Is the Worst Over For Silver?

In last month or so, I've been talking about the surprisingly high levels of pessimism in the silver and gold stacking community. I've noticed this on my channel, and through the comments people leave, but I've also seen it in other places, on forums and such. Eventually, I coined the term "Peak Despair" to describe this. Essentially, it would appear that a high percentage of silver and gold owners, are sick of how the market has been behaving, particularly since last summer.

(Feel free to watch the video, or continue reading)

Last summer, we witnessed the price of silver top $20 for the first time in almost 2 years. It was an exciting rally for many, considering silver was below $14 at times, during the previous winter. Yet, that rally fizzled out. All eyes were on the election.

Regardless of their political affiliation, most Silverbugs were excited to see Trump pull off the upset, and win the election. They were excited, because most mainstream pundits and analysts were predicting a stock market crash, and a precious metals rally, if Trump were to win. Of course, that narrative disappeared about as fast as Hillary Clinton did from the political scene. All of a sudden, Trump was supposedly great for the world. He was great for stocks, earnings, jobs; he was going to make America great again. Or at least, that's the narrative the mainstream media pushed on the markets, while simultaneously trying to undermine his every move.

The result of this exuberance, was a crash in the price of precious metals. Silver fell from over $18, to under $16. However, starting right before Christmas, silver once again began a rally in the winter, much like it had the year before. It rallied above $18 in February; stackers were getting excited again. Then, it was smacked down. It mustered another rally above $18, and was once again smacked down to around $16.

This pattern of rallies and crashes is familiar to the long-time stacker. Silver is not only a volatile metal, but it is a manipulated market. Furthermore, the price of silver is largely controlled by the paper market, for the time being. What this means, is that even though the physical supply and demand fundamentals for silver are incredibly bullish, going forward, the paper market is currently what sets the price. The veteran stacker realizes this, and takes advantage of these dips. They are looking forward to the day when fundamentals finally catch up to the paper market. They are looking forward to the day when there is no longer a strangehold on the silver market. In the mean time, they stack.

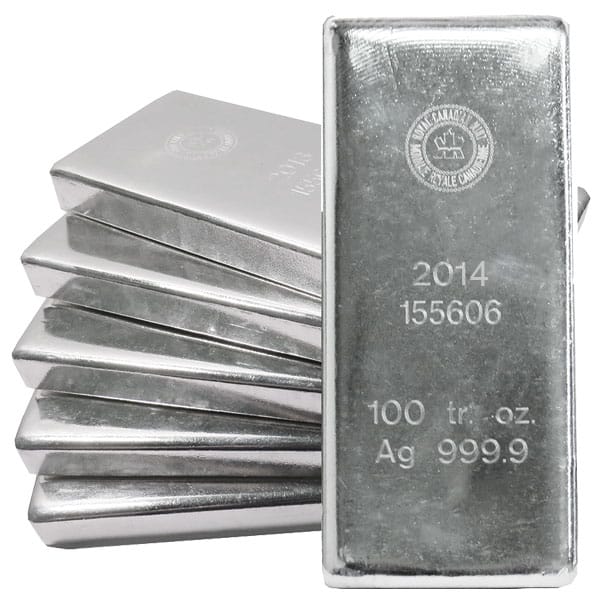

A stacker having his silver delivered, after buying the dip

However, I think this past May was particularly tough for many silver and gold owners to handle. Keep in mind, that most of this "Peak Despair", was coming from those that are relatively new to silver and gold, and will likely be persuaded out of their positions by the low prices. The strong hands likely were happy to take advantage of that dip.

Here we are in June; is the worst over for silver? I'd be a fool to conclusively say that we will never see prices around $16 again, especially when you consider we have a FOMC meeting less than a week away. Currently, it would appear the Fed will once again raise interest rates, which could certainly cause silver and gold prices to drop. However, I don't think they will fall by much, when you consider that this rate hike is largely priced in by the market. At this point, even though this is a manipulated market we're talking about, I'm not convinced we'll continue to see these heart-wrenching dips. Each time silver is hammered down in this manner, manipulators are digging themselves in a deeper hole of physical supply shortages.

Something I've talked about in past videos, is how billions of ounces of above ground reserves of silver have been depleted in the last 50+ years. This extra physical supply, has served to suppress the price of silver, year after year. However, each dip in price is often also taken advantage of by the buyers. Stackers buy the dip, oftentimes. However, stackers are not the only entities that understand the long term fundamentals of silver and gold. Eastern giants, like China and Russia, are also likely taking advantage of these dips, as they continue to accumulate physical assets.

From 2013; reserves today are even smaller

Is the worst over for silver? I believe that may be the case. I'm not convinced we'll see a crash in silver prices that coincides with a crash in stocks, similar to what happened in 2008. Though, I wouldn't rule out the possibility. The big picture idea of this video, is not to make a correct prediction of whether silver will be hammered down, like it has been in the past. Perhaps I will be correct, perhaps not. The message to take away from this, is that it doesn't matter. A short term crash in the price of silver, only makes the fundamentals even more bullish. It doesn't fix the physical supply and demand problem. It doesn't suddenly negate the value of silver as a safe haven asset. None of the world's geopolitical, economic, fiat, and debt problems are solved by a brief crash in silver prices. In the end, these dips, are exactly that, dips. They are a buying opportunity, a chance to load up, before the eventual and inevitable collapse of the current system, and the manipulation that is enabled by this system.

Image Sources: https://docs.google.com/document/d/17pbiAwufzoXSJ-nxrjgb6085TUIeda-rFkM5ZsXiiAE/edit?usp=sharing

I just bought a large safe to mount to a wall, and store my silver bullion coins.

now silver have no choice but to go up, and fast !

I'm a big Stacker of Silver - of course I get pissed off when they slam the metal down. Reason is I own my fair share plus - so I only buy small quantities now on dips - never more than a single monster box. But the positive for me is I'm retired and have enough assets plus pension and social security to make me comfortable. Worst case scenario is my sons and daughter get the huge payday when i pass on. They are versed in what it will eventually do in price. Personally I see $25 Silver by this time next year.

Keep stacking my Silver Brothers

I wish my "small quantity" were a monster box. Me buying a "small quantity" is a few ounces. Haha

lol - when I said small quantities I didn't mean to offend. I usually buy anywhere from 100-500 on the dips but never more than a monster box. Reason I own more than 30% of my total assets in Platinum, Gold and Silver. So I have my fair share plus. Keep stacking eventually we will be very happy

Interesting! I've been wondering about other precious metal i.e. not gold or silver

How about doing a blog on one for us (if you haven't already!)

"Small quantities on the dip... Never more than a monster box"

I wish I could consider that a small quantity. :D

Stack on

I caught the silverbug late in the game. I'm investing as much as I can in silver now, while the prices are so low. If the fix were to end tomorrow, I'd be greatly disappointed because I ran out of time to consolidate my position. To me, the longer the price fix stays in, the more time I have to buy.

Those who are upset about silver price need to ask themselves why the are so. Are they looking to somehow profit off of silver in the short run and believe an unmolested price will help them do that? Are they looking to cash in after years of accumulation, hoping the price will go up so they can take profits? Or are they holding silver for the long run, as insurance against a market crash or worse?

I fall into the latter category, and to me, the longer the price stays here, the better. The only time I want the price to go up is when I'm planning on needing it, when the economy tanks. Basically, Silver is insurance to me, and I want plenty of low cost insurance to protect myself from an eventuality. Profit is not my primary objective with this asset class.

I think the majority of stackers agree with you. I just feel bad for the retirees that are ready to sell, after decades of buying. That, and the fact that low silver and gold prices help enable the current system of Fiat and debt.

Stack on!

True, retirees don't get to see the full benefit. However, retirees do benefit from the anti-inflation properties of their investment, unlike if they had their money in cash, money market, or bonds.

Discussing this inspired me to write an article. You can see it here: https://steemit.com/silver/@infinite-monkey/silver-and-gold-for-insurance-not-profit-use-market-manipulation-to-your-advantage

Already saw it 😀

A few years ago I thought it would be fun to buy silver! I bought a bit at around $24 per ounce. The price went up to $40 and I thought I was RICH! LOL ... then this. The crash. Now I'm holding wondering when/if I can get out and invest in something else. For now... I hold :)

The periods of maximum pessimism are my favorite times to buy. Good post! Resteemed.

Buy when there's blood in the streets... 😀

Exactly. To make loads money when investing, you need to learn what everyone else is doing wrong and figure out how to profit from it.

I'm surprised by all this disheartened stackers, since 2016 things have been on the up albeit slowly!!!

Hi @silverfortune, great content! What is your opinion on the likely rise of gold in my article? Do you agree with it? You can read it if you want, thank you! https://steemit.com/gold/@unknowncrypto/the-bulls-are-returning-to-the-gold-market

Interesting post. The whole idea is to buy low, when the pessimism is at its highest.

Three days ago I wrote a post , where I analyzed the gold-silver ratio.

This could interest you.

Here is the link:

https://steemit.com/silver/@nenio/is-silver-undervalued

I really hope the end of rigging silver is over soon...on top of that still be able to stack before its shoots up

Never been a get rich quick kind. Just like inexpensive silver so I can afford to buy. Thank you and take care.