Diversification. The KING Of All Investment Strategies!

I recently watched Mike Maloney's latest video on http://www.goldsilver.com. What I found interesting was how he had seen a boom in Bitcoin sales of Gold and Silver.

That made me think about the importance of understanding what investment diversification means. You might have heard a financial advisor saying you need a well-diversified portfolio in stocks and bonds. Many people think they are well diversified if they have as an example. Bio, Commodity, Retail, Infrastructure and Finance stocks on the SP500. Or they have Gold shares, Gold ETFs, Numismatic and Gold Bullion. Cryptocurrencies like Bitcoin, Litecoin, Etherium, EOS, Monero and Dash. All of these are diversifications within one investment. I am not saying this is bad, but real diversification comes from you investing in several investment classes. A few of them I mentioned above.

What is real diversification?

Real diversification comes from diversifying your money to lower the risk of losing money in your portfolio. In my view, a well-diversified stock portfolio or a well-diversified gold investor is at high risk of getting hit when their market crash.

As an example an outstanding investment portfolio holds. Physical Gold and Silver, Private stocks, businesses you own, Real Estate, Debt investments and lending, cryptocurrencies, fiat currencies, land, insurances, commodities and food.

There are so many risks today! In several markets! How can one protect oneself from potential failures and crashes, war and nature events? You can become a real diversified investor that survives through any investment climate in the world. I thought it would be a good idea to give you my opinion on different types of investments. Remember this is my opinion, and you need to do your due diligence.

Here are the asset classes I know a little to a lot about:

Having cash in any calamity or natural disasters is vital. Cash is king, and if the government implements capital controls or if the Grid is down you have nothing to fear. Also with the world moving more towards cashless system cash is becoming very important. With many countries having negative interest rates having cash in your possession is very important. Elites in Switzerland have stacks of Cash with their precious metals. There are a couple of ways people trade with fiat currencies. Forex Exchange day trading or now you can trade on crypto exchanges with cryptocurrencies from and too fiat. Just remember what fiat currencies are. They are losing their value over time, and there are better ways to keep value in than being stuck in the fiat world. Although day traders can make some money if they know what they are doing.

Gold and Silver

Gold and silver are my favourite asset class. There are many ways you can invest in gold and silver and other precious metals like Palladium and Platinum. These metals are high-class metals that are in a class for themselves when it comes to wealth preservation over time. Humanity has been using these precious metals as money and wealth preservation since the Egyptians started to use them. Gold and Silver has several ways you can invest in them. You can invest in the physical metal itself. This can be done in bullion or rounds. I am a big proponent of this as it gives you the potential to access it if you need it in an emergency. These emergencies throughout history have been wars, natural disasters and fiat currency collapses. Gold can also be bought in dust form or dore bar forms. If you want to dig it out of the ground, there is enormous potential if you can own gold or a silver mine under a collapse of currency as an example. It just depends on how hands-on you want to be. Physical metals can also be stored at several locations around the world to mitigate geopolitical risks as well. That is if you can travel there in an emergency or before it happens. You can also own mining stocks. Mining stocks are of course a derivative of the mining business. The potential gains of mining stocks if gold or silver were to come back as money is vast if you know how to select the right stocks.

Then there is ETF's. GLD and SLV. I would say stay clear of these investments as they are paper contracts. In the case of GLD, the ratio between paper contracts and physical metal is 300+:1. This is not promising and if you read the prospectus. The fund can usually settle you in cash instead of getting your gold or silver. In ETF's there are of course good ones who have allocated Gold and Silver bars with serial numbers to your shares. These are safer, but the GLD and SLV are unallocated contracts, and it's on a first come first serve basis when it comes to getting the little gold and silver, in the fund's physical possession before they run out and you might sit with worthless gold and silver contracts that you get cash for.

Last is numismatic coins. Numismatics coins are risky if you don't know what you are doing. They are ranked by what shape they are in and the rarity. I'm not saying they are wrong. I have plenty of coins as I am a collector of coinage from throughout history. You need to know what you are doing, and it is a costly hobby. But good solid coins can beat the past. When it comes to newly minted coins that have numismatic values set to them, I will stay out of them. It is just a way for mints to print extra money for themselves.

In a crisis, I do believe numismatics would be if little value as people would look at 1oz of gold or silver as 1oz of gold and silver no matter what the history of the coin is.

Stocks

Stocks are derivatives of a business. They can be bought on stock exchanges around the world, or they can be purchased privately off stock exchanges. The latter is of less risk as it is off the major exchanges if the exchange has a vital sector that crashes, it could bring with it most of the listed companies. You can also print stocks if you create good businesses and sell them to the public or other investors as well. Stocks have significant components to them. Dividends and Capital Gains. Dividends are issued to you as an investor as a part of the revenue of a company. When you sell your shares, you get capital gains or losses if you sell at a loss.

Stocks can be divided up into business sectors. There are many and here is a few I can think of right now: Biotech, Commodities, Retail, Telecom, Energy, Manufacturing, Infrastructure, Military and many more. You can also divide all of these investments up into multiple different under categories as well.

Stocks can also be held in Mutual Funds, ETF's and SEG Funds. These funds buy a specific amount of stocks and might diversify into several sectors or internationally. You then buy a share stock in that fund that equals to stocks in circulation divided by market cap of the investments. As I said above Stocks are a derivative of a business, and Mutual funds or SEG funds could be a derivative of a derivative of a derivative of the business. So you can see how you will be far away from having anything to say about how a business is run or what they do. These funds many times have high fees and even as a passive investor you can lose a lot of money if you don't continue to give your financial advisor money to put into the fund. I could go all day about the risks, but as you can see from the above topic of gold. The further one is from the asset the more dangerous the investment could become as you have a hard time doing due diligence.

You can buy stocks as IPO's(Initial Public Offerings) when a company goes public and issues shares. Today it is hard to get into good investments as the banks and government have conspired against most of the middle class and poor making it hard to invest for them in any good investments. This is, of course, meant to be for you not to get scammed, but what it has done is that it took away from you to be able to invest in a good deal if they want your money. The rich get richer, and the poor and middle class get poorer thanks to the government. I think that's enough on stocks, but you can also use a lot of different other derivatives to make money on stocks as well. I will go into this more under derivatives.

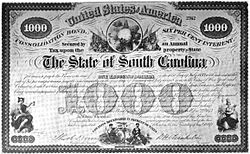

Bonds

Bonds are debt issued by companies who need to raise money from borrowers. Most debt bonds today are issued first through banks who get a piece of the pie. There are several different bonds. Government and business bonds. Government bonds get issued when a government does deficit spending. Meaning spending more than they have in income from taxpayers they steal from. Government bonds are divided up into several types National, State and Province, Municipal and County and City debt. In the first place, the government should not be borrowing money. If they steal money from the taxpayer and still doesn't have enough money to cover their operational costs, they should be cut back until there is enough money coming in. Instead, the governments raise taxes and spend money without your consent, and it becomes unsustainable, and it creates inflation and eventually defaults on the debt when the government finally becomes bankrupt.

Corporate Bonds or business bonds are of course different. But the same thing applies here as well too much debt will kill the corporation. Debt is rated by rating agencies like S&P, Fitch or Moody's from top grade to junk grade and default. Any debt is risky as you need to know if it will be a good investment. Do your due diligence on the corporations or governments before you invest in bonds? Debt can quickly enslave people, businesses and governments. Stay clear of debt if it is possible. But if you know how to use it you can make a fortune with debt. Especially in real estate.

Real Estate

Real Estate comes in many forms and shapes. From agricultural land, industrial, commercial, natural resources, energy and residential. All of these can be divided up into many new subcategories. They have different densities. From Farm Land to massive skyscrapers. Real estate's most significant advantage is the cashflow one can make from it or the capital gains if you do the right thing to develop the property.

For Land, there are natural land and agricultural land. Most are agricultural until a city grows big and needs to expand. Many times it requires housing, and it needs to get land from ex. Farmers. Companies are working on land development. They buy the property from a farmer. Talks to the city or a municipality about what zoning it can do to the land. Then they subdivide the land into smaller lots and sell them off, or if they are a real estate develpoer, they can also start building housing and commercial outlets and stores. For industrial and commercial it works in the same way. The land goes from raw land to developed land and earns the appreciation of the property from the possible utilization of the property.

Industrial land is land that is created for a business that is building, designing, melting or refining things. They are manufacturers the firms in these lots. Industrial is the backbone of the economy that takes commodities and makes them into a product.

Commercial land is for businesses who sell products or take manufactured products and sell them to consumers, or they can be trade based businesses. There are several ways you can make money in the commercial. You can buy, hold and rent. You can sell it for a capital gain, or you can take it down. Rezone it and increase the value by making it available for higher density.

Residential land is where there are the most opportunities from single-family homes to, duplex, triplex to apartment buildings. You can approach making money in several ways on residential from Rent To Own, Wholesale, Flipping, Buy Hold and many more opportunities. This can be done on several different types of residential. There is also Mixed real estate as well many times in dense zoning you add commercial on the bottom floors and residential on the top ones.

Then you have the energy or commodity land. Used for taking out resources from the earth or producing power to the populace. Yoy need to acquire the properties. To purchase the property, you need to know about the geology and composition of the metals and minerals in the ground to figure out what resource you will harvest from it. Energy can be made from nearby resources, and you can acquire land to produce from nearby resources like coal, uranium, water, wind and solar. Power can come from many places.

Not to forget if one wants to either renovate your home or use your home as leverage to buy other investments you can do so with a HELOC or a Home Equity Line of Credit as it's called. This is not of course without risks, but if you know what you are doing, you can win big.

Derivatives

You can call many investments derivatives. A derivative in the most straightforward term is like this. A derivative of an orange tree is an orange, a derivative of a derivative of the orange tree could be orange juice.

There are so many derivatives out there:

From Derivatives of debt to derivatives on stocks and an outcome.

Here are some of the better know derivatives:

Stocks: Futures, Indexes, Mutual Funds, Segregated Funds, Options and Puts

Debt: Bond, Collateralized Debt Obligations, Mortgage Backed Securities and, Auto Backed Securities, Special Purpose Entities and Vehicles, Collateralized Loan Obligations, LIBOR, CDOR and NORIBOR to name a few.

Insurance: Portfolio Insurance, Credit Default Swap

Gold: ETF, Swaps

Currency: Swaps

Outcomes: VIX

Economic Outcomes: Indexes

This is just to name a few. There are hundreds of derivatives. You can say as I mentioned above. Most modern-day investments are derivatives of something, not the real thing. Is this healthy or has this added a lot more risk to the economy? I believe they have created a lot of uncertainty. I don't know if people remember 2008 when the economy blew up from derivative exposure to the housing market. Houses were bundled into SPE's mentioned above the structured into a CDO also discussed above and to top this off the banksters who created them better against them using a type of inflation called a CDS the reason it was called this was to avoid insurance regulation. This ended up in the defaulted loans collapsing the value of CDO's sold to pension funds around the world. To make matters worse, the banks had insured these terrible CDO's with the Credit Default Swaps. Not only the banks that sold them, but everyone could do it. This created a squeeze of too many investors insuring the same burning house and AIG the insurance giant could not cover it.

See the video Josh, and I did with @StephenKendal that explains in great detail how the above was accomplished and how the markets collapsed in 2008:

A derivative like a futures contract was initially a good thing making it easier for farmers to make sure they will make a future profit on their agricultural products. But today they are used to manipulate the economy and commodities instead of their initial purpose. Derivatives have taken the making money with money end of a monetary systems era. To another level of manipulation and scything money out of the economy. Bankers have created multiple schemes that will fail miserably when they all come home to roost as an underlying asset fails and the ten folds of derivatives attached to it become worthless.

Insurance

Insurance has become a necessity in today's world. From life insurance to wealth to car insurance. The structure of an insurance company could be risky if they overextend their promises to pay or during an example of a big natural disaster or as simple as derivative exposure and being on the hook for billions of dollars more than the underlying asset is worth in the case of a CDO's CDS.

I use insurance as a part of my retirement plan. I do know the risks being involved in an insurance policy that they don't have enough to cover all assets promised. I have whole life insurance that I can use for pension payouts and a cash value that I can use as a lending institution for myself not having to use banks.

Then there is Car, house, travel, asset and business insurances. These are great to cover any losses, damages or sickness that might happen. These are great as they protect you from severe losses of your assets.

Then there is wealth insurance. This is very different from the leveraged insurance system. Wealth insurance is not like portfolio protection that made the dot com bubble investors complacent, but its instead a 100% covered insurance based on Precious metals vs. paper money which risks I described above.

And last real-life insurance in food and water for surviving anything from a natural disaster to war to a currency collapse.

Cryptocurrencies

Many cryptocurrencies are trying to become and replace currency of today. These currencies sometimes give you excellent privacy, and they were built to replace a failing fiat currency system. There are a lot of risks involved with cryptocurrencies. There is also considerable rewards to reap. These currencies have come to stay and their underlying technology the blockchain will revolutionize many asset classes above as well.

There are many coins out there. From the big ones Bitcoin, Litecoin, Ripple, IOTA, EOS, Bitcoin Cash, Dash and many more. Bitcoin was the first currency out, but today it sees substantial growing pains that it didn't predict. Solutions are being created for them, but we don't know if they will save Bitcoin or if other coins called altcoins will emerge as winners in this global race to build a decentralized monetary system that takes away the power to create money out of thin air from banks, governments and central banks.

Cryptocurrencies are here to stay, and with still being a small market on a global scale the potential for growth is enormous. Another significant development from the Cryptos was the invention of the Ethrium platform and how it is now used to decentralize the power for companies to go public without paying substantial fees to stock exchanges and banks.

Cryptocurrencies see an exciting future ahead, and they have come to stay and will change the world as we know it to a better place if used for good and not evil which banks and governments want to. Cryptos gave back the power of currency to the people instead of a global bankster cartel having a monopoly on it.

Commodities

Commodities are essential. They are the driving forces behind human creation. From the cars we drive's metals to the structures we build's concrete. To the food we eat.Without commodities, their world is no world to live in and no civilization. Commodities are the real thing, and they are not derivatives of something. You can hold a commodity in your hand or use it to create a fantastic product for the markets and humanity to create a better world for everyone.

Commodities and their supply drive population growth. When a commodity an energy source is abundant the human life gets easier, and we can support more humans. The more scarce a commodity is, the harder it'll be for a civilization to grow. It is imperative that commodities are taken great care of as they are limited many times. They are the life creators on this planet, and without them, the world we live on would not exist.

Many commodities today have become manipulated or even diluted with minor quality commodities to keep the price of a product down. You get what you pay for, and when you buy a great product, you usually spend a lot more money than a product that quickly breaks and is a lot cheaper than other products.

Commodities can be gold and silver, any metals, gases, agricultural plants, water and other types. They are essential for living, and if you can keep a certain amount of them that are important to keep you alive and thrive, you will win in the long run.

Business

A business is a great asset. As Robert Kiyosaki, my mentor said a business gives you the power to print money. You can do so by either selling a new product, a commodity, an idea or many other things. The more people want your new product, the more you get to print off money. A business is also a great asset today as it lets you write off more taxes that the government has stolen from you. If you look at the wealthiest people in the world today, they are all business owners.

They had an idea and ran with it. They found a solution to a problem and people want their product. Entrepreneurs are problem solvers and the more problems you can solve the more money you make, and the more you win!

A business can create many derivatives as also described above. All I have to say is start your business now and get out of debt slavery in a system that is built against you.

Ideas

Ideas are great, but ideas made into action is even better. Ideas into actions are usually the above. Ideas could be written down and sold to people for profit if you are an expert on something. You could create a patent on an idea to make royalties, and you can write a book. There are many ways to make a good investment, and that is in thoughts and ideas that you might come up with. Remember this. Every great mind throughout history had many great ideas! Great ideas can give you massive royalties and great ideas into actions can create a brighter future for humanity and potentially a great business as an asset.

Education

Education is a crucial asset to hold. Especially professional ones like a carpenter or plumber or a nurse. They are crucial for the society today. Remember to find an education that makes you very valuable to society, and I'm not talking about gender studies. I am talking about right school education that can give you something to fall back on in hard times to make money to survive, or you use training to increase your financial knowledge.

If you want to invest in any of the above, you need to become severe and educate yourself. If you do so and you take action with your knowledge you can become very wealthy.

Food and Water

We all need to survive. Most people don't think about this today as they believe we live in a modern world where nothing could happen to us. This is a dangerous mindset and at one point in life not being prepared can strike you. It can mean a life or death situation as in Venezuela's currency collapse, or in Puerto Rico, after the several hurricanes hit them damaging essential services and infrastructure leaving mass amounts of people starving and dying as a result. Remember food and water are more important than any of the assets above as if you have all the above and not food and water you might be dead fast. Be prepared, and when an event happens, you won't panic. You will stay calm, and you might be able to help many either people that you wouldn't be able to help if you weren't prepared.

Hope this is a good overview. I am not a financial advisor, and therefore all of the investments I spoke about is all my opinion. Do your duedilligence, and you'll find what I've been talking about very interesting.

No matter what kind of investments you choose remember to diversify and educate yourself. I might have forgotten some so please comment below if you have anyone to add!

This is crucial for people to understand. There is a wonderful podcast called "How I Built This" which features interviews with entrepreneurs. Today they discussed how true entrepreneurs are always hedging their bets with multiple sources of income. I try to teach my daughter this at 8 years old - its never too young to get realistic about creating abundance.

Diversification is an effective way of strategy in investing and it is biblical. The Bible says " Invest in seven ventures, yes, eight; you don't know what disaster may come upon the land" ( Eccl. 11:2 New International Version).

Trop cool!

Well done! Super long and well thought out!

Than you for sharing..

Good post.

As usual, great article John! Thank you.

Yesterday, I saw an interesting article on how to have a good diversification strategy for one's 'crypto currency portfolio':

How to Construct a Diversified Crypto Asset Portfolio from btcmanager.com.

A lot of it makes sense, but I would also encourage people to consider holding the decentralized Bitshares and EOS tokens and platforms. EOS has the potential to be the next big "Ethereum" and Bitshares looks extremely promising too.

Great article!

Nice post pls go check me out @starray1

Useful article thank you very much.