Which trading time frames to use? | How I use charts to decide on a market

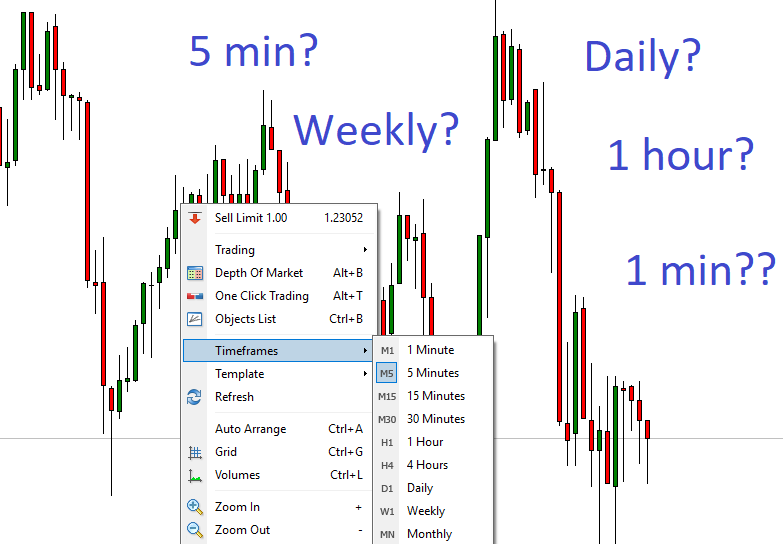

A chart is not a chart in trading. The price action you see on a chart can represent years or it can represent only the last hour or so, it depends on which time frame you use.

The time frames that are used in trading can broadly be divided into the higher and the lower time frames.

Higher time frames

Examples: 4 hour, Daily, Weekly and Monthly.

Lower time frames

Examples: 1 hour, 30 minutes, 15 minutes, 5 minutes and 1 minutes.

These are the standard time frames that you typically will find with most chart packages. Some markets offer slightly different time frames, like the 3 minute chart instead of the 5 minute charts. And the more advanced chart services will also offer a chart template where you can define your own time frame. 2.3 minute charts anyone? 😁

Which time frame to use?

The question should rather be “what kind of trader are you?”

Are you an active trader or a long term investor?

The lower time frames show more of the market noise. At this level you cannot rely so much on indicators or patterns since the price actions will not be very smooth or predictable. So in order to succeed here you will need to be a discretionary trader, and use scalping style techniques.

However for an active trader, or a day trader, these time frames offer more opportunities to enter, and you can pinpoint entries and exits from the price action.

The higher time frames show a bird’s-eye view of the market, it is zoomed out, and you can see the big picture of the price moves. The trends you see here will correlate to the macro economic situation in the asset or currency, and is thus more reliable for future projections. Also, the indicators, patterns and price action markers will be more reliable here.

So if you do not have much time to spend in the markets and if you are a long term investor you do not need to bother with the lower time frames. There will be fewer opportunities to enter the market, but you do not need to monitor it, it is enough to check in once a day or a couple of times a week.

However, many longer term traders do zoom in, once they get a signal on their daily chart, to better time the entry of their trade. Instead of entering the trade at the candle close, you can for example zoom in to the 30 minute chart, and monitor the market to get a better entry like this:

How I use charts

I am predominantly a price action trader, so I do not rely much on indicators. Instead I use multiple time frames as part of my analysis. I want to know the long term situation and trends on the daily and weekly charts, but I also want to use the lower time frames to better follow the intraday price action.

I use a zoom-in method where I start at the weekly and zoom in gradually to about the 15 minute chart. When I feel I have gotten a feel for the market i am trading I will have about 3 charts open at the same time with 3 different time frames, like this:

The trick I use when I browse through different markets (like cryptos, fiats, idicies, etc) to find one I feel is tradable is to look for two things:

- Smooth price action with a directional bias (trending)

- Enough volatility to profit from it

So I look for instruments that show the most fluent motion, without noise, and I look in particular for clear waves with rallies and pullbacks.

Consider the following two charts:

In the first chart the price action is choppy, there is no clear trend, and the range of the moves is not long enough to be very profitable. So that one is a pass.

However, the second chart shows fluent and directional price moves. And the range is good enough. So this one I would consider trading.

Fractal theory

I want to add briefly that there is a theory behind using multiple time frames to get a good grip on which instrument to trade. And that theory comes from mathematics and chaos theory and involves fractals.

Basically, fractal theory in trading involves repeating cycles within other larger repeating cycles. The markets notoriously repeat themselves in cycles, and the theory says that if you zoom in you will see that the larger cycles represent a series of smaller cycles. So if you zoom in or out through different time frames you will see the same kind of patterns and they are similar in nature.

These kind of repeating patterns can be seen in Elliot wave analysis and Bill William’s system to name just a few.

In closing

The best time frame is the one that works for you. No matter what other traders use, you must find the time period that resonates best with you. And remember, any time frame you choose will show the same price and price movements, it is just a matter of how zoomed in or out you are.

Congratulations @mariuse! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPInteresting question!

My background is chemical engineering + Artificial Intelligence and during my beginning years working in AI, I came upon fractals.

I view and understand fractals as the mathematics of systems that grow and retract - the mathematics of dynamic systems with feedback.

Please also see my 7 rules:

https://steemit.com/trading-rules/@freedomshift/7-rules-for-trading-investing-hodl-virtual-assets-aka-crypto-currencies

Rule #1 of the 7 deals with time and I just posted:

https://steemit.com/bitcoin/@freedomshift/7-rules-for-trading-investing-hodl-virtual-assets-aka-crypto-currencies-rule-4-expanded-and-illustrated

Which gets into details regarding timing.

Thank you!

All the best!

Thanks for your comment!

Yeah, fractals in trading have a different recursive nature than in mathematics. And you have the discretionary dimension as well. But it is interesting how Bill William used fractals, he used lower time frame patterns to project higher time frame future patterns.

Fractals is complicated and require a lot of research to get a handle of it.

I first come across fractals and wrote a program to compute at different level of details - precision and each run took a long time - back in 1989. I think the computation will still take a long time unless the computer or the techniques is in line with the fractal mathematics.

In engineering, I learned the power of analog computers and when applied to calculus. I later learned APL - a statistical programming language and marveled at its power and simplicity / conciseness. I just know that there is one or could be developed to facilitate fractals computation and to unleash its power in modeling lifes fractal nature.

Interesting!

What is fascinating is that even though the calculations and the relationship beween the structures are infinitely complex, the rules behind the recursive loop are simplistic.

"The" Mandelbrot set is the set obtained from the quadratic recurrence equation

z_(n+1)=z_n^2+C

(1)

with z_0=C, where points C in the complex plane for which the orbit of z_n does not tend to infinity are in the set. Setting z_0 equal to any point in the set that is not a periodic point gives the same result. The Mandelbrot set was originally called a mu molecule by Mandelbrot. J. Hubbard and A. Douady proved that the Mandelbrot set is connected.

http://mathworld.wolfram.com/MandelbrotSet.html

Aahhh, the beloved Mandelbrot ;) ... Hi guys... Sorry to hi-jack your thread here (I've bookmarked it for later reading, as I am a crypto trader too).

Thing is, I have Ginabot notifying me whenever anyone says "mandelbrot set", lol... This usually takes me to people who would be interested in the kind of art I do. I use fractal software to create art. Do check it out if your curiosity is piqued =)

@mandelsage

cool! I posted here:

https://steemit.com/artificial-intelligence/@freedomshift/fractals-mandelbrot-set

Thanks for commenting!

Nice art!

What kind of fractal software do you use?

Cool. We studied the Mandelbrot Set and Douady at Uni, brings back memories:)

I remember we played around with setting random parameters to get even more organic depictions.

This is perhaps the most simplistic demonstration of fractals, but, interesting to the general public.

Agreed, the crystal is simple. But it still has some of the fascinating characteristics of more complex ones, like it has an approaching infinite perimeter and the mathematical dimension is not the standard 1D or 2D, but somewhere in between.

good post

Thank you!

The time-frame of the trade will determine which tf charts do you use. I mean, if you're looking for a position for months, you'll check 2hr or 4hr. If you're looking for a position within days, you'll check 5-15-30min chart.

Thanks for your comment!

True, the time frame should correspond to the lenght one expects to hold the trade. Good point!

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by mariuse from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.