or cheaply at the expense of becoming a landlord to your neighbors.

If Fred does all of this, he goes from spending $1,500 a month on rent to owning a multi-family complex that, after rent, makes him only pay a few hundred a month towards his mortgage and expenses. His cost of living went down tremendously! Now, instead of paying rent, he is paying a mortgage which is essentially him buying his house off the bank slowly.

After let's say 20 years of being a land lord and only paying a small amount of money in mortgage payments, if any at all, he now owns a multi-unit house and has saved/invested massive amounts of money on an annual basis due to his money being freed up to work for him, instead of his current landlord.

Moral of the story: the path to wealth begins with the tightening of some screws on a loose budget due to the unawareness of the long term ramifications of not living below your means.

I hope this post was able to shed some light on the topic of becoming financially free.

I recommend Set for life to anyone interested in losing monetary worries and to anyone who is interested in becoming wealthy.

Yours truly,

Lucas Hohl-Marchetta.

I plan on making a post on house hacking so do not fret! I did not delve too deep into that topic because this post was mainly meant to shed a light on the cost of living lavishly!

:)

Great post! Yes this definitely shed some light on the importance of saving and living below one's means. Very useful applicable insights! I've followed you and look forward to seeing more of your future posts :)